Paddle Raises $25M as Web Monetization Booms

Hey FinTech Fanatic!

Fresh off a wave of AI-driven demand and Apple’s web payment policy shift, Paddle has raised $25M to fuel its next phase of growth. The Merchant of Record platform is doubling down on enterprise features, global expansion, and go-to-market firepower, with a new Austin office and key execs from Shopify, Intercom, and more.

With 40% YoY growth and a footprint across SaaS, AI, and consumer app companies, Paddle is betting big on helping digital businesses scale faster, with fewer payment headaches. Scroll down for how it’s positioning itself to lead the web monetization wave. 👇

On another exciting note, Rex Salisbury just locked in another $20M to keep betting on FinTech’s next wave. Yes, it’s a good week for digital builders in the FinTech space.

See you Monday!

Cheers,

INSIGHTS

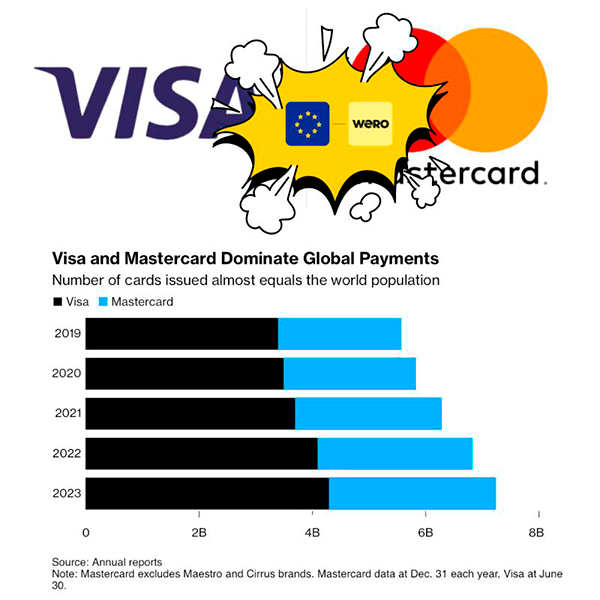

🇧🇪 Five Belgian Banks are preparing to launch Wero, expanding the European Payments Initiative’s footprint and accelerating efforts to unify the continent’s digital payments environment.

FINTECH NEWS

🇬🇧 Wise ends Q1 FY26 with 11% jump in income. Wise generated income of £362 million between April and June, marking an 11% increase year over year. The company expects its full-year growth to remain in line with its medium-term guidance of 15-20% on a constant currency basis.

🇺🇸 Some big US banks plan to launch stablecoins, expecting crypto-friendly regulations. Stablecoins, a type of cryptocurrency designed to maintain a stable value, are typically pegged to a fiat currency, such as the U.S. dollar, and are commonly used by crypto traders to transfer funds between tokens.

🇹🇷 Trendyol, Baykar CEO, ADQ, and Ant International to develop a FinTech platform in Turkey. The four parties signed a memorandum of understanding to form a platform that would provide services including digital payments, loans, deposits, investments, and insurance. The launch would be subject to regulatory approvals.

🇬🇧 German FinTech Debtist launches in the UK. The new London office is part of the company’s strategic growth agenda, through which it aims to establish its tech-driven receivables management solution across Europe, step by step. Read more

🇺🇸 Gemini IPO set to launch soon. According to the company, it will soon issue an S-1 filing and conduct a roadshow to reveal more details about the number of shares and the price range being offered. Goldman Sachs, J.P. Morgan, and Citigroup, as underwriters, have important roles in the IPO process.

FINTECH RUNNING CLUB

🇧🇷 Run in Sao Paulo with Us!

PAYMENTS NEWS

🇵🇭 GoTyme now has 6.5 million clients and P30 billion deposits. As of the second quarter, the digital bank stated that it has become one of the country’s fastest-growing financial institutions, now ranking among the top four in monthly active app users and the top five in Instapay transaction volumes.

