Mesh Hits Unicorn Status with $75M Series C to Build the Universal Crypto Payments Network

Hey FinTech Fanatic!

Mesh just raised a $75M Series C, pushing its valuation to $1B.

Mesh is building the connective tissue that lets consumers pay with any crypto asset, while merchants settle instantly in the stablecoin or fiat they choose.

As crypto moves from experimentation to real-world payments, capital is flowing to interoperability. Wallets, chains, assets. One network.

Mesh is betting that the winners won’t issue the most tokens, but will quietly replace legacy card rails.

The round was led by Dragonfly, with Paradigm, Coinbase Ventures, and others backing the thesis. Expansion across LATAM, Asia, and Europe is already underway...

Agentic commerce keeps accelerating 👇

Mastercard just launched Agent Suite, a new set of tools to help enterprises deploy agentic AI inside payments and commerce workflows.

Think AI agents for product discovery, personalisation, and execution. Built with Mastercard’s data, rails, and advisory layer. Less hype. More operational use cases.

As Payments become software-driven, networks are racing to stay relevant not just at checkout, but inside how decisions are made.

If you’re watching how the FinTech landscape is evolving, scroll down to see what else is moving 👇 I’ll be back tomorrow with more firsthand signals from across the industry.

Cheers,

INSIGHTS

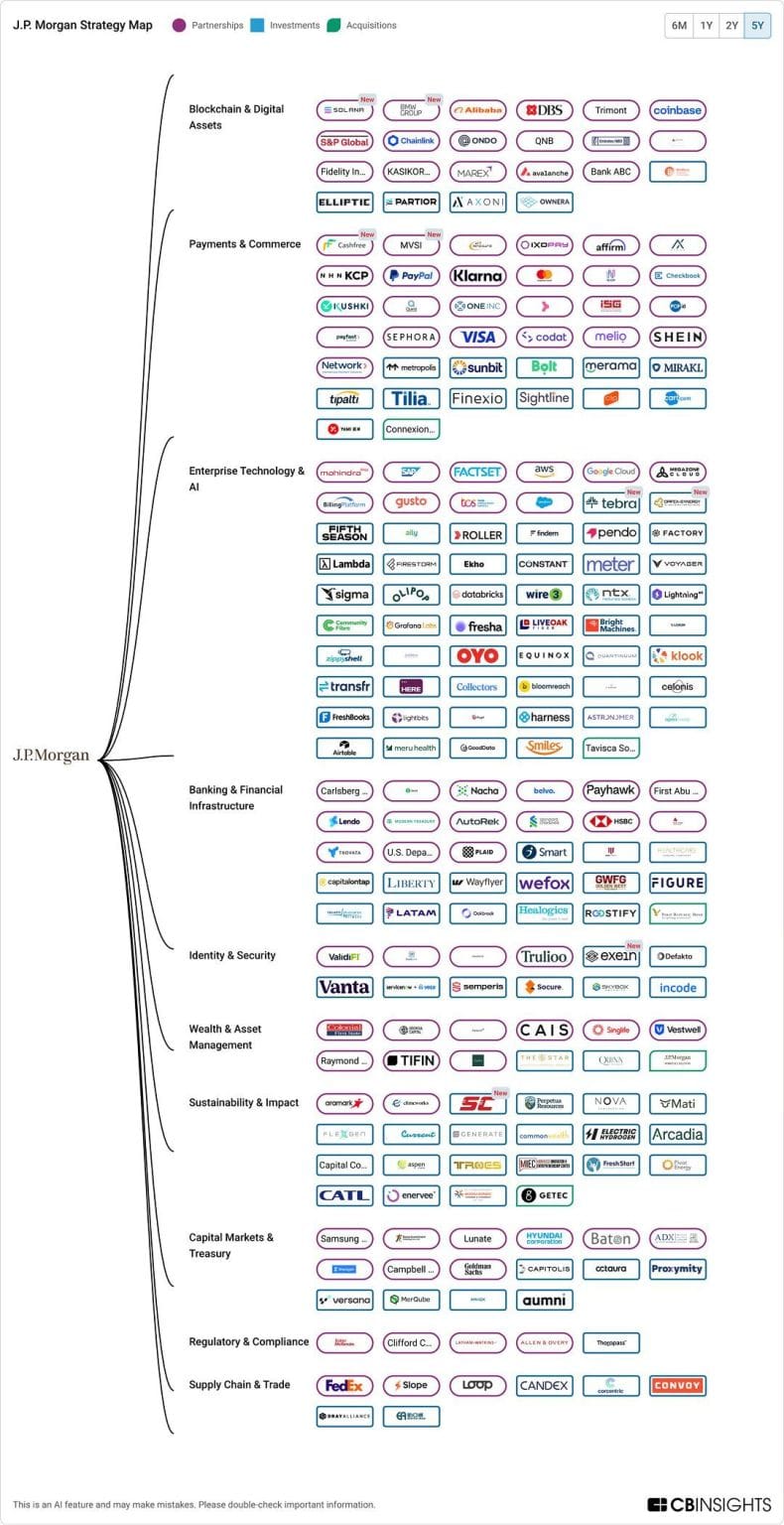

➡️ J.P. Morgan Strategy Breakdown.

FINTECH NEWS

🌍 Your Chance to Host in Mexico! The FinTech Running Club is growing fast, and this could be your moment to lead! If you’re passionate about FinTech, community, and networking, why not start your own chapter in your city in Mexico! Are you curious? 👉 Sign up to become a host!

🇨🇴 Terrenta begins operations in Colombia and becomes the first regulated real estate crowdfunding FinTech. Terrenta has begun operations in the country, focused on the real estate and construction sector, authorised and regulated by the Financial Superintendency of Colombia, expanding access to investment and financing alternatives within a regulated framework.

PAYMENTS NEWS

🇱🇹 UK FinTech giant Checkout.com to open tech hub in Lithuania. Guillaume Pousaz, founder and CEO of Checkout.com, said that Lithuania’s mature FinTech sector and clear regulatory framework align with the company’s mission to build a reliable, globally adaptable payments platform.

