Major Brazilian Fintechs Accused of Credit Scheme 'Piracy' And More Apple Pay News

Hey FinTech Fanatic!

In the latest development of the ongoing 'war' between banks and payment companies over interest-free installment payments and revolving credit card balances, the Brazilian Federation of Banks (Febraban) has intensified the dispute.

Febraban, representing major banks, filed two complaints with the Central Bank of Brazil (BC), seeking an investigation and potential penalties against fintechs Mercado Pago, PagBank, PicPay, and Stone.

According to Febraban, these fintechs are allegedly involved in irregular and fictitious operations, where they discreetly charge consumers interest. The federation accuses these companies of what it terms "pirate interest-free installment". Febraban asserts that these firms are imposing "remunerative interests" on users, but disguising them in credit card statements as interest-free installments.

If proven, this practice could be a serious concern, as such activities might be prohibited or unauthorized by the Central Bank and potentially fraudulent, undermining the legality of these charges.

Context of the Dispute

This controversy emerges amidst a heated debate over the regulation of revolving credit card interest rates, sparked by the Bill 2.685/2022 and the inception of the Desenrola program. This issue has raised questions about the future of interest-free installments, which currently account for 15% of the consumer credit market in Brazil.

The sector is racing against time since the bill, passed in early October, gave the market 90 days to find a solution and present it to the National Monetary Council (CMN). If not, the interest rates on revolving credit will be capped at 100% of the principal amount. Currently, revolving credit is only available for 30 days; thereafter, unpaid balances shift to interest-bearing installment payments.

"Buyer Installment" Scheme

In its first complaint, Febraban alleges that independent acquirers PagBank, Stone, and Mercado Pago have developed a credit offering known as "buyer installment". In practice, this involves adding a percentage to the price of products for installment purchases. However, while charging interest to consumers, these acquirers supposedly record a false transaction of "interest-free installment" in the card brand systems, thus misrepresenting the actual transaction.

Febraban claims this method is an artifice to pass on the costs associated with receivables anticipation charged by the payment terminals of commercial establishments. This approach could make retailers more dependent on receivable anticipation from interest-free installments, simultaneously relying on consumer indebtedness, leading to high credit card interest rates.

Allegations of "Financial Engineering"

The second complaint by Febraban targets digital wallets Mercado Pago and PicPay. The federation accuses these firms of engaging in "financial engineering" to provide loans with interest to consumers, while recording the transactions as "interest-free installments". This practice supposedly involves using the credit card limits of individuals for various financial operations, only to later charge them in installments with added interest, but recording these as interest-free purchases on credit cards.

Febraban emphasizes that these companies are not authorized to provide direct loans to consumers and that such practices directly contravene the rules of credit card brands, as well as regulations set by the Central Bank and the National Monetary Council.

Response from the Accused Companies

Mercado Pago, PicPay, PagBank, and Stone have not individually commented on the allegations. Their collective stance is represented by the Brazilian Internet Association (Abranet), which includes several payment market companies.

Abranet dismisses Febraban's accusations as another attempt by major banks to undermine independent companies. They argue that there's no demonstrated link between the high-interest rates charged by big banks and the interest-free installment scheme, noting that credit card interest rates can reach up to 445% per year.

The Central Bank, when approached by Fintechs Brasil, a partner site, declined to comment on the matter. Abecs, representing over 90 payment companies including major acquirers controlled by banks, also chose not to issue a statement.

This unfolding story highlights the complexities and competitive tensions within Brazil's rapidly evolving fintech landscape, underscoring the need for clear regulations and transparency in financial operations to protect consumers and maintain market integrity.

Enjoy more global FinTech industry updates I listed for you below and I'll be back with more news tomorrow!

