Mexico's FinTech Revolution & A Milestone for Financial Inclusion: Mercado Pago's Journey to 1 Million Credit Cards

Hey FinTech Fanatic!

Today I'd like to start with an amazing FinTech story from Mexico. Mercado Pago, a leading financial platform in Mexico and a part of the Mercado Libre group, has achieved significant growth in the country, particularly highlighted by the issuance of its one-millionth credit card.

Remarkably, three out of every ten of these cards have been issued to Mexicans who have never owned a credit card before.

This milestone was celebrated at an event with VISA in Mexico City, achieved just ten months after the product's launch, averaging two cards issued per minute 🤯

This achievement underscores the untapped potential in Mexico's financial market, given its low banking penetration compared to other regions, with a vast majority of transactions still conducted in cash.

Traditional banking has been slow to adapt to this digital shift, as evidenced by the digital bank Bineo's modest client acquisition post a significant investment. In contrast, in Brazil, there is a higher credit card penetration rate of four cards per person.

Mercado Pago has positioned itself as a comprehensive financial services provider by becoming an Electronic Payment Funds Institution (IFPE) under Mexico's FinTech Law.

The platform offers a suite of financial products and services catering to individual customers and SMEs, through partnerships with specialized companies.

These include remittance deposits with Western Union and TransNetwork, debit cards in alliance with Mastercard, investment opportunities on the GBM platform, cryptocurrency savings through Paxos, and insurance products via BNP Paribas, Prudential, and Klimber.

Personal loans are among the fastest-growing products offered by Mercado Pago, leveraging the vast amount of transactional data and digital engagement of its users to provide instant credit that is deposited into the digital wallets of its clients.

This service benefits those sending remittances and merchants using the app.

Mercado Pago is also venturing into the physical retail space to compete with convenience stores like Oxxo, which act as banking points.

The company is distributing Mercado Pago terminals to partner merchants, enabling them to accept service payments and cash deposits, transforming cash into digital wallet funds.

This move represents a new direction for the FinTech giant, adding another layer to its already diverse financial services ecosystem.

If you want to read more great FinTech stories from Latin America, I highly recommend signing up for my Weekly LATAM FinTech newsletter!

More global FinTech industry updates can be found below, and I’ll be back in your inbox tomorrow!

Cheers,

BREAKING NEWS

🇺🇸 Digital wallets play key role in US lawsuit against Apple. The US has filed a lawsuit against Apple, accusing the firm of monopolising the smartphone market through a host of actions, including the blocking of third-party apps from offering contactless payments. The lawsuit alleges Apple maintains a smartphone monopoly by imposing contract restrictions and withholding access from developers.

