Klarna’s CEO Warns AI Job Losses Are Coming, Do You Agree?

Hey FinTech Fanatic!

A few days ago, I read an interview with Klarna CEO Sebastian Siemiatkowski, and he didn’t hold back.

While many tech leaders keep saying AI will create more jobs than it replaces, Siemiatkowski warns that the short-term impact could be far more painful.

Klarna itself has already cut its workforce from 7,400 to 3,000 after going all-in on AI across support, product, and operations.

In this interview, Sebastian Siemiatkowski warned that a massive shift is coming for knowledge workers. He pointed to jobs like translators in Brussels, which he says AI can already handle better, faster, and cheaper.

His point? Society keeps talking about the long-term benefits of AI, but few are acknowledging the short-term pain.

Do you agree with Siemiatkowski? Are we underestimating how deeply AI could reshape FinTech jobs?

And which roles are under threat specifically?

Let me know what you think! hit reply or drop it in the comments below 👇

Cheers,

#FINTECHREPORT

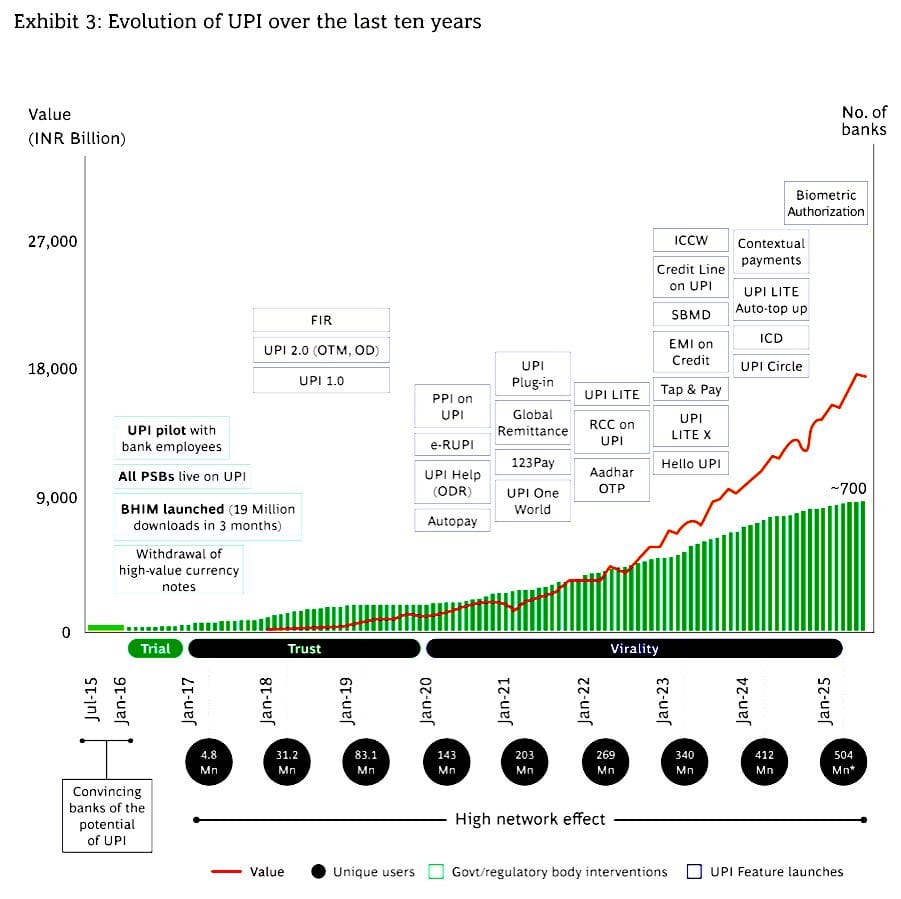

🌍 UPI: The Global Benchmark for Digital Payments.

FINTECH NEWS

🇸🇪 Stockholm is coming back strong! 🏃 After a 4-month pause, our energetic host Ihor Harkusha is back with new routes and ready to build more network in the heart of the city🧡 Join us on October 18th!

🇺🇸 PayPay's valuation could exceed $20 billion in its planned December US IPO. SoftBank is preparing to take Japanese payments app operator PayPay public in the U.S. as early as December, with investors expecting a valuation that could exceed 3 trillion yen ($20 billion).

