London Calling: Tide Crowned at $1.5B 🦄

Hey FinTech Fanatic!

The UK’s startup scene just crowned a fresh unicorn 🦄.

Business banking platform Tide hit a $1.5 billion valuation after raising $120 million in a round led by TPG. Not bad for a company that was valued at “only” $650 million back in 2021.

Tide’s 1.6 million SME customers across the UK, India, and Germany (with France just added to the mix this month) are fueling the growth.

CEO Oliver Prill says the raise—partly new money, partly secondary sale—wasn’t about going public just yet, but about keeping momentum while giving early investors and staff some liquidity.

An IPO? “At some stage, there will be an exit,” Prill teased. But for now, it’s all about chasing the opportunities ahead.

And speaking of opportunities in the UK… I’m in London right now for some exciting meetings. Can’t wait to share more soon, so stay tuned!

Cheers,

FINTECH NEWS

🇺🇸 BitGo files for IPO with $4.2b in H1 2025 revenue, and $90b in crypto on platform. Crypto custodian BitGo has filed its first public S-1 registration statement with the U.S. Securities and Exchange Commission, planning to list Class A common stock on the New York Stock Exchange under the ticker BTGO.

🇬🇧 Cleo is considering a flotation. The London Stock Exchange is not fit for purpose, with stifling listings and tax rules, says Barney Hussey-Yeo of Cleo. City regulators and the government hope Cleo’s plans could provide a much-needed boost for the nation’s beleaguered public markets, but the company’s founder has some bad news.

🇮🇳 PhonePe cuts losses and revenue climbs 40%. PhonePe, which plans to file its Draft Red Herring Prospectus later this year, posted a threefold growth in its adjusted Profit After Tax (PAT) to Rs 630 crore in FY25, from Rs 197 crore in the previous fiscal year.

PAYMENTS NEWS

🇬🇧 CellPoint Digital launches One Source Orchestration, OSO, the first payment orchestration platform to meet the demand of OOSD retailing models. OSO provides the advanced and configurable payment capabilities travel merchants need to seize the revenue opportunity presented by OOSD models and enter new markets with fewer barriers.

🌍 Checkout.com powers Rail Europe to 8% uplift in acceptance rates and stronger fraud protection. Rail Europe has achieved an 8% uplift in acceptance rates across its B2C and B2B platforms, while significantly reducing fraud and chargebacks, helping millions of international travellers book European rail with confidence.

🇬🇧 Paysafe partners with CMC Markets to expand presence in online trading. CMC customers can use Skrill or Neteller to fund their trading accounts seamlessly and securely. The digital wallets will allow CMC customers to benefit from rapid payment solutions that have been developed with traders in mind.

🇶🇦 QNB enables Unified Payments Interface acceptance in Qatar. QNB has enabled the acceptance of QR code-based Unified Payments Interface (UPI) across Qatar via point-of-sale (POS) terminals for QNB’s merchant clients, powered by NETSTARS’ payment solution.

OPEN BANKING NEWS

🇳🇿 Open banking meets KiwiSaver for the first time through the Feijoa ‘round-up’ app. The Feijoa app is a KiwiSaver version of ASB’s Save the Change banking feature that lets users round up transactions, with the difference between the sum spent and the rounded amount being added to their savings accounts.

REGTECH NEWS

🌎 Hyperpersonalization has reached fraud prevention: AI and open data transform cybercrime. Pomelo highlights the challenges of risk areas as instant payments expand in Latin America and emphasizes the value of having configurable and integrated security tools. “There´s preliminary research that can be done because with the right tools and data processing capabilities, you can have very specific targets,” said Paula Barnes, Risk Leader at Pomelo.

🇵🇰 LemFi secures State Bank of Pakistan approval. The approval enables LemFi to operate in partnership with United Bank Limited, one of Pakistan’s largest and most trusted financial institutions. Continue reading

