Mastercard Joins Paxos Stablecoin Consortium, Adds Fiserv and PayPal Stablecoins

Hey FinTech Fanatic!

Stablecoins are once again in the spotlight! After yesterday’s news on Fiserv stepping into the stablecoin space, today brings another major update, this time from Mastercard.

The global payments company has officially joined the Global Dollar Network, a stablecoin consortium formed by Paxos in 2024. Existing members include Robinhood, Kraken, and even Mastercard’s longtime rival, Visa, which joined back in April.

The consortium enables participants to mint USDG, a stablecoin pegged to the USD and backed by U.S. Treasuries, with interest from reserves shared among its members.

Alongside its entry into the consortium, Mastercard confirmed it will integrate USDG into its ecosystem. The company also announced expanded support for stablecoins outside the consortium, adding PayPal’s PYUSD and the newly launched FIUSD from Fiserv to its network, alongside the already integrated USDC from Circle.

“If the stablecoins are well-formed, well-regulated, and they meet our criteria, we will enable them in a variety of use cases,” said Raj Dhamodharan, EVP of blockchain and crypto at Mastercard.

The move follows a wave of institutional engagement in the financial sector, accelerated by last week’s U.S. Senate approval of the GENIUS Act, a regulatory framework for stablecoins.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🇬🇧 These 3 areas have raised a combined $30bn in VC cash since 2020:

🥇 Old Street - an incredible $12.9bn raised by startups here

🥈 Liverpool Street - $10bn raised by startups

🥉 White City - $6.5bn raised by startups

FINTECH NEWS

🇮🇳 Tata Capital is reportedly set to receive SEBI approval for a $2 billion IPO. The non-banking finance arm of the Tata Group aims to launch the share sale as early as August. The approval clears the way for the company to incorporate feedback from the regulator into its prospectus, before it starts marketing the deal.

PAYMENTS NEWS

🇬🇧 Ecommpay wins at Retail Systems Awards 2025. Ecommpay Payouts via Hosted Payment Page won the Payments Innovation category. It facilitates payments for member communities, delivering a swift time-to-market solution to overcome the traditional requirements of payout functionality.

🇪🇺 The top 45 Merchant acquirers in Europe processed 141.05 billion Mastercard & Visa transactions in 2024

🇨🇳 China may test yuan stablecoins in Hong Kong. China’s central bank is exploring the idea of using Hong Kong as a testing ground for yuan-linked stablecoins to improve cross-border digital payments, according to a Morgan Stanley report, as part of its push to internationalise the yuan despite ongoing economic headwinds.

🇬🇧 MuchBetter secures Mastercard Principal Licence for expansion into the UK and Israel. This strategic milestone empowers MuchBetter to accelerate its growth across both markets, broaden its Cards-as-a-Service (CaaS) proposition, and onboard new partners with greater autonomy, speed, and regulatory efficiency.

🇿🇦 Peach Payments rolls out enterprise POS terminal with alternative payment methods. The Digit Pro is programmable with bespoke apps, and a library of plug-and-play apps is available. This allows merchants that have online and physical stores to have one payment partner and, therefore, only one integration process, which saves time and money.

🇲🇽 Unlimit to add card issuance to the Mexican financial portfolio. The company will now be able to work together with co-brand partners, whether a bank, retailer, or FinTech, and provide them with a financial infrastructure enabling them to easily launch payment products across Latin America.

🇼🇸 ANZ launches instant payments. ANZ customers in Samoa can now send and receive instant payments following the bank’s integration with the Samoa Automated Transfer System (SATS). Keep reading

🇺🇸 Remitly launches International Business Payments from the U.S. Remitly developed a service that maintains the company’s trusted user experience while offering dedicated business support, without the cost or complexity of traditional enterprise solutions.

🇧🇩 Google Pay is now in Bangladesh with City Bank. Customers can add all their City Bank-issued Mastercard or Visa cards (both physical and virtual cards) to Google Wallet to make contactless payments with Google Pay. Continue reading

🇱🇧 Bank Audi and Neo Digital Bank introduce Google Pay services in Lebanon. Customers can now add their Mastercard issued by Bank Audi or Neo to Google Wallet and use it for contactless payments at points of sale, as well as for online or in-app purchases both within Lebanon and abroad.

DIGITAL BANKING NEWS

🇬🇧 Zopa launches current accounts to go toe-to-toe with Revolut. The bank aims to serve over 5 million customers in the next three to four years and over 10 million customers in five to seven years, targeting deposits of £1,500 to £2,000 per account.

🇺🇸 Goldman Sachs launches AI assistant firmwide. The GS AI assistant will help Goldman employees in summarising complex documents and drafting initial content, to perform data analysis, according to the internal memo. Goldman joins a long list of big banks already leveraging the technology to shape their operations.

🇨🇴 Nubank and Pibank are disrupting traditional Colombian banking in the credit and debit card segment. Nubank has entered the top tier of savings account providers, offering high interest rates up to around 11–13 % E.A. Meanwhile, Pibank has surged into the market with savings accounts yielding approximately 12 % E.A.

