Mastercard Joins McLaren in $100M F1 Deal

Hey FinTech Fanatic!

Just when it felt like the biggest FinTech x Sports collabs were already out there (yesterday’s edition was all about football), another one was unveiled, and such a big one!

McLaren is partnering with Mastercard on a $100 million per season deal for its Formula 1 team 🤯

This comes right after Revolut linked up with Audi’s F1 team and Airwallex joined McLaren, too, so the track is getting crowded with FinTech names.

Oh, and football fans, you’ll like this… scroll down to find out another FinTech x Sports collab 👇

See you tomorrow!

Cheers,

#FINTECHREPORT

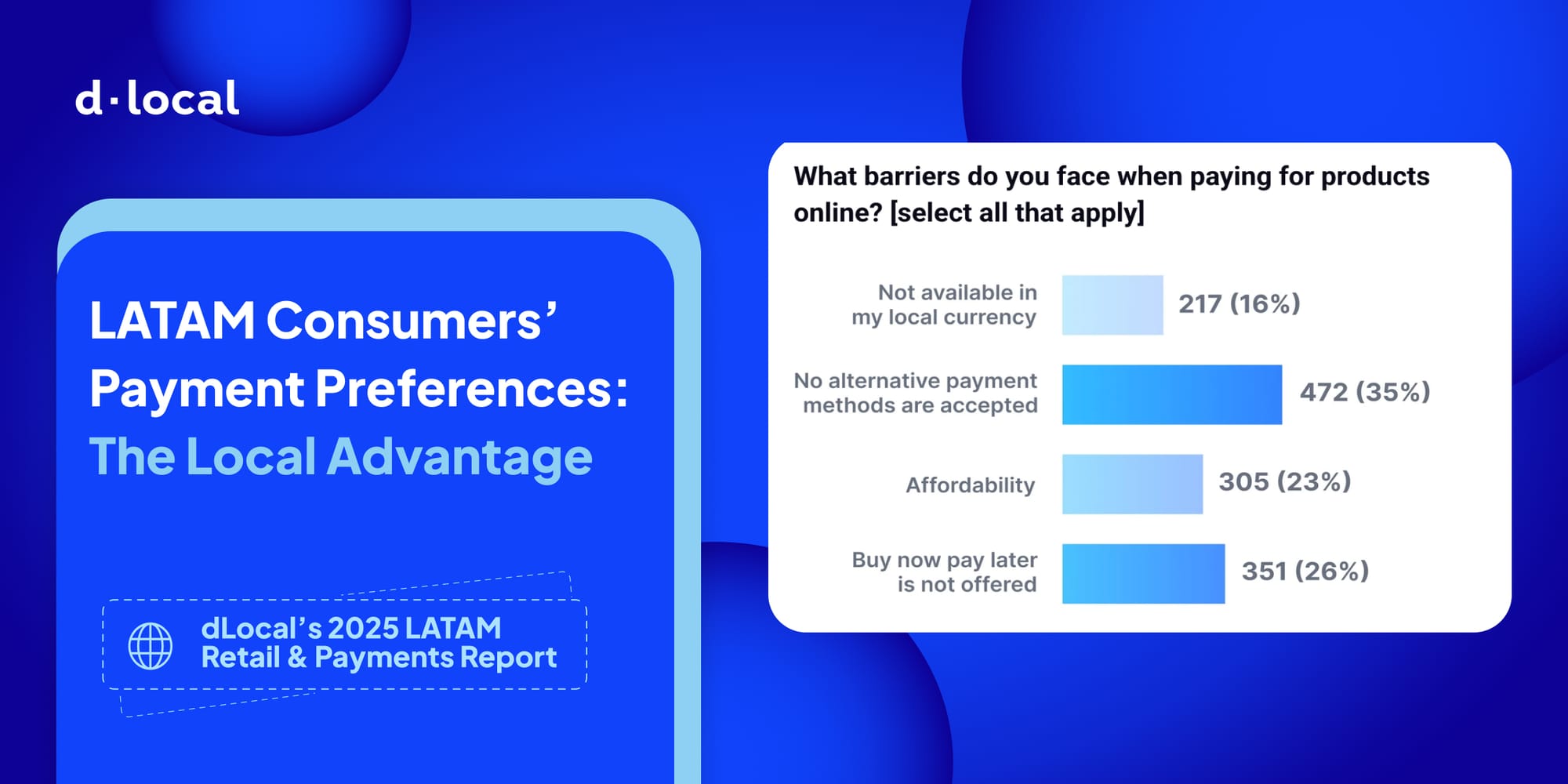

🌎 Unlock the power of LATAM retail: essential consumer insights from the dLocal Payments Survey. The report provides a first look into these crucial consumer attitudes, from payment preferences and brand perceptions to the influence of tariffs.

