Kraken to Roll Out Tokenized U.S. Stocks Across Europe and Australia

Hey FinTech Fanatic!

Kraken’s roadmap is gradually unfolding beyond crypto trading. In recent weeks, the exchange has taken several steps to integrate more traditional financial services into its offering, starting with a Mastercard partnership to launch a crypto debit card. Days later, it introduced access to more than 11,000 U.S.-listed stocks and ETFs for U.S. clients through its platform.

Now, Kraken is preparing to bring that access to clients in the U.K., Europe, and Australia, not through legacy rails, but via tokenized equities. The new product, xStocks, is built in collaboration with Backed Finance and will deliver blockchain-based versions of well-known U.S. stocks and ETFs. Issued as SPL tokens on Solana, these assets can be traded on Kraken or transferred on-chain to compatible wallets.

Kraken pointed out that access to U.S. equities from outside the country has long been shaped by structural barriers. High fees, limited trading hours, and regulatory friction are part of a system that still depends on legacy infrastructure. These constraints have made international equity investing both costly and complex.

Tokenized stocks offer a new approach. By representing equity exposure on blockchain rails, they can enable around-the-clock access and reduce intermediaries. While the concept is still gaining traction, its potential to reimagine how global investors interact with public markets is beginning to take form.

As Kraken expands its vision, Mark Greenberg, the company’s Global Head of Consumer, summarized the shift: “Access to traditional U.S. equities remains slow, costly, and restricted. With xStocks, we’re using blockchain technology to deliver something better, open, instant, accessible, and borderless exposure to some of America’s most iconic companies.”

Read more global FinTech industry updates below 👇 and I'll be back with more on Monday!

Cheers,

P.S. FinTech runner fanatics, this one’s for you – Checkout.com is hosting the Pick Up the Pace Run in Amsterdam at Money20/20 on June 4, 7 AM from RAI. See you there? If so, sign up here!

