Papara’s Operations Halted by Turkish Central Bank

Hey FinTech Fanatic!

The Central Bank of the Republic of Türkiye (CBRT) has permanently revoked the operating license of Papara, one of the country’s most prominent FinTechs.

The ban happened after an investigation into illegal betting and money laundering.

Authorities say more than 26,000 Papara accounts were linked to 102 unauthorized betting platforms between 2021 and 2023, with nearly ₺12 billion ($287M) moving through banks and crypto wallets.

Founder Ahmet Faruk Karslı and several executives were arrested earlier this year, and the company has since been placed under state control.

Papara had built a reputation for its prepaid cards, instant transfers, and cross-border ambitions in Europe and Asia. Its fall from grace now stands as one of the most high-profile FinTech enforcement cases in Türkiye to date.

This is a clear signal from regulators that AML/KYC enforcement will tighten sharply across the sector. What’s your take — will this reshape how FinTechs operate in the region?

Let’s make it a productive Monday! Here’s your FinTech rundown 👇

Cheers,

ARTICLE OF THE DAY

🇬🇧 Why global payouts must match digital expectations for immediacy. Rich Wood, Head of EU FI and NBFI at PagoNxt Payments, emphasizes that in an era defined by instant digital experiences, slow payments undermine customer trust. He notes payouts are no longer just back-office operations; they are central to customer satisfaction, loyalty, and the modern financial experience.

INSIGHTS

🇺🇸 Stablecoins unlock new pathways of economic growth and trade. David Malpass at ACI Worldwide’s Payments Unleashed Summit highlighted the transformative potential of stablecoins in global finance. He described them as a bridge between traditional banking and emerging digital systems, capable of lowering costs and enabling real-time, cross-border transactions.

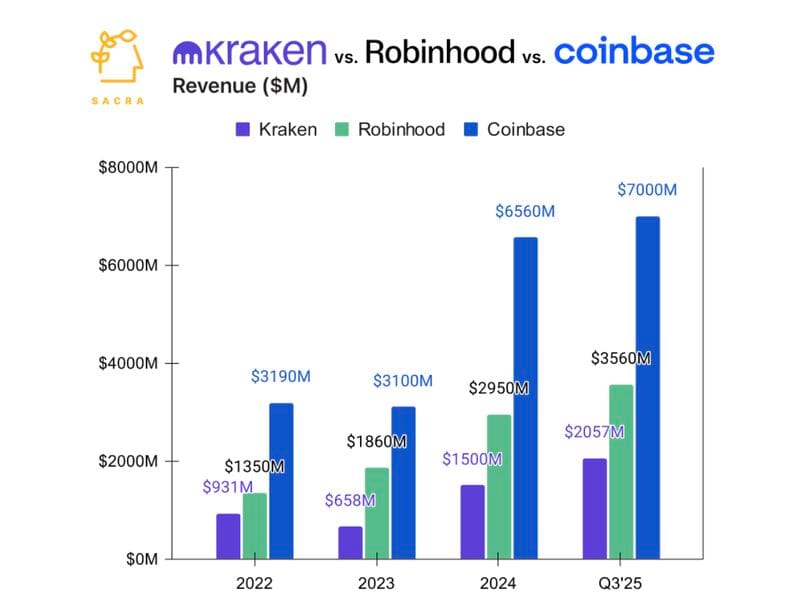

📊 Kraken vs. Robinhood vs. Coinbase

A comparison on Revenue ($M) 2022-2025👇

FINTECH NEWS

✨ New Runs Added! The FRC calendar just got an upgrade! Check out our newest November runs and join the community, hitting the streets from Munich to Hong Kong. 🏃➡️ See the full calendar and find your next run!

🇵🇭 Manny Pacquiao enters the payments ring with BSP-approved Manny Pay, a new payments application operating with a Bangko Sentral ng Pilipinas (BSP) licence. Powered by 7th Pillar Integration Systems, Manny Pay handles payments from multiple sources, including credit cards, bank transfers, and other e-wallets, while reportedly offering lower fees.

🇹🇷 Turkey’s central bank revokes FinTech company Papara’s license amid illegal betting probe. Papara has been under investigation since May for allegedly facilitating illegal online betting. The probe led to the arrest of 11 people, including the company’s founder and CEO, Ahmed Faruk Karslı.

PAYMENTS NEWS

🇺🇸 Worldpay adds support for OpenAI’s agentic commerce protocol. As the company noted in a news release, this is an open standard for AI commerce, enabling AI agents, people, and businesses to collaborate on purchases. With ACP, users of OpenAI’s ChatGPT will be able to shop directly from participating Worldpay merchants using Instant Checkout.

🇬🇧 payabl. brings connected in-store payments to the UK as part of its omnichannel growth, helping merchants deliver fast, reliable, and secure in-person payments as part of a unified experience across channels. payabl. in-store enables businesses in retail, hospitality, and services to accept multiple payment methods.

🇬🇧 Revolut banking FinTech launches 1:1 stablecoin conversions. Revolut users will be able to exchange stablecoins for $1 every time, and deposit/withdraw their stablecoins using more than six supported chains, including Ethereum, Solana, Tron, and others.