🇺🇸 Mastercard launches Agent Suite to ready enterprises for a new era. The suite of services aims to help customers take actionable steps to integrate agentic AI into their daily operations and accelerate toward this next frontier. Customers will be able to build, test, and deploy fit-for-purpose agents from the Mastercard Agent Suite.

🇨🇦 Wise strengthens its investment in the Canadian market with a membership with Payments Canada. This milestone will enable Wise to deepen its service offering for Canadian customers, further establishing the company as a key financial player in Canada. Once a participant, Wise will be able to speed up transfer times and reduce costs for people and businesses.

🇧🇷 PicPay seeks investor confidence in the first IPO of a Brazilian company in 4 years. The company, controlled by the billionaire Batista family, is seeking a vote of confidence from investors after filing for an IPO in the United States this month, aiming for a market value of up to US$2.5 billion.

🇺🇸 PAQ Wallet digital wallet, launches a new app to send money from the US to Guatemala in partnership with Leap Financial. Through credit cards, debit cards, bank accounts, or cash, users can make fast and secure digital transfers, typically processed in minutes, depending on the network and partner verification, at competitive costs compared to traditional methods.

DIGITAL BANKING NEWS

🇩🇪 N26 launches ‘N26 for under 18s’, marking the first step in its family offering. The product provides a unified view of their child’s spending alongside their own, while allowing parents to effortlessly guide their child's first steps in money management in an increasingly cashless world, all within a completely secure environment.

🇦🇷 Pierpaolo Barbieri on power, competition, and the future of Argentina’s financial system. Barbieri, founder and CEO of Ualá, reflected on Argentina’s economy, consumption trends, and the region’s financial future in an interview at Forbes, emphasising how his background as a historian shaped his approach to building a FinTech serving more than 11 million users. Watch the full interview

🇬🇧 Revolut Business moves into revenue operations with a recurring billing tool. The tool allows merchants to build, automate, and optimise subscription plans directly within their Revolut Business app, aiding the platform's evolution from a payments processor to a full revenue operations partner.

