Musk Confirms Upcoming Beta for X Money

Hey FinTech Fanatic!

Quick note before diving in: big congratulations to Rutger van Faassen, who won the free VIP ticket to Stablecon in New York City 🇺🇸! Funny twist, he already has a ticket.

So… we’ve still got 1 VIP pass left, and we’d love to give it to someone in the community.

If you can attend today, email edil@connectingthedotsinfin.tech, First come, first served.

Huge thanks to Nik Milanovic and the Stablecon team for making it happen.

I’ve been thinking about doing more giveaways like this. If that’s something you’d be into, tell me in the comments what kind of giveaways would get you excited. 🎁

Now, let’s jump into your daily dose of FinTech 👇

It all started with a quick reply. Elon Musk, responding to a post from Tesla Owners Silicon Valley, confirmed that X’s long-awaited payments feature is on the way. After months of anticipation, the wait may soon be over. "This will be a very limited-access beta at first. When people’s savings are involved, extreme care must be taken," he wrote.

The comment added to the quiet momentum building over the past few months. Back in January, CEO Linda Yaccarino revealed that the rollout would happen later this year in partnership with Visa. The idea consisted of users being able to link their debit cards and send in-app P2P payments.

Then, one month later, Ran Goldi from Fireblocks said that X Money could be "crypto-ready by year-end", though no details followed.

Since buying Twitter in 2022, Musk has pointed to a bigger ambition: an all-in-one platform where people can message, shop, and move money. For a while, it sounded like a stretch. But with Visa now involved and beta testing just ahead, that vision is starting to take shape.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

