Lesaka Acquires Bank Zero in $62M Deal to Bolster SA FinTech Ambitions

Hey FinTech Fanatics!

South African FinTech firm Lesaka Technologies is making a bold move to solidify its digital banking footprint with the R1.1 billion (~$62M) acquisition of Bank Zero, a digital-only mutual bank.

The all-equity-and-cash deal, still subject to regulatory approvals, will see Lesaka acquire 100% of Bank Zero’s issued shares. In return, Bank Zero shareholders will receive 12% of Lesaka’s diluted shares and up to $5.1M in cash.

Launched in 2018, Bank Zero brings over 40,000 funded accounts and a deposit base of ZAR400 million. What Lesaka gains isn’t just a license, it’s a ready-built platform and customer base to fuel its ambitions of becoming a vertically integrated FinTech powerhouse.

The leadership at Bank Zero isn’t going anywhere, at least for now. Executive Chairman Michael Jordaan and CEO Yatin Narsai will stay on through the transition.

“This transaction reflects a strategic partnership underpinned by long-term alignment… Our belief in the combined platform’s future is clear,” said Jordaan.

For Lesaka, this is about more than just a bank; it’s about accelerating its FinTech vision by integrating banking capabilities directly into its technology stack.

Lesaka Chairman Ali Mazanderani called the acquisition a “transformative event”, one that accelerates the company's strategy to serve South Africa’s underbanked population with modern, digital financial tools.

With both parties aligned on vision and leadership continuity, this deal marks a milestone moment for South African FinTech and a signal that banking and FinTech aren’t just converging, they’re merging.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

#FINTECHREPORT

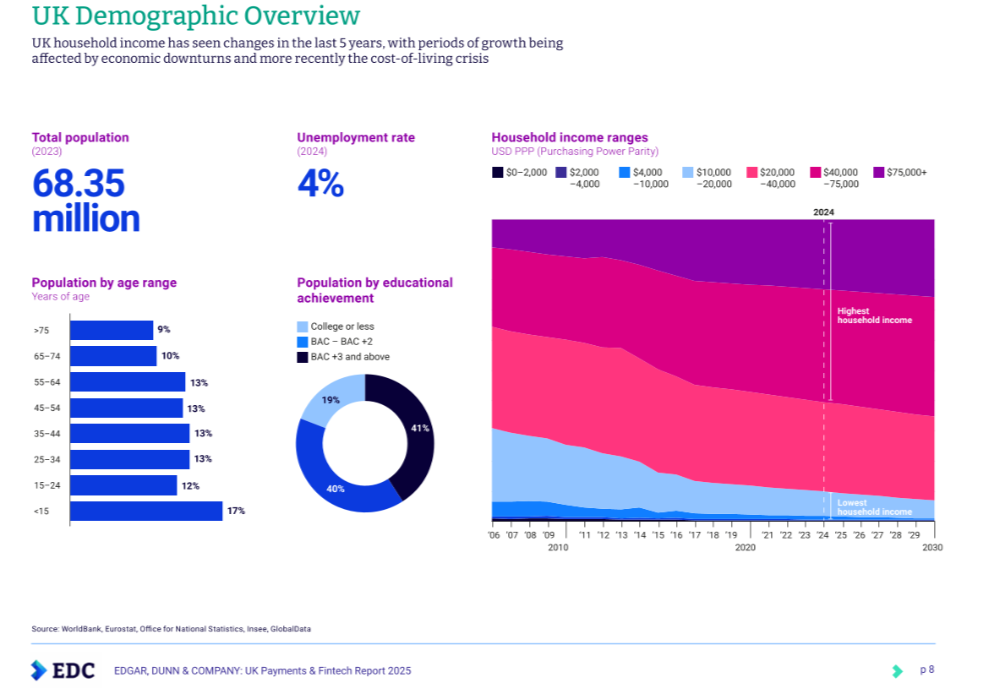

🇬🇧 UK Payments & FinTech Report 2025.

