PayPal + OpenAI Introduce Agentic Commerce in ChatGPT

Hey FinTech Fanatic!

PayPal revealed that it will adopt the Agentic Commerce Protocol (ACP) and expand payments in ChatGPT.

This means you’ll soon be able to discover millions of PayPal merchants right in the AI interface and check out instantly using PayPal’s wallet and buyer protection.

For OpenAI, this brings the convenience of PayPal’s wallet through Instant Checkout. Users get multiple funding options and also benefit from PayPal’s buyer and seller protections, along with post-purchase services like tracking and dispute resolution — features consumers trust and value.

It is up to PayPal to manage merchant routing, payment validation, and orchestration behind the scenes.

The company is also rolling out ChatGPT Enterprise to its 24,000+ employees and integrating OpenAI tools like Codex to speed up product development, signaling a company-wide AI shift.

The result is chat-driven commerce at a global scale, and millions of small businesses made discoverable overnight.

Busy day at PayPal

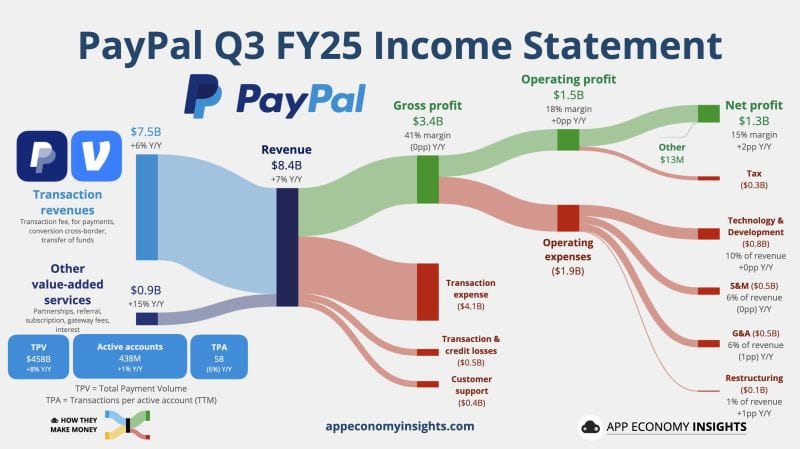

In addition to the ChatGPT move, PayPal released its Q3 2025 earnings. They beat Q3 expectations with $1.34 EPS and $8.42B in revenue, prompting its stock to jump 8.5% in pre-market trading. The company raised its full-year earnings outlook and announced its first-ever dividend.

They also launched a new agentic commerce services, with a set of tools designed to help merchants thrive in the era of AI-powered shopping.

Cheers,

FEATURED NEWS

📈 PayPal reports third quarter 2025 earnings, and the stock is on fire 🔥

INSIGHTS

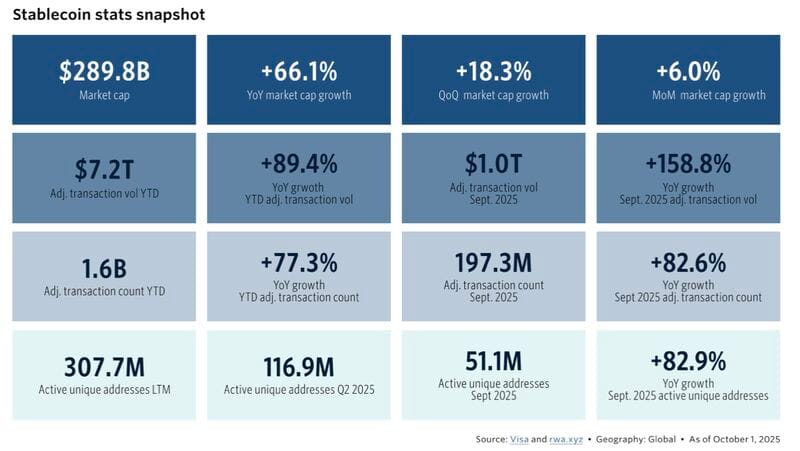

💰YTD Stablecoin transaction volume has reached $7.2 trillion, now more than half of Visa’s total 2024 payments volume of $13.2 trillion 🤯

Here's a Stablecoin stats snapshot👇

FINTECH NEWS

🌍 New FRC Hosts Alert! The FinTech Running Club continues to grow, now with locations in Munich and Hong Kong! Join Cosima Karmann in Munich on Nov 14 and Dan Owens in Hong Kong on Nov 17 for their first official runs. 🏃♀️🏃♂️

🇸🇦 Gulf Startup Tabby nabs $4.5 billion valuation in secondary sale. The new valuation is up from the $3.3 billion price tag Tabby garnered in a $160 million financing round just eight months ago. The deal allowed firms, including HSG and Boyu Capital, to buy shares from existing investors, according to a statement.

