No Apple Pay Later in Germany: Apple Partners with Zinia for BNPL

Hey FinTech Fanatic!

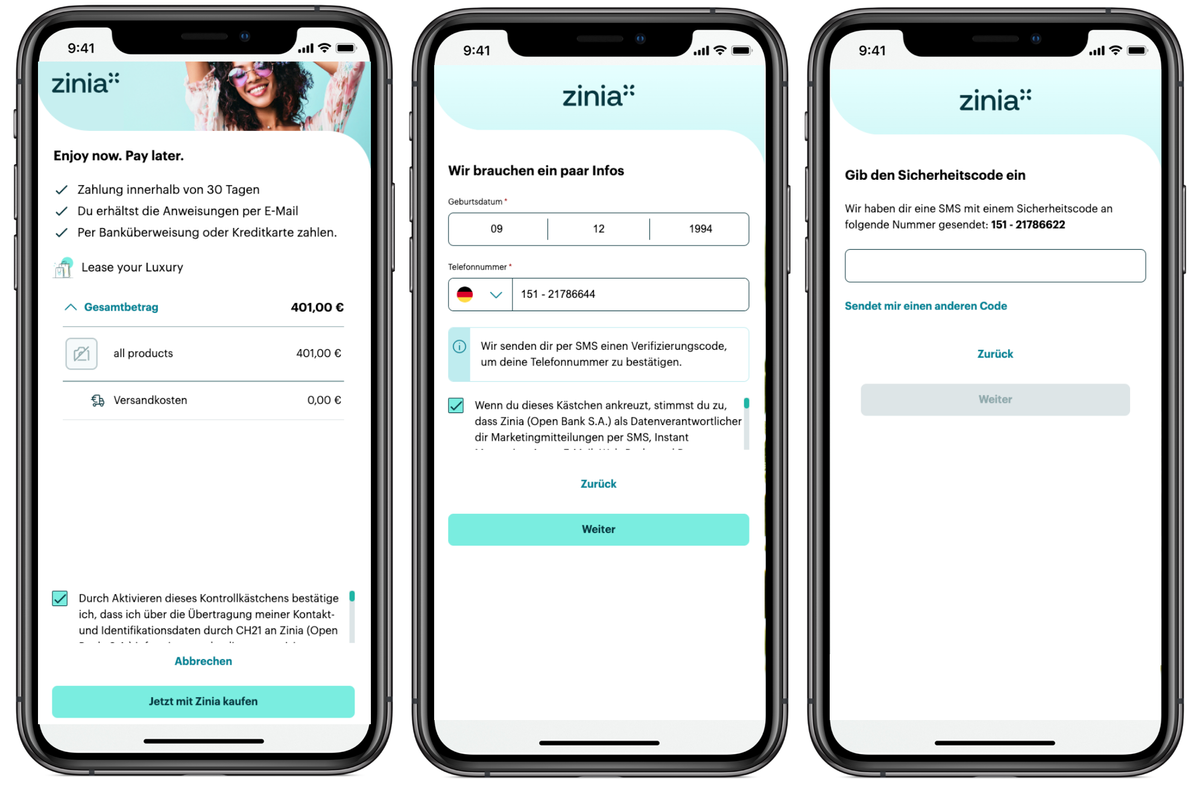

No Apple Pay Later in Germany, instead, Santander's Buy Now Pay Later (BNPL) platform Zinia, has been chosen by Apple to provide installment payment plans for customers in Germany, available for both online and in-store purchases.

With Zinia, Apple customers can now choose to split their payments into installments of 3, 6, 12, 18, 24, or 36 months. Additionally, there's an option to defer the payment for 30 days post-shipment (for online purchases) or after in-store pickup.

As a special promotion, Apple customers who finance their iPhone purchases through Zinia in the upcoming months will be able to do so with interest-free installments over 12 or 24 months.

The transaction process is straightforward: customers simply need to provide their phone number and date of birth, confirm receipt of a security code, and complete a quick validation by logging into their online banking within the Apple Store online.

Zinia, which has been serving German consumers since 2022, aims to leverage its growth in the German market to expand its product offerings across other European countries in the near future.

