PayPal Supercharges BNPL With 5% Cash Back

Hey FinTech Fanatic,

PayPal just gave Buy Now, Pay Later a serious upgrade.

Starting today, shoppers can earn 5% Cash Back on PayPal’s BNPL purchases — both in-store and online — through the end of the year. That means split payments, more flexibility, and a little extra left in your wallet for the holidays.

The company also rolled out Pay Monthly for in-store shoppers across the U.S., extending its BNPL reach beyond e-commerce to wherever customers shop.

As Michelle Gill, PayPal’s GM for Financial Services, put it: customers want payment options that make shopping “easier and more rewarding.” Mission accomplished.

Scroll down for the rest of today’s FinTech stories shaking up the industry 👇

Cheers,

PODCAST

🌍 Bizum’s Vision and the Future of European Payments. In this episode, Arthur speaks with Fernando Rodriguez Ferrer, Chief International Business Officer at Bizum, to discuss the company’s strategic vision for digital payments in Europe over the next three to five years. The conversation highlights how Bizum aims to leverage its strong local presence in Spain while contributing to a more integrated and unified European payment ecosystem. You can also listen to us on Spotify and Apple Podcasts

Beyond Borders: the Bizum Effect

FINTECH NEWS

🇸🇦 HALA FinTech’s strategic growth and recent funding milestone. Rima Najjar is hosting Maher Loubieh, Co-Founder of HALA FinTech, for an insightful conversation on the company's evolution, growth trajectory, and plans following its recent $157 million funding round, led by TPG and Sanabil Investments, a subsidiary of Saudi Arabia’s Public Investment Fund (PIF).

🇬🇧 Robinhood aims to target UK ‘DIY’ platforms Hargreaves Lansdown and AJ Bell. The California-based company, which came to fame during the meme stock craze of 2021, is in talks with regulators at the Financial Conduct Authority about bringing its prediction market products to the UK.

🇺🇸 Payaza sets new African FinTech standard with ₦20.3 billion ($13.5M) debt redemption and triple credit rating upgrades. In a significant demonstration of financial strength, the entire debt was settled ahead of schedule using the company’s own internally generated cash flow.

🇮🇱 eToro adds the Block function to its feed. eToro has introduced a long-awaited Block function to its social feed, allowing users to control what content they see. By selecting "Report & Block this user" on any post and choosing a reason, users can remove all posts from that individual from their feed, improving content personalization and user experience.

PAYMENTS NEWS

🇵🇹 Elecctro and Getnet are leading the way in seamless EV charging in Portugal. Now, users can simply tap their bank card to pay at charging stations, no subscriptions, no apps, no long-term commitments required. Together, they're reshaping the EV charging landscape with a focus on simplicity, security, and scalability.

🇨🇴 BRE-B officially began operating on Monday, October 6. The new BRE-B system will allow people and businesses to send and receive money quickly, securely, and interoperably all year round. This system is designed so that both individuals and companies can send money digitally, regardless of the bank or digital wallet.

🇺🇸 PayPal’s PYUSD Stablecoin reaches $1 billion market cap through Spark partnership. PYUSD is now the ninth-largest stablecoin by market cap, with over 100% growth in the past year. Spark provides stablecoin infrastructure backed by an $8 billion reserve, enabling users to supply and borrow PYUSD.

🇺🇸 PayPal introduces 5% cash back on buy now pay later purchases this holiday season. With PayPal's BNPL offering, shoppers can split purchases into convenient payments and earn cash back, thus making their money go further during the holidays. PayPal is also introducing Pay Monthly3 in-store in the U.S., providing customers with more choice and flexibility to pay over time wherever they shop.

🇧🇷 Pix Installment Rules to be released at the end of October, says Central Bank. The set of rules to be announced by the authority will define the operating model for Pix Parcelado, updating financial institutions and users on the new instant payment method. Keep reading

🇵🇭 Western Union introduces its first digital remittance app in the Philippines. The new app lets Filipino users request money from overseas senders and initiate transfers abroad. Through the app, customers can access Western Union’s international financial network of billions of bank accounts, millions of digital wallets, and thousands of retail outlets.

🇮🇳 PayGlocal enables Indian merchants to accept Apple Pay for global payments. Merchants using PayGlocal can now accept payments from over 180 countries without needing to manage complex local banking arrangements or additional compliance processes.

🇺🇸 PayDo introduces US IBAN via SWIFT. This new feature allows businesses and professionals to receive US dollar payments directly, without delays from intermediary bank checks. At the same time, PayDo has extended its currency support to more than 60 national and regional currencies.

REGTECH NEWS

🇳🇬 Zest payments paid CBN ₦2.7 million over the delayed 2023 audited financial report. The sanction, disclosed in Stanbic IBTC Holdings’ half-year report, came alongside other regulatory penalties within the group, highlighting growing compliance strain.