FINTECH NEWS

🇺🇸 LITXCHANGE to launch FinTech platform to dismantle Wall Street's "Rigged Game", launches Beta Q4, crowdfunding campaign nears $1 million goal. It is set to disrupt the $3.6 trillion per year financial industry by helping retail investors gain an edge typically reserved for institutions, avoiding market manipulation with swarm intelligence and AI enhancements.

🇬🇧 Tap Global debuts on London’s AIM market. Marking the transition to AIM from Aquis, Chief Executive Arsen Torosian said the move aims to amplify and raise awareness of the company among investors. Continue reading

PAYMENTS NEWS

🇬🇧 Checkout.com and the Merchant Risk Council deepen partnership to help merchants combat security risks, as industry fraud rates rise. The renewed multi-year agreement expands both organizations’ investment in foundational educational programs for the global payments and fraud prevention community.

🇮🇳 Goa-based company Instifi secures Bank of India authorization as a payment aggregator. This positions the company as the only one in Goa to hold the authorization, marking a significant step forward for the state's digital economy. Keep reading

🇮🇳 Post offices go digital: UPI payments rolling out nationwide. This new initiative, made possible by the integration of a new application into the Postal Department's IT system, aims to provide greater convenience to citizens and reduce reliance on cash transactions.

DIGITAL BANKING NEWS

🇺🇦 Ukrainian FinTech startup Spendbase launches its own digital banking and virtual cards. This will help businesses achieve maximum transparency and control over corporate expenses. With enhanced management capabilities at the team, account, and user levels, companies will be able to optimize their funds even more effectively.

🇺🇸 Banco Santander’s (SAN) US Unit is divesting seven branches to focus on digital banking. The divestment is part of Santander Bank’s push to become a digital-first bank. Additionally, the sale underscores Santander’s conviction that its customers will continue to receive quality service from Community Bank.

🇵🇰 Digital payments in Pakistan jump 12% as mobile banking grows. In the third quarter of fiscal year 2024-25, transactions rose by 12%. The total number reached 2.408 billion. Meanwhile, the overall value of these transactions also increased by 8%, reaching Rs164 trillion.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase Derivatives will launch US Perpetual-Style Futures. The new Perpetual-Style Futures contracts eliminate the need for offshore workarounds, offering traders a domestic, regulated alternative with the same utility: simplified contract expirations, capital-efficient trading, long-term strategy execution, and risk management.

🇺🇸 Bakkt Holdings files $1B shelf offering that could fuel Bitcoin buys. The company filed a Form S-3 with the US Securities and Exchange Commission, revealing its intentions to offer common stock and securities. The firm said it could issue up to $1 billion of any combination of Class A common stock.

🇺🇸 eToro unlocks 50+ cryptoassets for US users. The company announced the continued expansion of its cryptoasset offering to U.S. users. The cryptoassets available to US users now include Cosmos, Filecoin, Hedera, Morpho, Solana, and more. Read more

🇩🇪 Crypto firm Taurus for Deutsche, State Street launches private stablecoin contract. Taurus’ CSO said the new product demonstrates how stablecoin users can preserve privacy without sacrificing compliance, ensuring accessibility for authorized parties like issuers and regulators.

🇺🇸 Bit Digital exits bitcoin mining, pivots to Ethereum staking. The decision marks a significant realignment in its business model amid shifting economic and environmental dynamics in the crypto sector. It plans to gradually liquidate its remaining Bitcoin holdings to increase its ETH position and further fund staking operations.

🇧🇷 Webull re-enters the crypto market through Brazil launch. The online investment platform is partnering with Coinbase to offer digital currency trading to Brazilian users. The service provides 24/7 access to major cryptocurrencies, including Bitcoin, Ethereum, Solana, and Cardano.

PARTNERSHIPS

🌍 I&M Group inks partnership deal with ThetaRay for AML platform. ThetaRay's AML platform will provide I&M Group with enhanced capabilities for onboarding, sanctions screening, customer risk assessment, transaction monitoring, alerts, investigating, and regulatory reporting.

