Lanistar's Bold Move: Conquering Latin America with Plans for UK and EU Return

Hey FinTech Fanatic,

Lanistar is expanding in Brazil and plans to enter Colombia and Argentina by May, while considering re-entering the UK and EU markets. According to an interview on Tech.eu CEO Baber believes Latin America offers significant growth opportunities, which will benefit future expansions in Europe.

Launched in mid-2022 in Brazil, Lanistar's product is a virtual debit card supported by influencers, designed for Gen Z and Millennials, and allows for online purchases and cryptocurrency transactions. Despite only having 68,000 Brazilian customers, Lanistar anticipates rapid growth following an influencer-led marketing campaign. Remember this strategy in the UK a few years ago?

The company, which operates through a banking-as-a-service model with Bankly, aims to attract half a million customers with this campaign, and shortly after integrating Apple Pay.

Despite its success on social media and eco-friendly initiatives, Lanistar debates its return to the UK market, having faced regulatory challenges there.

The company, funded by founder Kiziloz and his family, seeks fresh funding to continue its global expansion and influencer marketing strategy. Kiziloz, who owns 93 per cent of Lanistar, no longer has day-to-day involvement with the FinTech, but has relocated to Dubai, where he is seeking out potential investors in the UAE.

To be continued...

Enjoy more FinTech industry news I listed for you below, and I'll be back in your inbox tomorrow!

Cheers,

#FINTECHREPORT

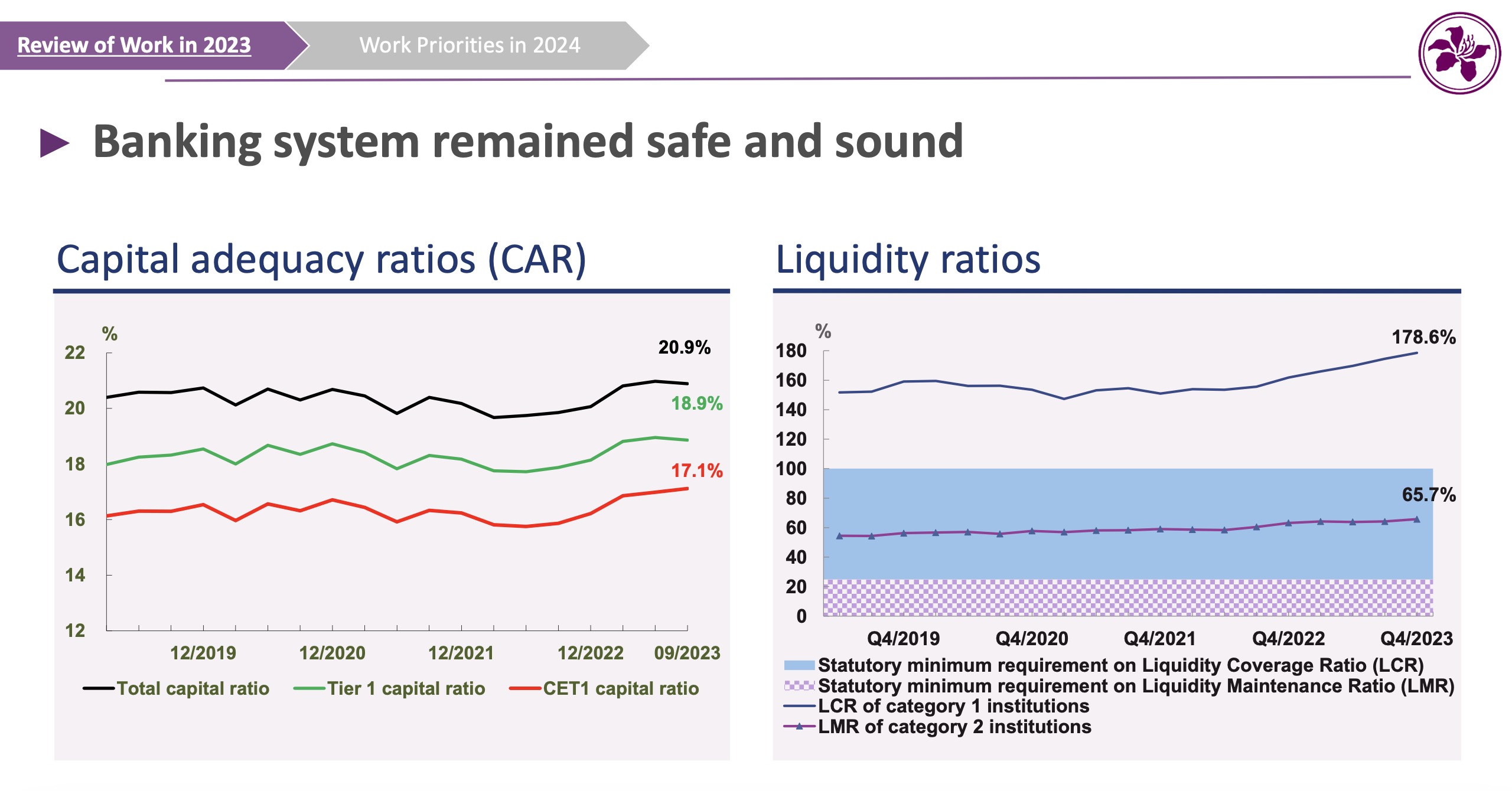

Hong Kong Banking Sector in 2023: Key Achievements and Priorities for 2024👇

FINTECH NEWS

🇮🇪 Wayflyer moves into brick-and-mortar segment. The cash advance platform is to expand its offering beyond online-only businesses to support brands that sell into brick-and-mortar retail channels. This new offering will give brands access to working capital for inventory orders on a rolling basis, with no purchase order or invoice required to access the funds.

