Klarna’s Losses Double Amid Rising US Consumer Strain

Hey FinTech Fanatic!

Swedish BNPL giant Klarna reported a Q1 net loss of $99M, more than double last year’s $47M, as loan defaults surged, a red flag tied to weakening U.S. consumer health.

Credit losses reached $136 million (up 17% YoY), driven by declining consumer confidence and macroeconomic pressure, including Trump-era trade tensions that have fueled inflation fears. Klarna’s deep U.S. push, via partnerships with Walmart, DoorDash, and eBay, now exposes it to American economic risks, prompting the FinTech to pause its planned NY IPO.

Still, Klarna is leaning into flexibility: “83% of our loan book refreshes within three months,” the company said, allowing it to react swiftly to market shifts.

Despite the loss, revenues rose 13% year-over-year (YoY) to $701 million, with 99 million active users. Klarna also cut costs by investing heavily in AI, even using an AI-generated avatar as its CEO to present earnings. Over the past two years, it has reduced headcount by 39%, with customer service costs down 12% year-over-year.

However, rising funding costs (+15% YoY to $130M) remain a concern as Klarna navigates rapid growth amid economic turbulence.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

P.S.: Before diving into today's news, I wanted to highlight a great opportunity for FinTech Marketeers: Mollie, one of the most exciting FinTechs (and my neighbors here in Amsterdam), is hiring. I can highly recommend applying here. You'll be in great hands with Jacqueline Rutgers 😉

SPONSORED CONTENT

The true cost of paying a $50K contractor.

Why hiring a contractor for $50,000 could actually cost you much more. Learn how hidden currency fees, payment methods, and taxes quietly eat away at your budget, adding an additional $100,000 if you pay 50 contractors.

How confusing tax rules and employee classification mistakes can turn a simple contract into a legal mess, including penalties or being forced to treat the contractor like a full-time employee.

A country-by-country breakdown showing how much money contractors actually take home.

Which countries are the best (and worst) places to hire contractors, based on what they really earn, how complicated the laws are, and what it costs you overall.

FINTECH NEWS

🇦🇪 Ripple builds on Dubai regulatory license to announce Zand Bank and Mamo as the first blockchain-enabled payments clients in the UAE. This functionality enables Ripple to manage payments end-to-end on behalf of its customers and settle payments in a matter of minutes, reducing time and friction.

🇮🇳 PhonePe’s 5% dilemma: Payments still dominate revenue as it gets IPO-ready. The company’s revenue still relies heavily on its payments business, while financial services contribute only a small portion. The insurance arm is growing, and the credit segment remains in its early stages.

🇺🇸 CFPB slashes Wise penalty. The U.S. FinTech must pay the bureau $45,000 and roughly $450,000 in redress to affected customers, a far cry from the $2.5 million penalty issued. A CFPB probe found that Wise misled customers in the U.S. about its ATM fees and failed to refund remittance fees in the required timeframe.

🇺🇸 Klarna’s losses widen after more consumers fail to repay loans. The company, which makes money by charging fees to merchants and consumers who fail to repay on time, said its customer credit losses had risen to $136mn, a 17% year-on-year increase.

🇺🇸 Circle pursues IPO, but talks with Coinbase and Ripple could mean a sale. There is a chance, though, that Circle’s IPO won’t come to fruition since the company has recently taken part in informal talks to sell itself to Coinbase Global or crypto payments company Ripple.

🇬🇧 iFOREX confirms London IPO plans, seeks £5m raise at £50m valuation. The offering will consist solely of new shares and target both institutional and retail investors, with the latter participating via the Bookbuild platform. The listing marks the latest fintech to test investor appetite in a subdued UK IPO market.

PAYMENTS NEWS

🇬🇧 UK to regulate ‘buy now, pay later’ lenders in legal overhaul. Under the rules, lenders such as Klarna and Clearpay will be required to check shoppers’ affordability before offering loans, while borrowers will be able to make complaints to the Financial Ombudsman.

🌍 Nuvei joins the European Payments Initiative to launch Wero for e-commerce. Nuvei's merchant clients will gain early access to this swiftly expanding European payment solution through their existing single integration with Nuvei's core payments platform.

