Klarna's AI Revolution: 700 Jobs Automated, Losses Cut by 76%, Preparing for a $20 Billion IPO

Hey FinTech Fanatic!

Klarna, the Stockholm-based FinTech, has dramatically reduced its net losses by 76% in 2023, positioning itself for a high-profile IPO valued at $20 billion. This is a notable turnaround from a peak valuation of $45.6 billion in 2021 to $6.7 billion later.

The company ended the year with a net loss of 2.5 billion kronor ($245 million), despite a 22% revenue increase to 23.5 billion kronor ($2.3 billion), largely fueled by its expansion in the US, now its largest market.

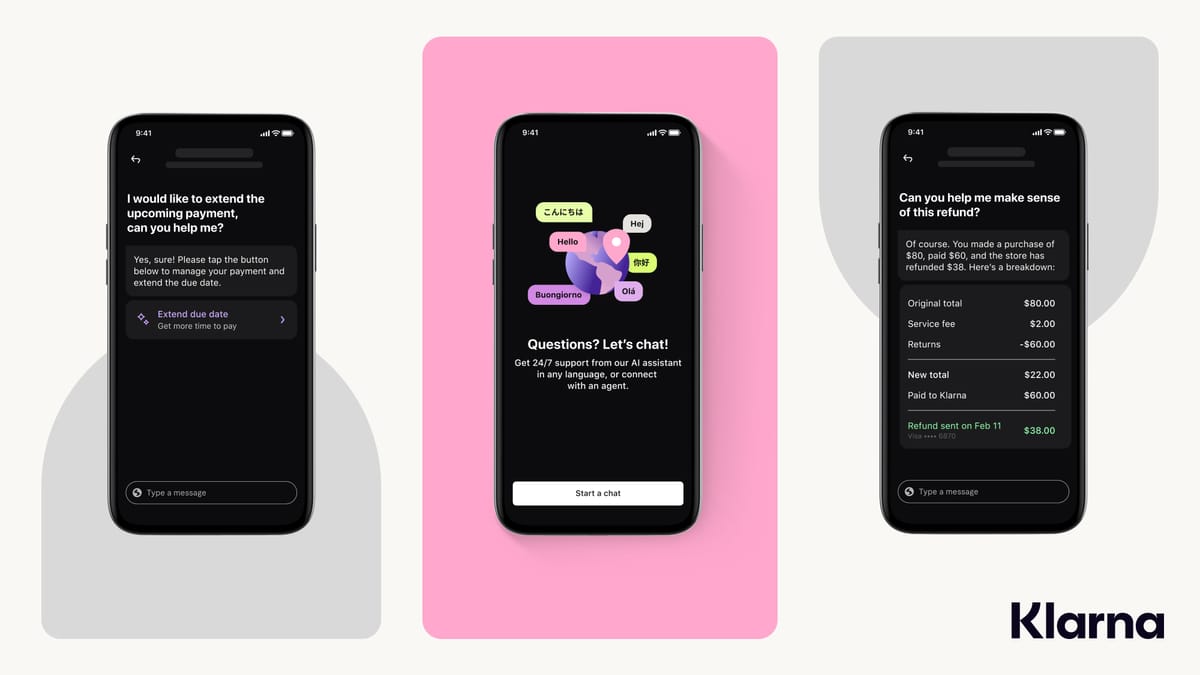

In parallel, Klarna launched a pioneering AI assistant, powered by OpenAI, achieving significant operational efficiency and customer satisfaction.

This assistant managed 2.3 million conversations in its first month, effectively doing the work of 700 full-time agents and reducing inquiry resolution time from 11 minutes to under 2. Klarna's CEO, Sebastian Siemiatkowski, highlighted the AI's role in enhancing customer service, noting its ability to communicate in over 35 languages across 23 markets, which has notably improved interactions with local immigrant and expat communities.

