Monzo Hits 13M Customers, +1M Added in 3 Months

Hey FinTech Fanatic!

Monzo just reached +13M customers, widening its lead in the digital banking race ahead of Revolut’s +11M in the UK. The bank added +1M users in the past quarter alone, with May and June marking its strongest growth to date.

The 13 million milestone includes +700k business accounts, a segment Monzo entered just a few years ago.

Today, 1 in 5 UK adults has a Monzo account, with two-thirds of new sign-ups driven by word of mouth, the company said.

Keep scrolling for more on Monzo and other FinTech updates 👇

Cheers,

INSIGHTS

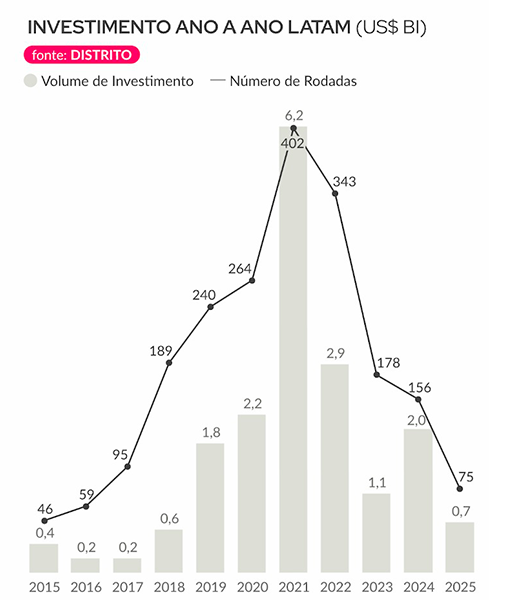

🌎 Investment in Latin FinTechs in the first half of the year fell to US$735 million. Brazil accounts for 56% of the region's financial startups and received 60% of the investments, according to a study released by the consultancy Distrito. Despite ranking only fifth in the number of startups (327), they have raised a total of US$5.5 billion across 163 deals.

FINTECH NEWS

🇳🇱 Vondelpark Meets FinTech. On Sunday, July 18, host Jil Ebanoidze gathered Amsterdam’s FinTech crowd for a relaxed run through Vondelpark, followed by coffee and conversation, a great way for founders, investors, and FinTech folks to connect beyond the usual conference space.

🇮🇳 Clear cuts 16% of workforce amid peak tax-filing season. The layoffs have affected several recently hired employees, including freshers who had joined just two months ago. The company is letting go of 20-25% of its workforce as part of a restructuring exercise.

PAYMENTS NEWS

🌎 Mercado Pago users grow and boost supply. The e-commerce ecosystem FinTech company reached nearly 68 million monthly active users by the end of the second quarter of 2025 in Brazil, Mexico, and Argentina, representing annual growth of 30 percent.

🇬🇧 AI FinTech Cleo eyes stablecoin push. Cleo is exploring a push into stablecoins as clearer regulatory frameworks in the digital asset space emerge. The stablecoin push would be a new frontier for Cleo, which is most known for its AI assistant, a characterful chatbot that encourages users to build better financial habits.

🇵🇭 Telecom giant Globe's profit from GCash doubles as mobile payment arm eyes IPO. Globe’s share in the equity earnings rose to 3.8 billion pesos in the first half, up 78% from a year ago. It now makes up 26% of Globe’s pre-tax net income, more than double the 12% contribution it made a year ago, Globe said in a statement.

🇺🇸 Corpay Cross‑Border uses blockchain technology to facilitate client FX conversions. Through Kinexys Digital Payments, Corpay Cross-Border can extend its trading hours for its global client base and provide speed of settlement not possible on traditional fiat FX rails without a significant lockup of liquidity.

🇦🇺 Treasury and Payments Platform Finmo enhances transaction security with the confirmation of payee rollout in Australia. CoP helps tackle rising fraud by verifying account details before funds are sent. It also helps prevent supplier fraud, misrouted payments, and delays in reconciliation, offering businesses greater confidence and control over every transaction.

🇸🇬 TransferMate receives in-principle approval from the Monetary Authority of Singapore to add payment services. TransferMate can now issue accounts, e-money, and local transfers after receiving in-principle approval from Singapore’s Monetary Authority (MAS).