🇿🇦 South Africa's Sava and Mastercard partner to support small, medium, and micro enterprises. The partnership offers small businesses in South Africa, Nigeria, Kenya, and Egypt an online platform powered by SAVA’s Payment Transaction System (PTS). This includes digital bank accounts and accounting integration tools to streamline company expense management.

PAYMENTS NEWS

🇳🇱 Rabobank signs up for dejamobile’s SoftPOS to offer its customers the ability to accept contactless payments on compatible Android devices and iPhones. The new feature of the Rabo SmartPin app extends Rabobank’s acquiring services for SMEs and merchants that require a highly mobile and versatile payment acceptance solution.

🇺🇸 Jefferson Bank selects Finastra Payments To Go for instant payments. The agile, resilient, cloud-based payments solution will help Jefferson Bank to efficiently deliver both RTP TCH and FedNow services 24/7, and accommodate the rapidly growing volume of instant payment transactions.

OPEN BANKING NEWS

🇮🇹 Mastercard and Nexi team up to advance open banking payments across Europe. Together, both companies will build an integrated digital payment ecosystem by advancing Mastercard Open Banking-powered solutions that offer secure, seamless payment experiences with more choice for consumers when shopping online.

DIGITAL BANKING NEWS

Lanistar is currently making a play in Brazil, with further launches planned in Colombia and Argentina in May. Yet it still has an eye on a return to the UK market and the EU. Currently, it has only 68,000 customers in Brazil but Baber says it’s about to go gangbusters in the country when it unleashes its influencer “roadblock” marketing campaign.

🇰🇪 Digital lenders are seeking Central Bank of Kenya (CBK) guidance on the documents required to unlock more than 400 applications awaiting clearance for award of licences. The DFSAK, representing digital loan providers, welcomes 19 new licenses but seeks clearer CBK guidance on required documents to expedite the process.

Sir Richard Branson is set to receive upwards of £650m from a potential takeover of his challenger bank Virgin Money by Nationwide, it has been estimated. Branson stands to receive an “exit fee” of at least £250m from Nationwide on top of the £400m valuation of his 14.5 per cent stake in Virgin Money under the preliminary agreement.

🇯🇵 Goldman obtains a Japanese banking license AGAIN. Big news this week with Goldman Sachs obtaining a banking license in Japan to support their global Transaction Banking business. The firm started the application process in 2019. More on that here

🇵🇭 ASEAN cross-border remittance service to go live by 2026. The Bangko Sentral ng Pilipinas (BSP) along with other central banks in the region aims to operationalize multilateral cross-border fund transfers by July 2026. “Our target ready-for-service date is sometime in July 2026,” BSP Deputy Governor Mamerto Tangonan said in a press conference.

🇵🇭 Only two of the six digital banks in the Philippines are profitable, with losses likely to persist in the medium term as the nascent industry continues to find the right business model for their target market with a largely untested credit profile. Read the full piece

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 PayPal’s Xoom offers free remittances for stablecoin users. PayPal's Xoom app users can transfer money internationally without fees by using its stablecoin, PYUSD. This strategy aims to increase PayPal's presence in the global remittance market and promote PYUSD's adoption.

🇦🇺 Bybit crypto card lands in Australia. The card debits crypto balances on Bybit and converts them seamlessly into fiat money used to pay for card transactions. “The introduction of the Bybit Card in Australia marks a significant milestone in our journey towards integrating digital currency into everyday life,” said Ben Zhou, co-founder and CEO.

DONEDEAL FUNDING NEWS

🇬🇧 London FinTech Flagstone notches hundred-million-plus US deal as it eyes international expansion. Flagstone has landed £108m funding from US private equity firm Estancia Capital Partners as it looks to tackle savings inertia and ramp up international expansion. Read on

🇬🇧 Griffin secures $24 million in funding and launches as a fully operational UK bank. PRA and FCA approves Griffin’s application to lift restrictions and exit mobilisation. Funding will be used to scale the bank and enhance infrastructure for new and existing customers.

🇬🇧 Revolut investor slashes $5bn off valuation. US tech investor TriplePoint Venture Growth slashed the value of its stake by 18pc at the end of last year, accounts show. The reduction implies the company is worth $23bn, down from $28bn a year ago. It marks the second time TriplePoint has slashed its internal valuation of Revolut, which was worth $33bn at its peak.

MOVERS & SHAKERS

🇫🇷 BNP Paribas veteran Jean-Brice Picardi joins Viva.com as general manager in France. As General Manager, Mr. Picardi will oversee all aspects of French operations, provide strategic guidance, and enable the team to maintain and develop the company's standards of innovation and excellence.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()