PayPal pushes crypto payments into the mainstream

The feature lets U.S. merchants accept payments in 100+ cryptocurrencies, converting them instantly to stablecoins or fiat, and reducing international transaction fees by up to 90%.

PayPal is rolling out Pay with Crypto, a major new step in its strategy to fuse digital assets with global commerce. The feature lets U.S. merchants accept payments in 100+ cryptocurrencies, converting them instantly to stablecoins or fiat, and reducing international transaction fees by up to 90%.

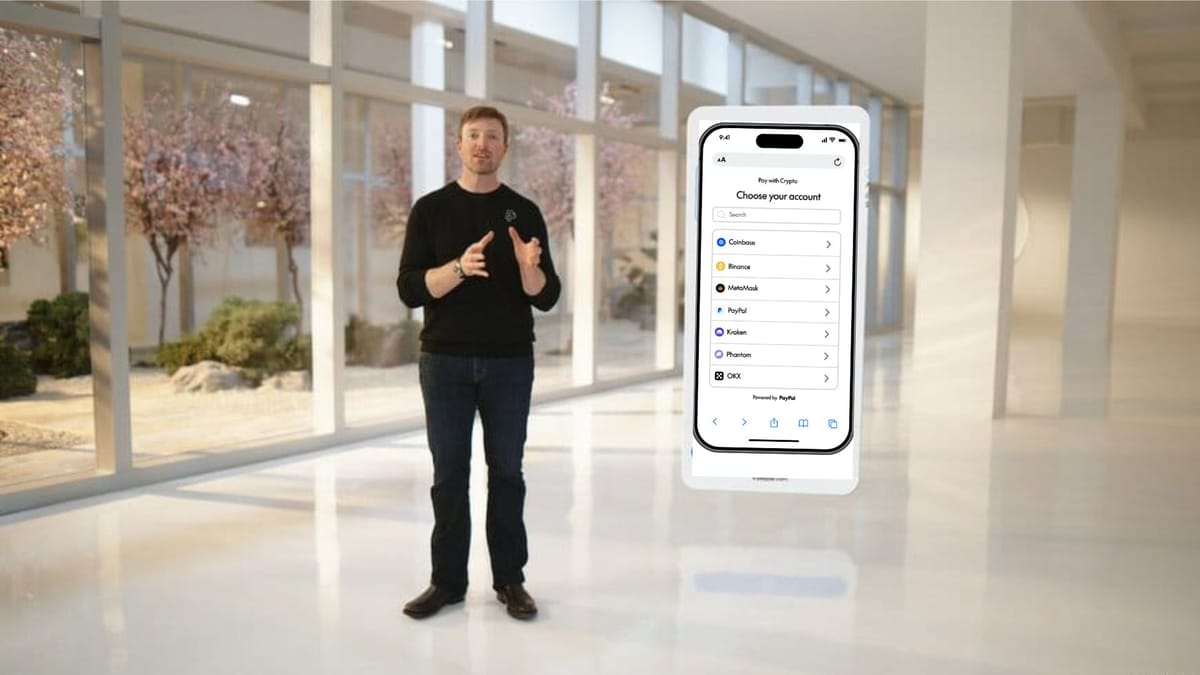

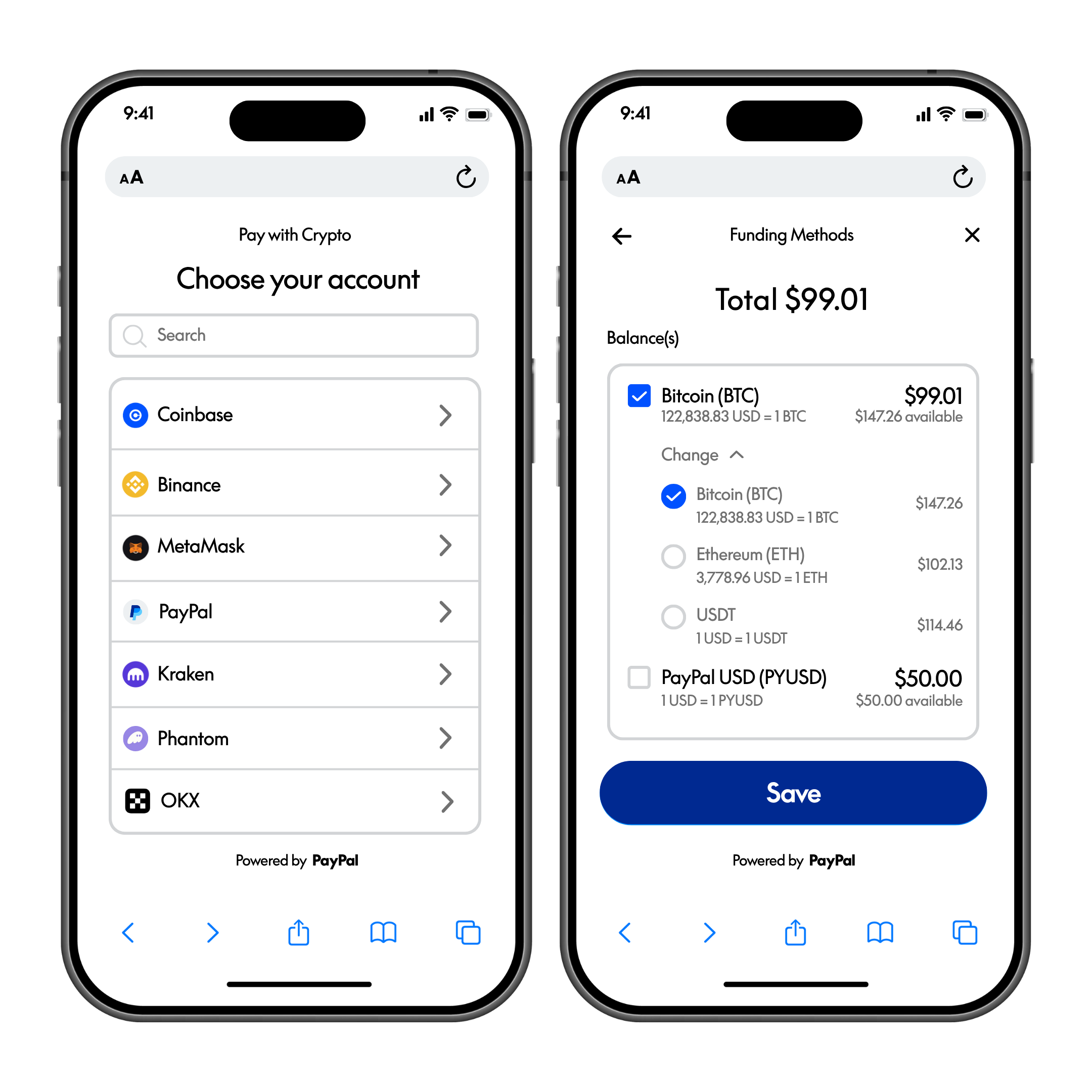

The offering supports near-instant settlement and seamless cross-border transactions. Integrating with wallets like Coinbase, MetaMask, Binance, and more, the solution connects businesses to a $3T+ crypto market and 650M+ users.

"Businesses of all sizes face incredible pressure when growing globally, from increased costs for accepting international payments to complex integrations. Today, we're removing these barriers and helping every business of every size achieve their goals," said Alex Chriss, President and CEO, PayPal. "Imagine a shopper in Guatemala buying a special gift from a merchant in Oklahoma City. Using PayPal's open platform, the business can accept crypto for payments, increase their profit margins, pay lower transaction fees, get near instant access to proceeds, and grow funds stored as PYUSD at 4% when held on PayPal."

Empowering U.S. Merchants, Fueling Global Reach

Pay with Crypto will first be available to U.S. merchants in the weeks ahead. It empowers merchants not just to accept crypto, but to grow profit margins, earn up to 4% on PayPal USD (PYUSD) balances held with PayPal, and pay vendors or freelancers quickly with stablecoin rails. PayPal is also expanding stablecoin utility globally through a new partnership with Fiserv, seeking to drive greater efficiency and adoption.