DIGITAL BANKING NEWS

🇬🇧 Shawbrook turns to Ardea and Goldman Sachs as IPO plans take off. Digital bank Shawbrook has confirmed it plans to float in London in a boost to the City. The lender said it intends to publish a registration document on 6 October for a listing on the London Stock Exchange’s main market.

🇵🇹 Revolut reaches an agreement with SIBS and officially joins MB Way. Revolut joined the MB Way network and began allowing instant transfers through the app, like other Portuguese banks. The British financial institution officially signed an agreement with SIBS to launch Multibanco. Additionally, Revolut hopes the Brazilian community in Portugal will help its growth in Brazil. "We believe we have created a base, which is demonstrated by the waiting list in Mexico of more than 200,000 people," Ignacio Zunzunegui, Director of Growth for Southern Europe, said.

🇷🇴 Revolut launches a new service in Romania. It has officially introduced the Beneficiary Name Display Service (BND), a function that allows verification of the recipient's name when initiating a payment to an IBAN account. Continue Reading

🇦🇪 Wio Bank deposits cross Dh50 billion as digital banking accelerates in UAE. The bank’s total customer base has grown 72% year-on-year, driven by a 93% jump in personal customers and a 42% rise in business accounts, reflecting a nationwide shift toward app-based banking solutions.

🇺🇸 Bud launches MCP server for AI-driven banking. With the new MCP server, developers and financial institutions can tap into these insights directly within AI experiences to answer questions about spending patterns, product suitability, affordability, and individual transactions, while respecting data consent and security boundaries.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Samsung taps Coinbase to bring crypto to more than 75 million Galaxy users. Exclusive access to Coinbase One will be offered within the Samsung Wallet app, introducing more than 75 million Samsung Galaxy owners to a premium crypto experience with the most trusted exchange. The companies aim to expand this effort globally and explore new partnership opportunities.

🇺🇸 Tokenization of real-world assets is an unstoppable ‘freight train’ coming to major markets, Vlad Tenev, Robinhood CEO, said. In June, Robinhood began offering more than 200 tokenized U.S. stocks to customers in the European Union, giving them a new way to gain exposure to the underlying assets. The move sent its stock surging to a then-record high.

🇨🇾 Trading 212 launches crypto trading under its Cyprus unit. The platform will offer Bitcoin, Ethereum, Solana, and other major crypto assets. It allows users to open a crypto account, which is separate from their regular CFDs account. Continue reading

PARTNERSHIPS

🌍 dLocal and XanderPay partner to streamline cross-border hotel payments. The collaboration aims to make international payouts faster and more cost-efficient for hotels and online travel agencies (OTAs) operating in multiple markets. The partnership combines dLocal’s payment network with XanderPay’s hotel-focused payment system to centralise and automate bank transfer payouts.

🇮🇳 Razorpay unveils India’s First RBI-compliant biometric authentication for payments with YES BANK. Businesses, banks, and consumers are embracing online transactions more than ever, but with growth comes complexity. Despite the convenience of card payments, nearly 35% of transactions fail due to OTP delays, incorrect entries, or redirection issues.

🇬🇧 Tap Digital Banking partnership with Moorwand. Through this partnership, Tap will integrate Moorwand’s comprehensive Banking-as-a-Service (BaaS) platform to provide customers with dedicated GBP accounts, complete with Sort Codes and Account Numbers, and EUR accounts with individual IBANs.