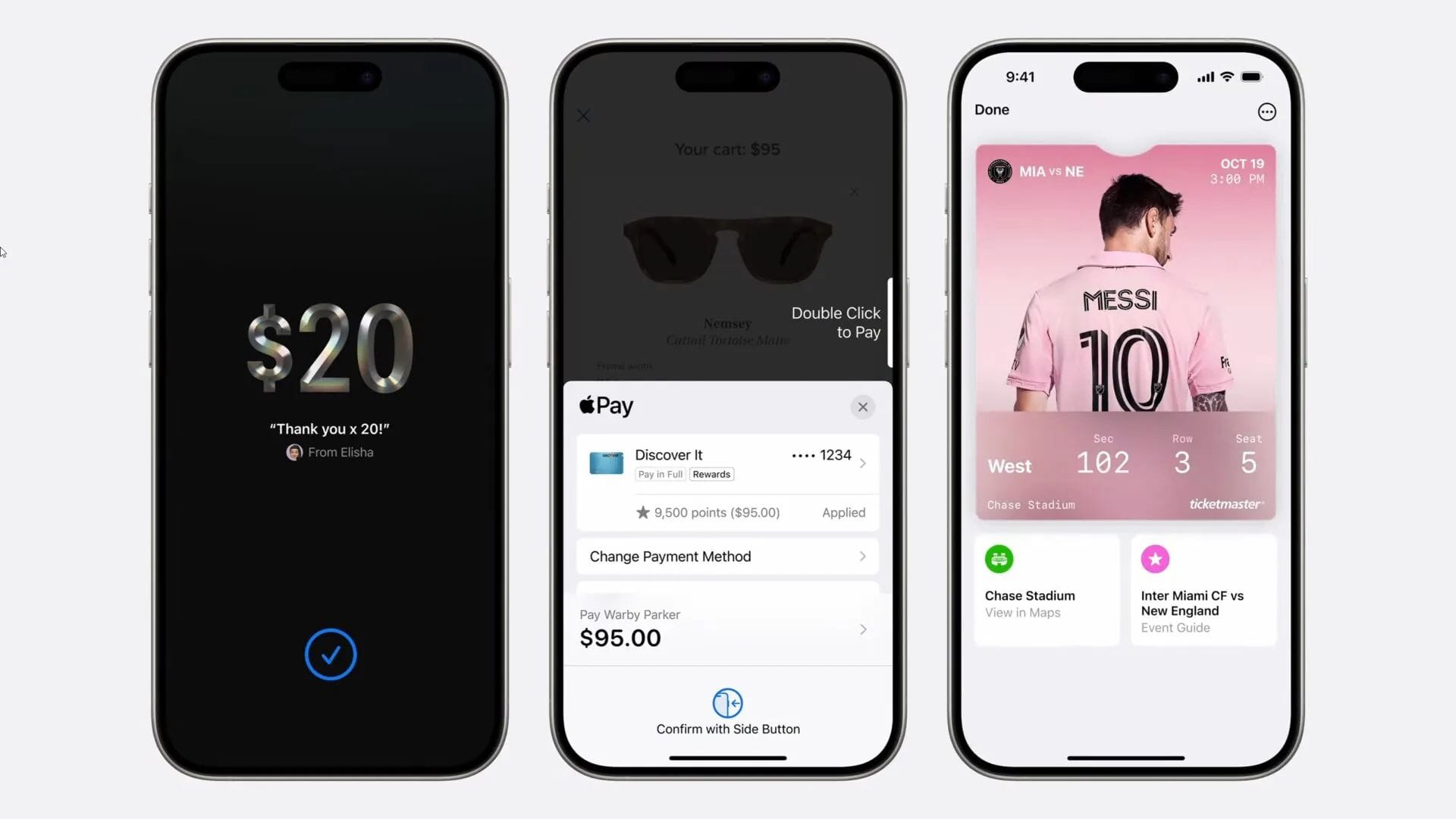

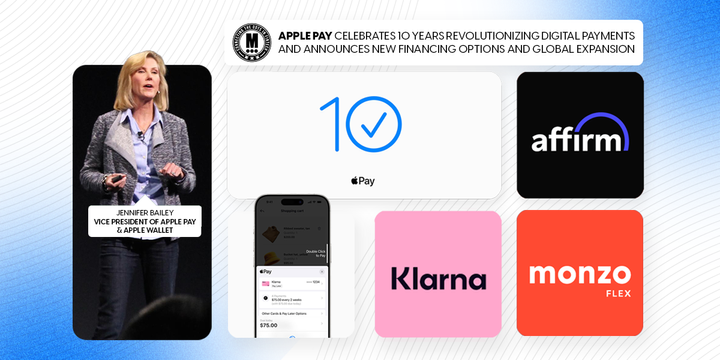

More Apple Pay news yesterday from Apple’s annual WWDC event. Among the standout announcements, for the FinTech industry, were three major updates to Apple Wallet that promise to enhance user convenience and functionality.

1. Tap to Cash

One of the most exciting new features is "Tap to Cash."

This innovative tool allows users to transfer money to another Apple Pay user nearby without exchanging personal details. Using iOS 18, you simply hold your phone near the recipient’s device, select the send cash option, and Apple Cash handles the rest. It’s like AirDrop, but for money.

2. Rewards and Installments in Apple Pay

Apple Wallet now lets users view and redeem their rewards or points directly through Apple Pay, both online and in apps. Additionally, accessing installment financing options from your bank is now more seamless than ever.

3. Event Tickets and New Event Guides

The redesigned event tickets feature brings a host of new functionalities, including an integrated event guide. This guide combines essential venue information with personalized recommendations from Apple apps.

Apple continues to push the envelope with these enhancements, ensuring that Apple Wallet remains a central hub for users' financial transactions.

What do you think about these updates? Let me know in the comments below👇

Cheers,

#FINTECHREPORT

📊 Trends in Regional Payments. This report explores principal payment trends throughout North America, Latin America, Europe, Asia, and Africa. It examines the genesis of these, and spotlight success barriers, opportunities, and potential impacts.

