Mollie Emerges as Frontrunner to Acquire GoCardless

Hey FinTech Fanatic!

GoCardless, valued at $2.1 billion last time, is up for sale. Trustly looked like the front-runner, but it’s looking more and more like Mollie will end up buying it, with the deal possibly closing next month.

Not directly related to M&A, but it might tie in (you’ll get why soon) … I’m launching the FinTech Quiz. Wondering what it is?

It’s 11 FinTech questions covering the latest deals, launches, and shake-ups, every week. Get a perfect 11/11 and you’ll land on the Leaderboard of Legends.

And the top scorer over time? Nice, there’s something special waiting for you. 😉

The first quiz is live now. This round closes on August 14th, 2025, at 12:30 PM CEST.

Now… here’s today’s biggest FinTech moves 👇

Cheers,

POST OF THE DAY

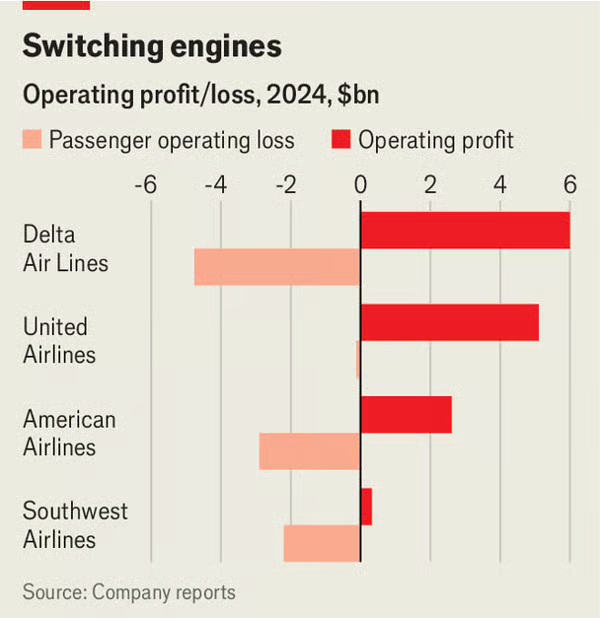

💰 You might expect airlines to earn by flying passengers. But you are mistaken.

INSIGHTS

🇰🇿 Kazakhstan becomes Regional FinTech Leader as startups quadruple. Rapid growth has fueled a fourfold increase in FinTech startups over the past five years. Kazakhstan now matches Russia in several digitalization areas and surpasses it in some. In 2024, cashless payments reached 86% of all transactions in Kazakhstan, compared to 87% in Russia.

FINTECH NEWS

🇧🇷 São Paulo Set the Pace outside of Nubank! Fathi Alexandre de Souza, host of the local FinTech Running Club, led a 5 km sunrise run through Ibirapuera Park, followed by coffee and networking at Nubank’s Casa Ultravioleta in São Paulo, keeping the city’s FinTech community energized and connected.

🇨🇦 Mogo sells $13.8 million of WonderFi stake to buy Bitcoin. It aims to hold remaining shares until Robinhood’s purchase closes, which is expected in the second half of 2025. In its announcement, Mogo said it was using the sale to boost its Bitcoin investment to roughly $2 million after making a $1 million contribution to Bitcoin exchange-traded funds (ETFs) in June.

PAYMENTS NEWS

🇨🇴 $5.1 million will enter the financial system over the next three years. According to Sonia Gómez, Director of Solutions Consulting at ACI Worldwide, the new infrastructure will allow for real-time transfers and payments between different banks, digital wallets, and financial institutions. Meanwhile, a key player in this space is Colombia's Bre-B. According to estimates by ACI Worldwide, it could add at least 5 million new users to the financial system and generate an economic boost of more than $280 million.

🇺🇸 Don’t miss this Axios podcast with Cindy Turner, Worldpay’s CPO, as she unpacks three big shifts in payments: building “trusted agent” models for AI-driven shopping, using stablecoins to speed marketplace settlements and cut FX costs, and scaling account-to-account payments in the U.S.

🇺🇸 Fintiv files RICO and Trade Secret misappropriation suit against Apple stemming from alleged theft of mobile wallet technology used to create Apple Pay, a service that generates billions in annual revenue and has been a major force in growing Apple's market valuation to more than $3 trillion.

🇦🇺 ASIC secures $10M penalty from iSignthis. Nickolas John Karantzis, its former Managing Director and CEO, was also disqualified from managing corporations for six years and penalized $1 million for breaching his director’s duties and failing to ensure information given to the ASX was not false or misleading.

🇵🇭 GCash introduces Tap to Pay, now available for Android users. GCash becomes the first e-wallet in the country to enable NFC-powered payments, allowing users to log in to the GCash app, tap, and pay at any Mastercard accepting POS terminal nationwide.

🇬🇧 Wagestream transforms workplace lending with affordable loan products. These developments, supported by the £300 million debt financing secured from Citi in April, directly address the issue of inaccessible credit and reinforce Wagestream’s commitment to providing fair financial services to the everyday worker.

🇺🇸 Marqeta turns to BNPL to boost revenue that's not from Block. BNPL has been growing at a fast clip for Marqeta. The company was one of the first card issuers offering Visa's Flexible Credentials, and works with two of the largest BNPL providers, Affirm and Klarna, to bring that technology to their customers.

REGTECH NEWS

🇺🇸 iDenfy adds Secretary of State verification to KYB Platform. The feature connects to SOS databases across all 50 U.S. states to verify business registration details and legal status, aiming to improve onboarding accuracy for high-risk sectors such as banking, FinTech, and cryptocurrency.