BLOCKCHAIN/CRYPTO NEWS

🇰🇪 Crypto firm Luno is back in Kenya after its 2015 exit. Luno’s relaunch in Kenya comes when the country’s parliament is reviewing the Virtual Asset Service Providers (VASP) Bill, 2025, which would require companies to register with both the Capital Markets Authority (CMA) and the Central Bank of Kenya (CBK).

PARTNERSHIPS

🇧🇷 AstroPay and Pomelo collaborate on regional card rollout. Through this partnership, Pomelo’s technology supports AstroPay’s regional expansion with speed and efficiency, ensuring agility, compliance with local regulations, and strong operational performance.

🇺🇸 ACI Worldwide expands technology partnership ecosystem to power ACI Connetic and to help financial institutions across the globe increase operational resiliency and address evolving regulatory requirements to safeguard the stability of the financial system.

🇲🇽 Belvo and Ualá join forces to facilitate access to credit through employment data. This will allow Ualá to make immediate decisions without relying on information from credit reporting agencies. Read more

🇰🇪 Pesalink and FinTech Alliance sign MoU to accelerate inclusive digital payments. The MoU is expected to foster joint initiatives that will reduce friction in FinTech-bank integrations, accelerate the adoption of instant account-to-account payments, and support a more inclusive, interoperable payments ecosystem.

🇦🇪 Ruya announces strategic partnership with Ignyte to empower the UAE's start-up ecosystem. This partnership will see Ruya championing that ecosystem through co-hosted events, mentorship programmes and a branded presence across Ignyte’s channels, embedding ethical Islamic finance at the heart of Dubai’s entrepreneurial journey.

🇩🇪 Silverflow partners with Deutsche Bank for a European payments platform. The collaboration enabled the bank to minimise integration time as compared to legacy deployments, thus onboarding clients faster. This initiative demonstrated how modern payment infrastructure transforms banking operations.

🌍 RS2 collaborates with Visa to deliver end‑to‑end global payment processing solution. This powerful combination will enable banks, FinTechs, and merchants around the world to access a streamlined, scalable, and secure payment platform.

🇬🇧 Zopa Bank partners with iVendi. The collaboration will enhance quoting and application processes for motor dealers currently working with Zopa Bank, while opening access to a broader network of potential introducers. Continue reading

🇬🇧 dLocal unlocked trapped funds and accelerated payouts with BVNK. The company turned to BVNK to explore stablecoins as a solution for unlocking trapped liquidity. The result was a faster, more flexible settlement process that has since become a blueprint for how to operate in markets with liquidity challenges.

🇬🇧 Wirex to launch Dedicated Appchain with Tanssi, aiming to power over $20 billion in crypto transactions. This move accelerates compliant, low-cost crypto payments globally, dramatically simplifies operations, and enhances Wirex’s autonomy, Ethereum-grade security, and interoperability with DeFi, stablecoins, and tokenised assets.

🇲🇽 EBANX enables APLAZO's BNPL payments for global e-commerce in Mexico. This collaboration enables international online merchants to offer their customers in Mexico accessible financing options tailored to their needs. Read more

🇨🇦 TerraPay partners with Paramount Commerce in Canada. Through this collaboration, TerraPay’s global network of money transfer operators can now facilitate seamless, real-time payments to recipients and is expected to expand beyond remittances, with future phases targeting payments in sectors such as payroll, travel, and digital content.

🇺🇸 Chainlink and Mastercard partner to enable over 3 billion cardholders to purchase crypto directly on-chain. This removes long-standing barriers that have kept mainstream users from accessing the on-chain economy. Keep reading

🇺🇸 Mastercard expands stablecoin push with Paxos, Fiserv and PayPal integrations. The initiatives are the latest examples of global banks and payment firms racing to embrace stablecoins, a type of digital currency with prices anchored to an external asset such as fiat currencies, into their offerings.