🇲🇽 Revolut officially launches its full digital banking service in Mexico after closing the beta phase. Mexican users can download the Revolut app, available on both the Apple App Store and the Google Play Store, to open an account. Continue reading

🇧🇷 Inter abandons BDRs on the B3 and announces it will remain only on the Nasdaq. The proposal to discontinue the Level II Sponsored BDR Program aims to maximise efficiency and minimise redundancies resulting from maintaining the status of a publicly traded company in more than one jurisdiction.

🇳🇱 Netherlands set to scrap bonus caps for some banking and FinTech staff. The proposal would lift caps on variable pay for most bank and FinTech staff while keeping limits in place for top material risk takers, and still requires further approval from the chamber and the Senate.

🌍 ECB official explains why Europe needs a digital Euro, eyes 2029 rollout. An executive board member at the ECB said that a digital euro would function as a free, cash-like payment option available across the entire euro area while reducing reliance on foreign-owned financial infrastructure that could theoretically cut European users off from their own money.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 Trading 212 sold crypto ETNs to UK retail investors without FCA authorisation. In October, the FCA overturned a ban on crypto ETNs for retail buyers, but firms are required to get authorisation from the watchdog to offer them. Read more

🇺🇸 Tether announces the launch of USA₮, the federally regulated, dollar-backed stablecoin developed specifically to operate within the United States’ new federal stablecoin framework established under the GENIUS Act. USA₮ is purpose-built for the U.S. market and its highly digital payment infrastructure.

PARTNERSHIPS

🇨🇦 Nuvei and WEX partner to expand virtual card payments for the global travel industry. The integration enables travel merchants and marketplaces, including online travel agencies (OTAs), airlines, and hospitality brands, to manage multiple supplier relationships more efficiently through secure virtual card payments.

🇦🇪 PayPal and NEO PAY to optimise UAE cross-border payments. As a result of this partnership, PayPal and NEO PAY intend to provide merchants across the region with the ability to accept PayPal payments and, in turn, bring a more secure and simplified option for consumers to pay online.

🇳🇬 PayPal is partnering with Nigerian FinTech Paga to finally let Nigerians receive international payments and fully access its global payments network after two decades of limited service. Under the partnership, Nigerian users can link their PayPal accounts to their Paga wallets and receive payments from more than 200 countries.

🇦🇪 MoneyHash and Tap Payments expand access to modern payment infrastructure. By integrating with the tap payment gateway through its payment orchestration services, MoneyHash continues to strengthen its platform, supporting merchants to deliver seamless payment experiences aligned with local customer preferences and regional market requirements.

🇸🇬 Adyen and Raptor team up to simplify operations for Singapore’s service sector. With payments integrated into its POS offerings, Raptor users are able to generate their own consolidated payment reports, gaining a full view of the cross-channel journeys of their customers, including their payment preferences.

🇮🇳 WazirX integrates Fireblocks to enhance digital asset custody. Fireblocks’ technology will enable WazirX to scale faster, operate more securely, and expand its blockchain support. The integration of Fireblocks will improve how assets are stored and protected on the platform, with stronger controls around access and transaction approvals.

🇨🇴 dLocal and Amway partner to strengthen local payments for direct selling across Latin America. Through its partnership with dLocal, Amway operates with local acquiring and domestic payment infrastructure in Colombia, accepting payments in local currency through local card processing.

🇺🇸 1Money partners with M0 to launch 1Money Issuance. In the new offering, 1Money issues fully reserved digital dollars, providing FinTech builders with the infrastructure to launch and integrate customised, interoperable stablecoins at scale.

🇺🇸 Yuno partners with Crypto.com to expand crypto payments across global merchants. The integration allows Yuno merchants to accept payments made through Crypto. com Pay, opening access to Crypto.com’s global user base of more than 140 million customers.