🇳🇬 FinTech Kalabash54 Launches Multi-Currency Payment Solution. The Kalabash Cards enable customers to fund, spend, and earn cashback rewards on both Nigerian naira transactions and global U.S. dollar transactions, applicable both locally and internationally for travel, shopping, dining, and lifestyle purchases.

🇿🇦 Lesaka’s FinTech platform deepens reach in South Africa’s township markets. Lesaka empowers township merchants of all sizes with a full suite of financial and digital solutions, including POS and card acquiring, growth capital, supplier and bill payments. Its technology helps local businesses grow, operate efficiently, and reduce risk.

🇻🇪 Venezuela banking giant to integrate Bitcoin and USDT soon. Conexus works to integrate Bitcoin and stablecoins directly into the national banking system. The company aims to take its services a step further by allowing local banks to offer direct crypto services, including custody, transfers, and fiat exchange for Bitcoin and stablecoins.

🇺🇸 Fiserv announces transfer of stock exchange listing to Nasdaq. The Company expects its common stock to begin trading on the Nasdaq Global Select Market on November 11, 2025, under its original Nasdaq ticker symbol “FISV.” Keep reading

🇺🇸 Affirm gets boost from New York Life with $750 million loan deal, giving the payments company fresh off-balance-sheet funding to support roughly $1.75 billion in annual loan volume. The partnership is part of a broader trend of insurers and private-credit investors moving deeper into consumer finance as higher interest rates make these assets more attractive.

🇮🇳 FinTech Body flags UPI dominance by American Companies, seeks measures for fair competition. The group has urged policy intervention to prevent systemic concentration and ensure fair competition within India's most critical digital payments channel.

REGTECH NEWS

🇪🇺 Circle warns EU stablecoin rules risk dual licensing by March 2026. Patrick Hansen, Circle’s Senior Director of EU Strategy and Policy, warned that unresolved conflicts between European crypto regulations could create significant compliance burdens for stablecoin service providers.

DIGITAL BANKING NEWS

🇺🇸 Santander’s Openbank celebrates its first year in the United States with more than $6 billion in deposits. Openbank has quickly established itself as a trusted, digital-first platform delivering a simple, safe, and rewarding experience, powered by Banco Santander, one of the world’s leading financial institutions.

🇬🇧 Starling has a new brand, and a new website might cost it $5m. The digital bank unveiled a rebrand in September with a more vibrant colour palette, new card designs, a fresh logo, and the removal of “Bank” from the company’s name. It has kept its website at the domain starlingbank.com, while its social media handles also have yet to change at the time of writing.

🇩🇪 BBVA expands digital offering with new deposit feature in cooperation with Paysafe. Barg eld via App is a new feature that lets customers deposit cash directly into their accounts at supermarket and retail checkouts. Customers can now easily complete both cash-in and cash-out transactions.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Stablecoin surge prompts review of new global bank crypto rules. Global regulators are in talks about overhauling rules on banks’ crypto holdings due to come into force next year after the rapid development of stablecoins sparked a US-led pushback against the original measures.

🇺🇸 Circle launches Arc Public Testnet. The open Layer-1 blockchain network is designed to meet the needs of developers and companies, bringing more economic activity on-chain. The launch arrives with broad-based engagement and collaboration from more than one hundred companies across the financial and economic system.

DONEDEAL FUNDING NEWS

🌍 Startup Hercle raises $10 million to build out stablecoin-based global money transfers. Hercle says it will use the funding to continue to expand across South America, the Middle East, and Africa, and also to broaden its global regulatory footprint.

🇺🇸 SavvyMoney raises $225M to accelerate innovation for financial institutions. The investment will accelerate SavvyMoney's product roadmap and go-to-market investments, enabling the company better to serve its core community of over 1,500 financial institutions.

M&A

🇬🇧 Coinbase targets $2 billion BVNK deal for fresh stablecoin push. If completed, the deal would boost Coinbase’s push into payments and stablecoin infrastructure. BVNK’s platform aligns with Coinbase Business, enabling merchant payments and treasury tools.

🇬🇧 Keyless to be acquired by Ping Identity to drive global adoption of privacy-preserving biometric authentication. Keyless’ acquisition will equip customers, employees, and citizens globally with biometric multi-factor authentication that never stores their biometric data.

MOVERS AND SHAKERS

🇮🇳 BharatPe appoints Harshita Khanna as CHRO. Khanna will lead the company’s human capital strategy, driving leadership capability, employee experience, and organisational transformation to support the firm’s next phase of expansion in India’s competitive FinTech landscape.

🇨🇱 Paytech Kushki appoints Carlos Molineiro as the new Country Manager in Chile. Molineiro's main objective will be to boost its growth and continue closing strategic alliances with large businesses in the country. The appointment aims to strengthen the company's presence and align with its growth in the country's market.

🇺🇸 Alkami appoints Cassandra Hudson as Chief Financial Officer. She brings more than 20 years of experience building, leading, and advising companies through rapid growth, capital markets transactions, international expansion, and M&A activity. Read more

🇩🇪 Fenergo appoints three Senior Executives to drive the next phase of AI innovation and product leadership. Sharon Bodkin joins as Vice President, Banking Product; Neil D’Rosario as Vice President, Buyside Product; and Adam McLaughlin as Director of Financial Crime Product. All appointments are effective immediately.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()