🇬🇧 Shawbrook looks to raise over £50M in November IPO. The company is targeting a listing in early November 2025 and expects to raise £50m in net proceeds through new shares. The IPO will be offered to qualified institutional buyers internationally and to retail investors resident in the United Kingdom through a partner network with RetailBook.

PAYMENTS NEWS

🇺🇸 Mastercard Payment Optimization Platform uses the power of data to drive more approvals. POP is designed to improve approval rates for merchants using data to make intelligent decisions about transactions. Mastercard continues to roll out POP with Adyen, NEOPAY, Tap Payments, and Worldpay, which will use the service to provide an optimal payment experience.

🇧🇷 Automatic Pix is now mandatory for payments to unauthorized institutions. Starting last Monday (the 13th), the use of Automatic Pix will be mandatory for debit transactions between different banks where the recipient is a legal entity or an entity not authorized to operate by the Central Bank (BC).

🇦🇪 Payments FinTech Capitalixe opens in Dubai. Lissele Pratt, Co-Founder of Capitalixe, emphasized that Capitalixe’s presence in Dubai allows the company to build trust through face-to-face interactions, accelerating client onboarding and enabling the delivery of reliable multi-currency banking solutions for businesses in these rapidly growing sectors.

🇬🇧 Paysend launches Instant Global Transfers. The new instant global transfer service is designed to be the fastest and simplest way to send and receive money across borders. This new service is powered by real-time global peer-to-peer (P2P) payments, allowing instant money transfers between individuals anywhere in the world using nothing more than a smartphone.

🇺🇸 Walmart announced a partnership with OpenAI that lets customers shop and check out directly within ChatGPT. Through this integration, customers can plan meals, restock essentials, or find new products by chatting with the system, and Walmart will handle the transaction from start to finish.

REGTECH NEWS

🇦🇪 Wise secures final approval from the Central Bank for stored value facilities and retail payment services licenses in the UAE. Wise has received licence approvals from the Central Bank of the UAE for Stored Value Facilities and Retail Payment Services, marking a key milestone in its plans to expand services to personal and business customers.

🇦🇪 Crypto.com granted in-principle approval to settle Dubai government payments in stablecoins. It brings the exchange a step closer to processing stablecoin and dirham payments for Dubai government services. The approval allows the exchange to expand into regulated digital payments in the region once final authorization is granted.

🇸🇬 Hong Kong's Reap secures MPI license from MAS. The firm said in a statement that the license authorizes Reap Singapore to provide regulated services under the payment services, namely account issuance service, domestic money transfer service, and cross-border money transfer service.

