Linqto Bankruptcy: Court Permits $500M+ Stake Sale

Hey FinTech Fanatic!

Collapsed FinTech Linqto got court approval to sell off its portfolio to fund its bankruptcy case.

Linqto did not specify which securities it would try to liquidate, but stated it would be from a portfolio worth more than $500 million.

Known as a retail gateway to private markets, Linqto is now under SEC scrutiny for accredited investor verification missteps.

Scroll down for the full story and more FinTech shake-ups below 👇

Also, want your favorite FinTech map featured on our website? Share it with us in the comments, and we might showcase it next!

See you tomorrow!

Cheers,

Do you think you know FinTech? Let's see...

Which FinTech just scored a goal by teaming up with Manchester United? Hint: It’s one of my portfolio companies.

A) Airwallex B) Sokin C) Bitpanda D) Upstox

#FINTECHREPORT

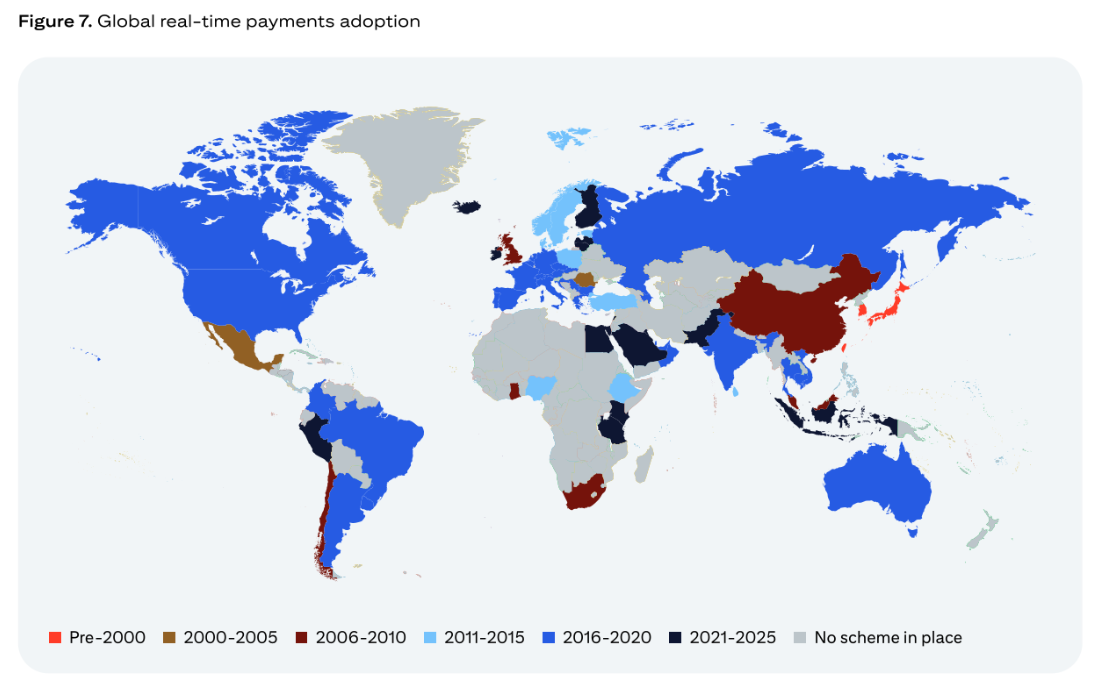

💰 Real Time: 24x7 Finance in an Always-On World. The financial services landscape is rapidly transforming, and real-time payments are already facilitating global commerce.

FINTECH NEWS

🇺🇸 Invest buys dip: purchases $21M Bullish, $16M Robinhood shares. According to trade notifications, ARK Invest’s flagship ARK Innovation ETF (ARKK) purchased 356,346 shares of Bullish, valued at about $21.2 million, and 150,908 shares of Robinhood Markets, worth $16.2 million.

🇸🇬 Aspire launches yield solution to enhance SME investment returns. The launch enables it to offer regulated investment solutions to businesses. To ensure stability and performance needed to turn idle cash into capital growth, Aspire's affiliate has partnered with Fullerton Fund Management for both Singapore and US dollar investments.

🇬🇧 HSBC shakes up leadership of FinTech venture less than a year after its launch. In the latest shake-up of the UK bank’s FinTech strategy, Vinay Mendonca has left his position as Chief Executive of SemFi, the joint venture between HSBC and US FinTech firm Tradeshift, unveiled last October.

