Monzo's Growth in BNPL, Premium Updates & Revolut's Customer Data Monetization Plans

Hey FinTech Fanatic!

Monzo Bank is enticing customers with a new lineup of premium accounts, featuring perks such as complimentary weekly snacks at Greggs and discounted train travel.

The introduction of these subscription plans, labeled Extra, Perks, and Max, stems from a comprehensive study involving over 45,000 customers. This research aimed to better understand customer preferences and everyday spending habits.

In addition, recent data suggests a significant impact from Monzo Bank on the UK buy-now-pay-later (BNPL) credit market. Within just one year, Monzo has captured 20% of the UK market, a remarkable transformation from nearly zero.

These insights are drawn from a report by Render, a credit technology company, highlighting Monzo's success with its 'Flex' BNPL product. This offering allows any Monzo customer to spread payment costs, irrespective of the merchant's BNPL availability.

Meanwhile, UK neobank Revolut is exploring strategies to monetize customer data by sharing it with advertising partners. This move aims to diversify revenue streams, particularly amid uncertainties surrounding its UK Banking License application.

To spearhead this initiative, Revolut has appointed Inam Mahmood, former head of ecommerce partnerships at TikTok UK, to lead a dedicated sales team. Sources familiar with the plan indicate an internal revenue target of £300 million from advertising by 2026, though Revolut declined to comment on this goal. Notably, the company reported total revenues of £923 million in 2022.

This trend of financial institutions venturing into media territory is echoed by JP Morgan Chase, which recently launched Chase Media Solutions. This digital media venture enables brands to directly engage with the bank's vast customer base of 80 million.

In light of these developments, it seems pertinent to amend Angela Strange's famous quote, "Every company will become a FinTech company," to include a new adage: "Every FinTech company will become a media company."

There is a long list of updates from the global FinTech industry listed for your perusal below👇, and I'll be back in your inbox with more news tomorrow!

Cheers,

#FINTECHREPORT

📊 The FinTech Landscape in Lithuania FinTech Report by Invest Lithuania is out👇

FINTECH NEWS

🇬🇧 Careem Pay expands its international remittance services to include ‘Faster Payments’ to the UK. Careem Pay enables customers, Captains, and business owners to manage their money, settle bills, and make seamless transactions both within and beyond the app.

🇦🇪 du, commercially rebranded from Emirates Integrated Telecommunications Company (EITC), has announced the launch of du Pay, marking a significant milestone in the UAE's transition toward a cashless economy and aligning seamlessly with the national agenda for digitalization.

🇬🇧 Shariah-conscious investment platform Mnaara launches in UK. Mnaara’s products and services are designed to simplify the investment process and provide convenient digital access to investments from anywhere in the world. More here