🇻🇳 OpenWay’s Way4 Platform powers Southeast Asia’s First Visa Flex Credential at ACB. The new feature allows ACB customers to switch between debit and credit payment options using a single card, providing them with greater control over their spending and a more flexible payment experience.

🇺🇸 Rain and Toku partner to launch real-time stablecoin payroll infrastructure. The integration enables employers to fund and settle payroll instantly in stablecoins, compliantly and at scale, across more than 100 jurisdictions. Rain's programmable payment rails connect directly to Toku's employment and tax compliance infrastructure, streamlining payroll operations for modern, distributed workforces.

🌍 Tuum Backs maib’s European Expansion. The collaboration will enable maib to launch greenfield operations with an asset-light model designed to deliver a seamless, fully digital retail banking experience. Keep reading

🇺🇸 GiveCard partners with Visa for better disbursements. The new collaboration will enable state and local governments, school districts, and nonprofits to rapidly implement and scale digital disbursement programs with Visa-backed prepaid cards and secure digital rails.

🇺🇸 Jack Henry selects AI Agents from boost.ai to automate call volumes. Through this collaboration, Jack Henry plans to deploy AI agents for its contact centre clients to help enterprises unlock enhanced 24/7 self-service capabilities while remaining fully compliant.

DONEDEAL FUNDING NEWS

🇺🇸 Clearspeed raises $60M in Series D funding, bringing the company’s total funding to $110 million for voice-based risk assessment tech. The round was led by Align Private Capital, with participation from IronGate Capital Advisors, Bravo Victor Venture Capital, and KBW Ventures.

🇿🇦 TransUnion invests in SA FinTech Omnisient to power data-driven financial inclusion. Through this collaboration, TransUnion expects to gain access to a broader range of alternative data sources and privacy preservation capabilities. The company intends to enhance existing solutions and develop new, market-relevant products that better meet the evolving needs of our customers.

FinTech company Bolt CEO, Ryan Breslow, returns with a $600M pitch to investors. The funds would be split evenly between Bolt, a financial technology company, and Love.com Shops LLC, a wellness startup co-founded by Breslow. Continue reading