🇬🇧 payabl. launches SEPA Direct Debit capabilities for business payment services. This will facilitate the automatic collection of recurring euro payments for companies operating across the 36 SEPA countries. The newly introduced functionality allows merchants to accept recurring payments from customers through payabl.’s gateway.

🇸🇬 Ant International expands merchant payment AI functions with Antom Copilot 2.0. New features include the industry-first Chargeback AI Assistant, automated payment method recommendation, AI-assisted onboarding, and risk management strategy configuration.

OPEN BANKING NEWS

🇺🇸 FinTech and Crypto industries launch fight to block bank fees for customer data. Two major FinTech trade groups, the Financial Data and Technology Association of North America and the Financial Technology Association, said they have met with the Treasury in recent weeks, urging regulators to uphold a regulation, known as the open banking rule.

REGTECH NEWS

🇺🇸 GENIUS stablecoin bill clears House and heads to Trump's desk. The US House of Representatives voted 308–122 to pass S. 1582, the GENIUS Act, a sweeping bill designed to establish a national regulatory framework for payment stablecoins.

DIGITAL BANKING NEWS

🇵🇱 Revolut is launching a loyalty program in Poland, called RevPoints. Revolut customers will be able to collect points for everyday transactions and then redeem them for attractive rewards, including airline miles, public transport tickets, hotel discounts, eSIM data, and purchases using Revolut Pay.

🇮🇳 Jupiter Money bags corporate agency licence to enter insurance distribution. Jupiter can now distribute life and general insurance policies through its app. The FinTech platform will initially offer curated products, including term life and health insurance, in partnership with major insurers.

🇩🇪 N26 strengthens travel offer with travel eSIM mobile plans and 1% cashback on international travel spend. Customers can enjoy flexible data plans with best-in-class prices, choosing from different plan sizes tailored to their destination. They can activate travel data plans for over 100 destinations in just a few taps.

BLOCKCHAIN/CRYPTO NEWS

🇦🇺 Digital asset FinTech Block Earner unveils Bitcoin-backed home loan. With a mission to bridge traditional finance and blockchain technology, its latest product seeks to reshape conventional thinking about housing affordability by pricing in “inflation-resistant assets” such as Bitcoin and gold.

🇬🇧 Ripple launches European operations with Luxembourg LEI Registration. The firm seeks an EMI license under MiCA regulations to issue RLUSD stablecoin and offer cross-border payments across 30 EEA countries. Continue reading

🇺🇸 Coinbase Wallet is now Base app, a crypto everything app. Coinbase is coming out with its super app after rebranding its Coinbase Wallet as Base app. “Coinbase Wallet is now the Base app, evolving from a wallet into an everything app that brings together social, apps, chat, payments, and trading,” the firm said.

🇳🇴 MiniPay surpasses 8 million wallets and 200 million transactions, with a 255% activation surge in Q2. MiniPay's rapid growth comes from solving real user needs in regions where financial volatility is high and access to a stable currency can be life-changing.

🇺🇸 Crypto theft is booming as criminals increasingly turn to physical attacks. The value of cryptocurrencies stolen by criminals surged in the first six months of 2025 after a high-profile hack and a wave of physical attacks targeting crypto holders and their relatives.

PARTNERSHIPS

🇦🇺 Mastercard and Equifax launch Open Score to bridge the credit gap for small businesses. It aims to expand access to credit for the 2.5 million Australians currently considered “credit invisible”. This includes small business owners and sole traders, as well as renters, migrants, and other individuals with limited or no credit history.

🌍 PAX and Lunu Pay enable crypto payments at 80 million terminals globally. The partnership allows merchants using PAX’s Android-based POS terminals to accept over 30 cryptocurrencies, including Bitcoin and Ethereum, without needing any new hardware.

🌎 Thredd and Payblr partner to power seamless cross-border FinTech expansion across Latin America. By combining Thredd’s modular technology stack and global processing expertise with Payblr’s cross-border card issuing capabilities, the partnership eliminates the traditional complexity associated with launching in LAC markets, offering a seamless pathway.

