Monzo Surges to Profit and Eyes EU Expansion

Hey FinTech Fanatic!

Monzo Bank has just posted its first full year of profit, a monumental achievement following a period of rapid growth and transformation. The fintech startup reported pre-tax profits of £15.4 million ($19.6 million) for the 2023-2024 fiscal year, a dramatic turnaround from a £116.3 million loss the previous year.

With revenues surging to £880 million, more than doubling from £355.6 million in 2022, Monzo has solidified its position as one of Britain’s premier digital banks. This financial leap underscores Monzo's resilience and adaptability, having bounced back from the challenges posed during the early days of the Covid-19 pandemic.

Highlights of Monzo's impressive year include:

- A profit of £15.4m ($19.6m)

- Revenue growth of 2.5x

- Deposits increased by 88% to £11.4bn ($14.51bn)

- Card spending rose by 47% to £47.8bn ($60.85bn)

- Gross loan book expanded by 84%

The bank is not just resting on its laurels; it is actively planning to open an office in Dublin as a gateway to the European Union market, with further expansion into the US on the horizon. Monzo's customer base has grown to 9.3 million consumers and 400,000 business clients, reflecting its broad and growing appeal.

In other news, European neobank bunq is aiming to secure a license for UK expansion after Brexit-related challenges. CEO Ali Niknam expressed optimism about gaining approval by the end of the year, as bunq also eyes the US market.

Cheers,

#FINTECHREPORT

🏦 The State of Open Banking in South East Asia by Appsynth & Brankas. Check out the complete report

INSIGHTS

📊 Thunes and Visa surveyed 233 European payment leaders at financial institutions and payment companies in five markets, revealing conflicted attitudes on payment interoperability. Click here for further information

FINTECH NEWS

🇧🇩 AamarPay, an online payment gateway company, has launched first FinTech ‘super app’ in Bangladesh. Company officials recently announced the integration of all essential services such as electricity bills and booking flights into a single app.

PAYMENTS NEWS

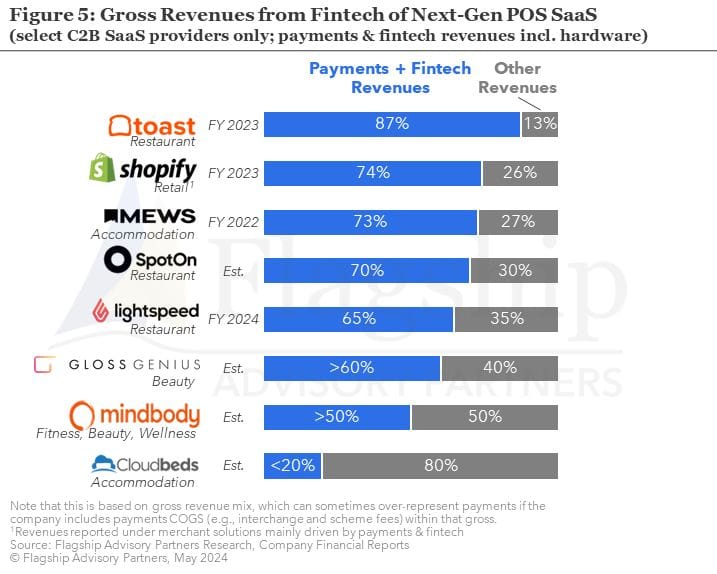

💵 Toast, a restaurant SaaS platform, has surpassed Shopify in terms of Payments and FinTech monetization, with 87% of its overall 2023 gross revenues attributable to payments, lending, and other FinTech products. Read more

🇨🇴 Nuvei partners with Visa to offer Visa Direct in Colombia. Nuvei is the first global payments provider to offer Visa Direct to its customers in the country. The partnership continues Nuvei's first-mover advantage in rolling out industry-leading payments solutions in Colombia.

🇲🇾 South Korea’s BC Card starts QR code payment service in Malaysia. The service allows South Korean customers to make payments with Paybooc in Malaysia while reducing the hassle and costs of currency exchange and credit card transactions for users’ convenience.

🇿🇦 EBANX, a global FinTech leader in cross-border payments, and Ozow, South Africa's leading instant EFT payments provider, announced an expanded strategic partnership to further enhance digital payment solutions in South Africa.

🇵🇱 Viva.com powers payments with BLIK, the leading Polish mobile payments method. This collaboration seeks to enhance merchant support and customer experience by combining BLIK's large user base with Viva.com's payment infrastructure. Click here to learn more

DIGITAL BANKING NEWS

🇬🇧 Monzo Bank posts first full year of profit after more than doubling revenue 🤯 The FinTech startup said in annual financial results that its pre-tax profits totaled £15.4 million ($19.6 million) in its 2023-2024 fiscal year, swinging to the black from a £116.3 million loss the year prior.