DONEDEAL FUNDING NEWS

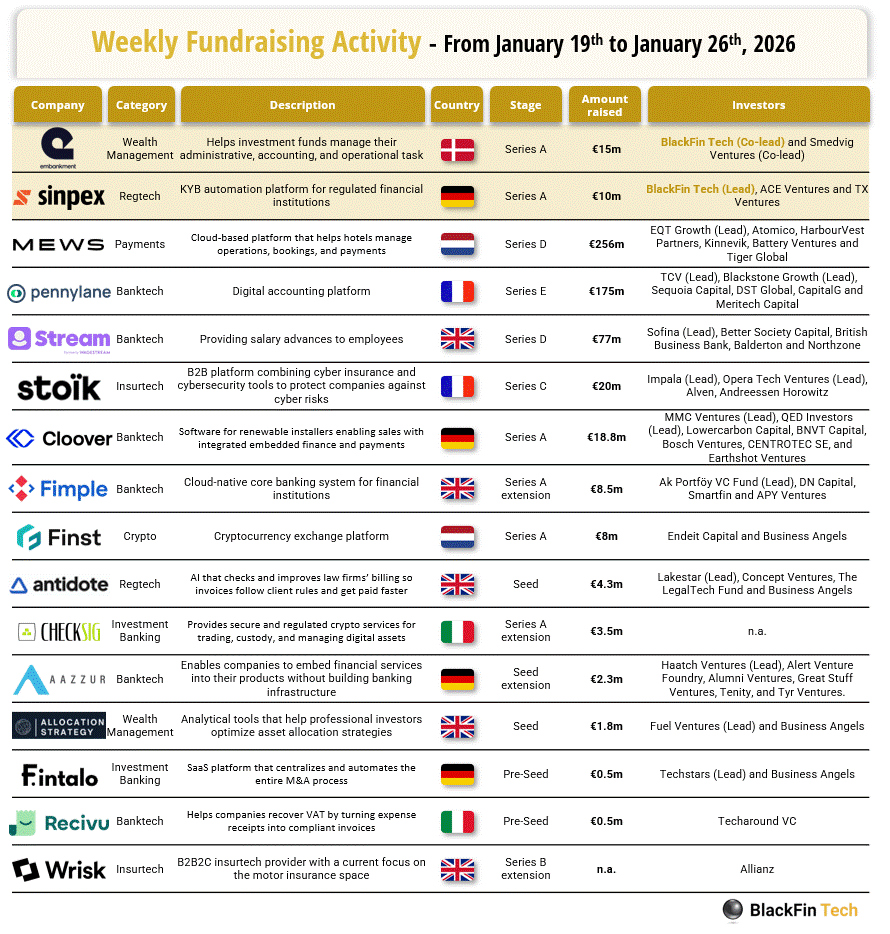

💰 Over the last week, there were sixteen FinTech deals in Europe, raising a total of €601.2 million, including four transactions in the UK, three in Germany, three in France, two in Italy, two in the Netherlands, and one each in Denmark and the Czech Republic.

🇮🇳 FinTech startup Mysa raises $3.4 million from Blume Ventures and Piper Serica. The company plans to use the fresh capital to expand its automation capabilities and launch additional banking products, including procurement tools, expense management linked to the UPI, and a corporate credit card.

🇩🇰 Lunar raises €46 million to accelerate Nordic growth. The capital increase is to scale its fast-growing business banking, develop its lending proposition, and support continued expansion across the Nordics. Read more

🇺🇸 Mesh secures $75m series C, reaches $1b valuation to build the universal crypto payments network. The round also accelerates Mesh's expansion into regions like Latin America, Asia and Europe, fueling product development and strengthening a global network that already reaches more than 900 million users worldwide.

🇦🇪 Mantas raises $1.77m to bring parametric insurance to cloud downtime. The capital will be used to support product development, strengthen risk modelling, and fund early customer deployments across the MENA region and North America. Keep reading

🇬🇧 Wealth app Chip raises £17m as Channel 4 backs TV push. The funding will support a TV-led marketing campaign later this year, as well as new product launches, like personalised investment tools or AI-driven financial guidance. The round values Chip at £208m and combines £6m of media-for-equity from Channel 4 Ventures.

🌍 Paraglide raises $5M Seed to reinvent accounts receivable with Agentic AI. With fresh capital, Paraglide plans to scale its product and customer base as agentic systems reshape back-office operations. Continue reading

MOVERS AND SHAKERS

🌍 KuCoin taps former LSEG exec Sabina Liu to lead MiCA expansion in Europe. Liu said that securing a MiCA license was a major milestone that gave KuCoin a unified regulatory framework to serve a region with mature and diverse finance, increasing crypto use and significant room for further adoption.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()