This AI initiative is part of Klarna's vision to streamline retail banking and enhance the financial health of its 150 million consumers worldwide. As Klarna prepares for its IPO in Q3 2024, the integration of such advanced technology underscores its commitment to innovation and market leadership in the FinTech industry.

Meanwhile, Stripe is providing its employees an opportunity to sell over $1 billion of their stock, reflecting the company's ongoing decision to delay going public.

In a recent agreement involving Stripe and some of its investors, shares from both current and former employees will be purchased, setting Stripe's valuation at $65 billion. This marks an increase from last year's $50 billion valuation, yet remains below the peak $95 billion valuation in 2021.

Investors in this deal include Sequoia Capital and the growth equity fund of Goldman Sachs, suggesting that Stripe's IPO may be postponed until at least 2025.

Enjoy more industry updates below, and I'll be back in your inbox tomorrow!

Cheers,

ARTICLE OF THE DAY

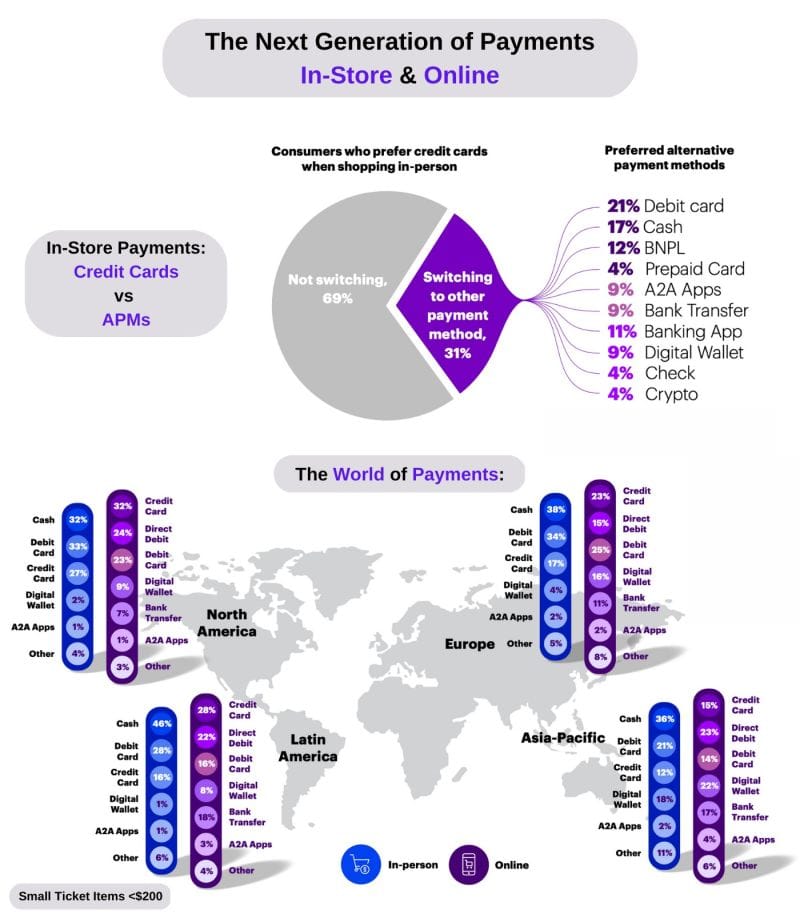

The world of Payments keeps evolving. The Next-Gen payment methods are here.

Read all about this in my latest Payments Newsletter Colab with Arthur Bedel👇

BREAKING NEWS

🇺🇸 Investing platform Webull Financial has agreed to list its shares in the United States via a merger with a blank-check firm (SPAC Deal) that values the online trading platform at $7.3 billion: The brokerage, which surged in popularity during the GameStop mania, had previously considered an IPO.

