Klarna's IPO Prep Faces Shareholder Debate & Apple's Latest Fintech Move

Hey FinTech Fanatic,

As Klarna approaches its Initial Public Offering (IPO), a debate has emerged among its shareholders regarding the potential for enhanced governance rights for foundational investors.

The discussion centers on a proposal that would afford certain investors more substantial control and rights than those associated with standard shares. This move aims to solidify the decision-making power of key stakeholders before the company goes public.

Despite the proposal's intentions, it has sparked controversy among the company's original founders and major investors.

Notably, Victor Jacobsson, a co-founder who has since parted ways with Klarna, has expressed opposition to the idea of granting special privileges to specific individuals, pointing to potential conflicts within the company's leadership.

In response to these concerns, a representative for Sebastian Siemiatkowski, another co-founder and current CEO, emphasized a collective effort to remove any existing preferential treatments in favor of a more unified approach among shareholders.

This stance is part of Klarna's broader strategy as it transitions to a UK-based holding structure, a change announced in the previous November.

The consideration of a dual-class share structure is a strategy seen in other tech companies, such as Meta Platforms, allowing founders to retain control even with a minority economic share.

Siemiatkowski has previously shown support for this model, arguing that it protects the company's long-term vision over short-term financial interests.

To be continued...

Enjoy more industry updates I listed for you below and I'll be back with more tomorrow!

Cheers,

POST OF THE DAY

The B2B Payment & FinTech Startup Landscape👇

Who is missing from this overview?

FEATURED NEWS

Get an inside look at Wise's lobbying efforts to eliminate exchange rate markups as a "junk fee" in international payments. How could a change in US presidents affect the regulation of international payments? Read more to find out in this great article from Adam Willems at Financial Revolutionist.

FINTECH NEWS

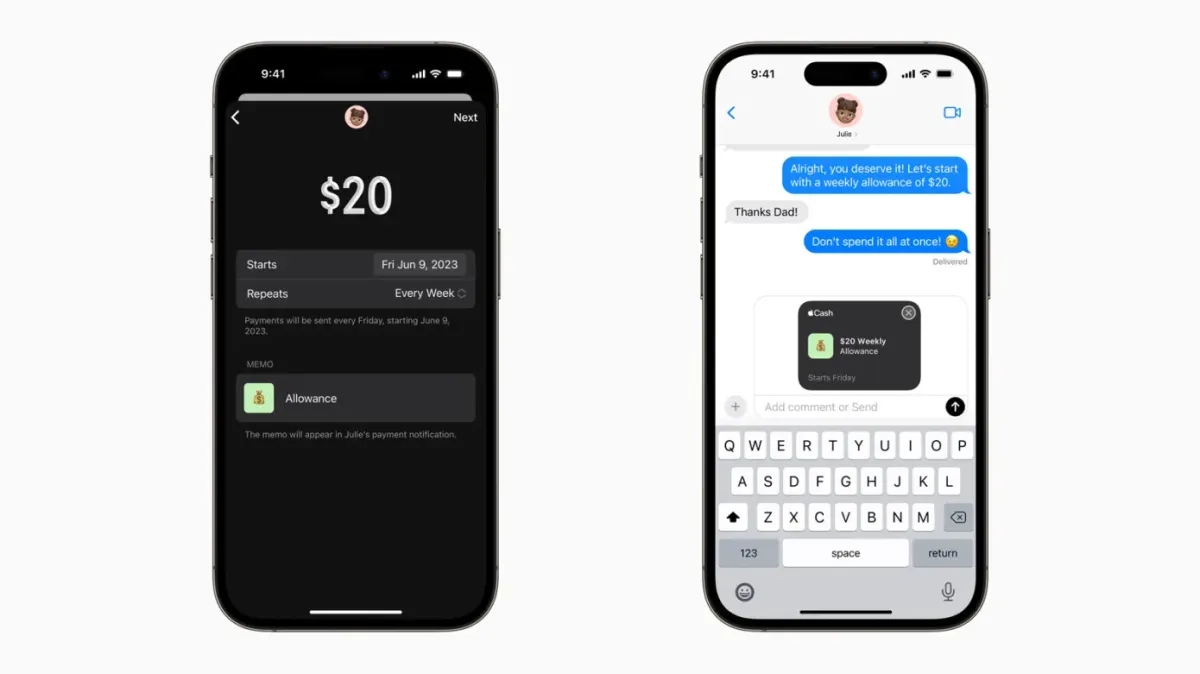

Apple releases a new API to fetch transactions from Apple Card and Apple Cash. Apple’s iOS 17.4 update is primarily about adapting iOS to EU’s Digital Market Act Regulation. But the company has also released a new API called FinanceKit that lets developers fetch transactions and balance information from Apple Card, Apple Cash and Savings with Apple.

🇦🇺 RentPay partners with Novatti to provide Alipay, WeChat Pay and UnionPay payment options for RentPay customers. “RentPay is about providing choice and flexibility to renters while ensuring that property managers gain efficiency and certainty of payments,” said Rent.com.au CEO, Greg Bader. Read on

🇨🇭 Arf, a global transaction services platform at the intersection of Web3 and traditional finance, announced that it has surpassed $1 billion in onchain liquidity volume to support global payments. This milestone underscores Arf's category-defining leadership with its unique blend of blockchain-powered solutions for global financial institutions.

🇦🇪 Mastercard and First Abu Dhabi Bank (FAB), the largest bank in the UAE, have announced an exclusive long-term global partnership, building on their long-standing collaboration, in the EEMEA region. The landmark deal spans four markets – the UAE, Saudi Arabia, Oman, and Egypt – and will see the market leaders join forces to further fuel the region’s digital payments ecosystem.

