Mastercard and Coinbase Face Off in FinTech’s Biggest Stablecoin Deal Yet

Hey FinTech Fanatic!

The stablecoin wars just went nuclear.

Coinbase and Mastercard are reportedly battling it out to acquire stablecoin infrastructure startup BVNK—for a jaw-dropping $2 billion—just one day after BVNK’s fresh funding round with Citi. 🤯

Negotiations suggest a price between $1.5B and $2.5B, and sources say Coinbase currently has the upper hand.

No matter who wins, this deal would mark the largest stablecoin acquisition ever and a clear signal: stablecoins have officially moved from crypto niche to financial mainstream.

Coinbase wants to tighten its grip as the bridge between crypto and traditional payments. Mastercard? It’s clearly not planning to sit out the next era of money.

Either way, stablecoins aren’t “coming.”

They’re here.

Now, let’s dive into today’s biggest FinTech stories 👇

Cheers,

ARTICLE OF THE DAY

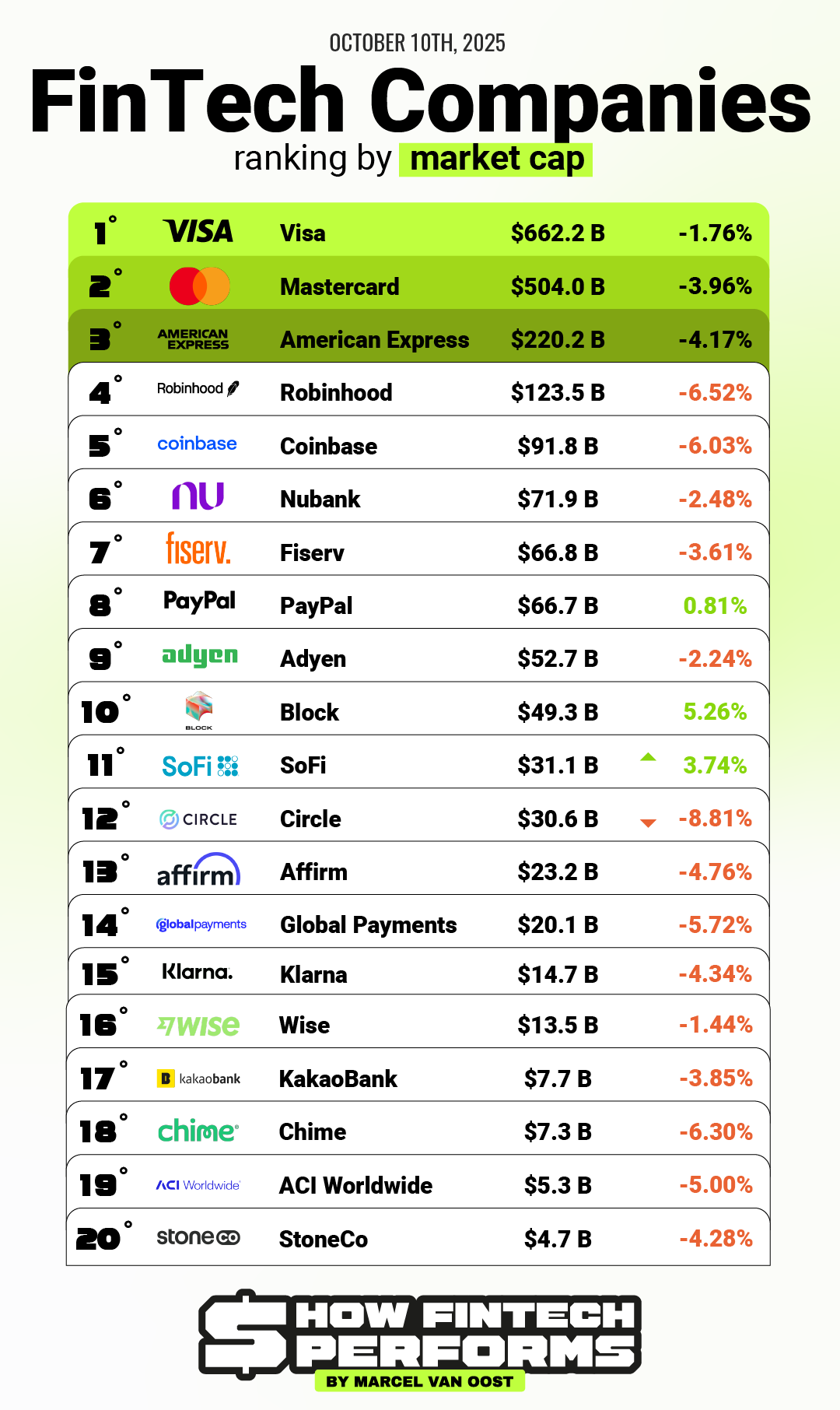

💰 Block and SoFi Defy the Downturn. While most FinTech names ended the week in the red, a few outliers managed to punch above their weight. Subscribe to my newsletter, How FinTech Performs, for more

FINTECH NEWS

🇲🇽 In response to fraud, banks rethink strategy in the face of criminal AI. By 2025, at least 50% of financial frauds are expected to be linked to AI attacks, according to estimates by ACI Worldwide. Given this scenario, Cleber Martins, the company's Head of Payments Intelligence and Risk Solutions, warned that banks will have to rethink their strategy to stay one step ahead of cybercriminals.