PAYMENTS NEWS

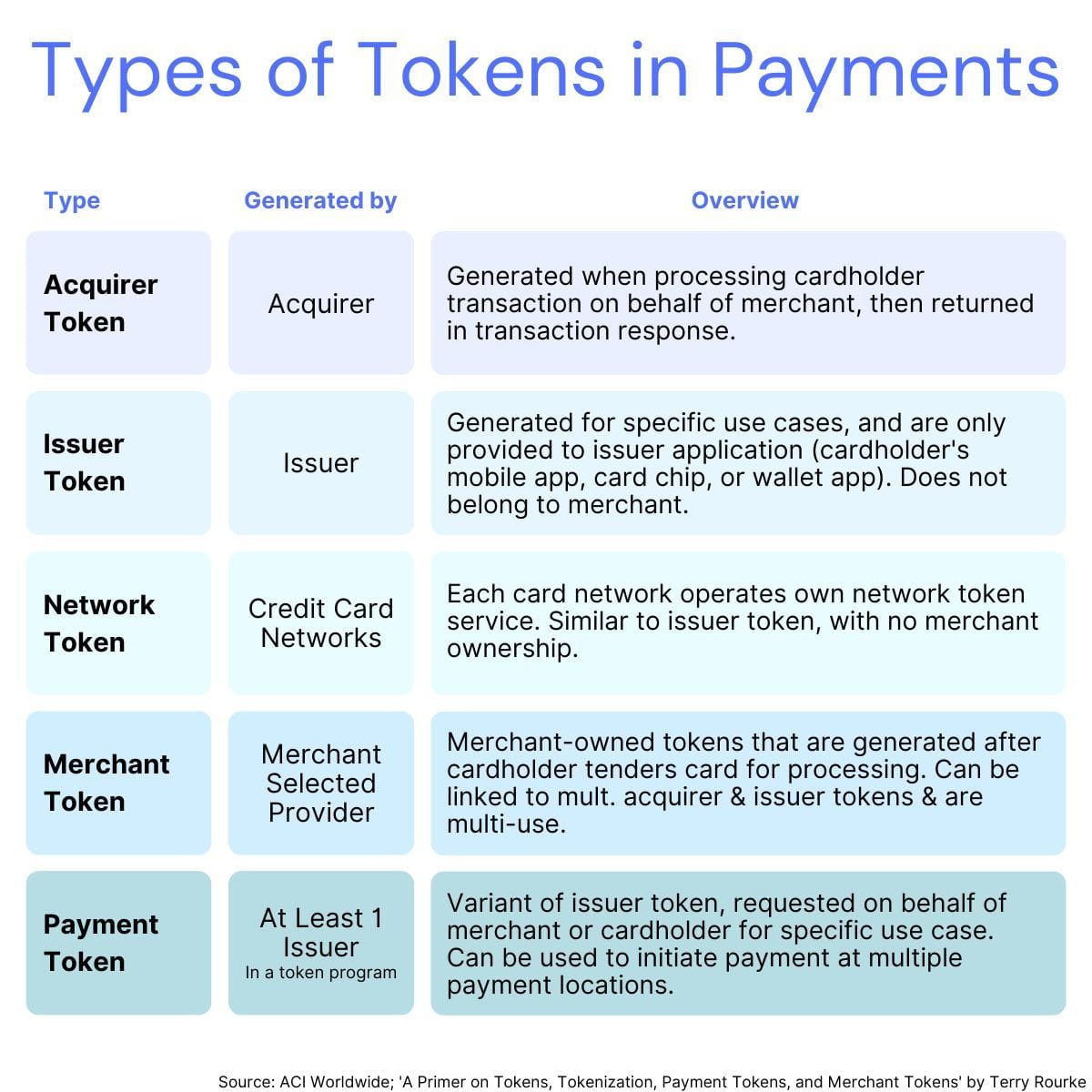

💳 Navigating the Complex World of Tokenization in Retail Payments.

Tokens can vary in format but generally they fall into 3 categories:

🇺🇸 Coupa and Bottomline simplify business payments. The partnership aims to simplify and optimize payment processes for businesses. Coupa can now connect to Paymode-X, Bottomline’s business payments network that offers Premium ACH, to automate payments from buyers to suppliers.

🇸🇬 Singapore's Qashier awarded in-principle approval for a Major Payment Institution Licence to offer merchant acquisition services, and domestic and cross-border money transfer services. The company plans to continue investing in research and development to deliver more innovative solutions to businesses in the region and beyond.

🇺🇸 Fed courts nonbanks for FedNow growth. The Federal Reserve is stressing the importance of FinTechs and core providers for the future expansion of its new instant payments system FedNow. Click here to learn more

Yuno expands across Asia, launching its innovative payment orchestration solution in key markets including Singapore, the Philippines, Thailand and Hong Kong, among others. Businesses in these countries can now leverage Yuno’s proprietary platform to access over 300 payment options.

🇮🇳 Paytm launches made in India 4G soundboxes, enables credit card-based UPI payments. Founder and CEO Vijay Shekhar Sharma said the advanced soundboxes provide superior sound quality and battery life, making them better suited to Indian conditions.

🇺🇸 PPRO expands local payments offering to the US. The platform announced its entry into the US market enabling global payment service providers (PSPs) and merchants to reach millions of US consumers via a single API. This follows PPRO’s previous successful geographic expansion into the APAC region and LatAm.

🇮🇳 Razorpay announced the launch of its own Unified Payments Interface (UPI) with ‘UPI Switch’ in partnership with Airtel Payments Bank. The FinTech major claimed that its ‘UPI Switch’ excels in dispute resolution, resolving issues 7X faster, within 24 hours compared to the industry average of seven days.

🇵🇷 FinTech AffiniPay expands footprint in Puerto Rico. The expansion of AffiniPay’s leading technology products reflects the efforts to increase its leading market position, serving legal professionals and capitalizing on an attractive growth market modernizing the payment experience.

🇺🇸 Walmart-backed FinTech One introduces buy now, pay later (BNPL) as it prepares bigger push into lending: One has begun offering BNPL loans for big-ticket items at some of the retailer’s more than 4,600 U.S. stores, CNBC has learned. Access the full info here

OPEN BANKING NEWS

🇬🇧 Visa-owned payments platform Tink has launched an open banking partnership with expense-sharing app Splitwise. The collaboration, announced Monday (April 22), brings Pay by Bank to Splitwise users, letting them make direct payments from within the Splitwise app, starting in the U.K.

REGTECH NEWS

🇬🇧 Nium is integrating the Trulioo Person Match identity verification capability to deliver rapid, compliant payment experiences for its U.K. operations. The expanded partnership allows Nium to comply with stringent KYC, AML and counter-terrorist financing controls required by money service business licenses in multiple markets.

🇦🇪 FinTech Galaxy taps FinbotsAI for credit scoring and risk assessment using artificial intelligence models and aggregated Open Banking data. The new product promises to transform use cases like credit scoring and risk assessment in the MENA region.