🇲🇽 Nu Mexico grows customer base by 50% in 12 months. Nu Mexico closed the second quarter of 2025 with 12 million customers, having been the first banking relationship for about 22% of them, Guilherme Lago, Nubank CFO and Nu Mexico Board’s Chairman, points out. Additionally, Nubank notches third buy upgrade in a week after earnings beat. Nubank now holds 15 buy recommendations, five holds, and two sells.

PAYMENTS NEWS

🇮🇳 Stripe’s UPI glitch mars OpenAI's India plan launch. Customers attempting to make payments via UPI were unable to complete their transactions. UPI payments had been temporarily disabled due to ongoing technical issues, and that resolution was expected within 12 to 24 hours, according to a message posted on the website. Meanwhile, Stripe unveils stablecoin, AI upgrades for global businesses at its Stripe Tour Singapore 2025 event on August 20, 2025.

🇺🇸 FIS unveils reconciliation service. Reconciliation Service is a fully managed solution designed to automate the end-to-end reconciliation process for banks, corporations, and financial institutions. Continue reading

REGTECH NEWS

🇦🇺 MoneyMe selects SEON to strengthen fraud prevention and credit decisioning. MoneyMe will deploy SEON to support a multi-product portfolio, including auto loans, credit cards, and personal loans, strengthening capabilities in device intelligence, behavioral analysis, and second-party fraud detection.

🇨🇦 Fig chooses Flagright for real-time transaction monitoring and AML compliance. Fig utilizes Flagright’s real-time transaction monitoring, AML screening, customer-risk scoring, AI forensics, and case management workspace to strengthen financial crime controls as it scales personal loan services across Canada.

DIGITAL BANKING NEWS

🇺🇦 monobank launches its network of payment terminals. The terminals allow customers to top up monobank cards free of charge. "We have begun installing them in Ukrainian cities and building our replenishment network," Oleg Gorokhovsky, co-owner of FinTech Band, announced on social media.

🇶🇦 Qatar's QNB first GCC bank to launch commercial unified digital wallet integration using the Mastercard gateway. With this advancement, QNB is leading the way in simplifying digital wallet acceptance for merchants through a scalable, seamless, and fully integrated solution.

🇦🇺 Infosys Finacle completes cloud banking migration for Uniting Financial Services. According to Infosys Finacle, the shift enables UFS to manage its operations more efficiently, expand its investment products, scale deposits, and strengthen its commercial loan business.

🇩🇪 Openbank migrates investment accounts to Upvest. This enables Openbank to offer a comprehensive, digital-first product range and a competitive user experience across all major asset classes to rival neo propositions. This strategic shift allows Openbank to benefit from cost-efficient investment infrastructure.

🌎 Citi gives its commercial banking platform an AI makeover to achieve client experience efficiencies as well as streamlined digital enhancements. Client feedback on the platform indicates an improved client experience as well as higher rates of satisfaction for ease of use and effectiveness.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Bullish receives $1.15bn of IPO proceeds in stablecoins. The vast majority of the stablecoins were minted for Bullish on the Solana network. Jefferies coordinated the stablecoin minting, conversion, and delivery process, working closely with the numerous issuers and platforms across the U.S., Europe, and Asia.

🇸🇬 WazirX users approve restructuring plan again after court rebuff. WazirX founder Nischal Shetty said that if the Singapore High Court approves the latest restructuring proposal, the exchange would restart and begin compensating users within 10 days of “the scheme taking effect.”

🇺🇸 Wyoming becomes the first to launch a state-issued stablecoin. Wyoming launched its long-promised stablecoin, designed to offer instant transactions and reduced fees for consumers and businesses, in the latest effort by the Cowboy State to attract digital asset businesses.

PARTNERSHIPS

🇱🇺 iCapital and Apollo expand partnership to enhance access to alternative investments. This move aims to provide wealth managers and their clients with greater access to a broadened menu of alternative investment solutions in a Luxembourg format and a comprehensive set of educational tools and resources to support the strategic diversification of client portfolios.

🇦🇪 BurjX partners with Fireblocks to secure a licensed digital asset platform in Abu Dhabi. By leveraging Fireblocks and compliance solutions, the company said it aims to deliver a secure trading experience for both retail and institutional users across the UAE and beyond.