🇮🇳 Paytm adds 'Hide Payment' feature to help users keep transactions private. While the 'Hide Payment' feature doesn’t allow deletion of any transaction, it enables users to temporarily remove specific payments from plain view within the Paytm app. Read more

REGTECH NEWS

🇦🇪 Mashreq and Clari5 to debut AI-powered Clari5 Genie. The platform is designed to help banks proactively manage fraud by using Gen-AI to uncover hidden patterns, simulate fraud investigations, and accelerate resolution, all within a secure, on-premise deployment.

🇩🇪 Germany’s BaFIN grants crypto license to Trade Republic amid slow MiCA rollout. The firm is now authorized to custody crypto assets, execute orders, receive and transmit orders, and provide crypto transfers on behalf of clients, throughout the 30 European Economic Area (EEA) countries.

DIGITAL BANKING NEWS

🇫🇷 Revolut plans to invest €1 billion in France and apply for a license. The watchdog has been pushing the company to get a license to enable better supervision because a large proportion of its European retail customers are located in the country.

🇰🇷 Kbank’s postponed IPO undermines BC Card’s financial soundness. The delayed initial public offering of Kbank is emerging as a stumbling block for BC Card, which is restructuring its revenue model following the departure of key member companies such as Woori Card.

🇬🇧 Bank of London under investigation by UK regulators. The Bank of England’s regulatory arm is looking into its operations over specific historical matters tied to the Bank of London’s operations before a change in group ownership. Read more

🇺🇸 Capital One agrees to pay $425 million to savers who sued. Under the agreement, Capital One pledged to pay $300 million to 360 Savings account holders, based on how much interest they would have earned if they had instead put their money in 360 Performance Savings accounts.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 JPMorgan CEO Jamie Dimon says the bank will let clients buy bitcoin. The decision marks a notable step for the largest U.S. bank, particularly due to Dimon’s history of criticizing the digital currency and the crypto market broadly, and is the latest sign of bitcoin’s entry into mainstream investing.

🇳🇱 European digital assets platform Bitvavo expands MiCA-ready liquidity access to Talos institutional clients. This integration enables asset managers, hedge funds, market makers, as well as brokers, to execute their trading strategies with access to deep euro liquidity with the support of the Talos technology.

🇺🇸 Kraken teases KRAK as mystery post fuels IPO and token tumors. This move comes shortly after Kraken reportedly fended off a major social engineering attack that compromised other platforms like Coinbase. Some observers suggest KRAK could represent the ticker symbol for a long-anticipated initial public offering.

🇺🇸 Coinbase automates 64% of all customer interactions with gen AI. The crypto platform is partnering with Amazon Web Services to deploy AI-powered chatbots for both internal and customer-facing support. Keep reading

🇺🇸 Binance and Kraken are said to have been targets of Coinbase-like hacks. Both digital-asset platforms were able to fend off the attacks without losing customer data. Binance was seeing scammers reaching out to its customer-service agents with bribery offers, and a Telegram handle to contact the culprit with.

🌎 Bybit Gold & FX now supports stock trading. This tool allows users to automatically mirror the strategies of professional traders in the gold and foreign exchange (FX) markets, using USDT as collateral. The feature is designed to make traditional markets more accessible to crypto users.

🇸🇨 KuCoin suspends KuCard service due to maintenance. The suspension is expected to last for approximately 2 hours. The platform has apologized for any inconvenience this temporary interruption may cause and appreciates users' understanding during the adjustment period.

PARTNERSHIPS

🇬🇧 UK lender Aldermore Bank in mortgage upgrade with Finova. Finova will support this shift by integrating its solution with the hosted environment, enhancing Aldermore's security operations centre, and security information and event management (SIEM) capabilities.

🇫🇷 Fireblocks wins Next Generation digital assets deal. The French company is in the final stages of launching a comprehensive payment ecosystem aimed at bridging traditional finance and digital finance through a unified solution. The kernel will be a new, fully MiCA-compliant stablecoin, pegged to the EUR.

🇺🇸 No card filling required as Etsy brings instant bank payments to US buyers in partnership with Stripe. Brian Gallagher, Staff Product Manager at Etsy, explained that the new feature allows shoppers to securely connect their bank account during checkout, offering a streamlined purchasing experience without the need to manually enter card details.

