Klarna's $40M Profit Boost from ChatGPT Adoption & More FinTech News

Hey FinTech Fanatic,

Regrettably, I won't be attending FinTech Week NYC this year, which admittedly leaves me with a sense of missing out. However, this does afford me additional time to curate pertinent news for you. Below, you'll find a selection of today's most compelling FinTech updates that you surely wouldn't want to overlook.

Including some BIG NEWS updates from Mexico. Scroll down and check them out!

Furthermore, I highly recommend participating in an upcoming webinar hosted by Uplinq Financial Technologies. Set your calendar for Wednesday, April 24, from 12 to 1 pm EST (UTC-04:00), as we delve into the critical issues surrounding "Fair and Accessible Credit for Small Businesses and the Impact of AI." This webinar will showcase insights from esteemed speakers:

- Ron Shevlin (Moderator) – Chief Research Officer at Cornerstone Advisors

- Jane Prokop – EVP and Global Head of Small and Medium Enterprises at Mastercard

- Qamar Saleem – CEO of SME Finance Forum/World Bank Group

- Patrick Reily – Co-founder of Uplinq Financial Technologies

- Manny Tocco – COO of Business Banking at Citizens Bank

The discussion will focus on how banks and credit unions can employ AI technology and alternative data to broaden lending opportunities for small businesses, with a particular emphasis on addressing the hurdles faced by minority and protected class segments. Discover the innovative solutions that promise to reshape the lending landscape, granting fair access to credit for underserved small business sectors while enabling lenders to manage risk profitably.

Stay tuned for more insightful updates tomorrow. Enjoy the webinar!

Cheers,

POST OF THE DAY

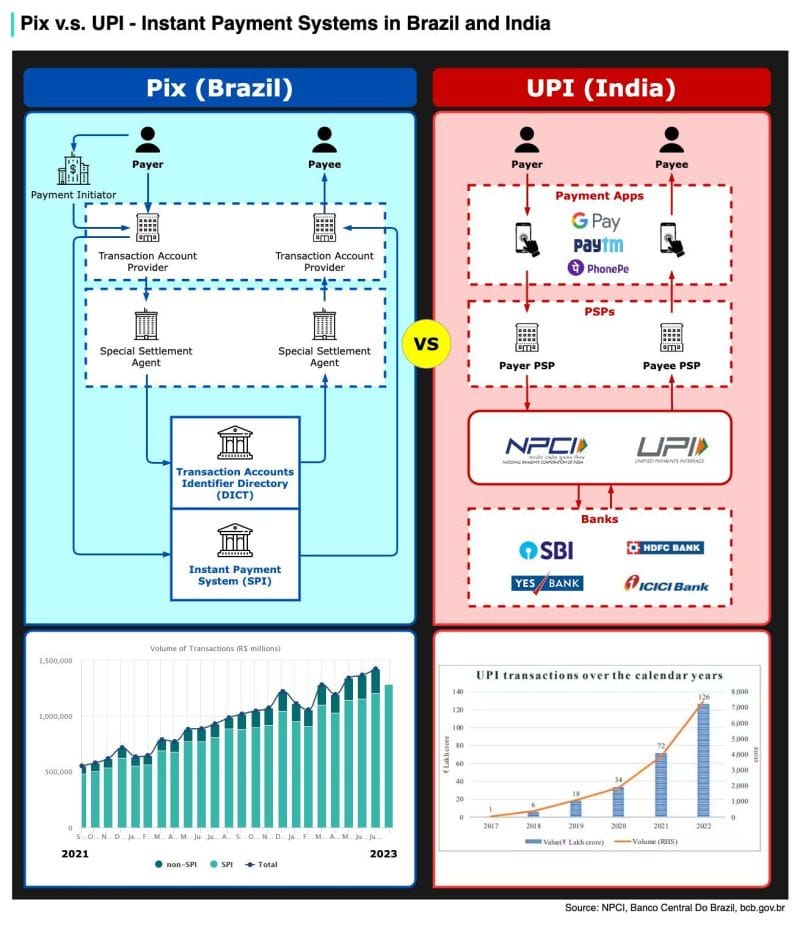

🇧🇷 Pix 🆚 UPI 🇮🇳 - Both are instant payment systems, but how do they work?

Let’s dive in:

BREAKING NEWS

🇲🇽 It's Official. The Governing Board of the CNBV has granted a Banking License for Revolut in Mexico. The new bank in the country, led by Juan Miguel Guerra Dávila, must comply with the required criteria to begin operations. Thus, the British startup's subsidiary will join Mexico's digital neobank offerings with its flagship product: international transfers.

