MrBeast Steps Into FinTech as Beast Industries Secures Key Filings

Hey FinTech Fanatics!

MrBeast Financial is gearing up to enter financial services. The company confirmed plans for a platform that will cover banking tools, advisory features, and crypto functions.

CEO Jeffrey Housenbold said the launch will combine financial literacy with accessible products. A trademark filing listed nine offerings, including student loans and insurance.

The strategy is to partner with an existing FinTech to move fast while avoiding heavy regulatory and capital requirements.

Beast Industries generated more than $400M last year, with rising media costs. It moves into FinTech signals a shift toward scalable revenue and broader distribution.

MrBeast’s reach is massive, with more than 450M subscribers. This gives the new platform a distribution engine from day one. Clear direction as the company adds operators and expands its product roadmap.

I also shared my take on LinkedIn. Major news about MrBeast entering the FinTech space. The plan to partner with existing FinTechs is a smart way to navigate regulatory hurdles efficiently.

If you're into what's changing fast in FinTech, dive into the updates below 👇

Cheers,

Marcel

#FINTECHREPORT

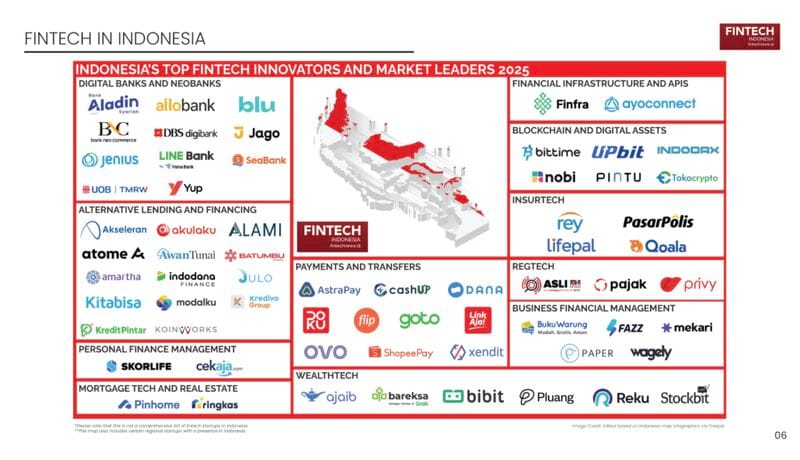

🇮🇩 The Indonesia FinTech Market Map 👇

Which company is missing in this overview?

FINTECH NEWS

🇺🇸 YouTube star MrBeast is moving into financial services. MrBeast is looking to launch a financial services platform and a phone company, Beast Mobile. His holding company, Beast Industries, is expanding beyond YouTube with new businesses and hires.

🇬🇧 Britain unveils fast-track licensing to boost FinTech growth. Under the new system, firms meeting “robust” entry criteria will be able to operate provisionally and carry out some regulated activities for up to 18 months, subject to safeguards, as they complete the full licensing process.

PODCAST RECOMMENDATION

🎤 What Makes or Breaks a Startup: An Investor’s POV by DashDevs. In Episode 126 of The FinTech Garden, Igor Tomych speaks with Michele Mattei of Bunq and Syeew about the qualities that help FinTech startups stand out, with Mattei outlining the product-focused processes and technologies that can drive companies toward unicorn status. Watch the full episode

What Makes or Breaks a Startup: An Investor’s POV by DashDevs

PAYMENTS NEWS

🇩🇪 N26 joins European digital payment system Wero. The integration of Wero into the N26 experience will introduce another secure and user-friendly digital payment option for customers. Through this, consumers will gain access to a streamlined payment experience that emphasises simplicity and convenience.

🌎 Mastercard unveils Agent Pay in Latin America and the Caribbean. Mastercard Agent Pay integrates trusted, seamless payment experiences into the tailored recommendations and insights provided on conversational platforms, enabling digital agents to transact, manage, and optimise purchase experiences on behalf of users. Additionally, Mastercard Credit Intelligence empowers lenders with faster, smarter and more personalised insights. It is designed to empower lenders with faster, smarter and more inclusive insights that help them better serve consumers and small businesses.

🇮🇱 Neema launches Request-to-Pay, a real-time, low-cost payment collection method that enables financial institutions and their business clients to receive funds directly from customers’ bank accounts, bypassing card schemes and supporting the shift toward account-to-account payments.

🇸🇾 Visa plans Syria launch after deal with central bank on digital payments. “The immediate focus will be on working with licensed financial institutions to develop a robust and secure payments foundation. This includes issuing payment cards and enabling digital wallets using global standards,” Visa said.

FINTECH RUNNING CLUB

🇫🇷 Paris has a new amazing Host!🏃

Meet Sam Perez and sign up to our newest Paris run here!

REGTECH NEWS

🇺🇸 LexisNexis Risk Solutions upgrades IDVerse platform to counter deepfake fraud. The enhanced platform strengthens document checks, biometric verification and liveness detection while reducing steps in the onboarding flow. The company said the update improves accuracy, speeds up document capture and supports a simpler verification journey.

DIGITAL BANKING NEWS

🇬🇧 Revolut integrates Solana for payments, transfers, and staking. The integration enables Revolut users to send, receive, or pay via Solana using USDT, USDC, and SOL while accessing the blockchain’s payment and transfer capabilities. Users can also participate in Solana staking through the platform.

🇺🇸 Nubank co-founder Cristina Junqueira sets sights on US market. Cristina Junqueira, co-founder of Nubank, has been appointed U.S. CEO and plans to leverage the neobank’s global experience to bring its technology-driven, customer-focused model to the American market.