INSIGHTS

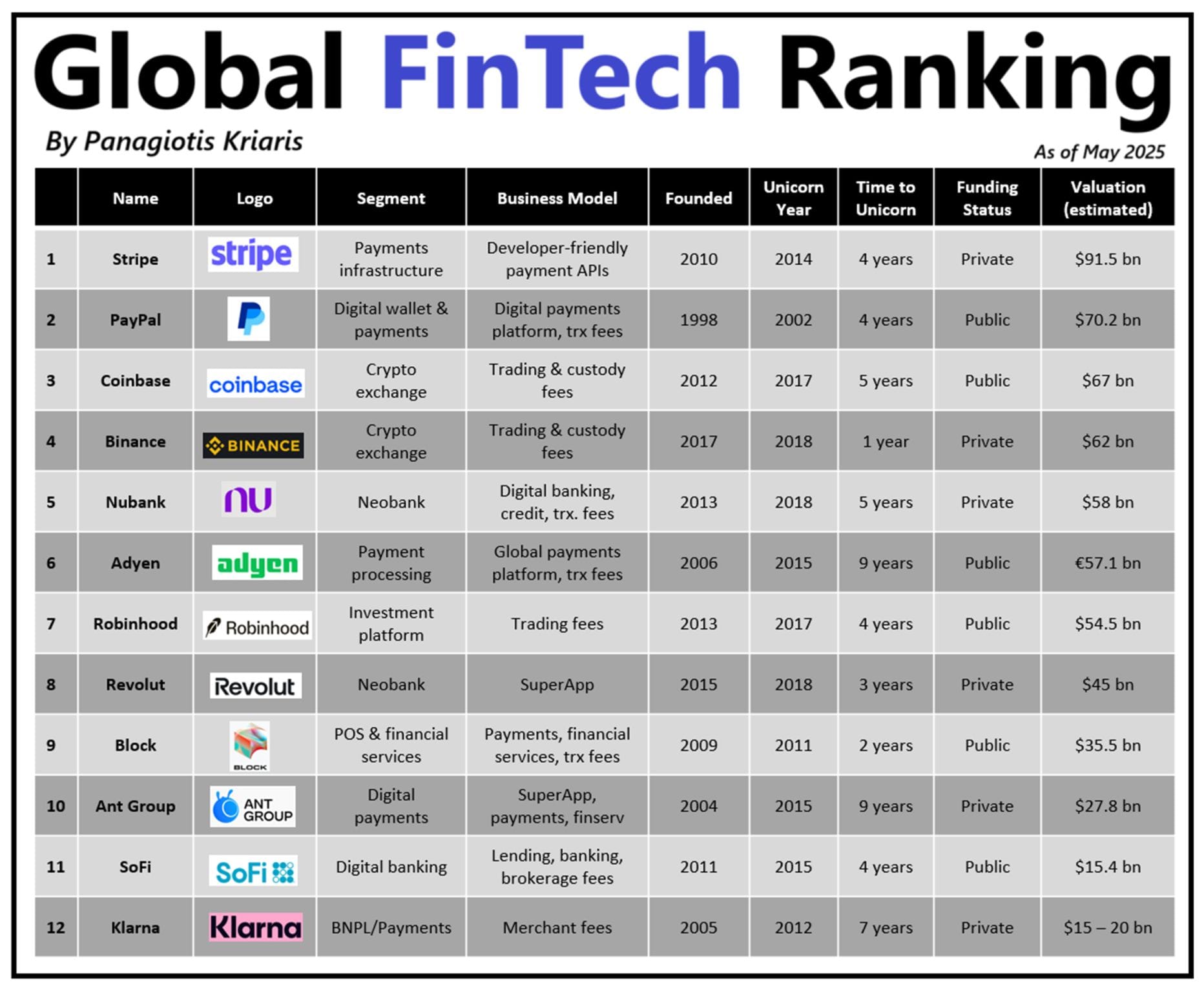

💰 Here's a Global FinTech Ranking with the top 12 FinTechs in the world ranked by estimated valuation.

FINTECH NEWS

🇮🇳 Pine Labs converts to public company ahead of IPO. The company is targeting an IPO in the second half of 2025, eyeing a USD 1 billion public issue comprising a fresh equity issuance and an offer for sale (OFS) component. Read more

🇮🇳 Groww plans to raise about $1 billion through an initial public offering that will include a mix of fresh issue and offer for sale, according to people familiar with the matter. The platform has not finalised the proportion between the two components, as several investors are involved in the transaction.

🇺🇸 Gilgamesh Ventures closes fund II and raises total AUM to $35 million. The firm aims to have a reputation amongst founders as a genuine partner that goes above and beyond to help build their companies, leveraging the firm’s deep and powerful network to amplify founders.

🇩🇪 Samsung partners with digital bank N26. Samsung users can easily pay with their Galaxy smartphone without having to pull a card out of their wallet. To kick off the partnership, customers who open a new N26 account will receive the opportunity to use the premium N26 Metal account free of charge for six months.

🇺🇸 Pagaya issues $300 million in bonds to fund BNPL loans. Pagaya is moving into the BNPL space as it’s one of consumer lending’s fastest-growing segments, making up roughly 8% of purchases during last year’s holiday season. The move puts the company in head-to-head competition with Klarna rival Affirm.

PAYMENTS NEWS

🇺🇸 Papaya Global launches Contingent OS, the first enterprise platform for managing and paying global contingent workers.

Papaya Global launches Contingent OS

🇬🇧 Digital Wallet Curve announced the launch of Curve Pay on iOS. Curve's staged architecture means it actively sits in the payment flow, which allows it to offer far more than a tap-to-pay experience. Customers can retroactively change the card they used, split payments, earn cashback, track spending in real time, and even pay from accounts, all through a single app.

🇮🇳 Digital Payments rise 35% and RBI’s E-rupee gains traction. The central bank highlighted a sharp rise in the adoption of the digital rupee or central bank digital currency (CBDC), known as eRs, indicating increasing acceptance in both retail and wholesale financial sectors.

🇷🇸 European Commission welcomes inclusion of Serbia in the Single Euro Payments Area. This is a practical example of the impact of the Growth Plan for the Western Balkans, including progressive access to certain areas of the EU single market based on alignment with the EU acquis Communautaire.

REGTECH NEWS

🇧🇷 Adyen receives authorization to operate as a payment initiator in Open Finance. This means that the FinTech has completed all certification and approval stages to operate with the modality. With this approval, Adyen now appears on a list of 54 ITPs that are currently authorized to operate in this mode.

DIGITAL BANKING NEWS

🇲🇽 Nu Mexico and OXXO launch cash deposits. This new feature will allow customers to deposit securely and conveniently through the extensive network of more than 23,000 OXXO* stores using a deposit code, simplifying access to digital finance for a significant portion of the Mexican population for whom physical cash remains relevant.