DIGITAL BANKING NEWS

🇲🇾 UAE’s digital asset infrastructure provider Fasset has inked a deal with Malaysian lender MBSB to explore blockchain-powered Shariah-compliant banking solutions in Malaysia. The partnership will enable users to buy, sell or swap digital assets in a secure blockchain-backed environment.

🇲🇾 Maybank announced the launch of Maybank Goal-Based Investment, a beginner-friendly digital retail investment tool that allows customers to kickstart their financial wealth journey easily and conveniently. Read on

🇬🇧 Revolut is exploring plans to monetize customer data through sharing it with advertising partners, as they seek new sources of revenue while its application for a UK Banking License remains in limbo. The firm has hired a TikTok executive to lead a ‘media strategy’ as it seeks to diversify revenues.

🇿🇦 After turning profitable in its home market South Africa and establishing a presence in the Philippines, global digital bank TymeBank is set to strengthen its foothold in Southeast Asia’s emerging markets by launching in Vietnam and Indonesia this year.

🇬🇧 Monzo is enticing customers to shell out for a new range of premium accounts, offering benefits such as a free weekly snack at Greggs and discounted train travel. The bank says the aim is to offer premium services that customers can benefit from daily.

🇷🇺 Russia's Tinkoff plans share issue to fund Rosbank deal. Both Tinkoff owner TCS Holding and Rosbank are controlled by billionaire Vladimir Potanin's Interros group, and the planned integration could strengthen Potanin's foothold in Russia's banking sector.

🇧🇷 The CFO: Nubank’s finance chief on the Brazilian bank’s three-pillar approach to growth. Guilherme Lago, CFO at Latin America’s digital banking darling, on adding 1.5 mn customers a month, investor education and why it’s important to stay ‘curious, critical and humble.’

🇸🇬 Standard Chartered nexus has spun off a technology solutions provider, audax, which offers a plug-and-play technology stack that enables banks and financial institutions to provide Banking as a Service (BaaS).

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Nubank now allows customers to deposit and withdraw Bitcoin. Read all about it here

🇵🇭 Philippines SEC orders Apple and Google to remove Binance from app stores. The Philippines SEC mandates the removal of the Binance app from Google and Apple stores in the country citing security threats to investors and, potentially, the local economy.

🇿🇦 South Africa grants crypto licences to Luno, VALR and 73 other companies. Luno’s license allows the company to provide crypto advisory and intermediary services while VALR’s license allows the company to provide advisory, intermediary and investment management services. More here

DONEDEAL FUNDING NEWS

Pomelo, a startup that combines international money transfer with credit, has raised $35 million in a Series A round. Additionally, the company is announcing a $75 million expansion of its warehouse facility. In an interview with TechCrunch, Pomelo founder and CEO Eric Velasquez Frenkiel described the Series A round as “preemptive.” He declined to reveal valuation, saying only it was an “up round.”

🇨🇭 14Peaks raises $30 Million to back FinTech and the future of work. Edoardo Ermotti, founder of Swiss venture capital firm 14 Peaks Capital, plans to offer investors in the inaugural fund an approach where they can have more influence in decision-making and better support portfolio companies.

🇺🇸 Bump raises $3M seed to help creators manage finances. Bump allows creators to track income and market value, which can help them negotiate better deals and see how much money they are owed from partners.

🇬🇧 Fundpath secures £2 million investment. The funding will enable Fundpath to accelerate its product roadmap by further investing in the people, technology, and data which power Fundpath, leading to an expansion of the breadth and depth of its service.

M&A

🇺🇸 Thunes announced an agreement to acquire Tilia, an all-in-one payments platform licensed in 48 U.S. states. The company, based in San Francisco, offers payment solutions (acceptance and pay-outs) for games, virtual worlds, creator economies, and in-app purchases.

🇺🇸 TabaPay will pay $9.7 million for Synapse's assets; Evolve to cover any shortfall of end-user funds. Jason Mikula reveals more from the bankruptcy filings.

🇬🇧 Konsentus, an open banking technology provider, has been sold to its management in a pre-pack administration for just £350K according to documents deposited at UK Companies House. Konsentus continues to trade and the 19 staff in London have been transferred to a new company.

🇺🇸 Karma Wallet acquires sustainability marketplace DoneGood ahead of card and membership programme launch. The acquisition of DoneGood is set to directly integrate into the incoming Karma Wallet card and associated membership programme, which the FinTech says it plans to launch in “late April” this year.

MOVERS & SHAKERS

🇬🇧 10x Banking, the cloud-native SaaS core banking platform, has announced the appointment of Will Dale as its Regional Vice President in APAC. The appointment, which sees Dale join from Mambu where he held the role of Regional VP for nearly five years, sees 10x cement its presence in APAC as part of its mission to bring core banking transformation to financial institutions across the region.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()