INSIGHTS

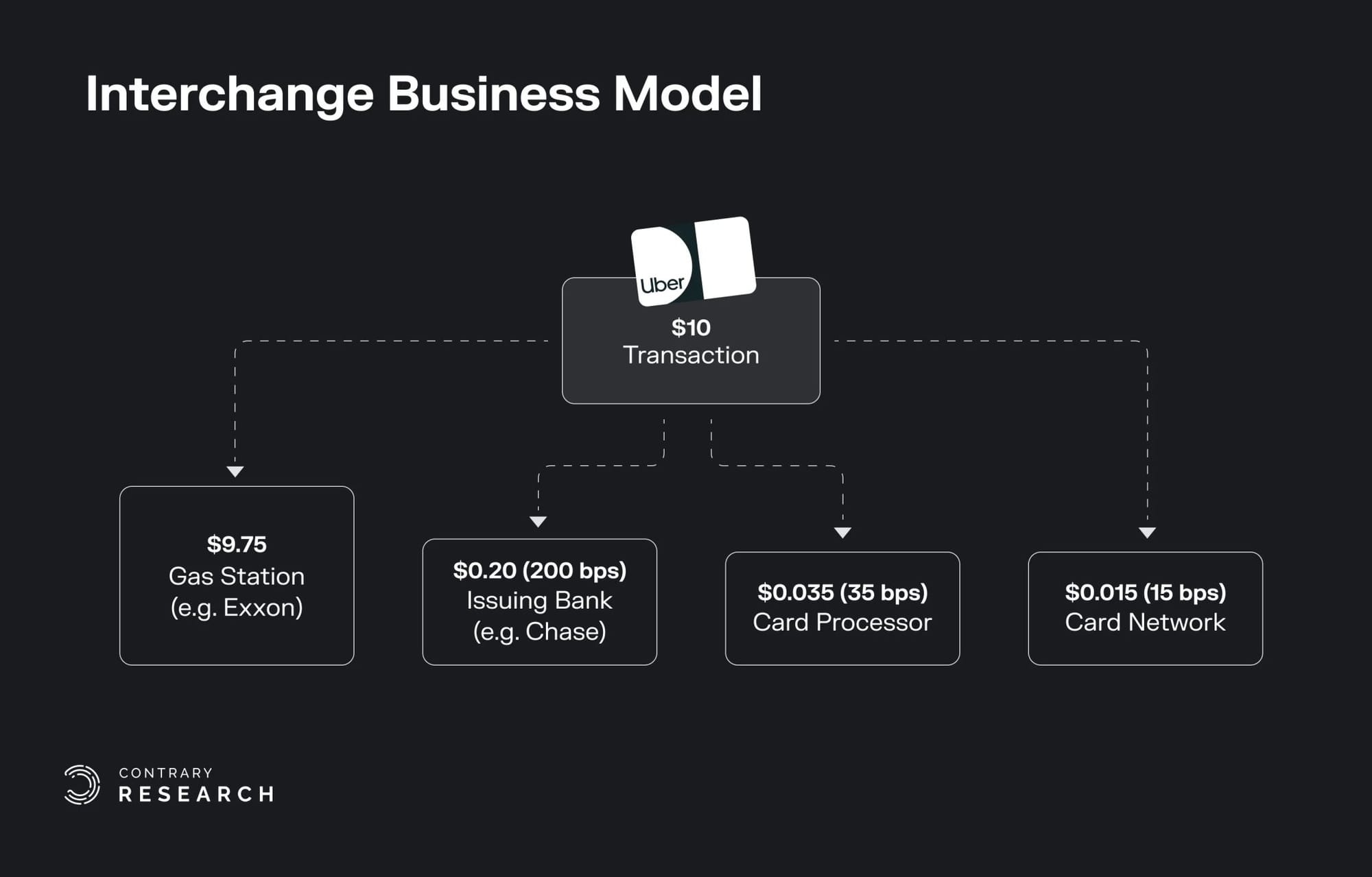

📈 The Great Bank Unbundling, by Contrary Research. Embedded Financial Services presents an opportunity for software companies to unlock new revenue streams via 𝗶𝗻𝘁𝗲𝗿𝗰𝗵𝗮𝗻𝗴𝗲, and improve retention. Read the complete deep dive here

FINTECH NEWS

🇪🇬 FABMISR, an Egypt-based financial institution, has formed a strategic alliance with Cayesh, a player in the supply chain finance sector in the country. The collaboration is designed to introduce lending programs tailored for MSMEs and utilise FABMISR's diverse corporate client base.

🇮🇪 Capchase expands to Ireland. This move is a natural step forward for the company, driven by the region's burgeoning startup ecosystem, evidenced by a significant surge of nearly 950 new companies registered in 2023.

🇨🇳 Huawei sharpens focus on financial services industry. The corporation announced the launch of the Financial Partner Go Global Program (FPGGP) Acceleration Program during the 2024 HiFS Frontier Forum. More here

🇨🇦 Toronto-based corporate card and expense management technology startup Float has begun rolling out a pair of new offerings: bill pay and reimbursements. With these products, Float aims to make it easier for Canadian businesses to pay bills and ensure their employees are reimbursed for out-of-pocket expenses.

