Nubank Follows a Growing Trend in FinTech and Launches Travel eSIM with Gigs

Hey FinTech Fanatic!

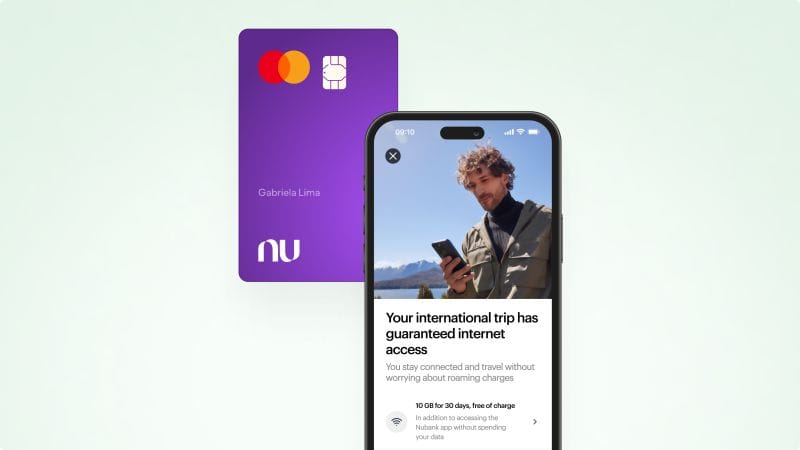

As I shared earlier Nubank is making its foray into the mobile network sector with the introduction of an eSIM (embedded SIM) service designed for travelers.

This new offering allows Nubank customers to access 10GB of free roaming internet across more than 40 countries, without needing to swap out their existing physical SIM card or eSIM.

The launch follows recent news that Brazil’s National Telecommunications Agency (ANATEL) had discreetly approved Nubank’s plans to become a mobile virtual network operator (MVNO) in collaboration with provider Claro.

Targeted at Nubank Ultravioleta customers—a premium subscription service introduced three years ago with perks like insurance, higher credit limits, cashback, and family accounts—the new eSIM service expands Nubank's offerings.

Nubank recently announced its entry into the travel sector with the upcoming launch of a “global account” in partnership with European FinTech Wise, which will enable Ultravioleta subscribers to make low-fee international money transfers.

This eSIM service, part of the travel sector initiative, provides 10GB of data for travelers in the U.S., Latin America, and Europe.