#FINTECHREPORT

📊 Gen Z Driving Shift Toward Digital Tax Payments, According to New Report From ACI Worldwide. Read the findings here and discover more insights.

INSIGHTS

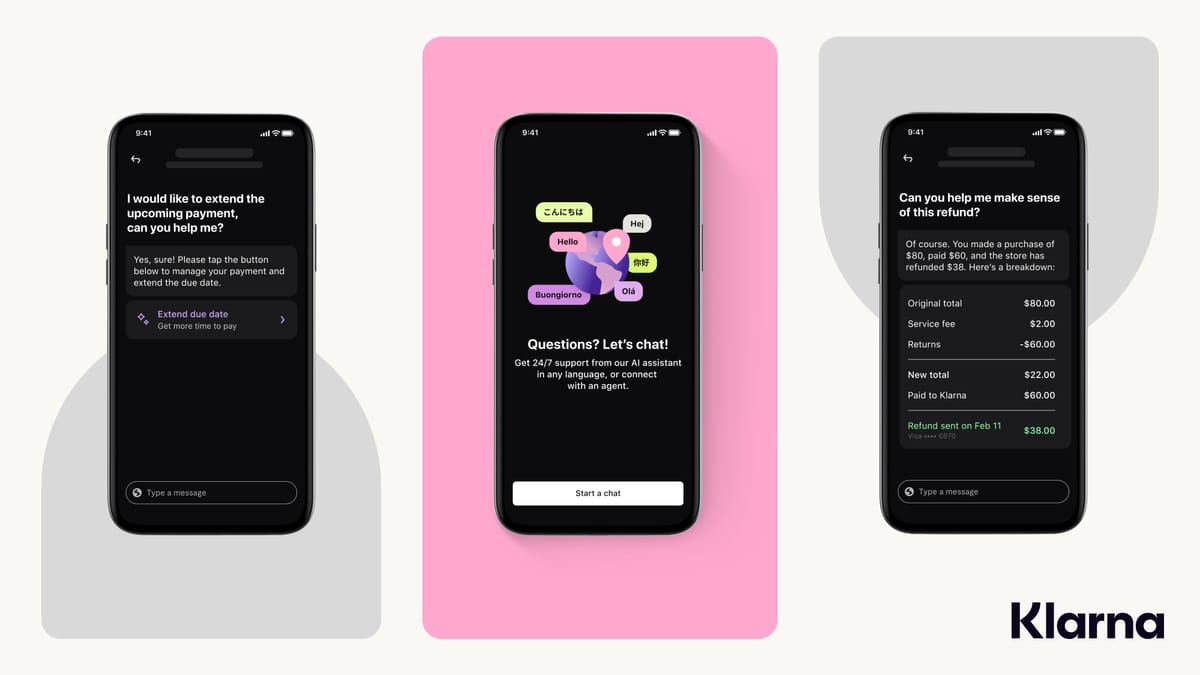

🇸🇪 Klarna boosts profits with ChatGPT as BNPL firms tap AI. Klarna is seeing generative AI improve its margins, as BNPL firms turn to new digital capabilities to address their profitability challenges. ChatGPT parent company OpenAI shared that the Klarna’s adoption of the technology is estimated to yield a $40 million improvement in the company’s profits this year.

FINTECH NEWS

🇸🇬 TerraPay receives Singapore MPI license. With this approval, TerraPay is set to redefine the payment landscape by offering services across Account Issuance, Domestic and Cross-border Money Transfers, Merchant Acquisition, and E-money Issuance, catering to the growing demand for efficient and transparent payment solutions in the region.

PAYMENTS NEWS

🇲🇽 Kueski, Mexico's leading BNPL provider, unveils In-Store mobile payment solution. Kueski, the buy now, pay later (BNPL) and online consumer lender in Latin America, announced the launch of the in-store version of Kueski Pay, which will become available to all consumers by the end of Q2 of 2024.

OPEN BANKING NEWS

🇺🇸 Fingoal partners with Quiltt to enhance financial services through transaction enrichment. By combining FinGoal's advanced transaction enrichment with Quiltt's API, developers can provide users with a more personalized financial experience across various open banking data access platforms supported by Quiltt.

REGTECH NEWS

🇳🇬 The Federal Government of Nigeria has revealed plans to introduce a payment-integrated ID card. This initiative, overseen by the National Identity Management Commission (NIMC), aims to provide both social and financial services. The proposed operation includes partnerships with the Central Bank of Nigeria (CBN) and the Nigeria Interbank Settlement System (NIBSS), utilizing the domestic card scheme, AfriGo.