DIGITAL BANKING NEWS

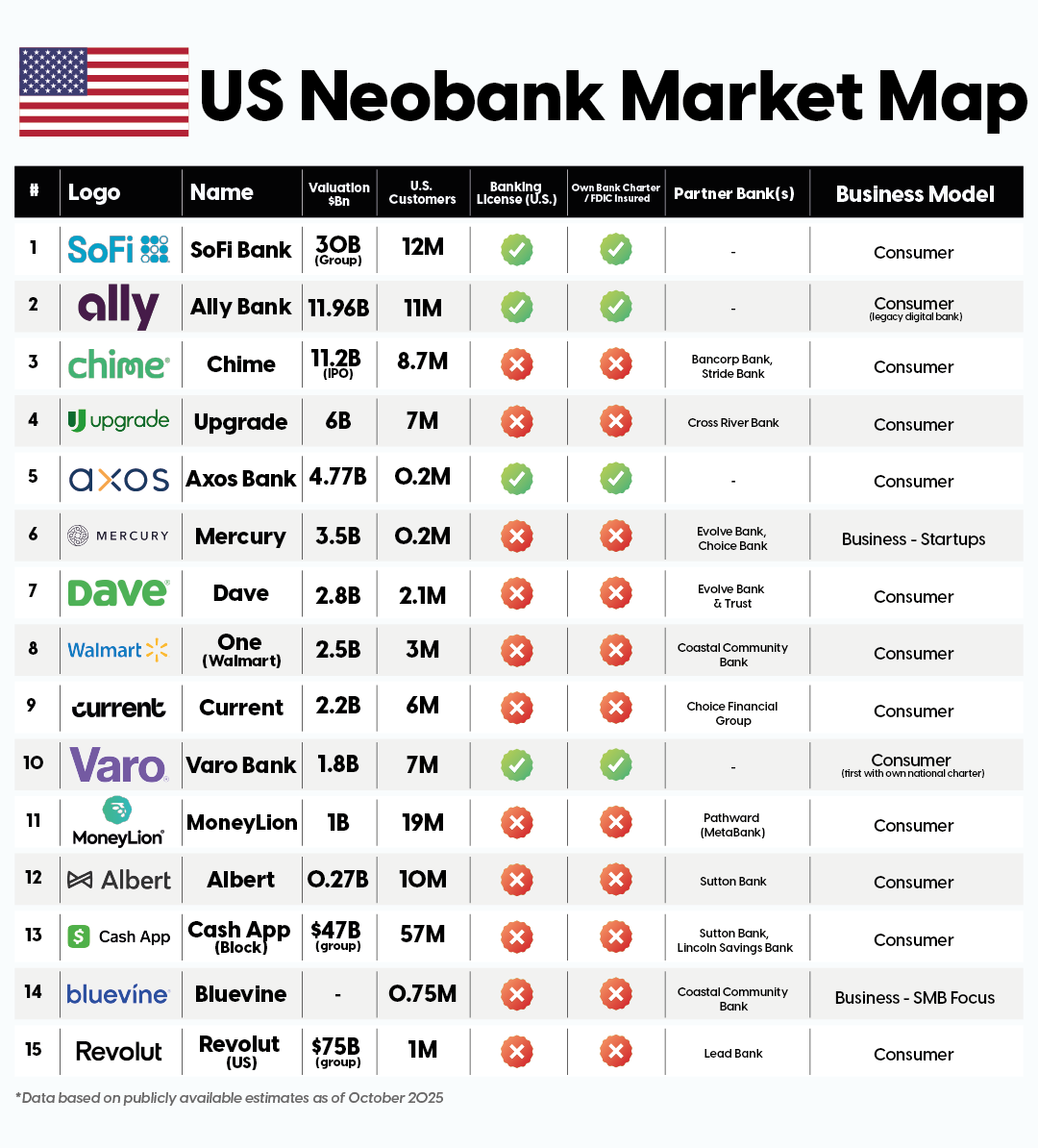

🇺🇸 How long before Revolut and Nubank crash this list?

🇬🇧 Revolut’s full UK banking licence held up by concerns over global risk controls. Revolut was approved for a UK banking licence in July 2024 after a three-year wrangle with regulators, but remains subject to restrictions during a mobilisation phase. A full banking licence would allow Revolut to enter the lucrative UK lending market, putting to work its significant customer deposits.

🇱🇹 Tide establishes tech centre in Lithuania to support global growth. Tide is planning to employ an additional 60 - 70 full-time professionals over the next 3 years, focusing on backend and mobile development in remote-first positions, with an office in Vilnius.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Bridge, a subsidiary of Stripe, has applied to the Office of the Comptroller of the Currency for a charter to become a national trust bank. This move would enable Bridge to operate under a unified federal framework aligned with the GENIUS Act. If approved, the bank would offer services including custody, stablecoin issuance, and management of stablecoin reserves.

🇸🇪 Safello is granted authorization under MiCA. The authorization covers a broad range of services, including the transfer, custody, and trading of crypto-assets, as well as the execution and transmission of orders, and the exchange of crypto-assets for both funds and other crypto-assets. This marks a significant regulatory milestone for Safello as it strengthens its position in the European crypto market.

🇰🇷 Binance eyes full re-entry into South Korea following Gopax executive review. South Korea resumes review of Binance’s Gopax acquisition, potentially allowing the crypto giant to re-enter the market by late 2025 amid AML compliance improvements.

🇩🇰 Lunar received a MiCA license for crypto services. With the new MiCA license, Lunar now operates under the EU’s first comprehensive regulatory framework for digital assets, offering users stronger protections, clearer rules, and a fully regulated crypto trading experience.

PARTNERSHIPS

🇬🇧 Ecommpay and Hyvä collaborate to tackle up to 70% cart abandonment rate. The unique combination of Hyvä’s lightweight, high-performance Magento checkout with Ecommpay’s robust global payments platform aims to deliver a better user experience and higher conversions, giving merchants a strategic advantage.