ARTICLE OF THE DAY

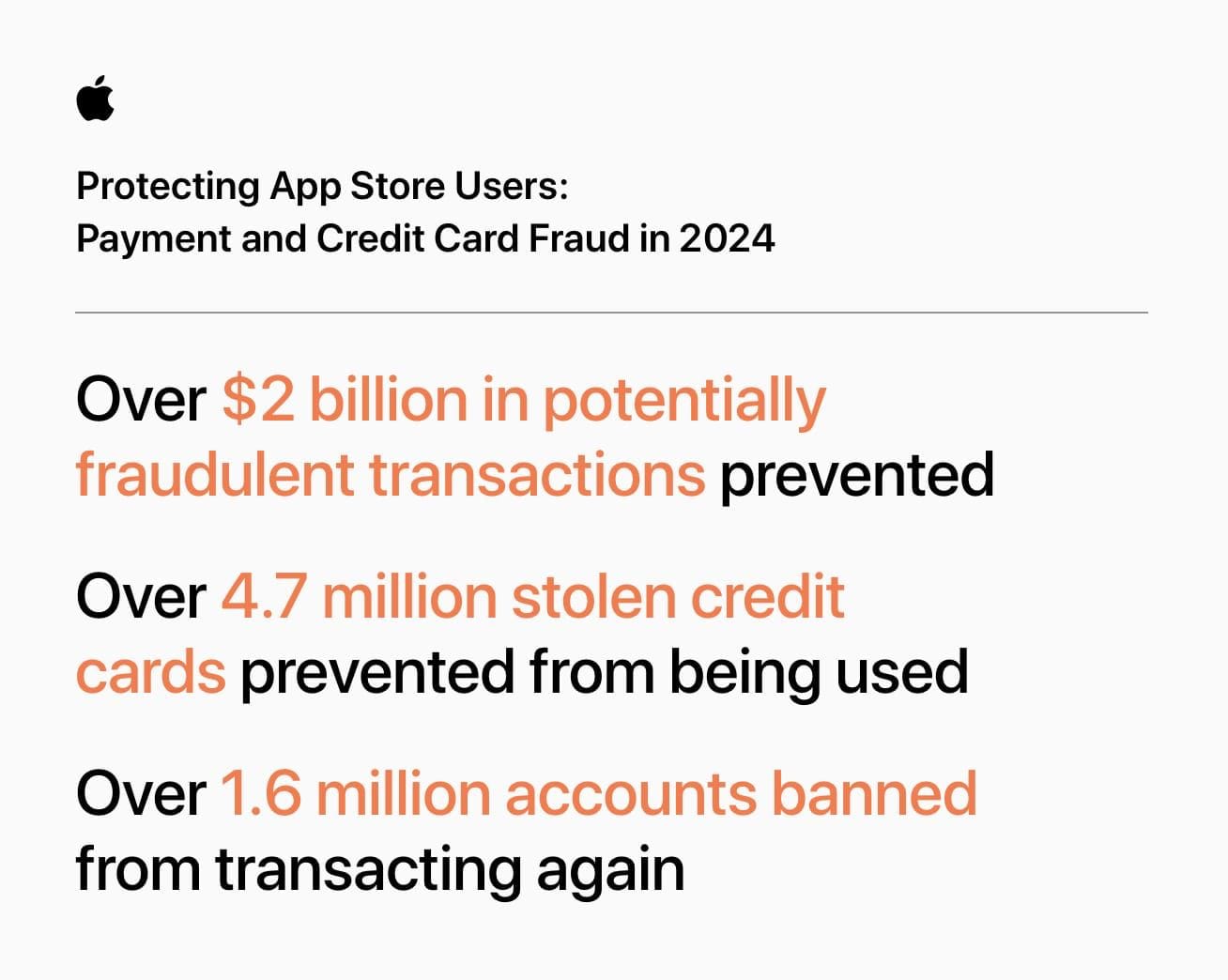

🇺🇸 Apple’s $9B Fraud Transactions Block — A Blueprint for FinTech Security. Apple just dropped a stunner revelation: over the last five years, the App Store blocked a jaw-dropping $9 billion in fraudulent transactions. Get all the details: click here to read the full article

FINTECH NEWS

🇧🇷 Decentralization of credit opens new fronts for fintechs, says Pomelo. Rafael Goulart, country manager of Pomelo in Brazil, highlighted how Open Finance is driving the decentralization of credit in the country and creating new opportunities for fintechs. He shared these insights during the “Fintech Innovation Day” by StartSe, in a panel alongside Marcelo Toledo from Itaú Unibanco.

🇬🇧 Monzo builds investor relations team as it eyes IPO. Monzo is building out an investor relations team, a key function for listed companies, in the latest sign that the FinTech is preparing for a highly anticipated initial public offering (IPO). Read more

🇺🇸 US-based FinTech Firm Purpleplum eyes global expansion and capital raise. With a modular, AI-enabled digital banking stack, Purpleplum plans to deepen its international footprint while preparing for a capital raise aimed at speeding up product development and expanding its local teams and partner ecosystem.

🇬🇧 Robinhood launches Robinhood Legend in the UK, stocks and shares ISA next. Robinhood Legend is a specialist desktop trading platform with advanced trading tools, primarily aimed at active, not casual, traders. It offers traders in-depth features, including a personalised setup for traders, deep analytical tools, and real-time data.

🇮🇱 eToro gives retail investors hedge fund superpowers with AI portfolios. The trading platform has introduced 11 new investment portfolios powered by artificial intelligence, built on the analysis of its retail trading data. The new tool analyzes 40 million eToro users, bringing hedge fund-style strategies to retail investors.

🇦🇪 Vault announces Public launch with latest investment from Peak XV Partners. Vault opens its digital private wealth platform, Vault Wealth Limited, to investors across MENA, delivering transparent, fiduciary-first advisory for the modern affluent.

PAYMENTS NEWS

🇩🇪 Tink and Adyen partner to bring Pay by Bank to Vodafone customers in Germany. Pay by Bank allows consumers to quickly transfer money directly from one bank account to another. It also provides end-to-end payments capabilities, data-driven insights, and financial products in a single global solution.