DIGITAL BANKING NEWS

🇳🇿 FinTech startup Emerge wants to 'fix' banking in New Zealand, starting with SMEs before launching into consumer banking. SquareOne has rebranded as Emerge, a FinTech company with a focus on rectifying what they perceive as a “broken landscape” within the business accounts and expenses market.

🇬🇧 Monzo joins Post Office Banking Framework with cash deposits for Monzo Customers nationwide. The service is now live so all personal and business banking Monzo users can conveniently deposit cash into their accounts at any Post Office branch using their debit card and have the money available in their account instantly.

🇸🇦 SAMA greenlights beta launch of STC Bank. The Saudi Central Bank (SAMA) has officially approved the transition of STC Pay – the mobile financial services arm of Saudi Telecom Company – into STC Bank. The approval has enabled the subsidiary to pursue a beta launch of its Sharia-compliant banking services.

BLOCKCHAIN/CRYPTO NEWS

➡️ TikTok’s growth in Europe has slowed down so much that it’s rolling out a new app that gives people financial incentives to watch its videos. The app, called Coin App within the company and TikTok Lite to the public, is designed to help TikTok boost growth among people aged 18 and older.

🇳🇬 Binance decries ‘outrageous’ decision to send exec Tigran Gambaryan to prison in Nigeria. Gambaryan’s lawyer argued that his client should not be held responsible for Binance’s activities in the African nation because he does not have decision-making authority in the company’s business operations.