🇺🇸 Grasshopper Bank partners with Lendio to enhance SBA loan delivery with AI-powered tools. By leveraging advanced customer acquisition and AI-powered decision-making tools from Lendio, Grasshopper Bank plans to streamline the entire SBA top-of-funnel process from application to approval.

🇩🇪 Fideus teams up with Holvi to simplify holding setups. Fideus takes care of the full setup for holding companies, from incorporation to tax returns and annual reports. All-in-one digital platform, powered by AI. And up to 60% less effort and cost than a traditional tax advisor.

🇺🇸 TerraPay and XanderPay launch payment models for hotel brands. The solution is designed to simplify cash flow management, reduce the costs and friction associated with cross-border transactions, and eliminate the complexity of processing third-party bookings.

🇲🇽 Global Payments and Banamex renew strategic partnership. Extending the strategic alliance enables both companies to serve the full spectrum of merchants, from small and medium-sized businesses to enterprises, including both digital native and brick-and-mortar establishments.

🇺🇸 Noah and Gnosis partner to deliver global stablecoin payment infrastructure. The collaboration allows users to transact in USD and stablecoins with full regulatory confidence. For users in emerging markets, it unlocks new access to U.S. dollar-denominated accounts and seamless payments to and from the U.S.

DONEDEAL FUNDING NEWS

🇺🇸 Rex Salisbury’s Cambrian Ventures raises new fund, bucking FinTech slowdown. Salisbury has been busy investing in pre-seed and seed-stage startups from Cambrian’s inaugural $20 million fund. Of the 33 companies he has funded, Salisbury claims about half have already secured Series A funding.

🇬🇧 yetipay raises £3.5M to expand its all-in-one payments platform. The funds will be used to continue the expansion of yetipay’s all-in-one payments platform and introduce new products to its growing base of independent and enterprise hospitality and retail customers.

🇫🇷 Index Ventures and Revolut's Storonsky back FinTech Spiko in $22m raise. Spiko aims to reduce the gap between the US and Europe by enabling smaller businesses to earn interest from practically risk-free assets, particularly treasury bills, a form of short-term debt securities issued by governments in the EU and the US.

🌏 Proximity announces the closing of a Series C round of US$36m. Proxymity will use this additional growth capital to further enhance its global proxy voting and shareholder disclosure technology and to support its expansion into the APAC region.

🇺🇸 Viva Finance lands $220M to expand access to credit across the US. According to Viva, the new capital injection will be used to "reach new customer segments and continue expanding nationwide", alongside supporting the enhancement of its product offerings and expansion of employer partnerships.

🇬🇧 Paddle raises $25M to accelerate growth and international expansion. The funding will be used to support Paddle’s continued global expansion, accelerate growth, and drive rapid product development to further support its enterprise customers.

🇺🇸 SMB-focused FinTech Receive bags $4M in seed funding. With the new capital, Receive has launched the Titanium Boost Business Mastercard® in partnership with Titanium Payments. The card gives Titanium’s SMB network immediate access to funds from pending transactions, turning delayed settlements into usable revenue.

M&A

🇳🇱 Coda accelerates global expansion with acquisition of European payments platform Recharge. The acquisition accelerates Coda's expansion beyond gaming and strengthens its ability to serve the broader digital content economy by extending its presence in Europe and building on its direct-to-consumer capabilities.

MOVERS AND SHAKERS

🇬🇧 CAB Payments confirms James Hopkinson as new CFO. Hopkinson brings extensive experience from his previous roles. This appointment is expected to strengthen the company’s leadership team and enhance its financial strategy, potentially impacting its operations and market positioning positively.

🇦🇺 Change at the top of ANZ Worldline after CEO resigns. John Collins has been appointed interim chief executive of ANZ's merchant acquiring joint venture with Worldline following the departure of Steve Aliferis. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()