FEATURED NEWS

🇸🇬 Pav Gill, the whistleblower who helped demolish German payment processor Wirecard, has launched a new platform for employees and shareholders to express their concerns over corporate missteps without fear of retaliation or exposure. More on that here

INSIGHTS

🇸🇪 Klarna narrows full-year losses ahead of expected IPO. Klarna shrank its net losses 76% in 2023 as the buy-now-pay-later firm makes preparations for one of the biggest IPOs of the year at a $20 Billion Valuation. Read more

FINTECH NEWS

🇧🇭 Bahrain's EazyPay joins forces with Visa. This first-of-its-kind collaboration in Bahrain marks the initial deployment of Visa Direct Account Funding Transaction (AFT) solution within the nation, empowering consumers with seamless and secure fund transfers to accounts both within Bahrain and across the globe.

🇩🇪 The family-focused Berlin FinTech Bling and Telekom partner to launch mobile phone plans: "Bling Mobile". Bling's venture into mobile communications taps into the rising popularity of e-SIMs, providing users with seamless connectivity options. This strategic shift also addresses the changing dynamics within the FinTech sector.

🇺🇸 Marqeta and AffiniPay unveil new SMB credit card. AffiniPay selected Marqeta because of its trusted platform for building card programs at scale that are dynamic, flexible and tailored to customer needs. Access the full article here

🇺🇸 Robinhood unveils retirement plans for Gig workers, bridging financial security gap. Robinhood introduces a groundbreaking retirement plan for gig economy workers, offering crucial financial security to those traditionally left out of retirement savings options. This initiative has the potential to revolutionize how independent workers plan for their financial futures.

🇱🇹 Accel-backed FinTech Kevin failed to pay staff for two months, say sources. Current and former employees tell Sifted they are disheartened about how the situation has been mishandled: Five current and former staffers said that kevin did not pay salaries to some of its employees for as long as two months as it battled to secure additional funding from investors.