DONEDEAL FUNDING NEWS

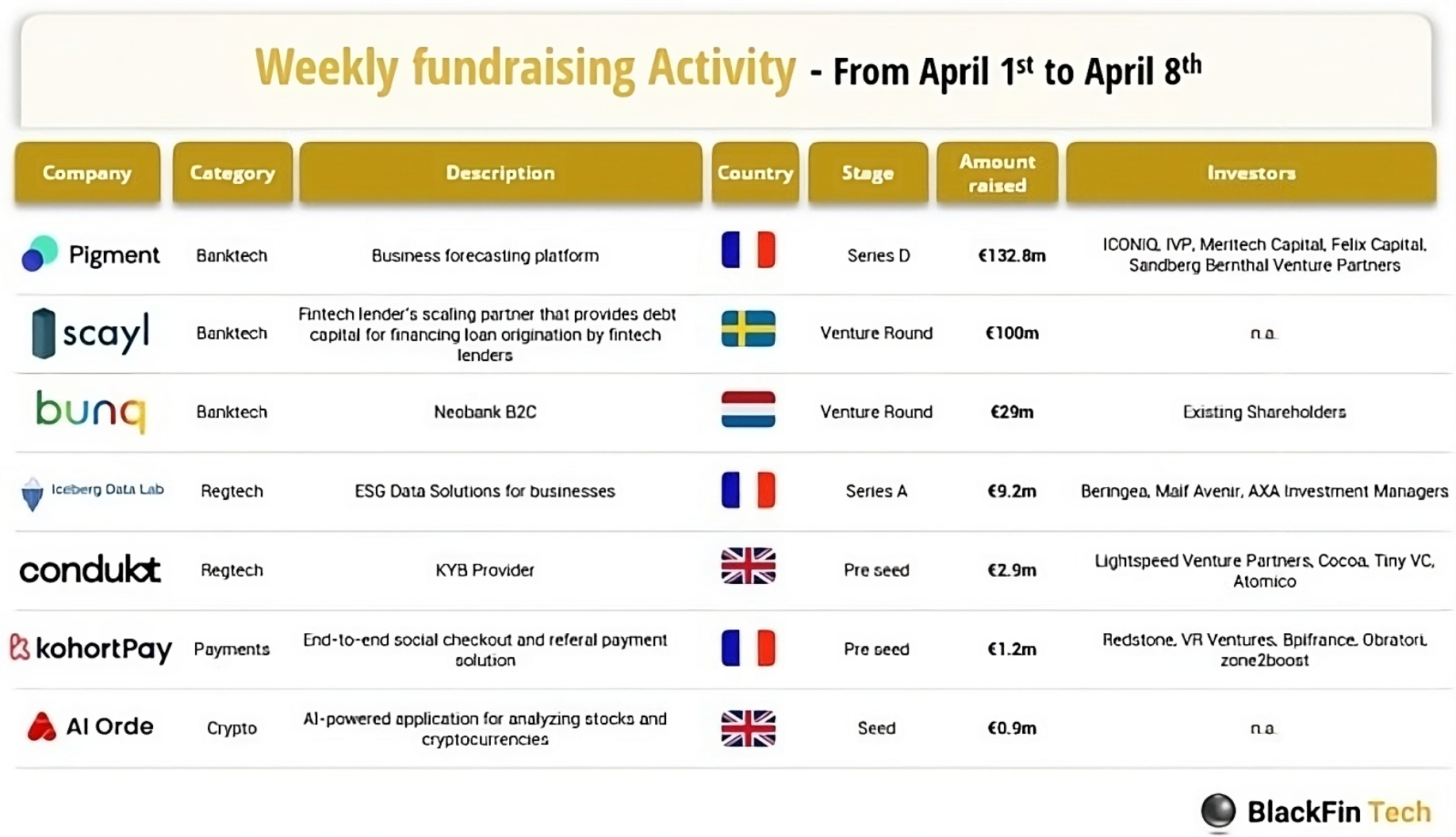

Last week we saw 7 official FinTech deals all over Europe for a total amount of 276m€ raised, with 3 deals in France, 2 in the UK, 1 in the Netherlands, and 1 in Sweden. Explore the complete BlackFin Tech article here

🇦🇺 Insurtech startup Honey Insurance secures a record $108 million in Series A funding led by Gallatin Point Capital. This mega-round demonstrates that founding teams in Australia continue to compete with the best on the global stage, and positions Honey Insurance as a strong challenger to the local home insurance oligopoly.

🇫🇷 Business planning startup Pigment raises $145M in rare French tech mega-round. The enterprise software company offers a business planning platform for large companies to visualize their past financial performance and forecast upcoming quarters.

🇯🇵 Japanese FinTech leader Smartpay was oversubscribed in raising USD $7 Million in pre series A round. The world's 4th largest economy has seen an increase in local and foreign investment in Japanese technology companies. Smartpay has brought together leading Japanese, European and American powerhouse investors that have deep experience in the FinTech industry.

🇨🇦 With latest funding and scotiabank partnership, Willful sets its sights on profitability. Since closing its seed extension in 2021, Willful has been busy, expanding its product, moving into new provinces, securing partnerships, investing in regulatory relationships, and helping tens of thousands of Canadians build their end-of-life financial plans.

🇮🇱 Novidea raises $30m. With this investment, Novidea will have the resources it needs to further refine its product, expand operations into new territories, and explore the possibilities of making strategic acquisitions in this space. Read on

🇪🇺 The surge in investment in European FinTech companies during March underscores the sector's resilience and attractiveness to early-stage investors. With €1.2bn injected into 336 pre-seed, seed, and Series A rounds, FinTech firms are leading the fundraising charge, buoyed by their growing appeal among consumers across Europe.

M&A

🇺🇸 Entrust closes Onfido acquisition. With this completed acquisition, Entrust now provides the industry’s most comprehensive portfolio of AI-powered, identity-centric security solutions. Terms of the acquisition were not disclosed. Continue reading

🇺🇸 Empower signs definitive agreement to acquire Petal, and completes acquisition of Cashalo, to accelerate access to fair credit for underserved consumers. Empower enters the U.S. credit card category and the Southeast Asian credit market, poised to revolutionize lending with a smarter, more inclusive approach to underwriting and product innovation.

MOVERS & SHAKERS

🇱🇺 Valeriia Nikitenko has joined MangoPay’s Legal team as Lead Legal Counsel for Regulatory Affairs, bringing experience in the online payment sector and insights from both the merchant and the payment service provider perspective, having held a variety of senior compliance roles.

🇸🇪 Klarna: 75 per cent of staff now use AI tools like ChatGPT as it looks at reducing hiring. Klarna made headlines in February after saying its AI assistant, powered by San Francisco start-up OpenAI, was handling a workload equivalent to 700 full-time customer service agents and that it was on par with humans on satisfaction ratings.

🇬🇧 Revolut reveals its five stage interview process for software engineers. Ben Baillie-Lane, who says he is leading tech, data, finance and legal expansions outside of Europe, says Revolut has a "very extensive" interview process. "We don't want to set people up to fail." Get all the details here.

🇦🇪 GTN, a UAE-based investment and trading tech firm, has appointed Industry veteran Damian Bunce as its new regional CEO for the Middle East. The company says Bunce will work to “lead GTN’s strategic initiatives in the Middle East” and “help coordinate global activities across its network of offices” as the company pursues further growth as part of its “global expansion journey”.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()