🇺🇸 X to launch X Money in partnership with Visa. The payments feature is expected to allow peer-to-peer (P2P) payments through the use of a debit card, as well as instantly transfer funds to its bank account. Continue reading

🇮🇳 PayPal receives in-principle approval to operate as cross-border payment aggregator in India. The Reserve Bank of India (RBI) has granted in-principle approval to PayPal Payments Private Limited to operate as a cross-border payment aggregator for exports.

🇺🇸 Fiserv reaffirms Clover revenue goal. The company’s Chief Financial Officer contended that the point-of-sale unit will still deliver $3.5 billion in revenue this year despite a recent volume growth slowdown. Read more

🇲🇽 Belvo is betting on alternative data in Mexico as open finance pauses. The firm has identified a key opportunity in the use of alternative data to improve access to credit, a resource they believe has potential in the Mexican financial ecosystem.

🇱🇹 MyTu integrates Apple Pay. With this integration, customers simply hold their iPhone or Apple Watch near a payment terminal to make a contactless payment. The updated myTU app supports instant issuance of virtual cards, allowing users to begin spending within minutes, without the need to wait for physical cards.

REGTECH NEWS

🇺🇸 Regtech Sumsub and Solana introduce on-chain identity attestations. Sumsub ID enables end-users to securely store and reuse their pre-verified documents for multiple verifications across Sumsub client platforms, simplifying compliance and improving user experience.

🇫🇷 French regulators approve the merger of Fiat and stablecoin payment services. The dual licences enable Merge to support businesses in Europe and globally with services ranging from collecting and holding funds to executing cross-border payments and converting between fiat and digital currencies.

DIGITAL BANKING NEWS

🇪🇸 Neobank bunq adds Bizum to its Spanish customers. Users with a Spanish IBAN can send or receive money through the app, a service that will be available for bunq Core, bunq Pro, and bunq Elite individual plans. The plan is to facilitate payments for merchants once they complete the integration of Bizum.

🇺🇸 Revolut seeks acquisitions after record profit. The British banking firm is looking to beef up its deals team and make acquisitions for its next phase of growth after the FinTech reported a record annual profit. Keep reading

🇸🇪 Klarna wants to break away from BankID. Sebastian Siemiatkowski, co-founder and CEO of Klarna, believes that BankID's dominant position hinders the development and the opportunity for alternative solutions to establish themselves. BankID is currently the largest identification service in Sweden.

🇬🇧 Starling reports strong revenue and invests in growth. Revenue increased to £714 million, while customer deposits rose to a record £12.1 billion. The number of open accounts reached 4.6 million, reflecting continued customer acquisition. Despite a drop in profit before tax to £223 million due to one-off legacy costs, underlying profit stood at £281 million.

🌎 Nubank launches price alert on airline tickets for high-income customers. Users will receive push and email notifications about price changes, and if the ticket drops in price within a month of purchase, they’ll automatically get a refund of up to R$500.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 OpenPayd to roll out stablecoin infrastructure, allowing businesses to move and manage digital assets and fiat through a single platform. Through this, OpenPayd seeks to make money movement instant and more optimal by connecting local and international fiat rails to major blockchains.

🇪🇸 Garanti BBVA Crypto unveils new mobile app with advanced features. Users can now easily buy and sell crypto assets in both TRY and USD trading pairs. Furthermore, users can create personalized lists of favorite coins, making it easier to monitor preferred assets.

🇺🇸 Bitget expands into real-world assets with BGUSD, offering daily yields and high liquidity. Holding BGUSD provides users with an annualized yield starting at 4%, credited daily to their spot accounts based on their minimum daily balance. For the first 30 days following launch, a promotional APY of 5% will apply.

PARTNERSHIPS

🇺🇸 Citcon and Splitit partner to enable merchants to offer credit card-linked installments. Partnering with Splitit allows Citcon to offer flexible omnichannel installments, bringing over 190 million U.S. cardholders with available credit, driving new sales at high average-ticket merchants.