🇺🇸 Coinbase and Mastercard are in talks to buy stablecoin startup BVNK. The terms and winning bidder haven’t been finalized, but the sale price ranges between $1.5 billion and $2.5 billion, according to some of the sources. The talks may not result in a final deal, but at present, Coinbase appears to have the inside track over Mastercard.

🇨🇳 Chinese FinTech giant Ant Group releases powerful AI model to rival DeepSeek and OpenAI. The new general-purpose Ling-1T model, with 1 trillion parameters, demonstrated “superior complex reasoning ability and overall advantage” against both open-source and closed-source rivals, the company said.

🇬🇧 Zilch eyes ‘hot’ FinTech IPO market amid product launch. Zilch CEO Philip Belamant hinted at a unique upcoming IPO, inspired by Klarna’s strong debut, and reaffirmed plans to list in London. As Zilch expands with “Zilch Pay” and an AI data platform, Belamant highlighted the firm’s strong lending foundation and rapid tech innovation.

PAYMENTS NEWS

🇪🇸 PagoNxt Payments automates €150M+ in annual cross-currency invoice payments for Gesban. The shift eliminated manual checks and approvals, cutting processing time from 15 minutes to seconds while improving FX margins by 2–3% and reducing operational risk. Supporting multiple currencies and already handling €13M in a pilot phase, the system is scaling across global entities.

🇮🇪 Stripe opens new headquarters in Dublin as Ireland's internet economy surges. The new dual headquarters will house expanding teams in engineering, product, operations, and sales, and bolster Stripe's efforts to help its users adopt frontier technology, including AI and stablecoins, to grow faster.

🇺🇸 Splitit launches Partner Program to power installments for agentic commerce. The Splitit Agentic Commerce Partner Program will bring card-linked installment capabilities to autonomous shopping agents, AI systems that can search, recommend, and make purchases on behalf of consumers and businesses.

🇦🇺 Afterpay launches commerce media solution ‘Curate’ powered by Magnite. Afterpay Curate will allow brands and agencies to tap into Afterpay’s shopper insights, layered onto premium, brand-safe publisher inventory across the DSP of their choice. Keep reading

🇱🇺 Luxembourg banks confirm instant payments are now possible. Luxembourg’s six main retail banks have confirmed they are offering instant euro payments, complying with new EU rules requiring all euro-area banks that provide standard credit transfers to also enable transactions settling within ten seconds, 24/7.

🇸🇬 Ant International’s Antom eyes more Singapore merchants as it grows payments and digitalisation services. The merchant payment and digitalisation services provider sees an opportunity to provide a one-stop shop for merchants, especially those in the retail and food and beverage sectors.

OPEN BANKING NEWS

🇬🇧 DashDevs named a finalist at the FF Awards 2025 in the Open Banking category, celebrating excellence and innovation across the global FinTech ecosystem. DashDevs’ achievement in reaching the finals highlights its work in delivering cutting-edge Open Banking solutions that merge regulatory compliance, scalable integrations, and a customer-first approach.

REGTECH NEWS

🇬🇧 Digital ID could help fight financial crime, top regulators say. The idea of a digital ID has become a controversial political topic since the Labour government announced last month that a new scheme would be rolled out in a bid to crack down on illegal working.

DIGITAL BANKING NEWS

🇪🇸 Santander to launch crypto trading via Openbank in Spain. The service, which is already available in Germany, will launch in the coming weeks and allow customers to invest in cryptoassets starting from just 1 euro. The service will operate under the European Union’s MiCA regulation, which came into full effect earlier this year.

🇩🇪 German banks turn to US financial firm BNY for international money transfers to help customers with international payments, a move aimed at fending off upstart low-cost competitors that has raised concerns over the sovereignty of Europe's financial services.

🇮🇳 Tide to invest ₹6,000 crore in India and create 800 new jobs over five years. The company will create over 800 jobs in the next 12 months, bringing its India headcount to 2,300. These new jobs will be across areas, including product development, software development, marketing, member support, and operations.

