N26 Account Closures in Italy Raise Concerns Among Users

Hey FinTech Fanatic!

Italian customers of N26, a Berlin-based digital bank, are facing sudden account closures without clear explanations. Reports have emerged of users being locked out of their accounts and funds, leading to questions about N26's operations in Italy.

In March 2022, the Bank of Italy issued a "special order" prohibiting N26 from acquiring new customers or offering new services, following an inspection that identified security and anti-money laundering weaknesses. This order came amidst a European controversy where N26 closed accounts in various countries, including Italy, without prior notice, leaving many without access to their savings.

N26 stated that these closures were mistakes made during the implementation of new financial crime prevention measures. The reason for these recent account closures in Italy remains unclear, and there's no confirmation if they are related to new anti-fraud measures.

N26's customer guidance in Italy mentions that account closure is a last resort and customers will be informed via email about the closure and next steps. However, the exact circumstances leading to the recent spate of closures are still not fully understood.

To be continued.

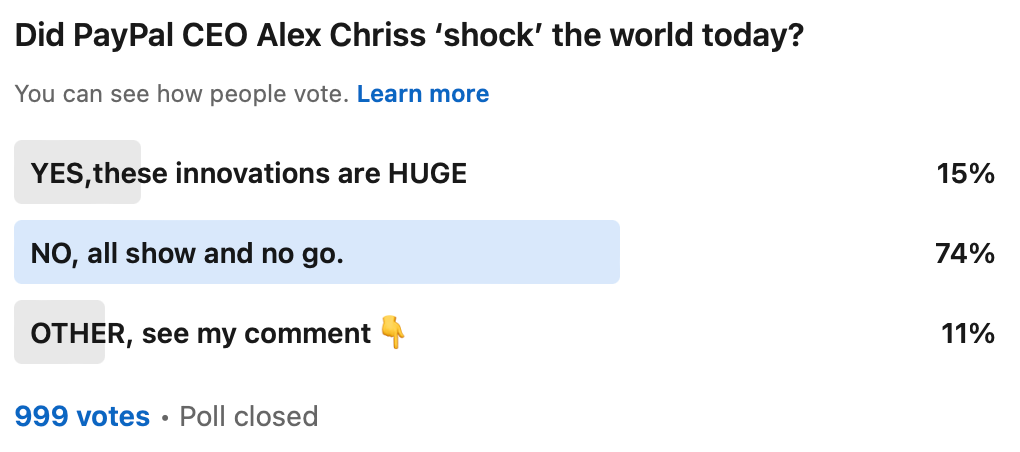

Back to PayPal's investor day that didn't seem to 'shock' the world as they promised. Here are the POLL results:

Enjoy more FinTech industry updates I listed for you below👇 and I'll be back in your inbox with some very interesting news from an Amsterdam powerhouse tomorrow! Stay tuned.

Cheers,

SPONSORED CONTENT

FEATURED NEWS

🇺🇸 Torpago and Marqeta launch Sunwest Bank’s visionary card program. Combining a cloud-native, event-driven infrastructure with Marqeta's modern card issuing API, Torpago ‘Powered By' empowers Sunwest to launch a market-leading, bank-branded credit card program. More on that here