🇪🇸 BBVA overhauls mobile app with AI and virtual financial coach. AI allows each customer to organize the app based on their financial preferences. Blue, which is now able to answer customer questions with natural language, the app is also incorporating a new financial coach.

🇺🇸 Santander introduces the first Openbank location in the United States at Miami Worldcenter. The new location will offer all of the services of a Santander Bank branch, and information about its Openbank division’s digital-first banking products.

BLOCKCHAIN/CRYPTO NEWS

🇨🇳 Hong Kong requires stablecoin issuers to get a license. Lawmakers have approved a bill to regulate stablecoins, a type of cryptocurrency linked to reserve assets like fiat currencies. The legislation, passed by the Legislative Council on May 21, will take effect later this year.

🌍 Ripple’s RLUSD poised to replace USDT in Europe after MiCA shake-up. Without USDT, Europe’s crypto trading landscape looks dented. Liquidity is drying up, and users are slowly shifting to platforms outside the EU. Continue reading

🇺🇸 BitGo launches crypto-as-a-service platform for FinTechs and banks to easily offer crypto trading to their end users. BitGo’s CaaS platform allows businesses to build, launch, and scale digital asset products faster and more compliantly than ever before.

🇺🇸 Kraken takes Wall Street onchain with tokenized equities. xStocks, a new tokenized equities brand developed by Backed, will be offered to clients in select non-U.S. markets worldwide. These clients will gain exposure to a range of popular U.S.-listed stocks and ETFs, issued as SPL tokens on the Solana blockchain.

PARTNERSHIPS

🇺🇸 FIS and Kipp partner to Prevent Card Declines and Unlock Revenue for Debit Issuers. Through this partnership, issuers can quickly take advantage of this interconnected solution, helping money move dynamically through debit accounts, card networks, and payment systems.

🌍 GTN partners with Georgia's Investment Bank and Brokerage Firm Galt & Taggart for cross-border trading. The move is expected to boost the scope of available assets for local investors, ETFs, mutual funds, bonds, CFDs, and options across major global exchanges in the US, Europe, Asia, and the Middle East.

🇮🇳 Indian tech firm Zoho announces $5m UAE FinTech deal. Zoho’s tools will support operations like invoicing, workforce management, and customer engagement, with integration options for various payment gateways. Keep reading

🇫🇷 Qonto and ACD join forces to ease the weight of admin work for French SMEs and accountants. This solution simplifies the daily banking, financing, accounting, and expense management of SMEs and the self-employed. It gives customers the boost that allows them to develop further.

🇱🇺 Banking Circle S.A. teams up with Visa Direct to enhance global payment capabilities. Through this new partnership, Visa Direct will leverage Banking Circle’s single API technology to multiple direct and local clearing rails via a single, secure, and trusted provider.

🇺🇸 Sling Money launches US and European virtual accounts in partnership with Bridge to expand global earning power. This partnership marks an expansion beyond peer-to-peer transactions to enable users to receive payments for freelance, project-based, or salaried work with ease.

DONEDEAL FUNDING NEWS

🇮🇳 Data Sutram bags $9 mn to offer fraud detection services to the BFSI sector. The startup plans to use the fresh capital to strengthen its fraud detection tool. Additionally, it aims to cater to a wider high-risk industries, including cryptocurrency, real-time payments, gaming, e-commerce, quick commerce, and insurance.

🇬🇧 Digital pensions FinTech Penfold raises £3.9 million. The company says the fresh funds will boost its drive to reach profitability by growing its presence across the UK SME and accountancy markets and accelerating the development of its pension app with new features for savers and businesses.

🌍 Carrot Credit raises $4.2 million in seed to scale crypto and stock-backed lending. The FinTech will use the funding to scale its credit infrastructure across Africa, expand its team, and deepen integrations with digital investment platforms.

🇪🇪 Estonia’s FinTech company Income targets EUR 1.5 million to expand private debt investment platform. The current funding will be used to expand the investor base, onboard new non-bank lenders, enhance the platform’s usability, and hire for key roles in engineering and analytics.

MOVERS AND SHAKERS

🌏 Paytm appoints Ramana Kumar as CEO for Middle East Operations. In his new role, Kumar will lead product localisation and regional ecosystem integration, leveraging Paytm’s experience with mobile payments, QR codes, and Soundbox devices that have transformed India’s payment landscape.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()