🇬🇧 Visa to move its European HQ. Visa is reportedly moving its European headquarters. The payment giant is on the verge of agreeing a deal with Canary Wharf Group to move to London’s Docklands from its current premises in Paddington.

OPEN BANKING NEWS

🇬🇧 UK open banking firm Ordo to close. Neonomics CEO announced the closure of its UK subsidiary, Ordo, to focus resources on growing demand in the Nordic and EU markets. The company is seeing strong momentum and investing in new open-finance services.

DIGITAL BANKING NEWS

🇰🇷 KakaoBank reports record earnings on growing noninterest income. The bank posted its strongest-ever half-year performance, reporting an operating profit of 353.2 billion won ($254 million) and a net profit of 263.7 billion won in the first half of 2025, the company said.

🇬🇧 Revolut’s new bet strategies, crypto derivatives, private banking, and a points-based credit card. The breakneck speed at which Revolut operates has expanded into new product verticals, such as these helped win the UK FinTech millions of users, billions in revenue, and a towering $45bn valuation.

🇺🇸 Starling to open new North America office amid talk of US IPO. The UK FinTech is opening a Canadian office and plans to take its software-as-a-service product Engine to mid-tier banks across North America. Read more

🇬🇧 Monzo tops 13 million customers on the back of record growth, word-of-mouth referrals, and a surge in business customers. It now serves 12.5 million personal customers and more than 700,000 business customers. The bank added c.1 million customers in the last quarter alone, demonstrating significant momentum behind the business.

🇶🇦 Qatar's QNB introduces 'end-to-end' online account opening for SMEs. This upgrade allows new entrepreneurs or established businesses to open their accounts fully digitally, securely, and within minutes, eliminating the need for branch visits. Read more

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Lloyds Bank goes crypto with HBAR. Lloyds Bank has entered the crypto space by partnering with Hedera, adopting its native token HBAR to explore blockchain-based solutions. This move marks a significant step for the UK banking giant as it embraces distributed ledger technology to enhance its financial services.

🇧🇷 Bitget Wallet launches USD-based, zero-fee Mastercard crypto payment card in Brazil. Issued in partnership with infrastructure provider Immersve, the card allows users to spend crypto directly from their wallets at over 150 million merchants that accept Mastercard globally.

🇺🇸 PayPal is now a funding option for Kraken clients in the U.S. Customers can deposit USD and start trading in just a few taps, no wires, no wait, and no bank logins. Adding PayPal as a deposit method is part of Kraken´s mission to make crypto easier for everyone.

🇺🇸 Ex-Apple Engineer unveils privacy-focused crypto Visa Card. The Payy Visa card hides stablecoin transactions using clever cryptographic proofs and a custom-built ledger, avoiding the situation where non-custodial card spending can be looked up and traced on public blockchains. A Co-founder of the team that built the Payy card thinks it’s irresponsible, unethical, and even borderline illegal.

PARTNERSHIPS

🇬🇧 Solidgate partners with Salv to secure global payments. The collaboration aims to enhance the security, compliance, and monitoring of transactions processed through Solidgate’s Treasury product as the company scales its global payments infrastructure.

🇴🇲 Mastercard Partners with Monak to cut costs in migrant remittances. By launching a new digital financial services platform, Mastercard and Monak plan to significantly reduce the cost and complexity traditionally associated with basic financial services, supporting broader efforts to drive financial inclusion.

🇮🇳 Razorpay partners with CRED and Visa for the CardSync payment solution to enable one-tap payments across online stores. CardSync automatically updates saved card details when users receive a new or replacement card, reducing payment failures and improving user experience.

🇺🇸 Taxbit Partners with Mural Pay to unlock stablecoin payments for customers. The partnership allows select Taxbit clients, which include digital asset exchanges, banks, FinTechs, and government entities, to invoice customers directly and accept desired stablecoins as payment.

🇺🇸 Corpay and Circle collaborate to bring stablecoin payments to global FX and commercial card rails. They will work together to embed USDC across Corpay’s cross-border pay-in and pay-out rails, allowing companies to access blockchain’s 24/7 settlement and programmability.