Cheers,

POST OF THE DAY

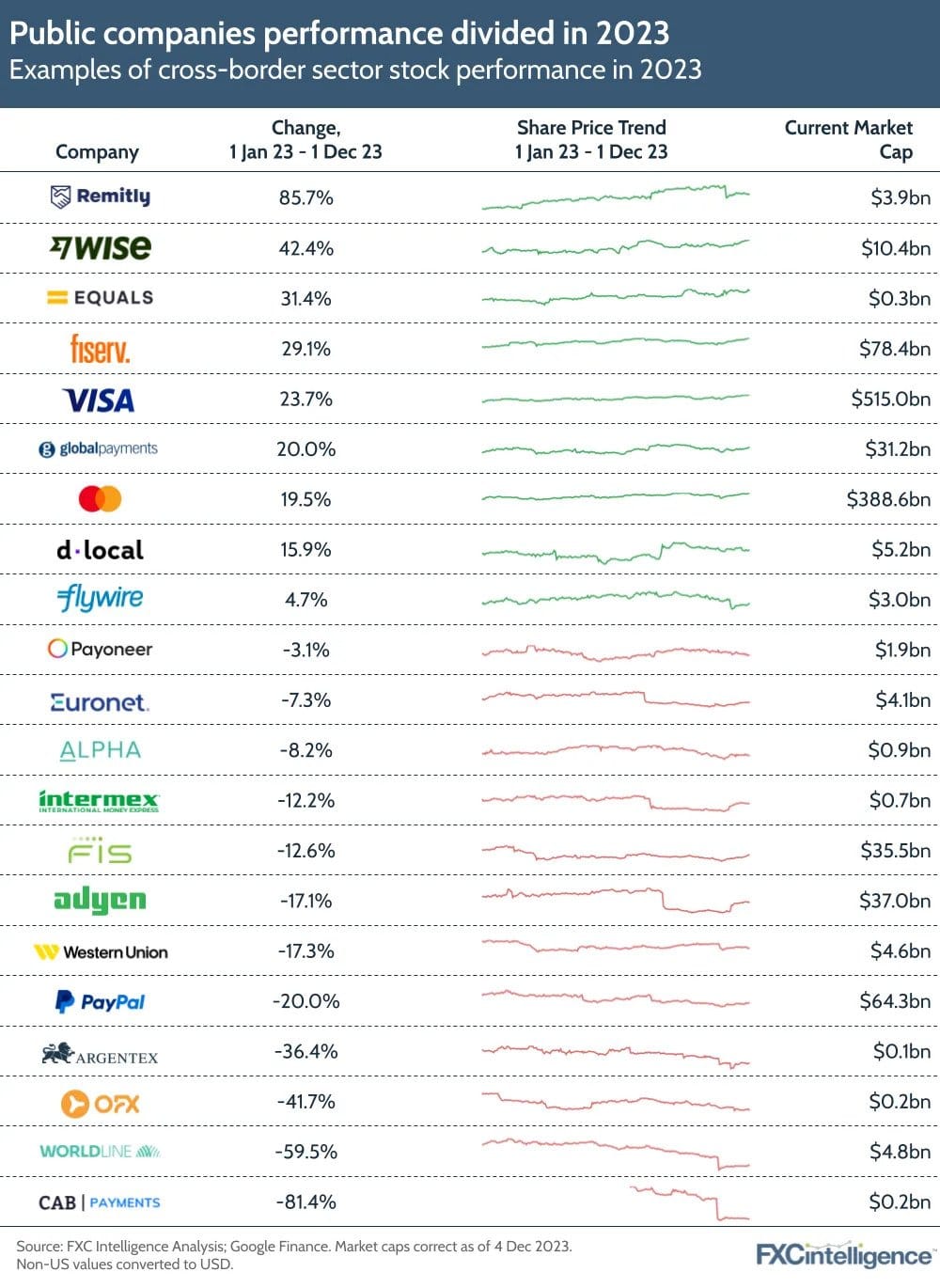

How have payments stocks performed in 2023?

BREAKING NEWS

Apple offers to let rivals access tap-and-go tech in EU antitrust case. The European Commission is likely to seek feedback next month from rivals and customers before deciding whether to accept Apple's offer, people familiar with the matter said.

#FINTECHREPORT

Thunes and Kapronasia explore Southeast Asia’s diverse payment culture in their report, 'From Cash to QR codes: Unpacking Southeast Asia’s Diverse Consumer Payments Culture,' which delves into the reasons behind the rising trend of payment digitization in Southeast Asia (SEA).