The bank says it has plans for an Irish 🇮🇪 office as part of a bid to enter the European Union market. Monzo also revealed that it is in the early stages of opening an office in Dublin, which it described as a “gateway” to expand across the EU.

🇧🇷 Nubank recognized by TIME as One of the World’s Most Influential Companies of 2024. As part of the Titans category, alongside global giants such as Amazon, Nvidia, Microsoft, and Disney, Nubank stands out as the only Latin American company featured in this category, underscoring its significant role in reshaping the financial landscape across the region.

🇳🇱 European neobank bunq is debunking financial fraudsters with the help of NVIDIA accelerated computing and AI. To address customer demands, bunq employed generative AI to enhance fraud and money laundering detection.

The $1.8 billion European neobank, hopes to secure license for UK 🇬🇧 expansion this year, after it initially launched in the U.K. in 2019. bunq was forced to exit the country in late 2020 in light of Brexit, which meant EU-based banks could no longer use their own country licenses to operate in the U.K.

🇮🇪 Digital bank Revolut has insisted its payment systems are robust and that it takes fraud seriously. It comes as the Irish Independent queried a number of cases with Revolut where its customers experienced fraudulent activity or had their accounts shut down without explanation.

🇰🇷 South Korea prepares for a fourth digital bank. Though the country was well banked before the arrival of the digital challengers, Kakao Bank, K Bank and Toss Bank have all found a way to build market share rapidly without burning an inordinate amount of cash.

BLOCKCHAIN/CRYPTO NEWS

🇭🇰 Spark FinTech Limited, an affiliate of Bybit, one of the world’s top three cryptocurrency exchanges by volume, has announced its decision to withdraw its application for a Virtual Asset Services Providers (VASP) license with the Hong Kong Securities and Futures Commission (SFC).

🇺🇸 Coinbase donates $25m to crypto super PAC. The money, which comes on the heels of a $25 million donation from Ripple, means that Fairshake and its affiliates have raised to $160 million in this election cycle, making it one of the largest Super PACs.