🇦🇪 Worldwide Cash Express teams up with TerraPay to broaden global payment services. According to the two entities, this partnership aims to boost customers' cross-border payment experience by making it faster, more secure, and more cost-effective.

🇪🇺 Plum (in partnership with Berlin-based FinTech Upvest) has expanded its investment offering to include ETFs across its EU markets. Customers can now invest in diversified funds by geographical region, sector and asset class, as well as tracking multiple stock market indices from around the world.

PAYMENTS NEWS

🇺🇸 Affirm buy now, pay later (BNPL) loans will be embedded into Apple Pay later this year. Apple device users will soon be able to tap into buy now, pay later loans from Affirm for purchases, the companies said Tuesday. Affirm will surface as an option for U.S. Apple Pay users on iPhones and iPads later this year, the San Francisco-based FinTech company said in a filing. Apple confirmed the news.

🇬🇧 Payments Orchestration platform Paysecure expands into LatAm and a55 has joined Paysecure as part of its strategic expansion plans. The collaboration is poised to revolutionize banking services for SMEs, enabling seamless integration with banks and PSPs in the region.

🇺🇸 Dash and Visa team on real-time payments in healthcare. The agreement leverages Visa’s digital payment network, Visa Direct, to allow Dash customers to send real-time payments to billions of eligible cards, bank accounts, and digital wallets.

