Kraken Raises $800 Million to Advance Strategic Roadmap

Hey FinTech Fanatic!

Kraken has raised $800 million across two tranches to accelerate its plan to bring traditional financial products on-chain.

The primary tranche included investors such as Jane Street, DRW Venture Capital, HSG, Oppenheimer Alternative Investment Management, and Tribe Capital, along with a commitment from Co-CEO Arjun Sethi’s family office.

A second tranche includes a $200 million strategic investment from Citadel Securities at a $20 billion valuation. Kraken says the backing reflects long-term confidence in its regulated, multi-asset infrastructure.

In 2024, Kraken generated $1.5 billion in revenue and surpassed that figure within the first three quarters of 2025. The company had raised only $27 million in primary capital before this round. We last covered Kraken earlier this year when it raised $500M as Valuation climbs to $15B.

Kraken plans to use the new capital to scale operations, deepen its regulatory footprint, and expand its product suite. The roadmap includes new market entries across Latin America, Asia Pacific, and EMEA.

Scroll down for more FinTech stories shaping the week, and I’ll be back in your inbox tomorrow!

Cheers,

INSIGHTS

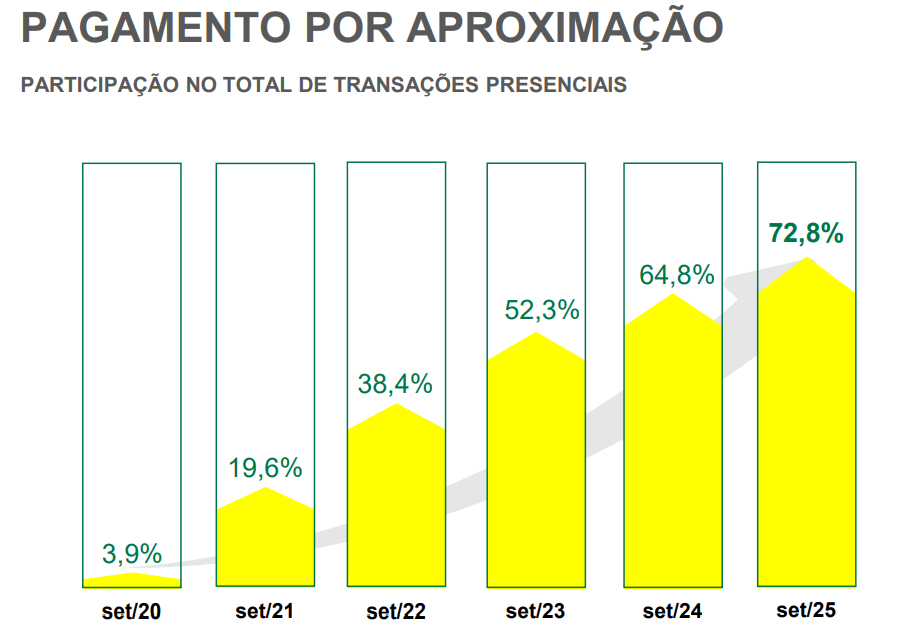

🇧🇷 Contactless payments account for 73% of card purchases in Brazil. In five years, the share of this payment method has increased from 3.9% to its current level and is expected to exceed 80% of in-person transactions by 2026 👇

FINTECH NEWS

🇩🇪 Trade Republic is on its way to becoming a 12 billion euro company. Trade Republic founder Christian Hecker is working on the deal of his life: Existing investors are to be allowed to sell shares in the neobroker, which would make the company the most valuable German start-up.

🇺🇸 Robinhood wants Apple shares to become crypto loan collateral. The brokerage targets a fully permissionless equities ecosystem in its three-phase plan. If the FinTech’s plans move forward, users would be able to withdraw their tokenized equities off-platform or use them, much like digital assets, as collateral for crypto loans.

🇺🇸 FinTech Wealthfront to offer lower-rate home mortgages. Its website says its mortgages will have interest rates roughly 0.50% lower than the national average for consumers with high FICO credit scores of 780-plus and home purchase prices of at least $750,000.