🇳🇱 Dutch trading platform Coinmerce acquires majority stake in Amsterdam’s Icoinic to offer alternative to Bitcoin ETF. Wilhelm Roth, CEO of Icoinic, says, “Together with Coinmerce, we have a unique proposition in the Dutch market. With the capabilities of a tech company, like Coinmerce, we can further improve and expand our products and services. We will reveal more about that soon.”

🇬🇧 Revolut’s U.K. boss says London risks losing its crown as the global center for FinTechs. With Paris and New York competing to host promising finance startups, London is at risk of a growing drift of workers away from the city, according to Francesca Carlesi, who joined Revolut as UK boss in December.

PAYMENTS NEWS

🇺🇸 Elon Musk says X could soon receive money transmitter licenses from New York and California. The license from California could come in the next month or so, while New York’s approval may be “a few months away,” said Musk, whose comments Wednesday at the Morgan Stanley technology, media and telecom conference were reported by Reuters.

🇳🇿 Kiwibank has successfully gone live with ACI Worldwide’s Enterprise Payments Platform, a managed cloud solution that will process all of Kiwibank’s account-to-account real-time payments. Working with ACI to move its infrastructure to the cloud provides Kiwibank access to cutting-edge technology at scale to streamline operation of multiple, and growing, payments services.

🇸🇬 Singapore will be the first country to get the Wise scan-to-pay feature, with other markets to follow. The process is much like other multi-currency payment apps. Funds will be deducted from a customer’s Wise account – either directly from his Singapore dollar balances, or converted from other currencies at the mid-market rate.

OPEN BANKING NEWS

🇲🇽 Prometeo revolutionizes the Mexican market with the launch of account to account payments, an embedded solution for businesses to receive payments. 'Account to Account Payments,' a financial product launched by Prometeo in the country, enables real-time money transfers, without friction and with greater efficiency for businesses and companies.

🇧🇭 Tarabut streamlines open banking onboarding at BENEFIT, introducing a new consent authentication method to streamline Bahrain's Open Banking ecosystem. The partnership will enhance customer experience by eliminating the scattered customer journeys typified by the need to switch between notifications and bank apps.

REGTECH NEWS

🇺🇸 Airbase and Sardine come together to combat payment and vendor fraud. This strategic collaboration with Sardine underscores Airbase’s commitment to safeguarding customer finances and reinforces its standing as a trusted spend management platform. Read more

DIGITAL BANKING NEWS

🇬🇧 Digital bank Bunq has relocated its deputy chief financial officer to London to lead its UK expansion drive. The company has appointed Parvinder Bhatia to a new role as UK country lead, a spokesperson told Financial News. Bunq, which has more than 11 million users in Europe, is returning to the UK market three years after quitting in late 2020 over Brexit.

🇺🇸 Edwards Federal Credit Union selects the Apiture digital banking platform. As part of a larger digital transformation effort, Edwards FCU sought a highly reliable, feature-rich mobile app and online banking solution to better serve existing members and support continued growth.

🇬🇧 Nationwide Building Society has reached a preliminary agreement to buy Virgin Money in a £2.9bn deal that would bolster its ability to challenge the UK’s big four banks. The acquisition would allow Nationwide to move into business banking after an aborted attempt during the pandemic and also expand its share of the mortgage market.

🇭🇰 Mox Bank Limited has launched Express Remit, powered by Wise Platform, a hassle-free global money transfers service that allows Mox customers to transfer money internationally anytime, from their Mox app. Customers can send money in ten currencies at mid-market rates with transparent fees, all with a few clicks.

🇺🇸 JPMorgan pursued Discover deal before Capital One’s $35bn offer. Talks show largest US lender’s appetite for a payments network to support its credit card business. “This would’ve been a truly company-changing deal,” said one of the people familiar with the talks between JPMorgan and Discover.

🇦🇺 Avenue Bank chief executive Peita Piper says a $17 million capital raise will give the nation’s newest bank enough cash to survive into the foreseeable future after its own directors warned that there was “material uncertainty” over business’ success. Avenue burned through nearly $8.7 million in the year ended last June 30, financial filings show, pressuring on its remaining cash facilities.

🇲🇽 Argentine FinTech company Ualá, aims to achieve profitability in Mexico by January 2026, approximately five years after its entry into the country in September 2020. Currently, Ualá has over a million users in Mexico and sets a goal to surpass five million within the next two to three years.

BLOCKCHAIN/CRYPTO NEWS

It’s not a joke: Binance has debuted a limited-edition perfume, called ’Crypto’ in an effort to attract women into the crypto industry ahead of International Women’s Day 🤯 The new scent “is blending finance with fragrance,” the company wrote in a press release.

🇺🇸 Binance US laid off 2/3 of staff in wake of SEC lawsuit, revenue plunged 75% after ‘near-mortal blow’. In a deposition from December recently released, Binance US COO Christopher Blodgett revealed that the company has been forced to lay off more than 200 employees, or two-thirds of its workforce, since June as a result of the SEC’s action.

🇪🇸 Sam Altman’s Eye-Scanning Worldcoin Venture blocked in Spain. The country banned Sam Altman’s Worldcoin from scanning people’s eyes in exchange for cryptocurrency tokens, citing concerns over the collection and processing of biometric data.

M&A

🇫🇷 French FinTech unicorn Qonto acquires Regate. Qonto, the Paris-based business banking startup still has hundreds of millions of cash on hand. And it is using an undisclosed portion of its cash reserve to acquire Regate, an accounting and financial automation platform.

🇨🇴 Infinity Capital, a cybersecurity and blockchain firm based in Dubai, UAE, announced the acquisition of Andro, a Colombian FinTech company specializing in blockchain infrastructure. Infinity Capital absorbs the brand and technology, along with an eight-month commitment to support Andro's talent in adapting the technology to its services.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()