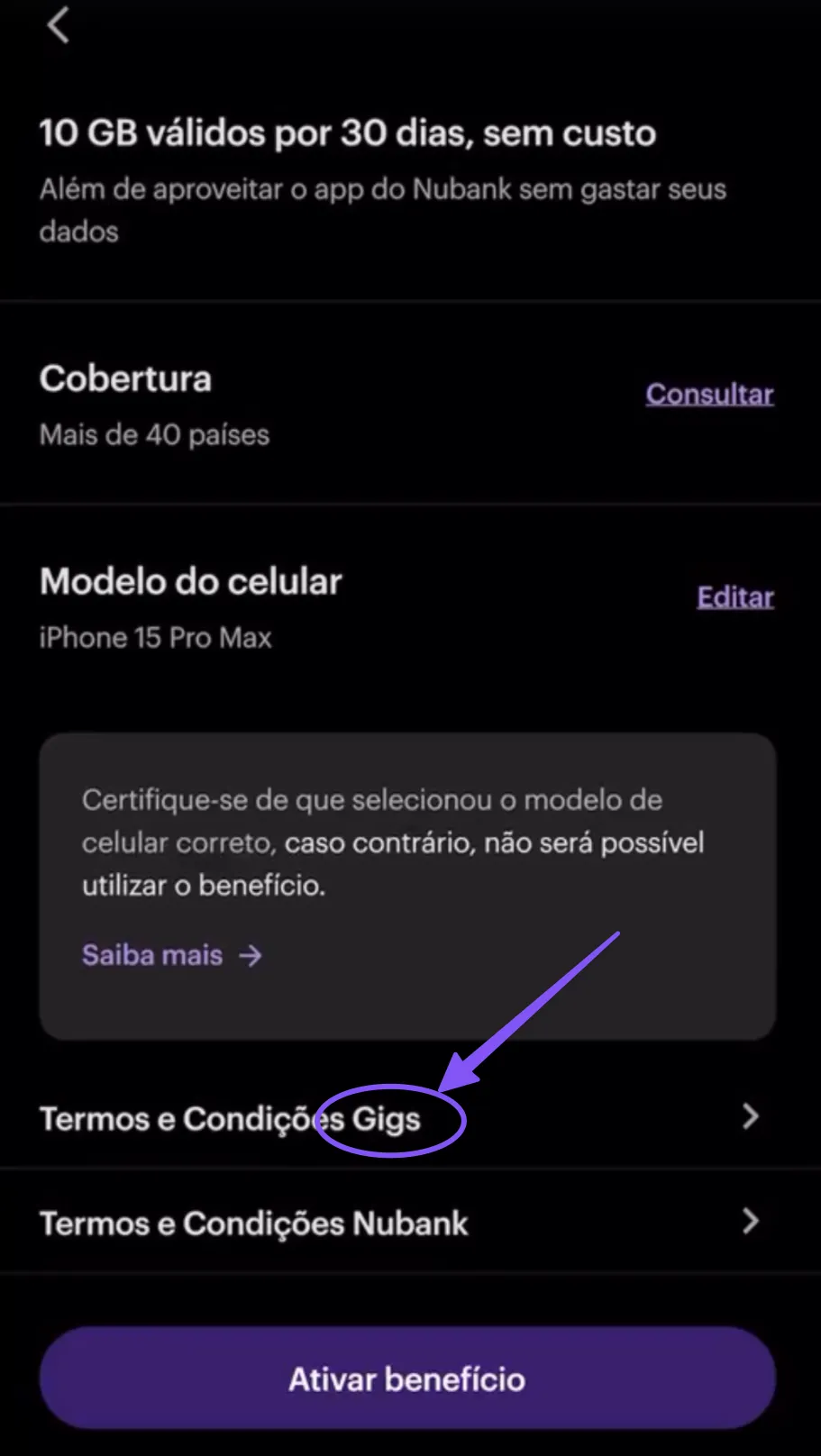

Users can activate the eSIM via the Nubank app, leveraging infrastructure powered by Gigs.

Gigs provides a platform that streamlines the creation of mobile network services through a single API, similar to how Stripe simplifies financial transactions for businesses.

“Bundling mobile plans represents a powerful lever for neobanks to turn irregular users into monthly paying subscribers, encourage upgrades to premium features, and create an ecosystem where banking acts as a hub for multiple value-added services,” Gigs co-founder and CEO Hermann Frank told TechCrunch.

Calling itself an MVNO could invite extra regulatory oversight. Although banks are already tightly regulated as financial institutions, being classed as a telecommunications company would likely usher in further regulatory obligations.

While Nubank is indeed preparing to launch an MVNO service in its domestic Brazil, its travel eSIM service is more straight forward to bring to market due to its partnership with Gigs, as that partner assumes all the regulatory compliance complexities that come with the territory.

E-SIM is a growing trend in FinTech. In February, Revolut launched a similar eSIM service for premium subscribers.

And last year, Indian neobank Zolve also added mobile networks to its arsenal of services so immigrants can not only have their banking set up before arriving in the U.S., but have a mobile service ready to go on arrival too.

Also, in Brazil Nubank would not be the first financial entity to launch its own mobile operator. Banco Inter owns Inter Cel and sells mobile plans to account holders using Vivo's coverage.

Is E-SIM going to be a feature of every banking app soon?

Cheers,

BREAKING NEWS

🚨 PayPal hires Uber’s former Head of Advertising to run new ad division based in user data. The payments giant would create this ad network using data from user purchases as well as wider spending patterns from the millions of people using PayPal and Venmo, according to an announcement released early Tuesday (May 28).

FINTECH NEWS

🇺🇸 Ascenda, a global premium rewards network, announced it has partnered with Ramp, the finance automation platform and corporate card designed to save businesses time and money, to provide Ramp customers more ways to redeem points earned on U.S. spend.

🇨🇦 FinTechs Canada responds to Bank of Canada retail payments policies and guidance. In its response, the association identified parts of the Bank of Canada’s policies and guidance that required clarification and would be difficult to implement. Find out more

🇸🇪 Klarna using GenAI to cut marketing costs by $10 mln annually. The company has cut its sales and marketing budget by 11% in the first quarter, with AI responsible for 37% of the cost savings, while increasing the number of campaigns, the company said.