DIGITAL BANKING NEWS

🇳🇬 Tatum Bank launches new digital platforms to boost financial access. The bank stated that the introduction of these platforms is part of its broader strategy to improve financial inclusion by providing more accessible and flexible tools for banking.

🇷🇺 Revolut, after the Bell investigation, began warning Russians about the inadmissibility of transferring funds from sanctioned organizations. “From the date of receipt of this letter, any confirmed attempt to bypass our controls will result in the closure of your account along with any required regulatory reporting obligations,” the bank said in a statement.

🇧🇷 Anatel authorizes exclusivity between Nubank and Claro. With the decision, the two companies can continue to coordinate the service, which currently has 44,400 subscribers. NuCel operates as a virtual mobile operator (MVNO). Nubank provides services, and Claro operates the network.

🇺🇸 Chime beats revenue estimates in first earnings since blowout US IPO. Chime's revenue rose 37% to $528 million in the three months ended June 30. The company went public in June in a blockbuster U.S. IPO that raised hopes of a lasting rebound in investor demand for high-growth tech listings.

🇦🇪 Wio Bank integrates Shory’s Car insurance to make protection more accessible in the UAE. By collaborating with Shory, Wio Bank can enable users to purchase car insurance in a few clicks, while offering customers the option to split insurance payments into monthly instalments ranging from three to 48 months.

BLOCKCHAIN/CRYPTO NEWS

🇪🇸 Binance teams up with BBVA to let customers keep assets off the exchange. Binance is working with Spanish bank BBVA to allow customers to hold their assets off the crypto exchange, as it tries to reassure investors following its record fine by US authorities nearly two years ago.

🇺🇸 Coinbase unlocks millions of assets with DEX trading. Traders can now access a new world of Base assets on decentralized exchanges through Coinbase's easy-to-use and seamless user interface. DEX trading is now rolling out to U.S. users with plans to support more markets and networks soon.

🇨🇳 Animoca, Standard Chartered & HKT launch stablecoin venture in Hong Kong. By combining their strengths in blockchain, banking, and telecom, this joint effort aims to launch a fully regulated digital currency and connect traditional finance with Hong Kong’s growing digital market.

PARTNERSHIPS

🇧🇷 Atlaslive and StarsPay join forces to streamline payments in Brazil. The integration ensures a smooth user experience across deposits, betting, and withdrawals. The system is designed for transparency, operational stability, and secure processing.

🇬🇧 Klarna automatically enables thousands of WooCommerce stores, tackling checkout drop-offs head-on via Stripe auto-enablement. By making Klarna available by default, Woo merchants can now meet modern checkout expectations straight out of the box.

🌏 Curity and Savyint partner to advance identity and API security for open banking in APAC. The partnership focuses on developing highly secure IAM and APIM solutions for the financial and banking sector, adhering to global security and identity standards, aligned with PSD2, mTLS, and others.

DONEDEAL FUNDING NEWS

🇺🇸 Stavtar Solutions secures $55 million from Elephant to accelerate growth and scale operations. The investment will fuel the next phase of expansion for the platform that has revolutionized how complex businesses manage their business spend, expense allocations, vendors, contracts, budgets, payments, and more.

🇿🇦 FinTech startup TurnStay secures $2M. Founded in 2021, TurnStay helps streamline payments for African travel companies, allowing them to take bookings from travelers all over the world with country-optimized checkout pages. Keep reading

🇰🇷 Open Asset has attracted a strategic investment worth 5 billion won from the country's leading financial value-added network (VAN) operator. With this investment, the two companies decided to jointly develop an integrated service that directly links OpenMint, Open Asset's stablecoin issuance service, and Dussen's financial payment infrastructure.

🇮🇳 Indian FinTechs raise USD 119.8 Mn. Indian FinTechs raised a total of USD 119.8 million in July 2025, marking a continued decline from USD 156.9 million in June, USD 210.7 million in May, and USD 238.9 million in April. InCred topped the charts with a USD 46.8 million raise, followed by Credit Wise and Navi.

🇺🇸 Casap has secured $25 million in Series A funding led by Emergence Capital. With new funding, Casap plans to expand its AI capabilities, enhance hiring, and further streamline post-transaction processes across the payments lifecycle. Its proprietary fraud score identifies suspicious activity to reduce future disputes.

M&A

🇬🇧 GoCardless has been courting buyers, with Dutch FinTech Mollie the current frontrunner. The UK FinTech has been in discussions with multiple potential acquirers since the start of the year, with Swedish FinTech Trustly at one point entering talks to buy GoCardless.

🇺🇸 Deluxe expands its payments network with the acquisition of the CheckMatch service from Kinexys by J.P. Morgan, a move that aims to revolutionize digital lockbox payments and offer significant advantages for small businesses. This strategic acquisition is not just a company expansion; it’s a step toward enhancing the entire B2B payment ecosystem.

MOVERS AND SHAKERS

🇮🇳 Pine Labs appoints Sameer Kamath as Chief Financial Officer. In this role, Kamath will be responsible for the global finance strategy, accounting, investor relations, and providing financial leadership across the Pine Labs group. Continue reading

🇺🇸 Lightspark appoints Alberto Martin as new CPO. He brings a distinguished track record of product innovation and leadership to the team. His vision, experience, and energy align perfectly with Lightspark’s mission to build the next generation of open, global payments.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()