#FINTECHREPORT

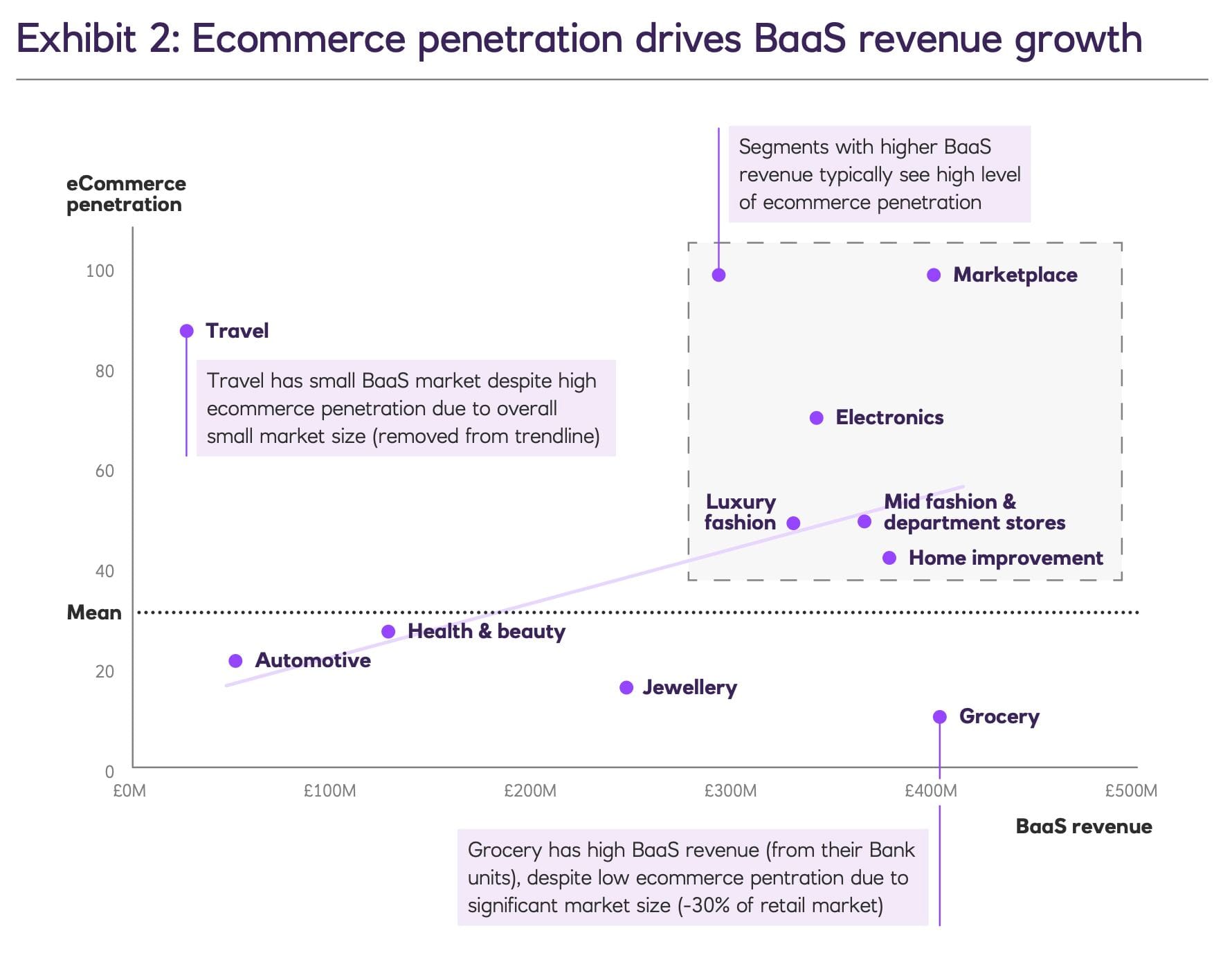

📰 Bridging Finance & Retail: The power of Banking-as-a-service. E-commerce has been a key enabler and driver of BaaS growth, providing a widely adopted channel to reach customers. More here

➡️ FinTech firms could do more to intentionally target women customers in emerging markets, boosting both their own prospects and financial inclusion, says a report from the World Bank's International Finance Corporation (IFC). FinTech and digital financial services have been considered a game-changer for women's financial inclusion and economic empowerment, says the IFC.

INSIGHTS

💵 Bootstrapping, particularly in an industry like FinTech where competitors have loads of VC cash, can require patience and steely nerves.

Just ask Paul Beldham, CEO and majority owner of PayQuicker, a payments platform which enables instant global payouts in 80 currencies for everything from insurance claims, to stipends for participants in clinical trials to affiliate marketing payments to social influencers.

Its system uses algorithms to determine the most efficient method in various cases—with money disbursed via prepaid debit cards, virtual cards and mobile wallets.

Beldham, 66, has an unusual—and unusually long—backstory for a FinTech entrepreneur.

I highly recommend reading the complete story here

FINTECH NEWS

🇺🇸 Robinhood enters $2.25B amended and restated credit agreement. Late Friday afternoon, Robinhood secured an additional line of credit from JP Morgan, allowing them to secure up to $3.375B if needed. Are they launching a credit card on Tuesday? Keep reading

🇺🇸 Neobank Chime targets Public Listing in the US in 2025, according to a person familiar with the matter. The FinTech company scored a $25 billion valuation in 2021 at the peak of a technology boom which then faded as interest rates and inflation rose.

🇹🇭 Ascend Money, a financial technology firm backed by Charoen Pokphand (CP) Group, aims to list on the Nasdaq stock exchange within two years, Suphachai Chearavanont, the company's founder and chairman, told the Bangkok Post. "The listing would strengthen its growth after becoming Thailand's first FinTech unicorn," he said.

🇺🇸 FinTech Brex announces closing of securitization transaction out of its Commercial Charge Card Master Trust. The transaction included the “issuance of $260M of charge card asset-based notes rated by Kroll Bond Rating Agency.” The highest-rated bonds obtained an “AA” rating, an improvement in rating from Brex’s first and second securitizations, which were rated “A”.

🇬🇧 Snoop partners with Equifax for free credit score service. By offering free credit score access alongside Snoop’s award-winning money management tools, Snoop gives users everything they need to improve their credit score and financial well-being. Read more

🇸🇬 Users of Grab’s services will now have the option of topping up their GrabPay e-wallets in cryptocurrencies following the ride-hailing operator’s tie-up with payment firm Triple-A. Licensed in Singapore, Triple-A handles the conversion of digital currencies into dollars with bank settlements instantly.