DONEDEAL FUNDING NEWS

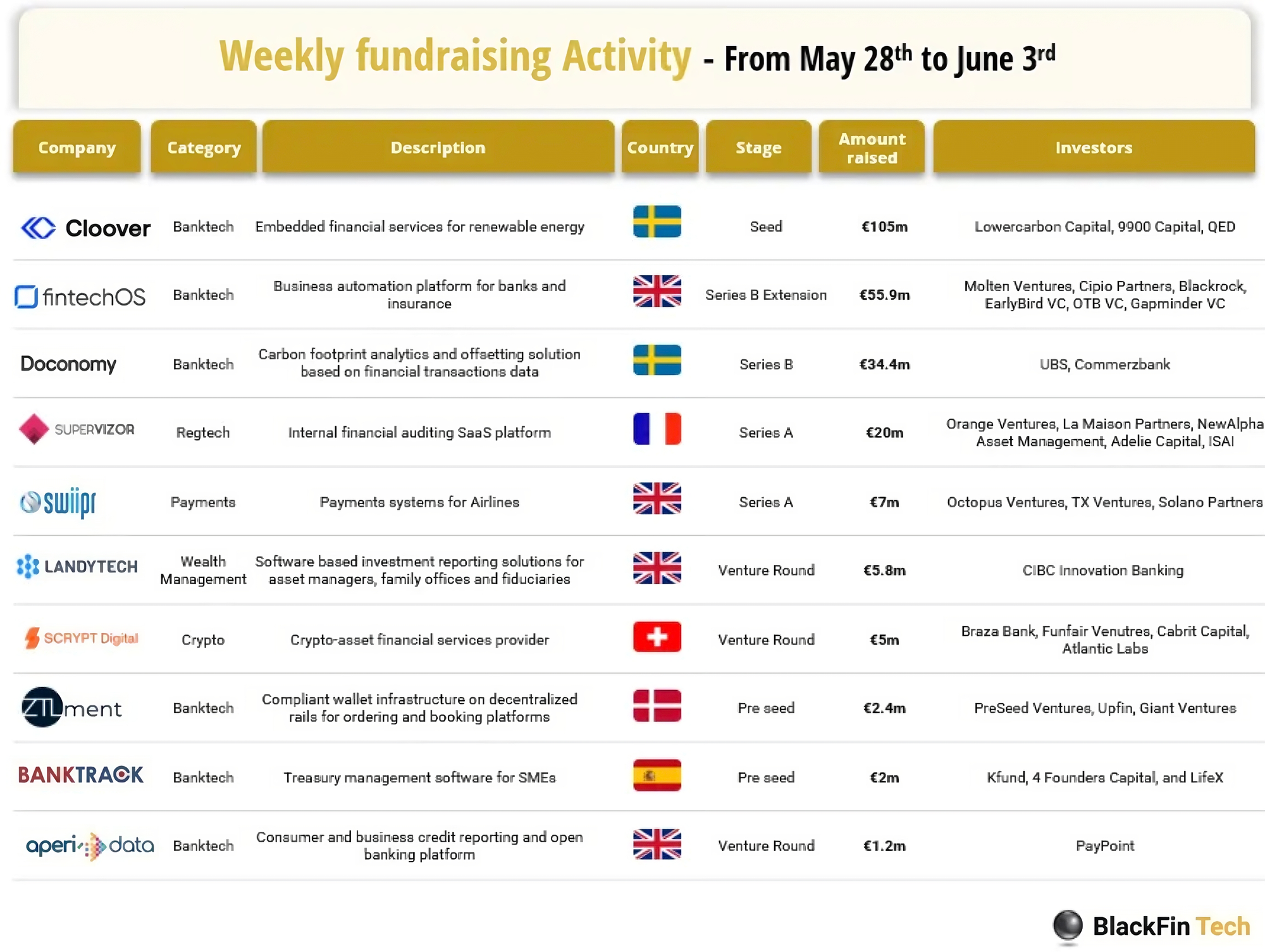

💰 Last week we saw 10 official FinTech deals in Europe for a total amount of €243m raised with 4 deals in the UK, 2 deals in Sweden, 1 deal in France, 1 deal in Switzerland, 1 deal in Denmark, and 1 deal in Spain. Read the complete BlackFin Tech overview article

🇸🇦 Spend management startup SiFi raises $10M to grow further in Saudi Arabia. SiFi’s product lets its customers control their corporate cards’ usage and limit expenditures at the merchant or geographic levels. It also enables employees to submit reimbursement requests, their expenses and invoices.

🇩🇰 Dreamcraft Ventures launches €66M fund for SaaS and FinTech. Investments so far cover DACH and the Nordic region. Dreamcraft follows graduation-centric structure and supports its portfolio founders on critical operational topics from the first engagement.

🇮🇹 Milan-based FinTech startup Sibill secures €6.2M to automate financial operations for Italian SMBs. This funding, raised in two tranches, will help Sibill work towards becoming the “leading” financial operations platform for SMBs in Italy, which has the most SMBs in Europe.

🇸🇪 Klarna-backer Creandum closes €500M fund to back up to 40 early-stage startups. Creandum plans to back Europe’s next category-defining technology companies with the latest fund. Already, the VC firm has backed some of the popular European companies.

M&A

🇵🇭 PH FinTech startup Beppo bolsters services with tax & bookkeeping acquisitions. Philippine FinTech startup Beppo has secured funding to acquire JuanTax, a tax platform, and five bookkeeping firms. This aims to address the growing demand for bookkeeping services amidst a shortage of accountants.

MOVERS & SHAKERS

🇨🇦 Zafin appoints Michael Nitsopoulos Chief Product Officer. As the CPO, Michael will oversee Zafin's product strategy, leveraging his deep expertise to enhance and expand Zafin's suite of solutions. Read more

🇺🇸 Navan has hired a former NYSE executive, Amy Butte, as its new Chief Financial Officer, ahead of the anticipated IPO of the $9.2 billion travel and expense management platform. Butte, who was the New York Stock Exchange’s CFO between 2004 and 2006, will join Navan in June.

🇬🇧 London FinTech Monzo hired over 700 employees and average salaries rose 15%. Monzo splits its staff up into two divisions: 'customer operations', and 'management, operations and administration.' These saw rises in headcount of 573 and 140 respectively. Read on

🇬🇧 IXOPAY appoints Brady Harris as CEO to drive global payments growth. His appointment aligns with the recent merger of IXOPAY and TokenEx, highlighting a significant shift in the payments industry towards a multi-processor payment model.

🇦🇷 Ualá COO Mariana Franza to Depart Latin American FinTech. Sources familiar with the matter, clarified that her exit is not connected to the company’s recent decision to lay off 140 employees, or 9% of its workforce, aimed at eliminating overlapping roles.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()