🇦🇺 Pipe announces expansion into Australia with partner Live Payments. Live Payments’ customers will be able to access capital offers inside its Customer Portal, which they use to manage their payments. Eligible Live Payments businesses will see capital offers from Pipe that are based on their unique revenue, cash flow, and business performance.

PAYMENTS NEWS

🌍Nuvei and European Payments Initiative launch Wero Payments for European eCommerce merchants. Wero enables instant account-to-account (A2A) payments through SEPA Instant Credit Transfer protocols, allowing consumers to pay securely and directly from their bank accounts in seconds.

🌍 Klarna is now available on Apple Pay in Denmark, Spain, and Sweden, with France to follow. Eligible customers can split purchases into three monthly installments, or pay up to 30 days later, always interest-free. Customers can also spread the cost of higher-value items over a longer period, with competitive interest rates starting from 0%.

🇺🇸 Plaid Introduces one-click payments. One click streamlines the open banking payment journey for Pay by Bank users through a cleaner, more accessible experience. One click automatically recalls their preferred bank and removes the selection pane entirely.

🇧🇷 Pix Parcelado promises inclusion in credit, but requires clear rules, experts argue. Regulation of this type of loan, planned by the Central Bank, will define the standards for offerings by financial institutions. Course corrections were necessary due to events that demanded urgent improvements from the regulator regarding the security requirements in the system's ecosystem.

REGTECH NEWS

🇺🇸 SEON upgrades AML Platform to give compliance teams more flexibility as they navigate increasingly fragmented regulations. The enhancements are designed to help businesses manage multijurisdictional requirements with more control over screening, rules, and investigations.

DIGITAL BANKING NEWS

🇬🇷 Revolut is set to open a store in Greece by the end of the year. The digital bank has informed the Bank of Greece about the opening of its store and the provision of Greek IBANs to its new customers' accounts, while it is planned that all Lithuanian IBANs of Greek customers will be converted to Greek ones.

🇳🇬 Mastercard and Zenith Bank launch essential debit card in Nigeria. The card is intended to serve the financial needs of underserved populations who have historically faced barriers to formal banking services. Zenith Bank aims to reach underserved market segments through simplified onboarding and lower issuance costs.

🇨🇴 Pibank is preparing to launch a credit card and compete with Nubank in a new segment. Pibank holds 70% of Banco Pichincha’s deposits and plans to release the card in 2026 or early 2027. The neobank offers high-yield savings rates and is positioning itself around simple, transparent products, setting the stage for its next growth phase.

🇧🇷 Free from Master's liquidation, Will Bank's fate remains uncertain. According to the Central Bank, the regime does not interrupt or suspend the institution's normal activities. In the case of Banco Master Múltiplo, the regulator appointed EFB to be responsible for executing the temporary special administration of the institution, with full management powers.

BLOCKCHAIN/CRYPTO NEWS

🇧🇷 Coinbase debuts DEX trading in Brazil as ‘everything app’ vision grows. The move comes amid new regulations from Brazil's central bank, requiring crypto firms to be licensed and report international transactions. Coinbase's DEX feature is non-custodial, allowing users to manage trades through a self-custody wallet without paying network fees.

PARTNERSHIPS

🇨🇱 Santander Chile proposes to incorporate PagoNxt as a strategic partner of Getnet Chile. This strategic alliance aims to strengthen the acquiring network's leadership in the local market. Getnet Chile has already achieved an 18.9% market share in physical card transactions and has more than 316,000 POS in operation nationwide.

🌍 Revolut integrates Polygon for payments, trading, and staking, processing $690m to date. Polygon enables Revolut users to move money across town or across borders with low fees, and seamlessly on- and off-ramp. Read more

🇬🇧 It's official: Curve is joining forces with Lloyds Banking Group. Curve says its new partnership will allow it to scale faster and bring its smart money-management tools and unified multi-card control to more users. The collaboration is a natural next step that strengthens its ability to build new features, expand its reach, and help people better manage their finances.