FINTECH NEWS

🇬🇧 McLaren bucked the recent trend and signed a new F1 title sponsor in a multi-million dollar deal. McLaren Racing CEO Zak Brown shared his excitement about the team’s renewed partnership with Mastercard, reaffirming their commitment to fans: “Our fans come first, we’re excited to bring them even closer to the team with unforgettable experiences.”

PAYMENTS NEWS

🇺🇸 One-third of consumers make urgent or same-day bill payments, finds ACI Worldwide SpeedPay Pulse report. Its 8th edition examines consumer billing and payment trends, offering billers valuable insights and practical advice to capitalize on emerging trends. This year’s report shows that digital payment channels now dominate the landscape, with mobile wallets embraced across generations.

🇸🇪 Klarna to seek valuation of up to $14 billion in IPO next month. The company paused its IPO plans in April after U.S. President Donald Trump's sweeping tariffs caused global markets to rattle. It had also looked at going public in 2021 but decided not to proceed.

🇲🇽 Brazilian FinTech OneKey Payments announces expansion to Mexico and Chile. The move is part of the company’s strategy to broaden its presence in the region and meet the growing demand for digital transactions, to become the leading international provider in Latin America by 2027.

🇺🇸 Plaid expands Layer with autofill to cut U.S. onboarding friction. The company said the feature is designed to align with fresh U.S. regulatory guidance. In July, the Federal Deposit Insurance Corporation clarified that banks can rely on pre-filled identity data to meet Customer Identification Program requirements, provided that customers review and approve the information.

🇺🇸 Google Cloud is building a blockchain for digital payments. This protocol is designed to facilitate easy digital payment processes for financial institutions and enterprises. For now, the project is in the private testnet, but it will be made available to the public in the coming months.

🇩🇪 German banks halted 10 billion euros in PayPal payments due to fraud concerns. The payments were halted after lenders flagged millions of suspicious direct debits from PayPal that appeared last week. PayPal said on its website that a temporary service interruption caused delays in transactions for a small number of accounts over the weekend.

🇮🇩 Moolahgo launches QRIS "scan & pay" on moolahPAY. This integration unlocks secure and seamless digital payments at approximately 40 million QRIS-enabled merchants across Indonesia. moolahPAY users can pay effortlessly by scanning any static or dynamic QRIS code.

REGTECH NEWS

🇲🇽 Collaborative AI could prevent financial crime in Mexico by Cleber Martins, Head of Payments Intelligence & Risk Solutions at ACI Worldwide. He reveals how AI can combat money laundering and fraud, and explains that democratic technology allows small and large institutions to compete on a level playing field.

🇦🇺 Australian bank introduces ID verification with selfie biometrics to fight fraud. Facial matching tech for identity verification will be implemented for new customers as of September 2025. The move is intended to curb identity fraud, which impacts more than 255,000 Australians a year.

🇩🇪 German FinTech Raisin addresses AML issues after being hit with a remediation order by Bafin. RAISIN has been hit with an AML (anti-money laundering) remediation order. Regulator BaFin said it ordered Raisin Bank AG to address a series of compliance 'deficiencies'.

DIGITAL BANKING NEWS

🇧🇷 Nubank evaluates an investment by a bank to obtain a license from the Central Bank. The move gained momentum after the Central Bank opened a public consultation to redefine the classification of financial institutions, which could limit Nubank's scope of operations. Additionally, Nubank may be considering a return to Argentina. A report from BTG suggests that this could have happened through acquiring Brubank, which serves around 4 million clients. Nubank itself has not confirmed these plans.