🇺🇸 Crypto.com partners with Plaid for instant asset transfers. The partnership allows Crypto.com users to easily transfer their investments from other platforms to Crypto.com without needing to sell and, therefore, incur taxes. Keep reading

DONEDEAL FUNDING NEWS

🇺🇸 BlindPay raised $3.3M in a seed round to build a better global payment infrastructure with stablecoins, giving businesses the tools to move money across borders, stay compliant, and open virtual US accounts in minutes, all through one API built for developers.

🇺🇸 OLarry raises $10 million in Series A Funding to bring AI-powered, proactive tax planning to high-net-worth individuals and businesses. It will use its new infusion of capital to continue building out the company's proprietary tax data classification and extraction model, enabling more efficient ingestion and structuring of complex financial data.

🇮🇳 Digital lending startup Zype secures INR 90 Cr funding led by Unleash Capital Partners. The startup is now aiming to build its credit profile to secure additional debt funding from banks and other NBFCs. Keep reading

🇮🇳 DPDzero raises $7 Mn led by GMO Venture Partners. The Bengaluru-based firm plans to use the new funds to hire its field collection agents, starting in Bengaluru and later expanding to Maharashtra and Uttar Pradesh. These agents will enable the company to offer end-to-end ethical collection services.

🇺🇸 US FinTech Saphyre lands $70m investment from FTV Capital. The New Jersey-headquartered company plans to use its latest funds to enhance its market presence in pre- and post-trade services, expand internationally, and accelerate product development.

🇸🇨 Fusepay, a Seychelles-based FinTech, raises $350k pre-seed. The company aims to simplify cross-border payments across Africa and emerging markets. The funds will be used to enhance its platform, grow its team, and expand operations as it builds out its payment infrastructure.

🇺🇸 Payment platform Lava raises $5.8M to build digital wallets for the ‘agent-native economy’. A new startup, Lava Payments, aims to take on payment giants by building a solution for the modern web where AI agents now handle transactions for their customers.

🇺🇸 FinTech startup Rillet lands $70m Series B from a16z and Iconiq just 12 weeks after last raise. Rillet plans to expand its AI capabilities and deepen integrations across the financial technology stack. Its goal is to build “a collaborative platform where AI agents and human expertise work together to transform how businesses understand and manage their financial performance.”

M&A

🇬🇧 Octopus buys Virgin Money investment arm to accelerate wealth push. The investment platform, which received an initial £50m backing from its parent company, aims to help the 92% of British investors who do not receive financial advice by offering coaching.

🇮🇳 PB FinTech acquires Pensionbazaar.com. The acquisition will further help PB FinTech diversify its financial services offerings, aiding users in choosing and investing in retirement and pension-related financial products, further cementing PB FinTech’s long-term growth strategy.

🇺🇸 Electronic Merchant Systems acquires omnichannel payments platform Paysley. Paysley will become a wholly owned subsidiary of the EMS corporation but will continue to operate as an independent brand, serving businesses directly and through agent, ISO, and ISV partnerships.

🇩🇪 Deutsche WertpapierService Bank has acquired Berlin-based FinTech lemon.markets to expand digital brokerage services. The acquisition will focus on developing competitive neo-brokerage solutions that offer faster time-to-market, flexible service options, and a modern customer experience.

MOVERS AND SHAKERS

🇺🇸 Currency.com appoints U.S. leadership team to accelerate nationwide expansion. Currency.com appointed Enrico Serafini as CEO and Dave Ackerman as COO. They will oversee the company’s rapid expansion across the region as it seeks to establish itself as a top-tier digital finance platform in the U.S.

🇺🇸 Google Pay’s Ben Volk to join PayPal as GM Consumer. Volk will lead efforts to enhance the PayPal Consumer experience at a pivotal time, as the company focuses on building more connected and relevant user journeys. Continue reading

🇪🇬 Raya Holding for Financial Investments appoints Marwa Hamza as Chief Human Resources Officer. In her new role, Marwa will oversee human capital efforts across a diversified investment portfolio, leading the development of a comprehensive talent strategy and building future leadership pipelines.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()