PAYMENTS NEWS

🇬🇧 DNA Payments adds Alipay+ to POS portfolio. Alipay+ will allow over 50,000 UK merchants using DNA Payments’ POS terminals to accept direct payments from global tourists, mostly from Asia, quickly and conveniently, benefiting sectors such as hospitality, tourism, travel and more.

🇬🇧 Gnosis Pay inks partnership with Visa to help connect the Web3 ecosystem with traditional payments. For Gnosis Pay, this partnership ensures digital currencies can be used easily for everyday transactions, reducing inefficiencies and offering a more agile user experience.

🇹🇷 FinTech Thunes explains why Turkey is expected to lead digital payments adoption. By developing a conducive ecosystem for financial innovation, Türkiye has “laid the ground for greater economic prospects for businesses and consumers." Thunes says its extensive payments network in the country “facilitates collections and payouts to link bank accounts, digital wallets, and merchants.”

🇮🇳 Indian conglomerate Adani is reportedly in discussions to enter the eCommerce and payments space. The company is considering applying for a license to take part in India’s Unified Payments Interface (UPI) network, the Financial Times reported Tuesday (May 28).

DIGITAL BANKING NEWS

🇬🇧 Revolut, the global financial app with more than 40 million customers worldwide, extends its international transfers feature Mobile Wallets with 14 new payment corridors, 9 new countries and 3 digital wallets: Airtel, Orange Money and MTN. The company is betting on strong economic ties between Europe and Africa.

🇬🇧 Martin Gilbert, the chair of Revolut and founder of Aberdeen Asset Management, has said the British FinTech giant is mulling a move into the fund management industry. Speaking about the company’s expansion plans, Gilbert acknowledged that until the FinTech sorted out its UK banking license and gained the trust of customers, particularly of older people, growth was going to be “tricky”.

🇩🇪 FinTech N26 says regulatory action cost it ‘billions’ in lost growth. Years of regulatory action against German FinTech N26 for its poor anti-money laundering controls may have cost the business billions of euros, co-founder Valentin Stalf told the Financial Times, as authorities finally remove a cap on its growth.

🇩🇪 N26 welcomes BaFin’s lift of its growth restriction, CEO Valentin Stalf shared yesterday on his LinkedIn page. Read the complete LinkedIn post for more info

🇧🇷 Nubank launches travel eSIM with Gigs. This new offering allows Nubank customers to access 10GB of free roaming internet across more than 40 countries, without needing to swap out their existing physical SIM card or eSIM. Read on

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 FTX’s Ryan Salame, one of Sam Bankman-Fried’s associates, is sentenced to 7½ years. A federal judge sentenced the former FTX exec, stating that his crimes and efforts to undermine transparency in the 2022 election merited a substantial penalty to deter others.