🇦🇱 Albania's c-bank grants preliminary licence to first digital bank. JET Bank aims to combine advanced technology with a simple, customer-focused model, the central bank said. JET Bank must now establish its operational infrastructure, management structure, procedures, and policies, and complete the required technical assessments.

🇺🇸 Chime is reassessing the possibility of pursuing a bank charter as regulators show greater openness toward FinTech licensing. Chime grows to 9.1 million active users, captures 13% of new checking accounts, and continues drawing most new customers from traditional banks in its push to become Americans’ primary financial relationship.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Big Banks partnering with Coinbase on crypto pilots. Coinbase CEO Brian Armstrong said major banks are piloting stablecoin, custody and trading initiatives with the exchange, arguing that institutions embracing crypto will gain an advantage as regulatory conditions improve.

🇮🇪 Ramp Swaps Limited receives EU-wide MiCAR authorisation. With MiCAR authorisation, Ramp Network can now provide its on- and off-ramp services across the entire European Union under a single licence with a consistent regulatory framework for converting between fiat currencies and digital assets.

🇺🇸 N3XT launches first fully blockchain-powered bank for instant, programmable B2B payments. N3XT’s blockchain environment is designed for interoperability with stablecoins, utility tokens, and other digital assets. Crypto market participants can program payments on the N3XT platform to automatically execute based on market conditions.

🇺🇸 Kraken launches VIP program, setting a new benchmark for ultra-high net worth crypto service. The program combines privacy-first design with meaningful, experience-led engagement to deliver a level of service rarely seen in the digital asset space.

🇨🇳 Chinese state-owned bank issues $600m on-chain digital yuan bonds. Huaxia Bank distributed the bonds to customers paying exclusively in China’s central bank digital currency. The bank issued the bonds, worth over $637 million, via its commercial shipping subsidiary Huaxia Financial Leasing, the firm said.

🌍 Fireblocks becomes an on-chain infrastructure partner for MoneyGram. MoneyGram and Fireblocks will attempt to bring faster, low-cost payments with real-time settlements based on stablecoin transfers. The partnership will connect over 200 countries and territories, 20,000 payment gateways, and nearly half a million retailers.

PARTNERSHIPS

🇻🇳 Circle collaborates with Pismo and Visa to launch Vietnam’s first AI-powered PayLater Card. This will enable Circle to launch the nation’s first truly AI-powered PayLater card, aiming to set new standards for transparency, personalisation, and user experience in the financial industry.

🇮🇪 Circle and OpenMind partner for autonomous AI payments. They plan to build basic standards and infrastructure. These are for Machine-to-Machine payments. They are going to use the USDC stablecoin. For that reason, this initiative is aimed at enabling autonomous AI systems.

🇬🇧 Revolut ramps up business offering in Visa tie-up. Revolut Business is set to introduce Titan, a premium business card, early next year as it pushes forward in its mission to create the ultimate all-in-one app. Additionally, CEAV and Revolut signed an alliance to simplify the financial management of travel agencies. Travel agencies that start operating with Revolut will be able to enjoy exclusive cashback on all their purchases within the travel sector.

🇩🇪 Kraken and Deutsche Börse announce strategic partnership to bridge traditional and digital markets. The integration gives Kraken clients access to competitive, bank-grade FX liquidity through one of the deepest global liquidity pools available, significantly improving fiat on- and off-ramp efficiency while ensuring institutional-grade execution and reliability.

🇬🇧 ClearBank partners with Plaid to power real-time open banking payments in the UK. Consumers will benefit from faster, more predictable bank payments, powered by ClearBank’s regulated infrastructure. Whether making payouts or moving money between accounts, users benefit from a more seamless, secure experience.

🇧🇷 Banco XP relaunches global account with Wise and Visa. Unlike the current versión, the new product will allow transactions in US dollars, euros and British pounds. By the end of the year, the new product will be available to approximately five million XP customers.

DONEDEAL FUNDING NEWS

🇧🇷 FinTech Kamino raised $10 mn to expand AI-platform and target mid-market CFOs. The plan is to help finance leaders manage liquidity, collections, and spending while offering tools that can surface strategic actions based on their own data.

🇵🇭 Tonik raises $12m pre-series C. The digital-only bank licensed in the Philippines stated that the funding will help meet regulatory capital requirements and support technology investments. Read more

🇺🇸 Fin raises $17m to launch stablecoin product for high-value payments. The Series A will fund team expansion and bring Fin's stablecoin‑powered payments product to market, launching soon with early users including global enterprises, financial institutions, and crypto-native businesses seeking faster, more reliable payment rails.

🇺🇸 Ostium raises $20 million Series A from General Catalyst & Jump Crypto. With this Series A funding round, Ostium will expand its asset class coverage, scale its infrastructure to support growing trading volumes, and continue building the most transparent and efficient platform for perpetual trading across all markets.

🇺🇸 Flex lands $60M Series B to become the private bank for America’s overlooked wealth creators. The funding lands after a year in which Flex quadrupled revenue and pushed its annualised payments volume from $1 billion to $3 billion, according to the company’s announcement.

M&A

🇰🇪 Vodacom set to hold majority stake in Safaricom after $1.6bn stake acquisition. While the deal will see Vodacom hold a 55% stake, the Kenyan government and general public investors will retain approximately 20% and 25% of Safaricom’s shareholding, respectively.

MOVERS AND SHAKERS

🇨🇭 Temenos confirms Takis Spiliopoulos as CEO following interim role. Temenos said the decision reflects the board’s assessment of his leadership experience, familiarity with the company’s long-term plans and his background in software, product development, finance and operations.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()