PAYMENTS NEWS

🇳🇱 iDEAL to phase into Wero starting in 2026. For Dutch users, this means they will soon be able to make cross-border online payments as easily and securely as they do at home. Whether ordering a book from a French webshop or booking a hotel in Germany, the experience will be seamless.

🇬🇧 Uber selects Checkout.com to deliver fast, reliable global payments across its enterprise platform. Through the partnership, Uber will leverage Checkout.com’s global and proprietary acquiring network, as well as advanced payment technologies designed to make transactions faster, safer, and more reliable.

🇬🇧 Ecommpay achieves full Digital Accessibility Centre approval for its payment pages and dashboard. Using colours, fonts, and layouts that ensure accessibility for those with visual and hearing impairment and cognitive and physical disabilities, the DAC-certified Ecommpay payments platform and dashboard enable merchants to deliver an inclusive payments experience to their customers.

🇺🇸 OpenAI and PayPal team up to power instant checkout and agentic commerce in ChatGPT. Millions of ChatGPT users will be able to check out instantly using PayPal, and PayPal will support payment processing for merchants leveraging OpenAI Instant Checkout. Additionally, PayPal launches agentic commerce services, a suite of solutions that allow merchants to attract customers and future-proof their success in the new era of AI-powered commerce.

🇺🇸 Bottomline announces embedded AI agent to transform treasury and cash management. With a planned rollout in early 2026, this new technology will empower finance leaders with conversational AI and predictive insights, transforming treasury workflows, enhancing cash visibility, and driving faster, smarter decision-making.

🇺🇾 dLocal launches BNPL Fuse. With one API and contract, it connects merchants to multiple local providers across eight countries, reaching over 500 million underbanked buyers. The solution simplifies compliance, boosts sales, and strengthens dLocal’s role in global digital payments.

🇺🇸 Thunes announced the launch of its Pay-to-Stablecoin-Wallets solution, part of its single global API enabling instant payouts across more than 130 countries in both fiat and stablecoins. It sets a new global standard for real-time, borderless money movement, powering a future where funds move instantly, anytime, anywhere.

🇺🇸 Apple Pay eliminates $1 billion in fraud, expands to 89 markets, and reduces fraud rates by 60% to 90% compared to traditional card transactions. The platform also generated over $100 billion in incremental merchant sales globally through higher authorization rates and increased engagement.

REGTECH NEWS

🇱🇹 IDenfy launches AML screening tech. The new system offers a fully documented, auditable workflow integrated with iDenfy’s KYC and KYB tools, enabling real-time monitoring against sanctions, PEP lists, and adverse media. It also improves data accuracy and streamlines manual processes for compliance teams.

DIGITAL BANKING NEWS

🇬🇧 Starling Bank launches AI tool for customers to spot purchase scams. Starling’s customers can upload images of items, listings, and messages from sellers on online marketplaces to the Scam Intelligence tool in the app. It will analyse the pictures for signs of fraud before sending personalised guidance about whether or not it is safe to proceed with the purchase.

🇦🇷 Ualá lays off 135 employees in the region: 80% of the cuts affect Argentina. The company explained that the measure is a response to the search for greater regional efficiency and the result of task automation. The layoffs represent 8% of the company's total workforce, which operates in Argentina, Mexico, and Colombia.

🇧🇷 OpenAI launches ChatGPT in Brazil and partners with Nubank. The agreement provides special benefits for the digital bank's customers: those with a regular Nubank account will receive a free month of subscription, Nubank+ users will receive three months, and Ultravioleta customers will receive a full year of ChatGPT Go at no additional cost.

🇹🇼 Neobanks and payment platforms struggle to crack the Taiwan market. Strict regulations and inconsistent enforcement are preventing FinTechs like Revolut and Wise from entering Taiwan’s market. Though their services function partially, the lack of New Taiwan dollar support limits local use.

🇸🇻 Banco Agrícola, Acción, and Mastercard join forces to promote digital banking services in El Salvador through Nequi. Through the partnership, Bancoagrícola and Accion are identifying new use cases to drive balance retention and wallet activity, such as making regular payments like school fees and local merchant transactions.

BLOCKCHAIN/CRYPTO NEWS

🌍 Binance expands crypto access to over 30 African countries with local payments. The exchange aims to lower barriers to digital asset adoption by supporting small businesses and offering remittances without traditional banking fees. Read more

🇺🇸 Blockchain firm tZero eyes 2026 IPO amid surge in crypto public listings. CEO Alan Konevsky confirmed talks with banks and hinted at a new funding round as the company prepares its market debut. Tokenization could unlock a $400 trillion opportunity, with analysts projecting the RWA market to reach $16 trillion by 2030.