DIGITAL BANKING NEWS

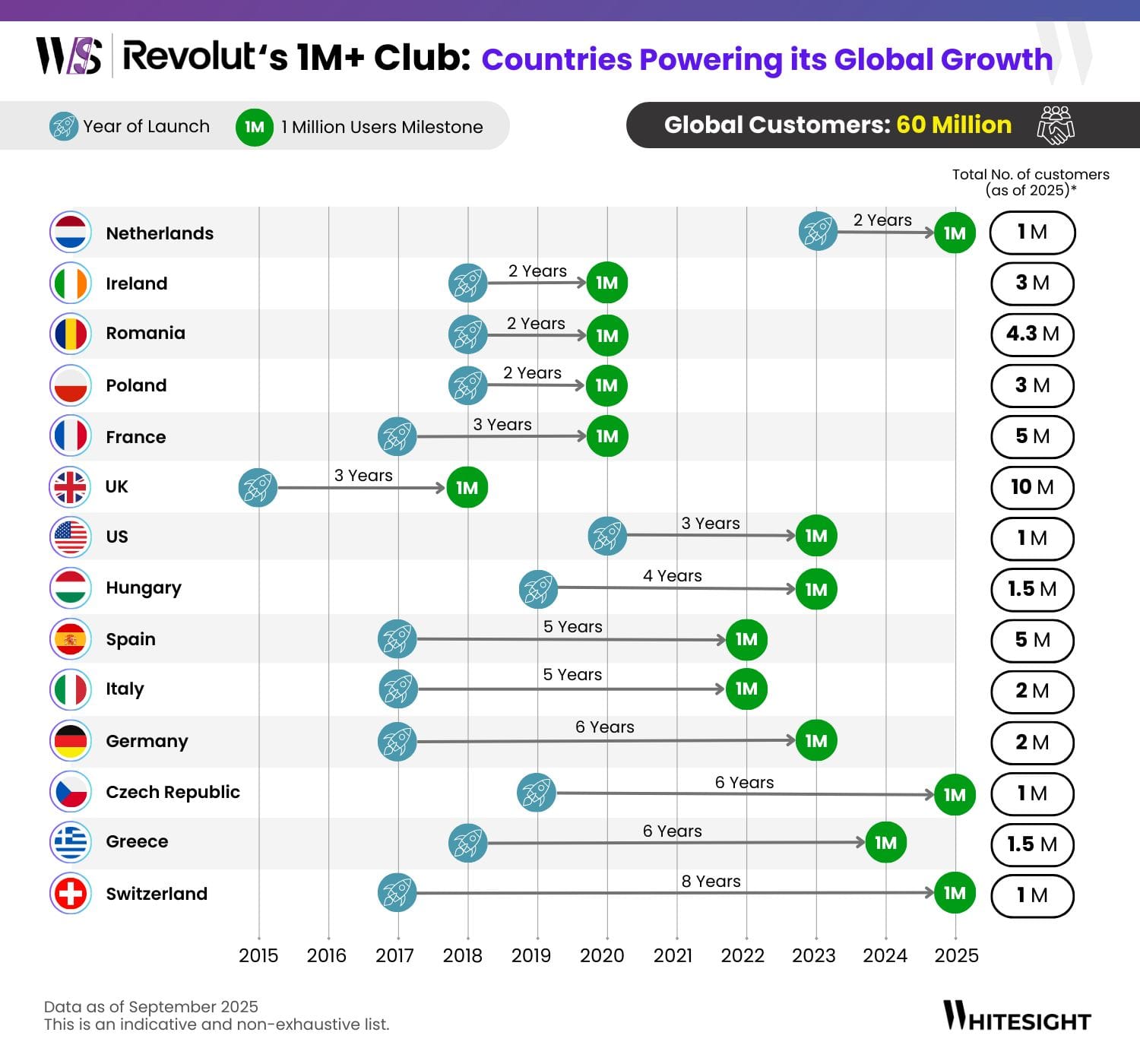

🌍 Revolut serves 60M+ customers across 48 countries, and the speed at which markets hit the 1M users mark reveals the engine behind its scale.

🇵🇱 Revolut Bank already has 5 million customers in Poland. Becoming the bank of choice. This is a slogan that Revolut Bank consistently pursues in Poland. It already has over 5 million customers in the country. Keep reading

🇨🇳 ZA Bank surpasses 1 million customers. The Hong Kong-based digital bank saw deposits and card transactions rise in H1. Total customer deposits rose 8.8% year-on-year to HK$21.1 billion by the end of the first half of the year. Card transactions jumped 33% YoY, above the market average of an 8.4% growth.

BLOCKCHAIN/CRYPTO NEWS

🇨🇳 First Chinese CNH stablecoin debuts as global race heats up. The stablecoin is meant to facilitate cross-border transactions with countries in the Belt and Road initiative, an infrastructure project building physical roads linking China to the Middle East and Europe, and establishing maritime trade routes with other regions.