PAYMENTS NEWS

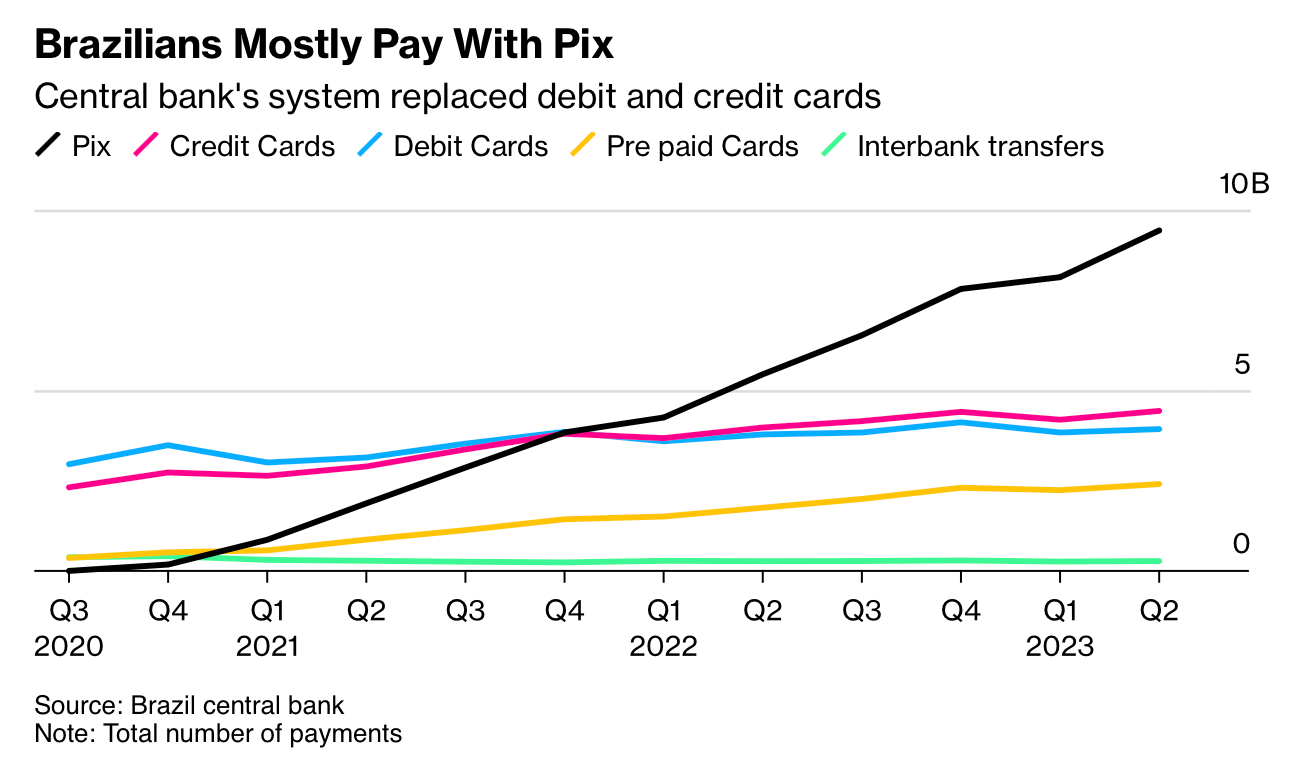

🇧🇷 Brazil’s instant payment system has quickly become a hit at home, with more than 160 million users since it was launched by the central bank in late 2020. Now the plan is to take it global:

🇨🇴 ACI Worldwide partners with Kuvasz solutions to advance real-time payments adoption in Colombia. The partnership will serve as a model for future implementations in the region, positioning Colombia as a leader when it comes to real-time payments adoption in Latin America.

🇺🇸 Orum, the simplest API for fast, reliable payments, has announced that it is live with FedACH and will be adding FedNow and FedWire services. The launch of Orum’s new Deliver API allows the innovative FinTech to offer bank-rate pricing and expanded processing windows.

🇫🇷 Worldline predicts slower revenue growth this year due to European consumer spending constraints, causing its shares to drop up to 15%. Despite plans to enhance profitability and reduce costs, Worldline reported a €817mn loss for 2023, largely attributed to a €1.15bn impairment charge related to acquisition revaluation.

OPEN BANKING NEWS

🇺🇸 Dwolla unveils open banking services to empower mid- to enterprise-sized businesses with the functionality they need to offer fast and secure A2A payments through Dwolla’s single API. With Dwolla’s Open Banking Services, businesses can embark on a journey towards more efficient, secure and streamlined A2A payments.

🇬🇧 Uncapped implements Yapily's open banking kit. This collaboration significantly bolsters progress in the financial lending sector and democratises access to capital for online companies. Alongside Yapily, Uncapped is able to provide funding and offer continued support to growing businesses.

REGTECH NEWS

🇬🇧 Themis is introducing a state-of-the-art AI chatbot for its financial crime platform, providing instant assistance and personalised support to users - whenever they need it. This marks the latest advance in Themis’ mission to provide top-quality anti-financial crime software and services, accessibly and affordably.

🇮🇱 AU10TIX, a Regtech FinTech in identity verification and management, launched an innovative Know Your Business (KYB) solution that enables companies to know exactly who they are doing business with and avoid potential financial and reputational losses. Read full article

🇱🇹 Full-scale action against EUR 2 billion money laundering network via Lithuanian financial institution. Eurojust supports a joint investigation team with operations in Italy, Latvia and Lithuania, also tackling EUR 15 million Italian public money fraud.

🇺🇸 Experian Consumer Credit reports to now include Apple Pay Later loan information. Experian® announced it will now include “pay-in-4” BNPL loan information from Apple Pay Later on consumers’ credit reports, making Apple the first major BNPL provider to fully furnish “pay-in-4” loan information and payment history directly to the credit reporting agency.

DIGITAL BANKING NEWS

🇸🇬 Revolut launches Mobile Wallets in Singapore for direct transfers. The company has expanded its suite of services with the launch of the "Mobile Wallets" feature in Singapore, offering customers the capability of transferring money directly to Bangladesh and Kenya.