🇩🇪 Bizcap expands lending in Germany. The move underscores Bizcap's commitment to empowering SMEs worldwide with fast, flexible, and transparent financing solutions. Through its German offering, it will provide loans ranging from €5,000 to €500,000, with approval decisions in as little as 24 hours and next-day funding.

🇲🇾 Two Islamic digital banks get conditional approval to join Labuan's sandbox. Green Digital Bank Corp and Fasset Islamic Digital Bank Ltd have been granted conditional approvals by the Labuan Financial Services Authority to operate as Islamic digital banks under its i-BOX sandbox framework. However, they are not yet permitted to offer services to customers.

BLOCKCHAIN/CRYPTO NEWS

🇦🇪 SCA grants Bybit a full UAE license, and expansion is planned in Abu Dhabi and Dubai. The license allows Bybit to operate regulated virtual asset trading, brokerage, custody, and fiat conversion services in the country. The exchange aims to employ more than 500 staff across Abu Dhabi and Dubai.

🇺🇸 U.S. Bank selected to provide custody services for reserves backing payment stablecoins from Anchorage Digital Bank. Anchorage Digital CEO Nathan McCauley said that partnering with U.S. Bank highlights the increasing convergence of traditional and digital finance and the momentum behind mainstream adoption of dollar-backed stablecoins.

PARTNERSHIPS

🇨🇱 Pomelo partnered with MetroMuv to power its FinTech expansion in Chile through next-generation payment infrastructure. The collaboration enables a faster, safer, and more scalable experience for thousands of metro users while building an integrated mobility and payment ecosystem.

🇺🇸 Klarna and Google Cloud enter strategic AI partnership to bring more creative and engaging shopping experiences to millions of Klarna users worldwide. Through this collaboration, Klarna will leverage Google Cloud's complete AI stack, from infrastructure to platform to models, to accelerate the development of innovative, consumer-centric products and creative campaigns.

🇮🇹 HYPE and Cleafy signed a partnership for the Integration of Cleafy’s FxDR Platform for Fraud Prevention. The partnership aims to improve the efficiency of financial fraud management with a view to further enhancing security standards in the field of digital banking.

🇺🇸 Bank of North Dakota and Fiserv partner to launch Roughrider Coin. The Roughrider coin will aim to increase bank-to-bank transactions, encourage global money movement, and drive merchant adoption. The coin will be available to banks and credit unions in North Dakota in 2026.

DONEDEAL FUNDING NEWS

🇺🇸 $50M series B fuels Yendo’s AI Credit Platform, unlocking $4T in consumer assets. The funding will accelerate Yendo’s expansion beyond secured lending as it builds an AI-powered digital bank for the millions of Americans underserved by traditional financial institutions.

🇧🇷 Pagaleve FinTech raises USD 30 million in new funding round in Brazil. This round gives Pagaleve the resources to accelerate innovation and launch products that transform the consumer shopping experience while strengthening its retail partners. Read more

🇷🇴 Rhuna raises $2M seed round led by Aptos Labs to build stablecoin payment infrastructure for entertainment. The new funding will strengthen Rhuna’s payments and settlement rails, expand organizer tooling and integrations (including POS, ticketing, and mobility partners), and accelerate the launch of Rhuna’s consumer app, which brings discovery, access, and wallet-native checkout into one seamless experience.

🇺🇸 Cross-border payments FinTech Routefusion raises $26.5M. The latest funding will be used to expand Routefusion's partner network, broaden its liquidity and compliance capabilities, and grow its product, engineering, and go-to-market teams. Keep reading

🇦🇷 Crypto FinTech Lemon raises $20m Series B. Argentina-based Lemon plans to use the funds to fuel its expansion to Chile, Colombia, Brazil, and Mexico as it looks to double its user base to 10 million over the next 12 months. Lemon allows users across Argentina and Peru to buy, sell, and store digital assets, make payments, and access a Visa debit card linked to their crypto holdings.

🇺🇸 AiPrise raises $12.5M Series A for AI-powered Global Compliance. AiPrise highlights the rapid global expansion of FinTech, driven by cross-border growth, stablecoin innovation, regulatory clarity, and the transformative power of AI. Continue reading

MOVERS AND SHAKERS

🇺🇸 Getnet welcomed Michelle Wong as the new Head of US Global Accounts. Michelle joins to help US-based merchants expand and operate across these regions. Part of the Santander Group, Getnet is a leading FinTech and Latin America’s largest acquirer, offering unified, omnichannel payment solutions that connect technologies, markets, and growth opportunities.

🇬🇧 Monzo appoints NatWest's Shelley Malton as new COO. Malton brings over three decades of financial services experience into her new role. At Monzo, Malton will work alongside CEO TS Anil and the executive team to drive the company's international expansion plans.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()