DONEDEAL FUNDING NEWS

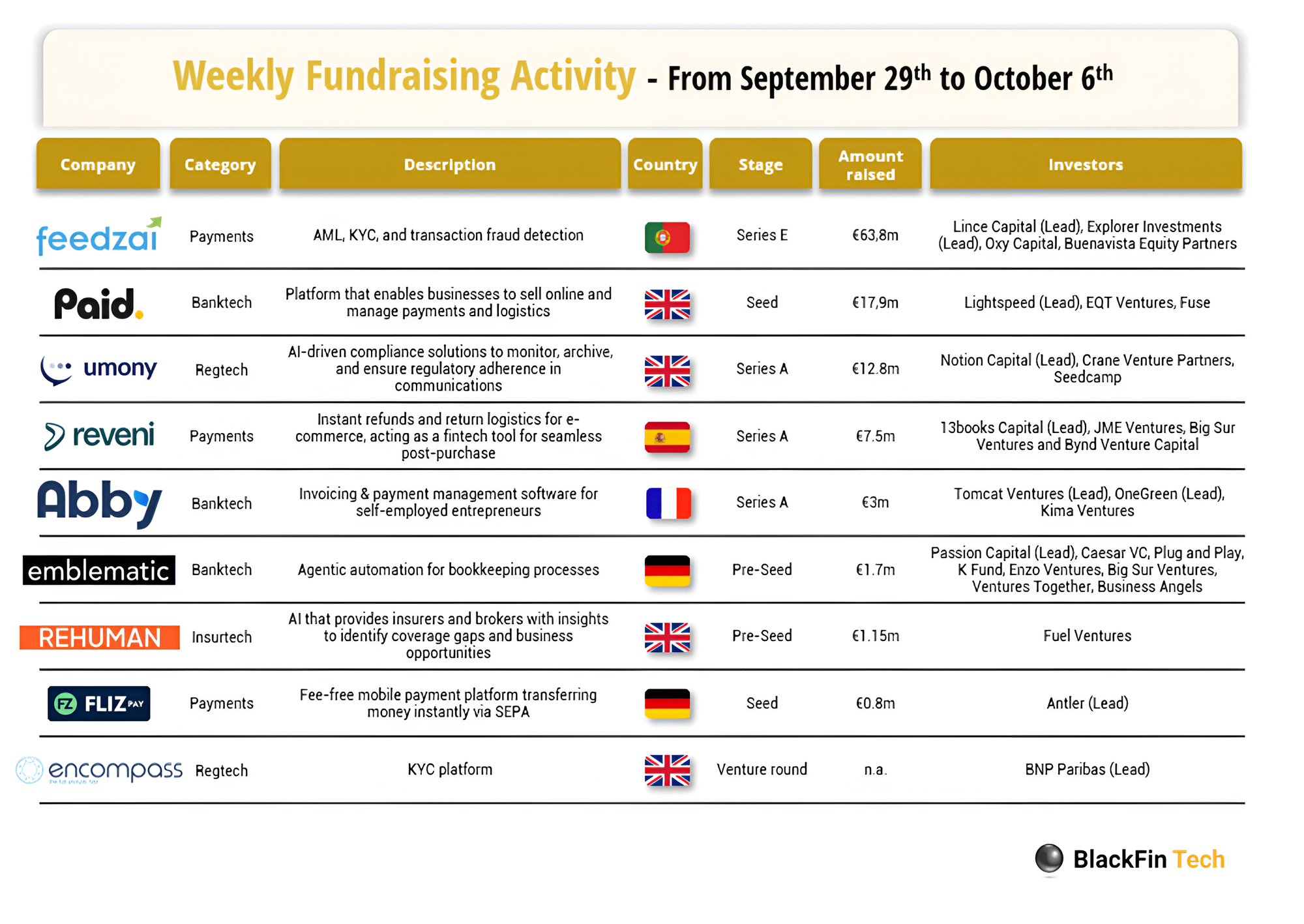

💰 Over the last week, there were nine FinTech deals in Europe, raising a total of €109 million, including four transactions in the UK, two in Germany, one in Portugal, one in Spain, and one in France.

🇮🇳 Indian FinTech startup Finarkein raises $1.5 million from DSP Group Family Office and others. Finarkein plans to allocate capital, which is a mix of primary and secondary, towards enhancing its Data & FinAI Platform, expanding the team, and exploring emerging data and AI opportunities within its existing customer base.

🇺🇦 U.S. enterprise fund for Ukraine (UMAEF) invests in FinTech-IT group, powering it to a $1bn valuation as Ukraine's first FinTech unicorn. Jaroslawa Z. Johnson, President and CEO of UMAEF, stated that with this investment, UMAEF is expanding its existing portfolio of FinTech investments made through u.ventures by supporting a local leader founded and developed by top-tier Ukrainian entrepreneurs.

M&A

🇬🇧 Themis acquires agentic fraud platform Pasabi and expands into social media monitoring. As part of the acquisition deal, Chris Downie has been appointed CEO at Themis, while Spinks has taken on the position of Head of AI and Data. In a statement, Themis says the buyout is accelerating its product roadmap by several years, confirming that the integration of Pasabi’s platform has already taken place.

🇺🇸 US payment processor Merchant Industry acquired by Lovell Minnick Partners. While financial terms remain undisclosed, the transaction structure allows Merchant Industry's founders to retain a "substantial minority equity stake in the go-forward business", according to an LMP statement.

🇺🇸 FinTech Decacorn Ramp acquires Jolt AI to help its engineers build faster. While a relatively small acquisition, the deal is significant in that it represents the role artificial intelligence is playing in many of the fastest-growing venture-backed startups, even those that aren’t strictly AI companies.

MOVERS AND SHAKERS

🇬🇧 Ex-ClearBank executive Yasemin Swanson as a COO at OpenPayd. Swanson will be responsible for scaling OpenPayd’s operational infrastructure as it expands globally and secures additional regulatory milestones. Read more

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()