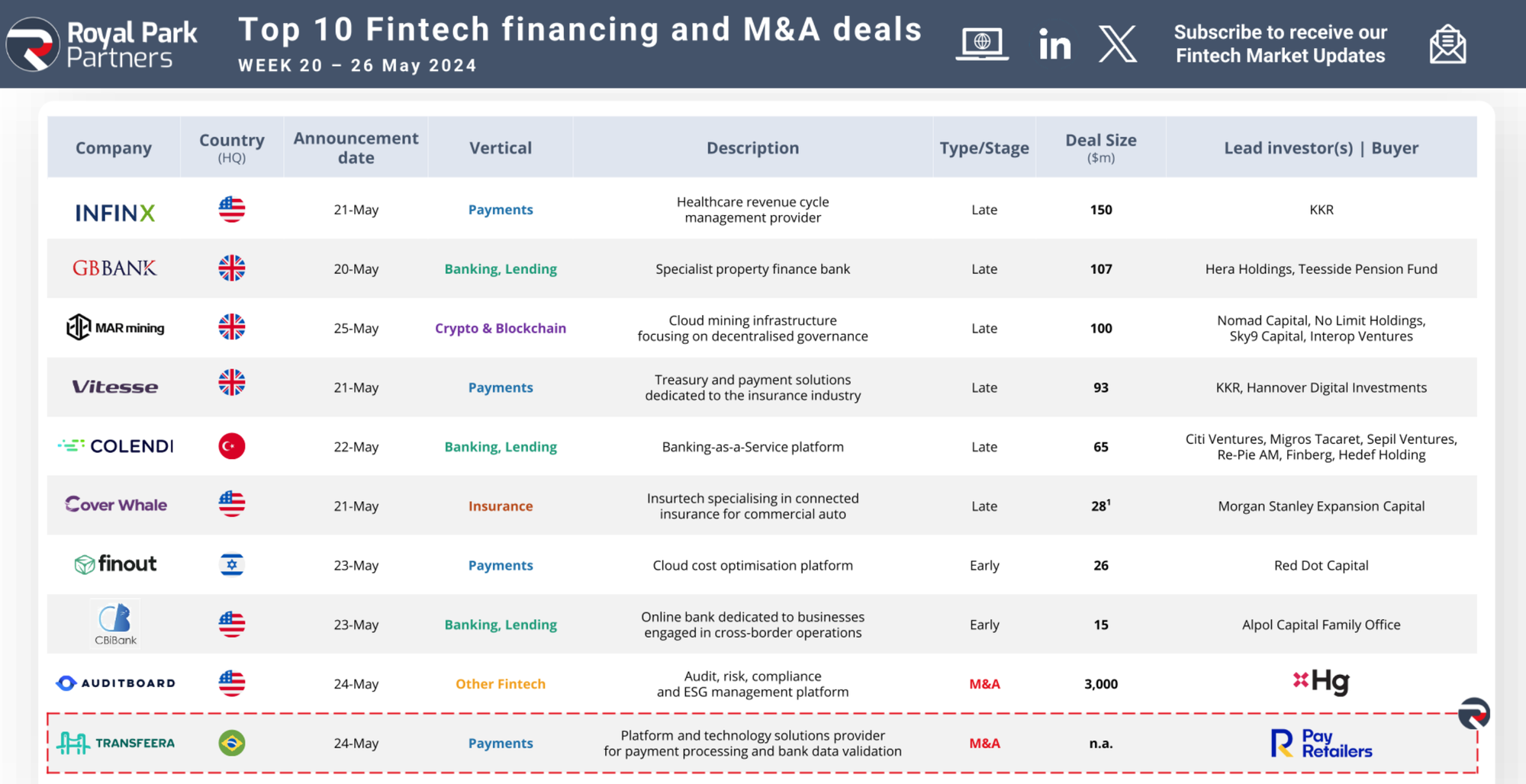

DONEDEAL FUNDING NEWS

🇬🇧 Swiipr, a travel paytech company transforming the airline industry’s outdated and inefficient disruption payments systems, has secured £6m in Series A funding. Launched in 2020, Swiipr is used by 26 airlines in 70 countries, including a major flag carrier with 4,000 staff across 167 airports.

🇩🇰 Copenhagen-based ZTLment secures €2.4 million. With the fresh capital, ZTLment aims to eliminate the need for outdated banking infrastructures once and for all and make it easy to make programmable and peer-to-peer payments.

🇺🇸 Félix Pago raises $15.5 million to help Latino workers send money home via WhatsApp. Félix Pago hopes to help customers with more than remittances. “The vision that we have for Félix is to become the trusted companion for the Latino immigrant in the U.S.” Read on

M&A

🇳🇬 Struggling Nigerian FinTech startup Brass has been acquired by a consortium led by Paystack. The co-founders have stepped down. The acquisition brings together several key players in the Nigerian FinTech space, underscoring the continued wave of consolidation in the industry.

MOVERS & SHAKERS

🇬🇧 Paymentology, a global issuer-processor announced the appointment of Tim Joslyn as its Chief Technology Officer (CTO), succeeding interim CTO James Letley. As CTO, Tim will be at the helm of overseeing the development and deployment of next-generation technology solutions to customers, and partners.

🇱🇹 The board of the financial technology company Paysera has appointed Konstantinas Balakinas as the third Deputy CEO. The Bank of Lithuania has approved his candidacy. Among Balakinas’ main responsibilities are the development of a super app and the launch of a P2P lending platform.

🇺🇸 Paystand, a blockchain-enabled B2B payments company, announces the appointment of Allison Grieb as chief sales officer. Grieb brings her years of sales roles at high-growth tech companies to the new position. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()