"Last week, we launched PayPal World, our global partnership bringing together five of the world's largest digital wallets on a single platform, fundamentally reimagining how money moves around the world. By enabling seamless cross-border crypto payments, we're breaking long-standing barriers in global commerce," Chriss added. "These innovations don't just simplify payments—they drive merchant growth, expand consumer choice, and reduce costs. This is the future of inclusive, borderless commerce, and we're proud to lead it."

What’s Included?

- Coverage of 90% of the $3T+ cryptocurrency market.

- Support for 100+ cryptocurrencies: BTC, ETH, USDT, XRP, BNB, SOL, USDC, and more.

- Wallet integration: Coinbase, OKX, Binance, Kraken, Phantom, MetaMask, Exodus and more.

- Near-instant settlement, minimal transaction costs, and new earning opportunities for holding PYUSD.

Important Disclaimers for Users and Merchants:

- Product not yet approved for New York State residents by NYDFS.

- Digital assets involve risks: operational, custody, network, and regulatory risks included.

- Stablecoins like PYUSD are designed to maintain a $1 value but are not Federal Deposit Insurance Corporation (FDIC) or Securities Investor Protection Corporation (SIPC) insured.

- PYUSD and related services may change, be suspended, or be subject to legal restrictions.

- Users must review Paxos and PayPal terms before using PYUSD.

- Transactions are irreversible once on the blockchain.

ALSO, READ:- FinTech Drama: JPMorgan Freezes Out Gemini After Public Clash

Comments ()