🇪🇬 Cairo-headquartered FinTech Valu launches Ulter, a payment program for luxury purchases. Ulter has the highest credit limit in the country, and offers flexible repayment plans spanning up to 60 months with no down payment, subject to the financed amount.

OPEN BANKING NEWS

🇬🇧 Ozone API and Tuum join forces. By combining their collective strengths, Ozone API and Tuum aim to create a seamless and comprehensive ecosystem that empowers banks and financial institutions to thrive in the new world of open banking and open finance.

🇬🇧 Jaja Finance turns to TrueLayer to smooth credit card repayments. Jaja will leverage TrueLayer’s Payments product to offer instant pay-ins, allowing customers to make one-off credit card repayments directly from their bank account.

🇦🇪 Open Banking and financial innovation company, FinTech Galaxy, has agreed a strategic partnership with Yabx. The collaboration targets initial improvements in UAE, Saudi Arabia, Jordan, and Bahrain with future expansion plans for North Africa.

DIGITAL BANKING NEWS

🇳🇱 Dutch SME lender BridgeFund migrates to Mambu core system. Together with Mambu, BridgeFund can expand its account volumes and product offerings with ease, while facilitating expansion into new markets.

🇩🇪 German banks to shut down their PayPal competitor Giropay/Paydirekt and instead throw their weight behind continent-wide startup the European Payments Initiative (EPI). It is understood that both Paydirekt and Giropay will be abandoned by the banks at a shareholder meeting this week.

🇩🇪 Tomorrow migrates brokerage from Solaris to FinTech lemon.markets. In addition to concluding all new securities transactions, the collaboration also includes migrating the securities accounts of existing Tomorrow customers. Read on

🇲🇾 Japan’s Seven Bank to install ATMs in 7-Eleven stores across Malaysia. This move by Seven Bank follows a growing trend of non-bank ATMs in Malaysia, exemplified by Euronet’s recent acquisition of the MEPS ATM network, making it the largest non-bank ATM operator in the country.

DONEDEAL FUNDING NEWS

🇩🇪 German RegTech Hawk has extended its Series B funding round with an additional investment from Dutch bank Rabobank. Hawk raised $17 million in March in the first tranche of its Series B. The arrival of Rabobank into the mix has led to a "substantial increase in valuation", although the value of the investment has not been disclosed.

🇫🇷 Paris-based SaaS Zeliq has raised a further $10M to expand its operations into the US. Currently, 50% of Zeliq's customers are in France, with 25% in the US, and the remaining 25% distributed worldwide. Funds will be put towards scaling in the US and internationally through marketing, product development and hiring.

🇪🇬 Sahl, a Cairo-based FinTech startup has raised $6 million in joint seed and series A funding. The startup plans to leverage these funds to create and develop better offerings as a comprehensive financial services provider.

🇦🇺 Sydney FinTech Bridgit has raised $14.2 million in a Series A as the non-bank lender looks to offer bridging loans to homeowners moving house. The firm provides short-term bridging loans for those seeking to buy a new home before selling their current one, and targets older generations seeking to downsize.

🇺🇸 Brightwave, an AI-powered financial research assistant that generates financial analysis on any subject, announced $6 million in seed funding. In just four months, Brightwave’s customer base has grown to include diverse funds, firms and strategies with assets under management totaling more than $120B

🇪🇬 HSBC Egypt plans to launch a fund worth EGP 1.5 billion (around $31.5 M) to invest in SMEs operating within the FinTech sector in Egypt, two sources in the know told Asharq Business. EFG Holding will manage the fund, one source said, expecting the fund to be launched in Q3 of this year.

M&A

🇺🇸 Bakkt reportedly considering sale of crypto platform. Bakkt — which has a market value of around $300 million as of Friday — had been working with a financial adviser to weigh strategic options including a possible breakup.

MOVERS & SHAKERS

🇺🇸 Ripple appoints Jack McDonald as Senior Vice President of Stablecoins. With over three decades of experience in investment banks, asset managers, financial services, FinTechs, and digital assets, Jack brings a wealth of knowledge and expertise to help lead the stablecoin team and bring Ripple’s stablecoin to market.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()