🇬🇧 Liverpool FC welcomes PayPal as the Club's official digital payments partner. Through this collaboration, LFC and PayPal will collaborate on initiatives that elevate the profile of LFC Women and expand grassroots football programmes through LFC Foundation, helping to nurture the next generation of talent and grow the game at all levels.

🌏 Hex Trust and Fireblocks partner to strengthen regulated digital asset custody offering in Asia and the Middle East. Institutions onboarding via Fireblocks gain a unified regulatory entry point, combining Fireblocks’ enterprise-grade infrastructure with Hex Trust’s regulated presence and custody services.

🇺🇸 Félix collaborates with Mastercard to accelerate U.S. to Latin America remittances. By integrating Mastercard’s global payment infrastructure with Félix’s technology platform, the collaboration will streamline the remittance process, reduce friction, and enhance trust across borders.

🌎 dLocal joins Circle Payments Network to power stablecoin payouts. Powered by Circle, CPN connects financial institutions to enable real-time settlement of cross-border payments. With dLocal’s deep infrastructure integrated, CPN participants can seamlessly disburse funds in local currencies across key emerging markets.

🇺🇸 Grasshopper has partnered with Narmi to roll out the next stage of their Model Context Protocol (MCP) server deployment. The MCP server now includes new read-only endpoints, supporting safe, regulated use of artificial intelligence within financial systems.

🇺🇸 Paysecure and Approvely partner to strengthen U.S. payment processing and risk management. By integrating with Approvely, Paysecure gives its clients the flexibility to optimize acceptance, reduce costs, and expand into new markets with confidence.

🇺🇸 Intuit inks $100M OpenAI deal to bring apps to ChatGPT. It will let users ask ChatGPT to calculate their tax refunds, consider credit options, reconcile books, send reminders about an unfinished invoice, or compose marketing e-mails, with systems that pull from a customer’s authorized data for grounded responses and to complete tasks.

DONEDEAL FUNDING NEWS

🇺🇸 Kraken raises $800 million to advance its strategic roadmap. With this additional capital, Kraken will continue scaling its global operations, deepening its regulated footprint, and expanding its product suite, both organically and through targeted acquisitions.

🌍 Crypto-banking-FinTech Deblock secures €30m Series A. The funding will support Deblock’s dual strategy of strengthening its position in France while expanding into Germany, its second core European market. The expansion will include building a local team and localising product features, including full German-language customer support.

🇬🇧 FinTech brand Keyzy £130m secures funding to grow rent-to-own platform. The investment will enable Keyzy to expand its portfolio by 250-plus homes across Greater London by 2027, specifically targeting young professionals and key workers. Keep reading

🇺🇸 Chargeflow raises $35 million to fight the surge in transaction denials. Chargeflow has built a merchant network of 15,000 clients, enabling the company to cross-reference data and provide deeper insights into customer behavior. Read more

🇬🇧 Octopus-backed Dost launches in UK with £6m round. The FinTech, which automates financial document processing and supplier management for mid-market enterprises, has completed a pilot phase working with UK enterprise customers across manufacturing, construction, logistics, and automotive.

M&A

🇰🇷 Naver to confirm plan to acquire crypto exchange operator Dunamu at board meeting next week. Naver is said to be pushing for a comprehensive stock swap through its FinTech subsidiary, Naver Financial, to make Dunamu a wholly owned subsidiary, a move aimed at expanding its business in the digital finance sector.

MOVERS AND SHAKERS

🇺🇸 Adyen US Executive Davi Strazza exits. The departing executive noted the company’s growth during the decade-plus that he’s been at Adyen, citing an increase in headcount from about 200 to 4,500 employees; a jump in annual processed volume to $1.3 trillion, from $30 billion; and a surge to $2 billion in annual net revenue, from $100 million.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()