INSIGHTS

The top 25 shareholders of Nubank own 72,5% of the company. I highly recommend reading the complete blog post “Why Warren Buffet invested in Nubank?” by Nino Pavicic for a deep dive into Nubank stock and its financials. Link here

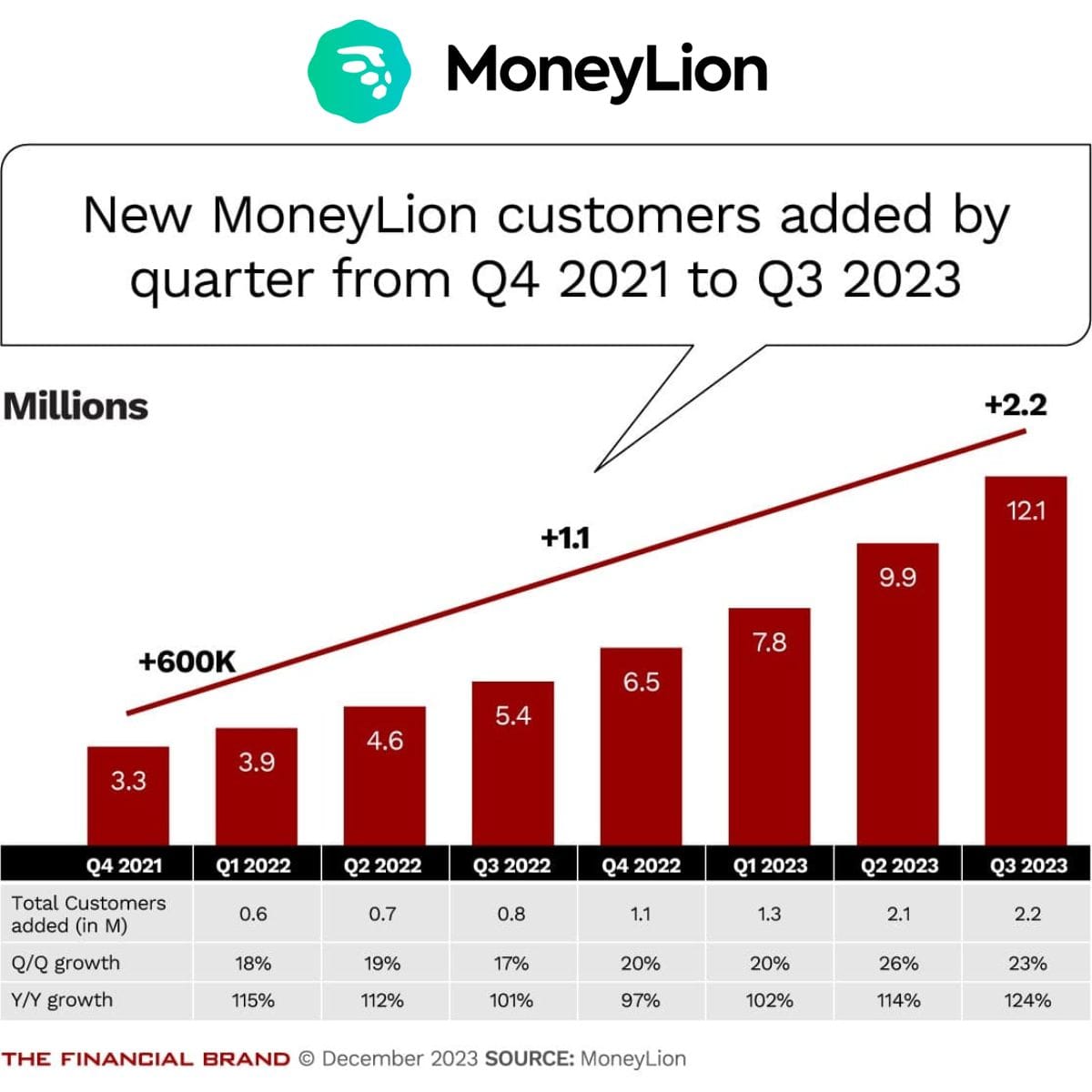

MoneyLion hit 12 million customers in the third quarter of 2023 (more than a twofold increase from the year before). Here's how:

FINTECH NEWS

🇺🇸 Bloom Credit adds business credit reporting to platform. Launch of new service will help clients report business tradelines to the major credit bureaus to enhance business profiles and mitigate risk for lenders.

🇭🇰 The Hong Kong government has allocated USD 25.6 billion for fintech and AI, and has made significant investments to establish Hong Kong as a fintech hub through innovation and technology.