DONEDEAL FUNDING NEWS

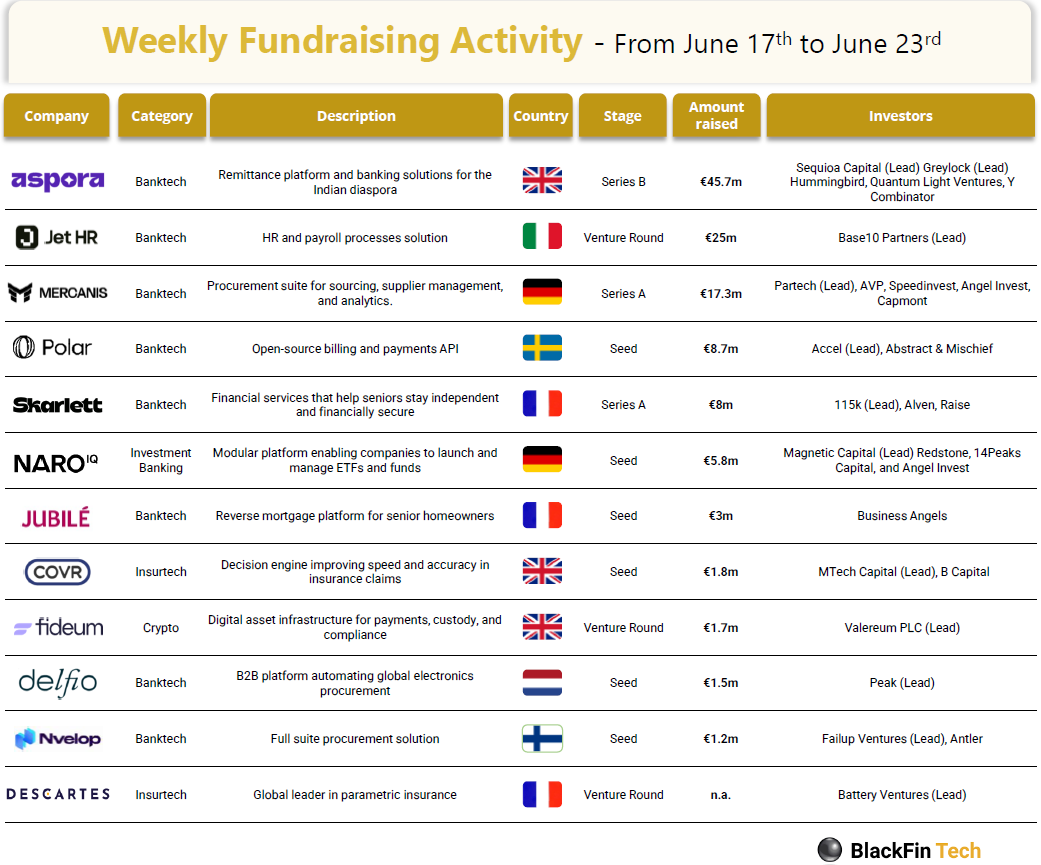

💰 Over the last week, there were 12 FinTech deals in Europe, raising a total of €120 million: three deals in the UK, three in France, two in Germany, and one deal each in Italy, Finland, Sweden, and the Netherlands.

🇬🇧 Car finance FinTech Carmoola secures £300m. The partnership with NatWest and Chenavari Investment Managers triples its existing debt facility as it looks to rapidly scale its direct-to-consumer solution. It says the approach makes car finance simple, accessible and affordable.

🇺🇸 Citadel Securities joins DRW in funding round for digital asset. Digital Asset Holdings LLC has raised $135 million from large financial firms to expand its engineering and product team and take advantage of increased activity in the blockchain space.

🇺🇸 Quinn raises $11M for embedded financial planning. Quinn's platform allows banks, FinTechs, and wealth management platforms to democratize access to financial planning without adding headcount. Doing so can also increase customer retention and cross-sell opportunities, boosting overall customer lifetime value.

🇺🇸 Canadian FinTech Conquest Planning raises $80m Series B. The Winnipeg-based start-up will use the funds to further develop its Strategic Advice Manager and accelerate its US expansion. Read more

🇫🇷 Flowdesk secures $100 million credit facility from Two Prime. The facility will support Flowdesk’s continued global expansion and capital-efficient trading infrastructure. Under the terms of the agreement, Two Prime will provide a multiple drawdown term loan facility in an aggregate principal amount of up to $100 million.

🇺🇸 Digital Asset raises $135M to scale Canton blockchain network. Digital Asset said the funding is intended to accelerate the adoption of institutional and decentralised finance on its Canton Network. Continue reading

MOVERS AND SHAKERS

🇫🇷 Revolut hires Béatrice Cossa-Dumurgier as Western Europe CEO. As part of her new role, Béatrice will oversee the development of Revolut’s activities in Western Europe, with a key focus on securing the company’s banking licence from the French banking regulator, the Autorité de Contrôle Prudentiel et de Résolution (ACPR), and the European Central Bank (ECB).

🇺🇸 Nium promotes Dharminder Singh from Lead Engineer to CTO. In his new position, Singh will oversee Nium’s global engineering team. His responsibilities include scaling the company’s platforms and driving product innovation to support its growth in cross-border payments.

🇬🇧 NAB hires Lloyds Bank's Pete Steel as inaugural digital, data and AI Chief. He will lead NAB's digital data and AI teams and initiatives, and be accountable for design, customer onboarding and NAB's digital bank Ubank. Keep reading

🇺🇸 PayPal has announced the appointment of Tahira Adatia as Senior Director of Business Operations and Strategy within its Global Risk Management leadership team. In her new role, she will contribute to advancing PayPal’s mission of maintaining customer safety and trust.

🇺🇸 Fundbox hires Vaya founders. Now, co-founders Ankit Singh and Soham Sen will take on leadership roles in product and engineering at Fundbox to help with the development of new credit products for the firm, which has already provided more than $6 billion in capital to over 150,000 SMBs.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()