Klarna Wins Regulatory Approval to Offer Credit

TGIF!

First of all I like to thank the Swan team for inviting me to the launch party in Amsterdam yesterday. I had a blast!

As Nicolas mentioned in his speech: "Launching In the Netherlands as a French FinTech/Payments company might seem like a Dutch company selling cheese in France" 😉

I wish you all the best in the Dutch market and far beyond!

You might enjoy some time off around Thanksgiving at the moment, as many of us do. Luckily, I still managed to find some interesting FinTech industry news updates and listed them for you below.

I also ran into an interesting Linkedin post yesterday, and I like to share it with you:

In the early days of Revolut, when money was tight, they had to get creative. Former Marketing Director of Revolut Chad West shared a great example 🤣:

They turned on free money transfers, stuck Nik Storonsky on a digital van, copied a Transferwise ad, and parked it outside of their office all day. 🤣

Now that’s what I call guerrilla marketing!

Do you know of a cool example of guerrilla marketing from a FinTech company? Let me know in the comments!

Have a great weekend and I'll be back with more news on Monday!

Cheers,

POST OF THE DAY

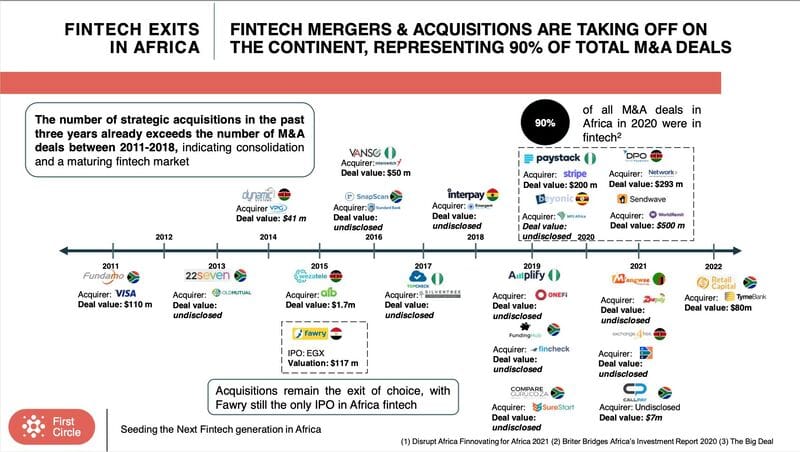

The FinTech sector has seen the most exits in Africa so far. Here are the 3️⃣ reasons why:

BREAKING NEWS

🇬🇧 Klarna wins regulatory approval to offer credit and payments products in the UK. The FCA’s new authorization allows it to continue operations in the UK market just as a temporary approval it received in the aftermath of Brexit was due to expire in just five weeks, according to a statement.

#FINTECHREPORT

Top 10 Fintech and Payment Trends to Watch in 2024. As we look at the top fintech and payment trends for 2024, it is important to examine the wider context before we get into the specifics. Access the full report for more information.

INSIGHTS

Want to avoid an HMBradley scenario? Diversify your bank network, Treasury Prime CEO says. Fintechs who rely on bank partnerships to provide financial services to their customers should not be beholden to a single sponsor institution, Treasury Prime CEO Chris Dean said, citing the recent example of neobank HMBradley. Read the full piece here

FINTECH NEWS

Ebury strikes fintech deal with PSV Eindhoven. The signing of the multi-year contract makes Ebury the exclusive fintech partner of the club, supporting them with their international payments and cash management, streamlining global cash flows.

🇬🇧 eToro has launched XtremeWeather, a new portfolio providing retail investors with exposure to companies that are well placed to meet the challenges posed by soaring incidences of extreme weather events. Read more

MSL has completed its certification with Mastercard, becoming one of the pioneering processors to get direct connectivity to the Mastercard Cloud in Europe. They can now provide issuers, program managers, and credit institutions throughout the EEA with card issuing and baas solutions.

🇮🇪 PaymentSense eyes Irish money licence. The company already has a presence in Ireland. If it succeeds with its license application, it could expand its service offering to include e-money services, joining the likes of Stripe, Square and SumUp.

PAYMENTS NEWS

dLocal and eSky Group partner to combine the power of payments with modern airline and travel innovation. This move reaffirms their unwavering commitment to delivering top-tier payment solutions in the vibrant markets of Latin America and Africa.

UK payments report calls for alternatives to Mastercard and Visa. The conclusions of the Future of Payments Review echo longstanding complaints across Europe about heavy reliance on the American duo for card payments.

OPEN BANKING NEWS

🇪🇺 Understanding PSD3: Anticipated market impact and preparing for changes. This article presents a comprehensive analysis of PSD3, encapsulating its evolution, key components, implications, and the roadmap ahead.

🇬🇧 UK Government plots open banking expansion as part of smart data “big bang,” The UK plans this initiative in order to give consumers more access to their data in seven core sectors, and take open banking beyond the CMA 9 for the first time.

PokerStars has partnered with Plaid to enhance the player experience globally by making it easier for players to authenticate their bank accounts and move money in and out of their PokerStars account. UK users can now “Pay by Bank” using Plaid’s Payment Initiation Service (PIS) technology.

DIGITAL BANKING NEWS

🇮🇪 Revolut teams up with RTÉ’s Toy Show Appeal for the third year in a row to enable viewers to donate instantly from their Revolut app. Last year, through the goodwill of the people in Ireland, the appeal raised €4 million for The Community Foundation Ireland, helping children and family members across the island.

🇬🇧 Virgin Money profits hit by rising bad loan provisions. The hit to profits was largely because of a jump in the amount the lender had set aside for bad loans to account for rising arrears in its credit card business amid a gloomy economic outlook.

🇿🇦 CEO Jonker: TymeBank bucks SA market glut with expansion plans. Basking in the success of its latest funding round, the digital bank is defying the naysayers and doubling down on a domestic financial market that many analysts view as a bubble ready to burst.

🇲🇽 Thought Machine expands into Latin America, partners with Trafalgar to develop Mexico’s next fintech for SMEs. This partnership is a crucial move toward empowering Mexican SMEs, essential to the national economy, with the digital tools they need for success in a dynamic economy.

Neobank winners and laggards point to long-term Fintech strategic shift. Research by Simon-Kucher estimates that the total number of neobanking customers worldwide has passed 1 billion — an increase of over 30% in just 18 months. More here

🇬🇧 Atom bank has agreed to lend a further £150m through Funding Circle to UK small businesses. This marks Atom bank's third partnership with Funding Circle, bringing their total lending to £800m. The funds will be utilized through the government-backed recovery loan scheme (RLS) provided by Funding Circle.

BLOCKCHAIN/CRYPTO NEWS

How Xapo Bank is capitalizing on a crypto revolution in Latin America. In this region, marked by diverse economic challenges and varying levels of financial technology adoption, Xapo Bank is emerging as a key player in its crypto revolution.

DONEDEAL FUNDING NEWS

🇬🇧 UK SME payments fintech Crezco raises $12m Series A, has also deepened its partnership with Xero, which will now be the first major small business cloud accounting software in the UK to offer bill payments to its users through open banking.

Fintech scale-up Smarter Contracts secures £2.65m in private equity funding. Most of the funding will be used to increase Smarter’s development and design capacity, giving them the scale they need to enhance the product features of Pulse®.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()