🇬🇧 Revolut launches instant access savings for children. The new feature, powered by Clearbank Limited, enables children in the UK to make their pocket money grow and experience the benefits of saving firsthand, with users now able to earn competitive interest of up to 4.5 percent AER, paid daily.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Trump Media partners with Crypto.com on crypto treasury company. The treasury company will become one of the latest to follow the playbook Michael Saylor created at Strategy, raising funds to buy and hold cryptocurrencies, according to a filing with the US Securities and Exchange Commission.

🇬🇧 Crypto Exchange Gemini introduces Ether and Solana staking for all U.K. customers. Staking is the process of locking up tokens to help secure proof-of-stake blockchains in exchange for rewards. Users can stake any amount of ether or Solana, with Gemini offering up to 6% annual percentage rate (APR) on SOL and a variable rate for ETH.

PARTNERSHIPS

🇺🇸 Thread Bank selects Finxact from Fiserv to power embedded banking strategies, serving as a model for community banks. Thread's partnership with Fiserv and Infinant serves as a blueprint for community banks looking to innovate, drive new deposits, and ultimately thrive in an ever-changing landscape.

🇩🇰 lemon.markets and Pleo partner to launch Pleo Investment Account. lemon.markets’ brokerage and custody infrastructure enables Pleo users to invest surplus cash in low-risk Money Market Funds (MMFs) and earn yield with next-day liquidity, directly within Pleo’s interface.

🌎 Rappi and AstroPay launch Latin America’s first super-app wallet integration to pay seamlessly across currencies, no cards required. The integration is now live in Argentina, Brazil, and Peru, with rollout to additional Rappi markets planned throughout 2025.

🇪🇬 Damen partners with e& Money to expand digital payment services in Egypt. This collaboration is set to improve access to financial services and support financial inclusion. The integration enables users to open an e-wallet via their mobile phones, with deposits and withdrawals available through Daman outlets, alongside the ability to transfer and receive money from any number.

🇬🇧 MoonPay launches an embedded balance solution on Bitcoin.com for instant, low-fee trading. With fiat balances now embedded in the app, Bitcoin.com users in the U.S., EU, and UK can fund, store, and spend from their balances to buy and sell crypto instantly, with zero MoonPay fees on crypto purchases.

🇺🇸 Circle and Finastra weave USDC settlement into bank payments. The technical integration will allow GPP’s network of financial institutions, which processes over $5 trillion in daily cross-border transactions, to utilize the USDC stablecoin as a settlement layer.

🇺🇸 Sightline and Cross River announce an integrated payments ecosystem for the gaming industry. The firm’s new debit product, developed for the U.S. gaming industry, is said to “redefine” where funds are stored and how transactions are authorised through a demand deposit account (DDA) at Cross River.

🇬🇧 Newcastle United announces a multi-year partnership with BYDFi. The partnership will strengthen the club’s presence in key international markets, while giving supporters access to digital finance tools, expertise, and new experiences through BYDFi’s cutting-edge platform.

DONEDEAL FUNDING NEWS

🇧🇷 B3 acquires Control of Shipay for R$37 million. B3 is purchasing 62% of the company for R$37 million. According to a market filing, the deal also includes the option to acquire the remaining stake by 2030, with the price contingent on the achievement of certain performance targets.

🇸🇬 Cross-Border Payments Platform Tazapay secures strategic investment from Ripple and Circle. It will use the capital to expand its global licensing and operations. Tazapay processes more than $10 billion in annualized payment volume. Keep reading

🇺🇸 Payment Labs closes $3.25M oversubscribed seed round. This investment round will accelerate the company’s mission to streamline and automate pay-ins and payouts for businesses, with customized solutions for things like royalties, revenue share, and business services that are not typically provided by traditional platforms.

M&A

🇺🇸 Okta to purchase Axiom Security to bolster privileged access. It plans to purchase a privileged access management startup. Okta chose Axiom to maintain alignment with its SaaS-first strategy and deliver quicker time to value. Continue reading

MOVERS AND SHAKERS

🇦🇺 Paul Monnington takes the reins at Mastercard in 2026. WPay boss Paul Monnington will take the reins at Mastercard in Australia and New Zealand in January 2026, after Richard Wormald accepted a promotion to head up the company’s Asia Pacific region in Singapore.

🇩🇪 Ex-central banker set to chair FinTech N26 in leadership shake-up. The appointment of Andreas Dombret is part of the strategy to resolve the conflict between investors and founders. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()