🇧🇷 Bitget Wallet integrates Brazil’s Pix for stablecoin payments. The move enables users to pay with self-custodied crypto by scanning any Pix QR code. By combining blockchain infrastructure with Pix’s national reach, Bitget Wallet is aiming to reduce the barriers between digital assets and everyday consumer transactions.

🇸🇬 LINE and Kaia to launch stablecoin superapp for cross-border payments. Kaia said the Unify service aims to combine consumer payments, remittances, and on- and off-ramps into a single interface. The company added that users would be able to deposit stablecoins to earn real-time incentives, transfer funds via messages, and make online and in-store payments.

PARTNERSHIPS

🇩🇪 Bling and Anio start a partnership. The collaboration between Bling and Anio is bringing a breath of fresh air to the mobile phone sector for children. With a focus on security and user-friendliness, the two companies have developed a special plan that offers parents reliable and controlled communication for their children.

🌍 Webull EU partners with Upvest to bring fractional investing to Europe. Through this collaboration, European investors are able to access European stocks and ETFs for the first time. Webull Securities (Europe) end users will also benefit from fractional trading, giving them the ability to start investing in European assets from as little as €1.

🌎 Thredd expands partnership with Reap for stablecoin cards. Under the expanded agreement, Thredd will provide the infrastructure supporting Reap’s physical and virtual card programmes, facilitating the company’s expansion into the US and Latin America.

🇪🇹 Siinqee Bank partners with Mastercard to launch prepaid cards, expanding digital payments in Ethiopia. By lowering barriers to entry, the partnership is expected to bring more Ethiopians into the financial system, enabling them to participate in global commerce, international travel, and online transactions.

🌍 Mukuru and MoneyGram partner to expand cross-border payments. The collaboration links Mukuru’s technology-driven Southern African infrastructure with MoneyGram’s worldwide payout network, creating a faster, more affordable, and more inclusive remittance experience.

🇬🇧 Sientia partners with Tillo to supercharge payment-linked advertising with real rewards. Through Tillo's plug-and-play API, Sientia can now seamlessly embed digital gift cards from over 3,000 global brands into its campaigns, enabling advertisers to drive engagement, reward purchases, and build lasting customer loyalty.

🇺🇸 Walmart Business taps TreviPay for pay-by-invoice. The next phase of its Pay-by-Invoice program enables eligible business customers to access a line of credit with a 30-day term for online and in-store purchases. The new program will be powered by TreviPay’s payments and accounts receivable automation technology.

🇸🇦 Remitly and tiqmo sign letter of intent to expand digital financial services in Saudi Arabia. Through this potential partnership, Remitly and tiqmo intend to cooperate by leveraging their respective strengths to provide customers in Saudi Arabia with a seamless and reliable way to send money to loved ones around the world.