🇺🇸 MoonPay and Trust Wallet sign multi-year partnership to expand on- and off-ramp services. The expanded deal makes MoonPay the default provider for buy and sell flows within the wallet, simplifying access to crypto across multiple fiat currencies and payment methods.

🇺🇸 Workday and DailyPay form a strategic partnership to bring on-demand pay to millions of workers. Through this collaboration, employers can give workers, including frontline and hourly workers, real-time access to their money as they earn it.

🇺🇸 Nuvei integrates with Zuora for subscription payments. The partnership enhances Nuvei’s ability to support enterprise recurring revenue at a global scale and provides Zuora’s customers with a robust payments infrastructure to accelerate growth in both established and emerging markets.

🇵🇭 Higlobe and Coins.ph launch first stablecoin-powered payment rail for U.S.–Philippines transfers with lowest cost guarantee. New payments solution set to save businesses and professionals tens of millions in fees. It will deliver the guaranteed lowest-cost, most transparent cross-border payment solution for U.S. businesses paying Filipino freelancers, vendors, and remote teams.

🇺🇸 Sunwest Credit Union and Tyfone partner to deploy an advanced digital transformation strategy with nFinia® Platform. The partnership aims to transform the credit union’s digital member experience, provide more engaging, personalized services, drive future growth, and generate operational efficiencies across the entire institution.

DONEDEAL FUNDING NEWS

🇹🇷 Turkey’s FinTech Firm Midas attracts global backers in $80m funding round. The company plans to channel fresh capital into derivatives trading and new tools for active investors. U.S. options trading will launch in September, followed by Turkish equity derivatives.

🇺🇸 Casca raises $29M for AI-based loan origination platform. The new money will be used to scale its operations, expand its team, and accelerate go-to-market efforts. Casca claims that its platform funds commercial loans up to 10 times faster than other FinTechs and 30 times faster than industry averages.

🌎 Cointel raises $7.4M in strategic round led by Avalanche and Sugafam Inc. This funding solidifies Cointel’s position at the intersection of AI, crypto, and education, building a globally scalable platform that meets the needs of new users, data-driven traders, and everyone in between.

M&A

🇺🇸 Bankrupt FinTech Linqto Inc to sell hard-to-get stakes in private firms. Linqto did not list which securities it would try to liquidate, but said they would come from a portfolio worth more than $500 million. It had acquired the stakes for itself and its customers before the online investment platform shut down and filed for bankruptcy.

🇺🇸 CSI buys digital banking tech provider Apiture for an undisclosed sum. The transaction is expected to close in the fourth quarter of 2025, pending regulatory approvals. Apiture provides a digital business and consumer banking platform featuring account onboarding, payments, open banking, and analytics capabilities.

🇳🇱 Coda completes acquisition of Recharge, expanding global reach in digital content monetization and distribution. The acquisition creates a single, trusted partner for the global distribution and monetization of digital content and prepaid products across mobile gaming, entertainment, and lifestyle.

🇺🇸 Kinective buys ESQ Data Solutions for ATM tech. Kinective says the acquisition, its fourth in the technology sector this year, brings "real-time device analytics, proactive alerts, and automated monitoring and recovery capabilities" to its banking operations platform.

🇮🇱 Kraken announced the acquisition of Capitalise.ai, bringing no-code trading automation to Kraken Pro. By integrating Capitalise.ai’s technology into Kraken Pro, users will soon be able to automate sophisticated strategies across digital and traditional asset classes without writing a single line of code.

🇺🇸 Fifth Third announces acquisition of DTS Connex, adding scale, innovation in cash management. DTS Connex’s technology solutions address the complex and complicated needs of clients seeking to increase efficiency, transparency, and oversight in cash logistics management.

MOVERS AND SHAKERS

🇬🇧 United FinTech appoints investment banker Rupsa Mukherjee as Head of M&A. Rupsa will work closely with United FinTech Founder & CEO Christian Frahm and the executive team to identify high-potential companies, lead acquisition strategy, and structure founder-friendly transactions that align with United FinTech’s long-term vision.

🇮🇳 BharatPe strengthens leadership team with key appointments in finance and investments. Rajesh C, as Head of Finance, brings more than two decades of experience across financial planning, accounting, and regulatory reporting. Himanshu Nazkani, as Head of Investments, will drive the company’s investment and insurance strategy while building partnerships across mutual funds, digital gold, fixed deposits, and insurance.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()