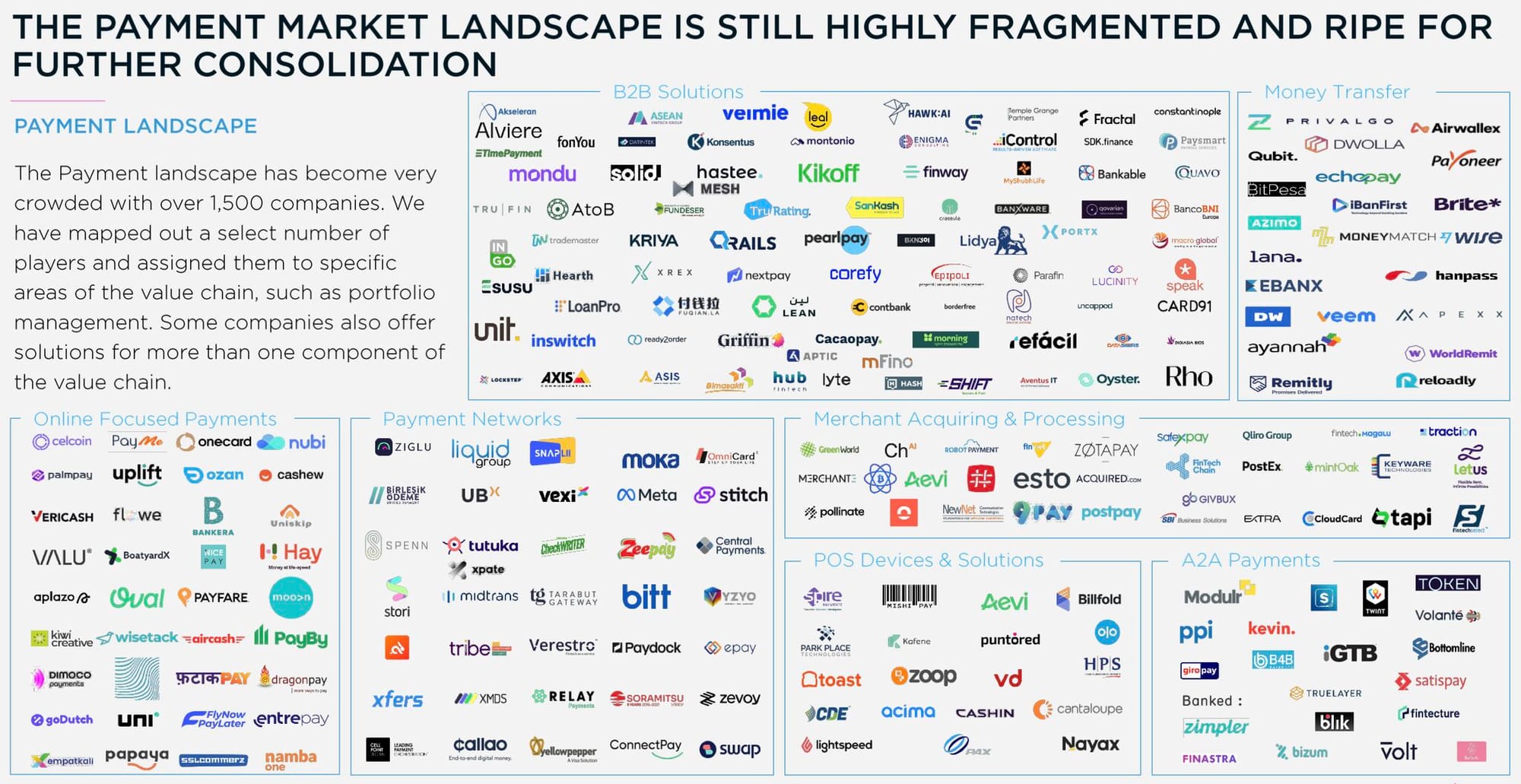

#FINTECHREPORT

Drake Star dropped its Payments Report including this Market map👇

INSIGHTS

Visa launched its Web3 loyalty solution. Here's a look beyond the hype:

FINTECH NEWS

🇺🇸 Chime was once valued at $25 billion. The CEO says the fintech darling is ‘IPO ready,’ but investors want to know: What is it worth now? As the valuations of fintech firms have plummeted the last two years, alongside venture funding, perhaps no one has suffered more than Chime Financial. Read more

EML Payments has announced it is winding down its Irish subsidiary, PCSIL, stating the business is no longer commercially viable and sustainable. Additionally, the Australian paytech disclosed that PCSIL is expected to face a USD 13.1 million deficit in FY24 if the current operational model persists.

🇺🇸 Chipotle partners with SoFi to provide a new employee assistance program. The Mexican-style chain restaurant will offer a student loan repayment matching benefit, as well as mental health and financial education resources, to support its growing Gen Z workforce.

PAYMENTS NEWS

I highly recommend joining this webinar: "Unlocking new revenue: Payment strategies to enter emerging markets." In the webinar from Thunes and The Paypers, you’ll learn how to supercharge your cross-border payment and orchestration strategies to navigate new markets in LATAM and SEA.