PAYMENTS NEWS

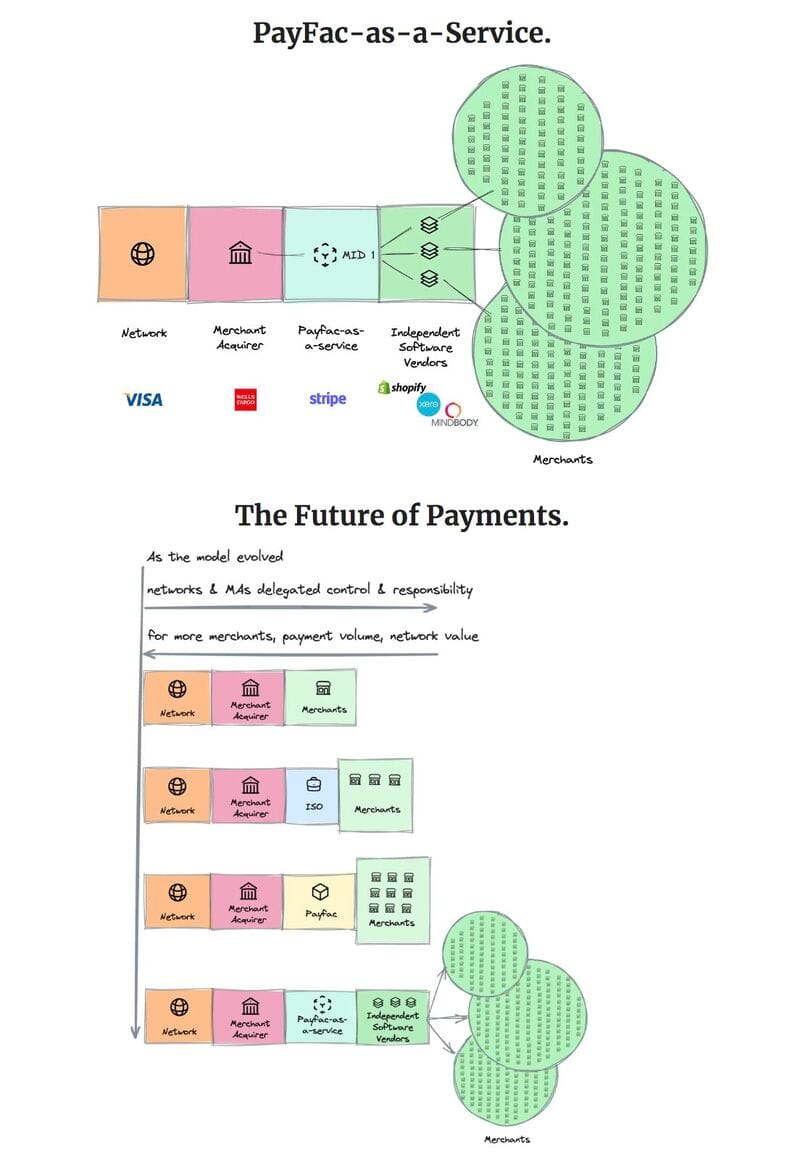

💳 Payfac is the model behind FinTech’s biggest successes, from Stripe and Square to Shopify, Uber, and more. It's a critical but often misunderstood topic, so here's an overview:

🇦🇺 Oracle and Zeller team up to power restaurant payments. Zeller, from Australia, and the global leader in restaurant POS systems, Oracle, have come together to provide restaurateurs with a complete solution for managing orders and securely taking payments at speed.

🇦🇷 Rebill, a startup supported by Y Combinator and known for its innovative cross-border payment gateway launched last year, has now introduced 1-Click Checkout in Latin America. Rebill's strategy focuses on providing a complete and ready-to-use product, distinguishing itself from providers that only offer an API.

REGTECH NEWS

🇺🇸 Green Check named “Best RegTech Company” in 2024 by FinTech Breakthrough Awards and a “Leading Pioneer in Cannabis Banking Solutions” by Global Health and Pharma’s 2023 Commercial Cannabis Awards. “Green Check is at the center of cannabis and FinTech, and these latest accolades highlight that synergy,” said Kevin Hart, founder and CEO of Green Check.