PARTNERSHIPS

🇺🇸 Coinbase and Citi collaborate to build the future of payments. Combining Coinbase’s blockchain infrastructure with Citi’s global payments network, the partnership aims to improve fiat-to-digital conversion systems, enhance stablecoin payment solutions, and develop always-on financial infrastructure.

🇺🇸 Visa teams with Alacriti as instant payment use grows. The partnership enables banks and credit unions to offer faster, card-based payments for uses like account funding, payouts, and transfers. The integration gives institutions greater speed, flexibility, and a unified view of payment sources.

🇺🇸 Venmo announced a partnership with Bilt. The partnership brings rent payments, mortgage repayments, and neighborhood commerce into the Venmo experience, marking a significant step in Venmo's evolution from a peer-to-peer payments app to a comprehensive everyday commerce platform.

🇺🇿 Alipay+ and Uzbekistan’s HUMO partner on cross-border QR payments. In the initial phase, HUMO users travelling from Uzbekistan will be able to make payments in China and more than 50 other markets using their home payment apps in Uzbek som across retail, dining, and transport sectors.

🇺🇸 OnePay chooses DriveWealth to power embedded investment platform. Through this partnership, DriveWealth is providing OnePay users with the ability to invest in stocks and ETFs in the OnePay app. Keep reading

🇸🇦 Jeel and Mambu join forces to power Saudi Arabia’s FinTech Sandbox and pave the way for banking as a service. The Jeel Sandbox serves as a cornerstone of Saudi Arabia’s FinTech roadmap, empowering startups, financial institutions, and innovators to test, validate, and deploy digital financial solutions efficiently in a secure and scalable environment.

DONEDEAL FUNDING NEWS

🇺🇸 FinTech Startup Ava secures $15.5m to tackle America’s $1t debt crisis. The funding will accelerate Ava’s mission to save Americans billions in interest and fees by scaling its subscription platform and advancing its autonomous finance engine. Continue reading

🇨🇴 Welli FinTech raises $75M in structured debt. Welli will use the funds to accelerate growth across Latin America and expand to new countries. Welli provides financing for patients who require medical procedures but lack the funds to pay upfront. Welli’s system instantly pre-approves loans and transfers payment directly to healthcare providers, helping underserved communities access quality treatment.

🇨🇦 Loon raises $3 million to build Canada’s first regulated stablecoin. The funding will accelerate product development, regulatory engagement, and team expansion across engineering and compliance. Read more

🌍 Danish RegTech startup Formalize raises €30 million. The new funding will enable Formalize to strengthen its position as the go-to compliance operations platform in Europe and scale its presence in key markets such as DACH and France, opening new offices and growing local teams to support customers.

🇺🇸 Kite announces investment from Coinbase Ventures to advance agentic payments with the x402 Protocol. The funds used from this investment will help address a critical bottleneck in the AI revolution. Continue reading

🇨🇦 Canada’s Wealthsimple valued at C$10 billion in new equity round. The capital raise announced is co-led by San Francisco-based Dragoneer Investment Group and GIC in Singapore. The round includes both a C$550 million primary offering and a secondary offering of up to C$200 million.

🇨🇳 FinTech firm FundPark nets $71m to boost AI-driven platform. The round includes capital from an Ares Management APAC Credit fund, with equity contributions from Alpha Nova Capital Management and Radiant Tech Ventures. Keep reading

🇸🇪 Swedish AI startup Grasp raises $7m in series A funding. The latest funding will be deployed to fuel Grasp's expansion plans and grow its product and sales teams. The platform connects highly domain-specific AI systems to trusted tools and datasets, helping teams produce higher-quality output.

🇵🇰 A16z leads $12.9M round for ZAR to bring stablecoins to Pakistan’s unbanked. The company said it hopes this approach will help citizens access dollar-backed digital money without requiring them to understand blockchain or crypto technology.

M&A

🇬🇧 Experian acquires KYC360 to boost fraud and financial crime solutions in the UK. With KYC360 seamlessly integrated into Experian, clients will benefit from optimised compliance, faster onboarding, and reduced operational costs, all of which will create a frictionless experience that also strengthens their financial crime defenses.

🇺🇸 Barclays is acquiring U.S. FinTech Best Egg for $800 million to strengthen its consumer lending capabilities and support its investment banking clients. Best Egg, which has facilitated over $40 billion in loans since 2013, will serve as an “origination engine” for the bank.

🇿🇦 AI FinTech Optasia sells stake to FirstRand for $277 million. The company is seeking to capitalize on frenzied demand to own stakes in AI-powered companies. Optasia is planning to sell a total of 1.25 billion shares in the IPO, with the book-building expected to close on Oct. 30.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()