🌍 Emirates NBD taps iPiD for confirmation of payee. The collaboration will enable Emirates NBD to provide real-time beneficiary validation for cross-border payments. With this solution, customers can verify payee names, IBANs, and account numbers in real time, before a payment is made.

DONEDEAL FUNDING NEWS

🇺🇸 Payment industry veterans launch Velocity with €8.9M to build the OS for digital finance. The company’s key areas of focus include growth investing, founder partnerships, market research, technology infrastructure, and strategic support for companies in high-growth phases.

🇮🇱 FinTech startup Sequence raises $7.5M to automate consumer and SMB finances. The Israeli company aims to automate and optimize finances across banks, loans, credit cards, and savings. Keep reading

🇦🇪 Dubai FinTech Qashio secures $19.8mln from US and MENA investors. The new funding is expected to help expand the company’s business across the GCC and beyond. Qashio operates a platform that helps businesses manage expenses and payments with integrated corporate cards and accounts payable automation.

🇸🇦 Stitch raises $10 million in seed to extend services to emerging markets. The funds will be used to expand Stitch’s team and enhance its platform capabilities, further establishing the company as a trusted infrastructure partner for banks, FinTech firms, and non-financial enterprises integrating financial services.

🇶🇦 LuLu’s investment arm backs Qatari FinTech firm PayLater. PayLater is among the first licensed providers of Buy Now, Pay Later (BNPL) solutions in Qatar. This investment represents LuLu AI’s first entry into Qatar’s financial market.

🇬🇧 UK paytech Dojo lands $190m from Vitruvian Partners. The investment, the first equity raise in Dojo’s history, will be used to fuel the company's European expansion strategy, supporting growth across Ireland, Italy, and Spain, where Dojo already maintains operations.

🇺🇸 Palla lands $14.5M for embedded cross-border payments. Miami-based Palla plans to use the new funding to expand into Europe-to-Latin America corridors and integrate additional payment systems. Keep reading

🇺🇸 VOX Funding secures $150 million credit facility from Raven Capital. This transaction marks a major milestone in VOX Funding’s ongoing expansion and reflects the strength of its platform. The added capacity will support the firm’s continued scaling, further strengthening its position as a leader in alternative credit.

🌏 Stablecoin company Conduit raises $36 million from Dragonfly Capital and Altos Ventures. The company plans to use the money raised in this round to introduce its product in five Asian countries by the end of the year and expand its client base to include new types of businesses.

🌎 Cerby raises $40 million to expand identity security automation platform. The company will use the new capital to expand the Cerby Application Network, continue investing in its agentic AI capabilities and making the platform extensible, innovate its entire solution suite, and scale its go-to-market operations.

🇺🇸 Rillet raises $25M from Sequoia to automate general ledger systems using AI. Rillet directly pulls data from their customers’ banks and platforms, such as Salesforce, Stripe, Ramp, Brex, and Rippling, to generate essential financial statements, including the balance sheet and income statement.

M&A

🇮🇳 Finwizz and Wishfin merge to build a leading omni-channel financial platform, eyeing IPO in 24 months. The combined entity leverages Finwizz’s distribution and Wishfin’s digital strengths, aiming to scale credit aggregation and attract strategic capital.

🇺🇸 Global Payments to sell payroll unit to FinTech Acrisure for $1.1 billion. The company will use the transaction proceeds to return capital to shareholders. The deal is expected to close in the second half of 2025. Continue reading

MOVERS AND SHAKERS

🇺🇸 Chargebacks911 appoints Donald Kossmann as CTO to lead AI-driven innovation in payments. Possessing more than 30 years of experience in computer science, AI, data systems, and fraud protection, Kossmann brings a rare blend of academic distinction and enterprise innovation to the role.

🇺🇸 OKX Global General Counsel Melissa Muehlfeld to leave the exchange. Since OKX paid half a billion dollars to settle charges with the U.S. Department of Justice in February of this year, the exchange has replaced some top legal and compliance staff.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()