Ant Group partners with Huawei to develop a dedicated version of Alipay. This alliance is expected to ease user experiences across multiple applications, and is also expected to boost operational efficiency for merchants who are engaged in both ecosystems.

PAYMENTS NEWS

🇲🇾 Tourists can pay via DuitNow QR in Malaysia. Payments Network Malaysia (PayNet) has just announced a new app called the “MY TouristPay App'' designed to give tourists visiting Malaysia access to the DuitNow QR payment network without opening a local bank account.

🇵🇭 Iloilo City adopts the BSP-backed Paleng-QR Plus program for digital payments, and has issued an ordinance promoting digital payments in public markets and local transportation. Read more

🇮🇳 The Reserve Bank of India has announced a substancial increase in the UPI transaction limit for hospitals and educational institutions. This change will enable users to conveniently make larger payments for healthcare and education expenses through the widely used UPI platform.

🇦🇪 UAE Central Bank has joined the GCC's Afaq payments system. The move to join Afaq “is in line with its strategic objectives of shaping the future of the UAE’s financial technology and digitisation journey through supporting innovation and payment systems initiatives”, the regulator said.

OPEN BANKING NEWS

🇻🇳 Vietnam readies for Open Banking revolution with new legal framework. The State Bank of Vietnam (SBV) announces a major regulatory overhaul for Open Banking, with comprehensive legal guidelines and circulars expected to come into effect by July 2024.

DIGITAL BANKING NEWS

🇺🇸 Neobank Dave launches DaveGPT chatbot and is exploring multiple uses of the technology. The challenger bank expects chatbot to resolve up to 75% of customer inquiries. More here

🇵🇹 Novo Banco explores WiZink consumer tie-up in Portugal. This could result in a joint venture where Novo Banco funds WiZink-originated loans, with WiZink owner Varde Partners retaining some control of the new entity, one source said.

🇺🇸 Elemi Bank applies to FDIC and seeks $25m in capital to launch corporate offering. To be based in Burbank, California, the bank is expected to establish itself as a state-chartered corporate bank, focusing on a B2B offering for SMEs, professionals, and real estate investors, as per sources at The Bank Slate.

DONEDEAL FUNDING NEWS

🇫🇷 French fintech Aria secures €15m to shake up business payments. The startup is taking on the $120 trillion spent on B2B payments annually and making the experience more B2C. It plans to use the funds to expand its deferred payment infrastructure across the platform economy and B2B marketplaces.

🇵🇹 Paynest bags €2 million investment. This investment will allow the team to advance their product development efforts, to fortify the team, and to accelerate the company's planned expansion across Europe. Read more

🇸🇦 Saudi fintech startup Nearpay Raises $14M in Series "A" Round. The funding round will be instrumental in supporting the company’s global expansion plans, advancing technological capabilities, and solidifying Nearpay's commitment to driving excellence in payments infrastructure.

M&A

FinTech M&A in Europe Hits New Low In the Second Half of 2023 📉

Flagship Advisory Partners is connecting the dots for us…

🇿🇦 Ebury acquires Prime Financial Markets and establishes presence in Africa. The acquisition marks Ebury’s entrance into Africa for the first time, establishing a local office in South Africa. Read on

🇺🇸 Ncontracts acquires Quantivate. With this acquisition, Ncontracts strengthens its position as a leader in SaaS and KaaS, crucial as increased regulatory scrutiny focuses on enterprise risk management practices in U.S. financial institutions.

MOVERS & SHAKERS

🇺🇸 Marqeta announces Alan Carlisle as Chief Compliance Officer. Alan's deep expertise in the field will be instrumental in enabling Marqeta’s continued growth and product differentiation to best serve its customers.

🇬🇧 Checkout.com faces second round of exec departures this year and makes further staff cuts. The European rival to Stripe has lost 10 executives in the past 18 months and made two office closures and layoffs in the last month. Read more

🇺🇸 Card issuer Discover Financial Services has named Michael G. Rhodes as its next CEO and President, effective on or before March 6, 2024, at which time he will be appointed to the Company’s Board of Directors. He will also serve as President of Discover Bank and join its Board of Directors, effective the same date.

🇬🇧 Paymentology names Marqeta’s Jeff Parker as new CEO. “I am delighted to take on the role of CEO at Paymentology, an organization that has already created a strong global value proposition in the payments space,” Parker said. Read on

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()