What is Payment Routing? Payment routing is a part of the Payment process for merchants working with multiple PSPs. The idea is that, based on a set of rules decided by the merchant, transactions will take the most efficient path to the right PSP. Discover more here

FIFA extends global partnership with Visa, including FIFA World Cup 2026™. The new agreement between Visa and FIFA, lasting through 2026, supports the growth of football and includes a program of youth, beach soccer, and FIFA events, and will culminate in the biggest FIFA World Cup™ in history in 2026.

🇳🇱 Knaken partners with Buckaroo to launch a new payment system. Knaken has launched its new payment system, 'Settle,' with Buckaroo being the first PSP in the Netherlands to integrate it. Settle offers a secure platform for users to transact with over 150 cryptocurrencies, including Bitcoin, Ethereum, and USDC.

🇵🇰 NayaPay partners with Alipay+ for digital payments in Pakistan. This alliance is designed to improve the digital payments system in Pakistan, tackling general issues such as limited interoperability and elevated transaction costs. Read on

Mastercard strengthens collaboration with Booking.com to remove payment friction for travel partners. This enhanced partnership with Booking.com aims to accelerate the use of Mastercard Virtual Cards, in order to simplify B2B payments and bring more security and convenience to the overall travel partner experience.

🇨🇾 payabl. secures EMI licence from the CBC. The granting of the authorisation underscores the company’s commitment to meet the changing demands of its clients, as the licence allows it to broaden its existing and new payment services in the region.

DIGITAL BANKING NEWS

🇦🇺 Travelex relaunches online FX services. Australia's Travelex has relaunched online foreign exchange (FX) cash services for the Commonwealth Bank of Australia, enabling CBA's retail customers to order over 30 currencies online at any time for collection at its branches.

🇨🇦 Neobank KOHO is one step closer to obtaining a Banking License in Canada. Koho confirmed Friday it has moved into phase two of securing a Schedule 1 banking license in Canada, a lengthy and rigorous process that requires final approval from the Office of the Superintendent of Financial Institutions (OSFI) and the Minister of Finance.

🇵🇭 UnionBank of the Philippines to Adopt Informatica’s Intelligent Master Data Management (MDM) SaaS. UnionBank claims that it “has always been the first to embrace technological innovations including, but not limited to, cloud and AI to empower its customers.” Link here

🇺🇸 KlariVis signs b1BANK to enterprise data and analytics tech. KlariVis empowers b1BANK's management by providing tools to interpret and act upon valuable data. This enables thoughtful and disciplined decision-making, enhancing the overall management capabilities of the bank.

🇺🇸 PNC launches mobile banking for underserved communities in Cleveland. It's part of PNC's effort to make banking less complicated for underserved areas that don't have easy access to banks. Click here to learn more

🇧🇷 In the latest quarter of 2023, digital banking in Brazil has come under the spotlight for customer complaints, with PagBank, Inter, C6, Neon, and Original featuring among the top ten banks with the highest number of complaints, as reported by the Central Bank. Notably, three of these digital banks are among the top five in the list.

DONEDEAL FUNDING NEWS

🇺🇸 Marstone raises $8M in series B funding. The round was led by Mendon Venture Partners and South Rose Capital, alongside new investors including the Castle Creek Launchpad Fund and existing investor Equity Bank.

🇭🇰 Qupital secures Series B2 funding to fuel market expansion and product innovation. The fresh capital injection will be instrumental in scaling its securitisation facility backed by Citi, which supports its rapidly growing e-commerce loan portfolio. Read more

MOVERS & SHAKERS

Crypto platform Kraken makes senior hires. The platform announced it is further strengthening its leadership team with two key appointments: Gilles BianRosa as Chief Operating and Product Officer (COO/CPO) and Marcus Hughes as its Global Head of Regulatory Strategy.

🇺🇸 Jamie Dimon shakes up JPMorgan leadership again. Jennifer Piepszak, a CEO contender, moves to leading the corporate and investment bank. Read the full article for additional insights.

BlueSnap appoints Sharon Weiss as general manager, Israel and EVP of R&D. Weiss joins BlueSnap with more than 20 years of experience in R&D, product management, software development and software architecture. More here

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()