DIGITAL BANKING NEWS

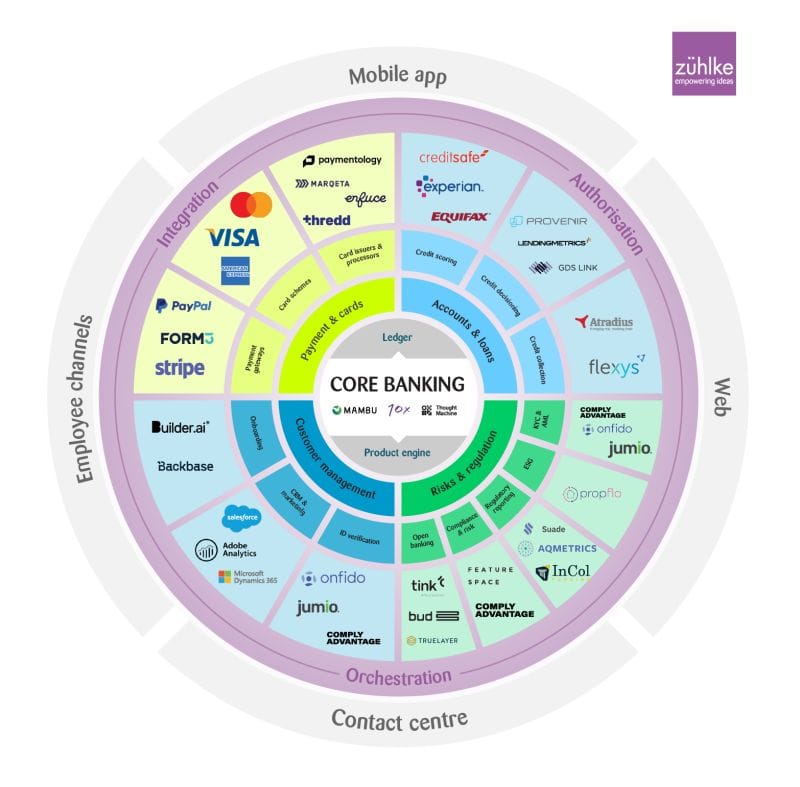

👉 Here is an example of what a modern bank's platform architecture could look like when composed of cloud-based services orchestrated via APIs.

Let’s dive into the Wheel of Finance:

🇺🇸 FV Bank, a licensed global digital bank, has announced an expansion in its deposit capabilities that gives clients the option to deposit euros into their USD bank account. Account holders now have the flexibility to receive euros directly into their FV Bank account.

DONEDEAL FUNDING NEWS

🇨🇭 nsave, which is making banking in Switzerland accessible to people in countries with unstable banking sectors or facing high inflation, has raised $4 million seed funding. The FinTech is in the early stages of product development, but will continue to double down on the savings and wealth side of retail banking as they listen and strive to meet the needs of their target customers.

🇮🇱 Ameetee, a FinTech startup, has raised a $1 million seed round to launch the first B2B FinTech platform that provides financial institutions with a universal solution to offer their customers investment in private companies in the form of transferable securities. Read more

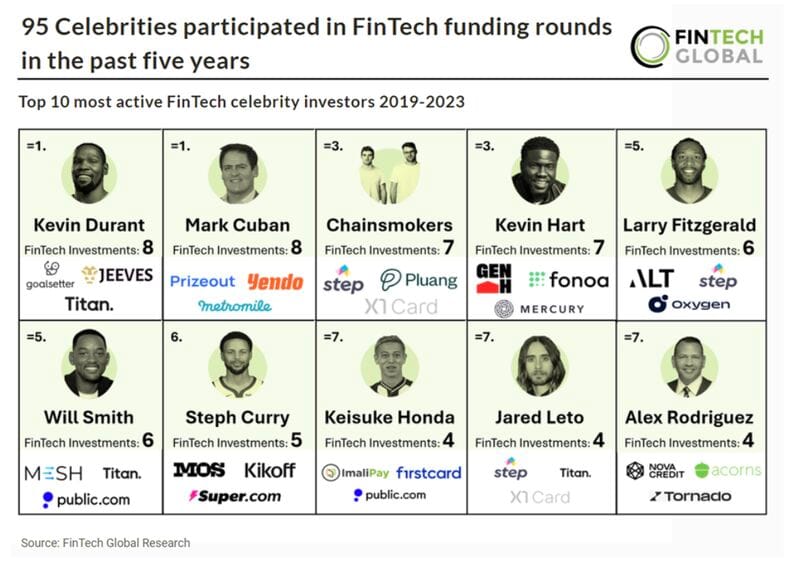

⭐️ 95 Celebrities participated in FinTech funding rounds in the past five years.

MOVERS & SHAKERS

🇺🇸 Robinhood co-founder to step down as Creative Chief Baiju Bhatt will remain a member of the investing platform’s board. Bhatt has been at or near the helm of Robinhood since its inception in 2013. The company said that he would step down from his role as chief creative officer to pursue other entrepreneurial interests.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()