🇬🇧 Checkout.com partners with HelloFresh to power global digital payments. The collaboration will help HelloFresh simplify and optimise its payments across all of its global markets, making it easier than ever for customers to enjoy fresh, home-cooked meals. Through this partnership, HelloFresh will benefit from Checkout.com’s global presence and local acquiring expertise in every market it operates.

🇩🇪 Salt Bank launches investment offering with Upvest. With Upvest’s Investment API, Salt Bank provides a fully integrated and seamless trading experience. The new service enables end users to buy and sell securities with transparent fees, directly within their mobile banking environment.

🇬🇧 Monzo simplifies Making Tax Digital with a built-in tax filing tool, powered by Sage. The tool is designed to help sole traders and landlords comply with the upcoming Making Tax Digital for Income Tax legislation. Also enables banks, FinTechs, and software platforms to seamlessly build accounting and other capabilities directly into their products.

🇮🇳 Breeze by Juspay and super.money announces checkout partnership to serve 500M+ shoppers. With this, brands can tap into a high-intent, high-conversion audience with frictionless checkout flows, seamless reward experiences, and a logistics optimisation suite.

🇳🇱 Adyen first to market with launch of SAP’s open payment framework, streamlining payment setup for retailers. This new payment solution is designed to eliminate manual payment integrations and streamline the setup and payment service providers. The Open Payment Framework allows retailers to accelerate time to market with fully integrated e-commerce payment capabilities.

🇧🇭 NBB adopts Kinexys by J.P. Morgan solution to pioneer programmable payments in the region. NBB will leverage Kinexys Digital Payments (KDP) to deliver real-time programmable payment capabilities that support more complex, conditional, and automated financial flows.

🇬🇧 Charity Bank to launch savings app powered by Sandstone Technology. According to Sandstone, the new offering will include enhanced self-service capabilities, robust security features, and a suite of modern tools designed to meet the evolving needs of Charity Bank’s customers and is expected to launch in Spring 2026.

🇮🇳 ComplyAdvantage and Google Cloud tackle India’s data localisation rules. The partnership aims to launch a new hosting region in India, directly addressing the need for compliant infrastructure among FinTechs and Financial Institutions (FIs) expanding into one of the world’s fastest-growing digital economies.

🇨🇦 Nuvei supports Visa Trusted Agent Protocol to advance agentic commerce. Nuvei's integrated payments ecosystem, aligned with Visa Intelligent Commerce, is designed to help merchants adopt agent-driven payments seamlessly, moving beyond legacy checkout models dependent on human interaction or virtual card numbers.

DONEDEAL FUNDING NEWS

🇬🇧 From Nutmeg to Clove, a New investing service lands £10M funding. The company said it plans to use the funding to build its platform and team of advisers, and to complete a full launch in 2026, once authorisation is granted by the Financial Conduct Authority.

🇺🇸 Glide Identity raises over $20M Series A to provide AI-safe, agent-ready authentication. Glide's technology replaces vulnerable one-time passwords with SIM-based cryptographic authentication that cannot be phished, intercepted or socially engineered.

🇰🇪 Kenyan FinTech Zanifu secures undisclosed investment from UAE-based Yango Group. The undisclosed deal will see Yango Group provide not only capital but also strategic support, leveraging its operational experience in over 30 markets to help shape Zanifu’s long-term business structure and growth.

🇬🇧 Ryft secures Series A Follow-on Investment from Ingenii VC and Pembroke VCT. With the launch of our omni-channel payment platform, Ryft will enable businesses operating online and in-store to efficiently process, manage, and monetise payments at scale in a secure and compliant way.

M&A

🇩🇪 Revolut acquires AI travel agent startup Swifty, incubated at Lufthansa Innovation Hub. This acquisition complements Revolut’s development of its AI financial assistant, building on the lifestyle offering. Swifty's AI agent is designed to autonomously handle the entire travel booking process through a simple conversational interface.

MOVERS AND SHAKERS

🇬🇧 Ruwani Hewa appointed director of payments at Starling Bank. Hewa says she will focus on the relaunch of Starling Banking Services as one of her initial priorities. She adds that this effort will look towards helping regulated firms access Faster Payments/Bacs and issue safeguarded and client money accounts under CASS.

🇧🇪 Ebury appoints Andy Dierens as the New Country Manager in Belgium to drive the next phase of growth. Andy will lead Ebury’s Belgian operations, set the strategic direction, deepen relationships with Belgian businesses with international growth aspirations, and drive the next phase of growth.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()