DONEDEAL FUNDING NEWS

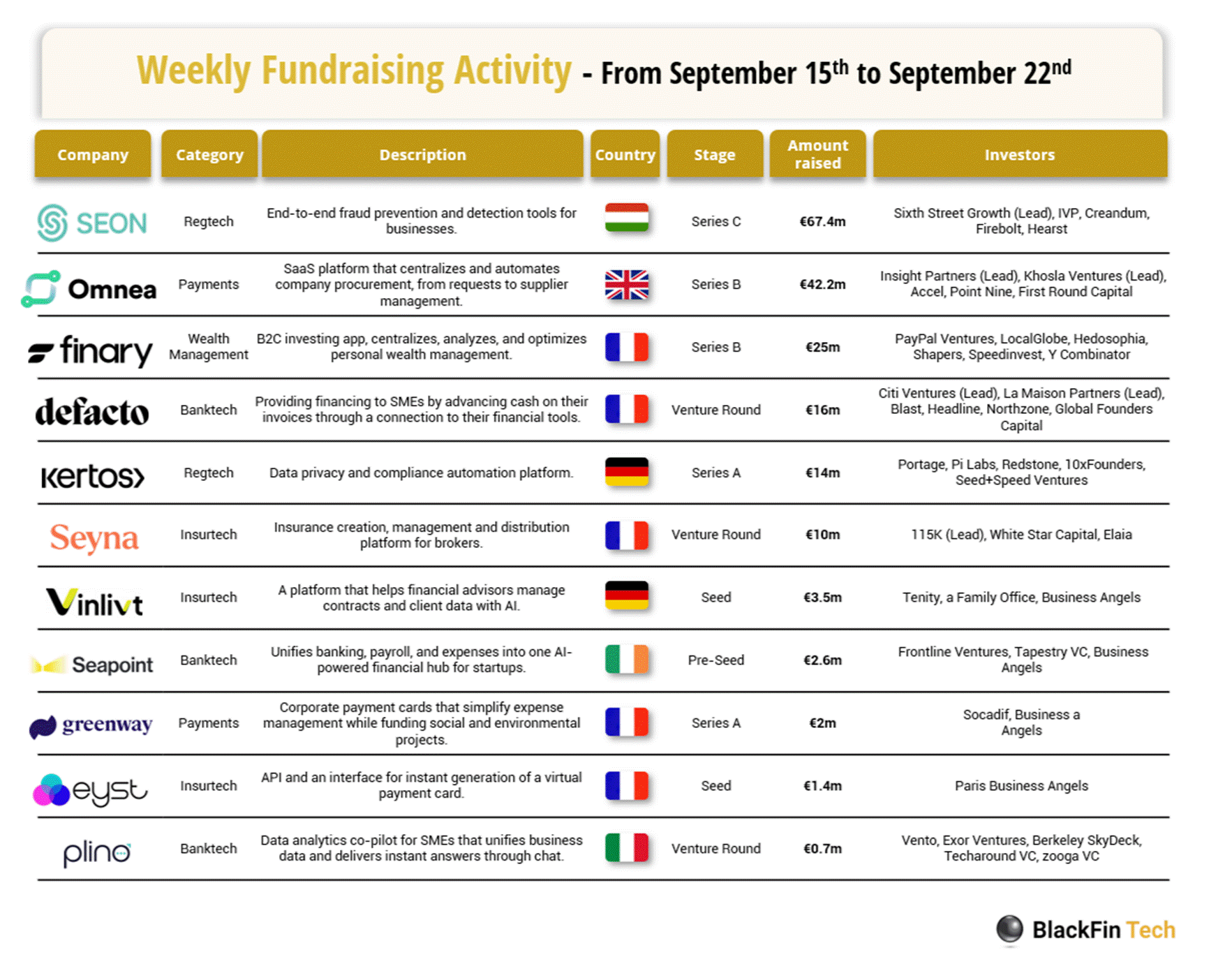

💰 Over the last week, there were 11 FinTech deals in Europe, raising a total of €185 million, including transactions in Hungary, the UK, France, Germany, and Ireland.

🇺🇸 Coinbase partner Cardless raises $60 million in growth push. The funds will be used to add features and build programs with name-brand clients, part of its effort to gain a stronger foothold in a business that traditional banks still dominate. The startup aims to reach profitability by the end of next year.

🇺🇸 Stripe Crypto Alumni Raise $19.2M for ATXP Protocol to Power Agentic Payments. Louis Amira emphasized that if ATXP is successful, it would enable the long-awaited promised land of microtransactions. Keep reading

🇦🇪 Saudi FinTech erad raises $33 million debt round led by Stride Ventures. The new capital will support erad’s expansion in Saudi Arabia and the UAE, scale its Shariah-compliant platform, and meet growing demand from SMEs across retail, F&B, healthcare, and e-commerce

🇸🇬 Kilde raises US$1.5 million to grow its private credit platform. The fresh funding will be used to expand Kilde’s team, upgrade its technology and capital markets capabilities, and position the platform to access larger borrowers and higher-quality deals.

🇮🇪 Rekord raises $2.1M to power the future of credit decisioning. Rekord will onboard new design partners, expand across the EU and UK, and grow its team to meet demand. The company is preparing pilot programs with selected institutions to demonstrate how its platform can reduce operating costs and significantly enhance the customer experience.

🇬🇧 TPG leads funding for UK FinTech Tide at $1.5 billion valuation. The fresh funds will be allocated toward a new line of products, investments in AI, and further international expansion. Continue reading

MOVERS AND SHAKERS

🇳🇬 Flutterwave reshuffles leadership team to strengthen risk, compliance, and oversight. It appoints Prashant Kalia, Mobolaji Bammeke, and Oluwabankole Falade. The company states that the changes are part of a planned succession strategy designed to enhance its governance as regulatory pressure on FinTech entities intensifies in Nigeria and globally.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()