DONEDEAL FUNDING NEWS

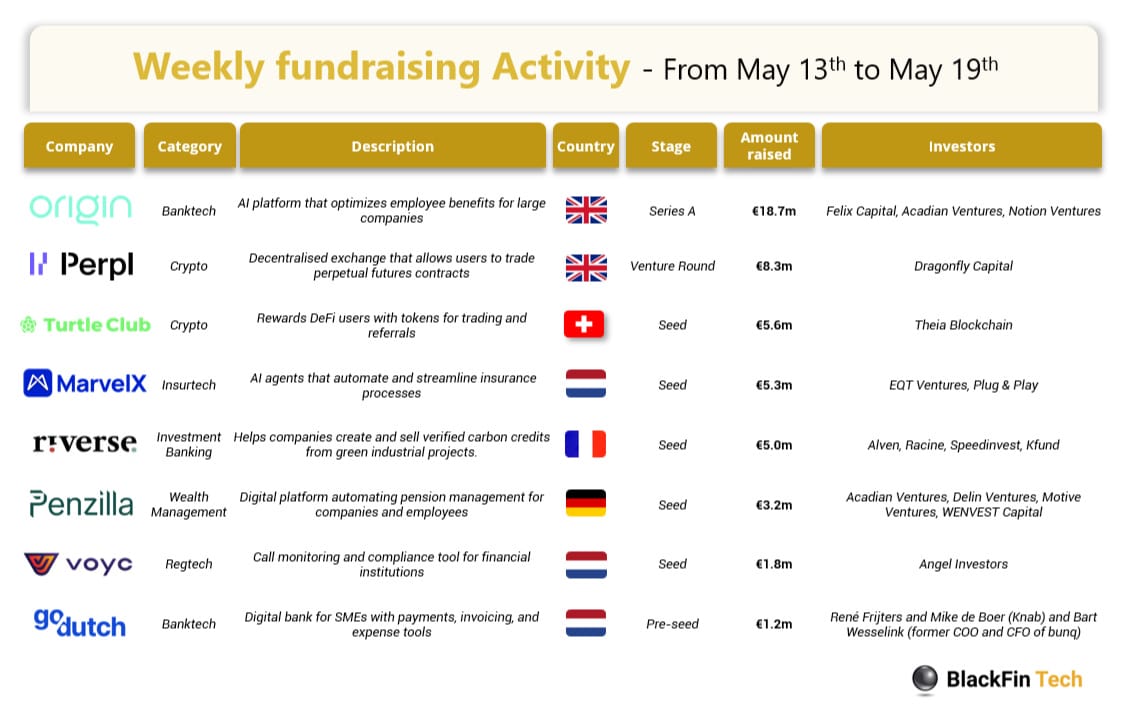

💰 Over the last week, there were 8 FinTech deals in Europe, raising a total of €48.1 million in equity, three deals in the Netherlands, two deals in the UK, and one deal each in France, Germany, and Switzerland.

🇪🇬 Thndr unveils new products and USD 15.7m at Egypt’s first FinTech Keynote. Thndr is officially seeking an asset management license in Egypt. That move would allow it to design and run its financial products with no middlemen or repackaged imports.

M&A

🇺🇸 Betterment acquires Rowboat Advisors to accelerate the platform for RIAs. The acquisition strengthens Betterment's technology platform and accelerates its roadmap for delivering sophisticated tools to RIAs through Betterment Advisor Solutions.

🇺🇸 Republic is in talks to acquire Indiegogo in an all-stock deal. This move aims to expand the Republic’s private market capabilities and revive the crowdfunding pioneer’s global reach. Continue reading

🇨🇭 Etops acquires financial planning software provider Finanzportal24. The wealthtech, which specialises in wealth and asset management technology, says the acquisition of Finanzportal24 will enable the company to provide financial services firms with an "even broader range of integrated client advisory solutions".

🇬🇧 Finastra to sell Treasury and Capital Markets business to Apax Partners. The CEO of Finastra stated that the sale marks a significant milestone as it prepares to enter its next phase with a focused suite of mission-critical financial services software. He noted that the transaction will provide capital to accelerate Finastra’s strategic initiatives and enable reinvestment in its core business.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()