🇸🇪 Sweden becomes the first non-euro area country to join Tips with its national currency. Swedish market participants are settling instant payments in Swedish kronor in the Eurosystem TARGET Instant Payment Settlement (TIPS), after a successful migration over the past weeks.

🇫🇷 ‘Qonto want to buy the world’: How France’s business banking unicorn is defying the FinTech downturn. The eight-year-old company is still growing fast in a market that’s seeing many competitors crash and burn. The company’s black-and-white logo is stuck on bus stops and escalators across the capital alongside punchy slogans inviting business owners to sign up. More here

🇳🇱 Rabobank successfully completes preproduction trial runs in commercial paper issuance and trading blockchain platform,Ubermorgen, which gives financial market participants instant access to funds through the automated issuance of commercial paper and certificates of deposit, highlighting blockchain's potential for real-time settlement and improved money market analytics.

Backbase, the global leader in Engagement Banking, announced that Alacriti, an innovator in cloud-based payments and money movement services, will integrate its payments hub solution into the Backbase Engagement Banking Platform. Through this partnership, Backbase clients will be able to offer instant payment capabilities to their customers.

BLOCKCHAIN/CRYPTO NEWS

Kraken launches Kraken Institutional, a new umbrella brand for a number of Kraken’s existing products and services aimed at institutions, asset managers, hedge funds and high net-worth individuals. It intends to provide a one-stop shop for innovative and bespoke solutions for the unique needs of Kraken’s institutional client base.

🇺🇸 In a reverse course that no one saw coming, JPMorgan has changed its tune on crypto amid the ongoing Bitcoin surge. Specifically, the institution said, “We see the higher cryptocurrency prices not only sustaining but improving” in a recently issued client note. The standing is in opposition to comments made by JPMorgan CEO Jamie Dimon.

🇺🇸 BlackRock bitcoin ETF trading volume surpasses $1B for second day in a row. Nearly 42.5 million shares of IBIT — worth roughly $1.3 billion — traded on Monday, which was an all-time high for the fund since its launch on Jan. 11. IBIT’s average daily shares traded is about 18.3 million, Yahoo Finance data indicates.

🇺🇸 Bitcoin ETFs hit volume record of $7.6B. As of market close on Wednesday, the ETFs hit $7.6 billion in volume, topping previous records, according to Bloomberg data. The ETFs, which were only approved to start trading in January, have posted high volumes every day so far this week.

DONEDEAL FUNDING NEWS

🇺🇸 Stripe valuation jumps to $65 billion in employee share-sale deal. Employees will get a chance to cash out over $1 billion of stock: Stripe is allowing its employees to cash out more stock as the FinTech giant continues to put off an initial public offering.

🇬🇧 Bank-to-FinTech matchmaker NayaOne raises $4.7 million. NayaOne CEO says the funding is a nod to the opportunity and magnitude of the challenge the firm is tackling in financial services, as more banks seek to catch up on the digital transformation journey by partnering with FinTechs.

SimpleClosure, the startup helping shut down other startups, has raised a $4 million seed round. The company will use the funds to expand the team across engineering, product and go-to-market functions. Click here to get the full article.

🇲🇽 Baubap, a Mexican microloan platform, has raised $120 million in debt financing from SixPoint Capital Management in a pre-Series A funding round. This capital will be used to meet market demand and aim to attract up to 1.4 million new customers, solidifying Baubap's position as a key player in the mobile lending segment in Mexico.

MOVERS & SHAKERS

🇺🇸 Treasury Prime, a BaaS platform backed by FinTech heavyweight QED Investors, has laid off about half the company, multiple sources told Jason Mikula. The move comes amidst ongoing turmoil in the banking-as-a-service space. The firm reportedly has struggled with high churn, leading some potential investors to balk at putting money into the company in the current environment.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()