M&A

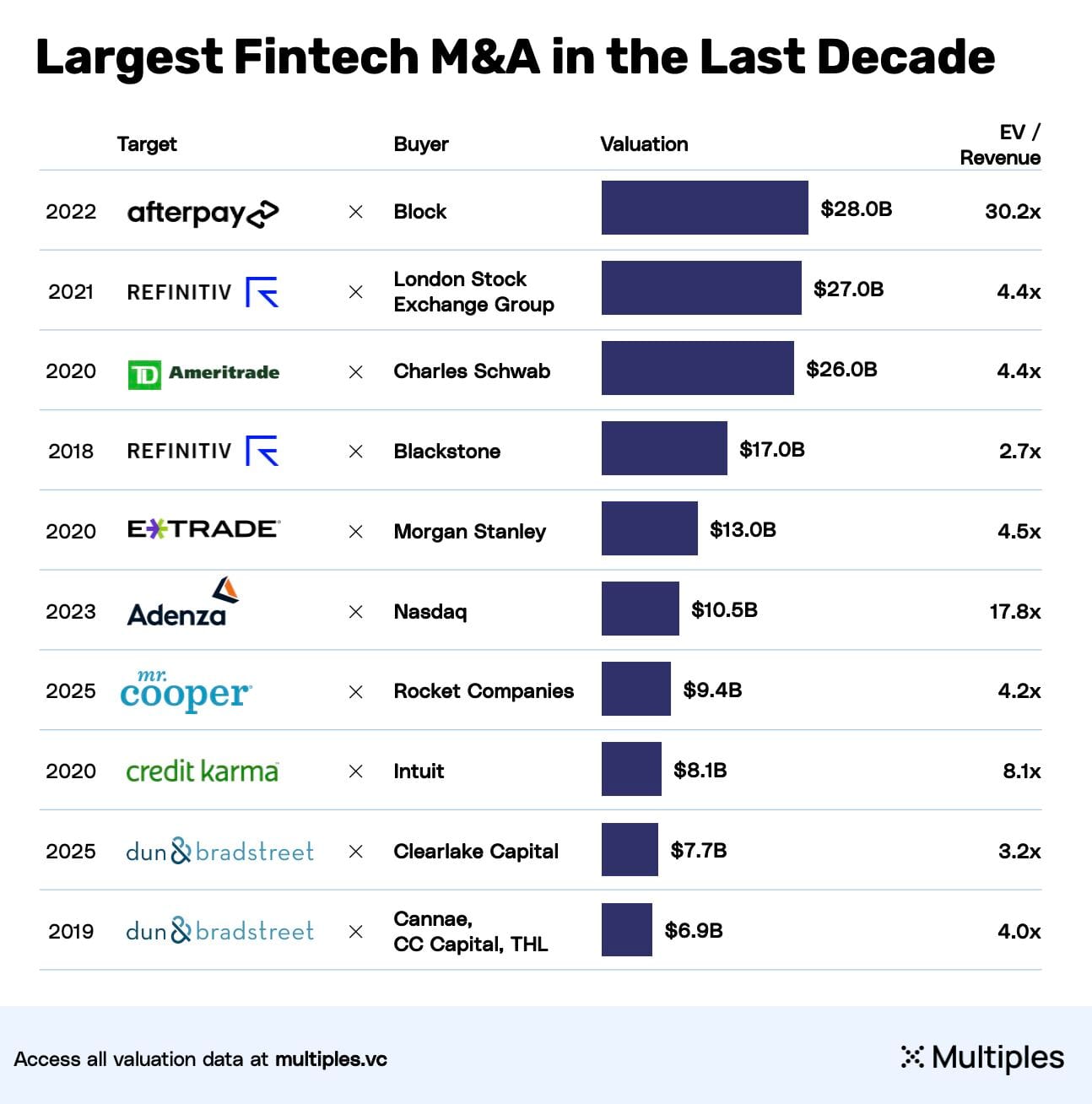

💰 The 10 biggest FinTech acquisitions in the last 10 years.

🇮🇳 PB FinTech founders sell shares worth ₹920 crore. The stake sales saw participation from major institutional investors. Buyers included HDFC Life Insurance, ICICI Prudential Life Insurance, and Ghisallo Master Fund LP, among others. Shares ended at ₹1,834.70, down by ₹5.05, or 0.27%, on the BSE.

🇿🇦 Net1 exits from Mobikwik with notable loss after 8 years. Net1 first invested $40 million in MobiKwik in 2016, aiming to integrate its virtual card and financial inclusion technologies. However, despite MobiKwik going public, Net1 appears to have made no return and has even incurred a loss on its investment.

🇺🇸 Envestnet is offloading Yodlee to a private equity buyer back in Silicon Valley, which values its 'trusted data access and intelligent analytics'. Under the new CEO and new owner, the Berwyn, Pa, wealth platform is liquidating the account aggregation unit and maintaining long-term license agreements

🇿🇦 South Africa’s Bank Zero and Lesaka to combine in $61 million deal. The merger allows Lesaka to build a vertically integrated FinTech platform. Combining the lender’s digital-banking infrastructure and its banking license with Lesaka’s FinTech and distribution platform is intended to transform the way Lesaka conducts business in the future.

🇺🇸 Core Scientific shares surge 33% on report of buyout talks with CoreWeave. The deal follows a previously rejected bid from CoreWeave that valued the company at less than a quarter of its current market cap. The deal would deepen a long-running partnership that includes billions of dollars in contracted commitments.

🇲🇽 Argentinian FinTech Tapi buys Mastercard unit in Mexico. Through Arcus’s payment network, Tapi aims to increase digitization in a market where cash usage remains strong alongside growing FinTech adoption. Keep reading

MOVERS AND SHAKERS

🇮🇳 FINDI appoints Randeep Singh as Group Chief Human Resources Officer to lead people strategy ahead of IPO. In his new role, Randeep will oversee the HR functions across all of FINDI’s verticals: FindiATM, FindiBANKIT, TSI, and Unified Banking Centres.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()