Klarna Unveils AI CEO Hotline, Marqeta-Powered Card, and Loyalty Boost

Hey FinTech Fanatic!

So, Klarna just dropped quite a few updates, all at once.

The most surprising? The FinTech company launched a voice-powered AI version of its CEO, Sebastian Siemiatkowski, to handle customer service interactions. Yup, you read it right. Klarna provided two phone numbers (one Swedish, one US), and anyone can call to speak with the AI version of their CEO & Founder. The AI lets users leave feedback, suggest improvements, or ask questions. Every call is transcribed and sent directly to Klarna’s product teams, turning real customer input into real product insights, fast.

Across the Atlantic, Klarna is teaming up with Marqeta. This partnership supports Klarna’s new debit card in the US, powered by Visa Flexible Credential (VFC). With VFC, customers can choose to pay now or later, all using the same card. The debit card is currently in testing in the US, with a wider launch planned later this year.

And there’s more. Klarna also announced an exclusive partnership with Nift to enhance customer experience and loyalty. Since the rollout, early results have surpassed benchmarks, reaching a 30% click-through rate and a 40% gift activation rate in the US. These offers are now available to Klarna users in both the US and the UK.

“We’re extremely proud to partner with Klarna as it strengthens its customer connections while unlocking a new, recurring revenue stream,” said Elery Pfeffer, Founder & CEO of Nift.

Read more global FinTech industry updates below 👇 and I'll be back with more on Monday!

Cheers,

POST OF THE DAY

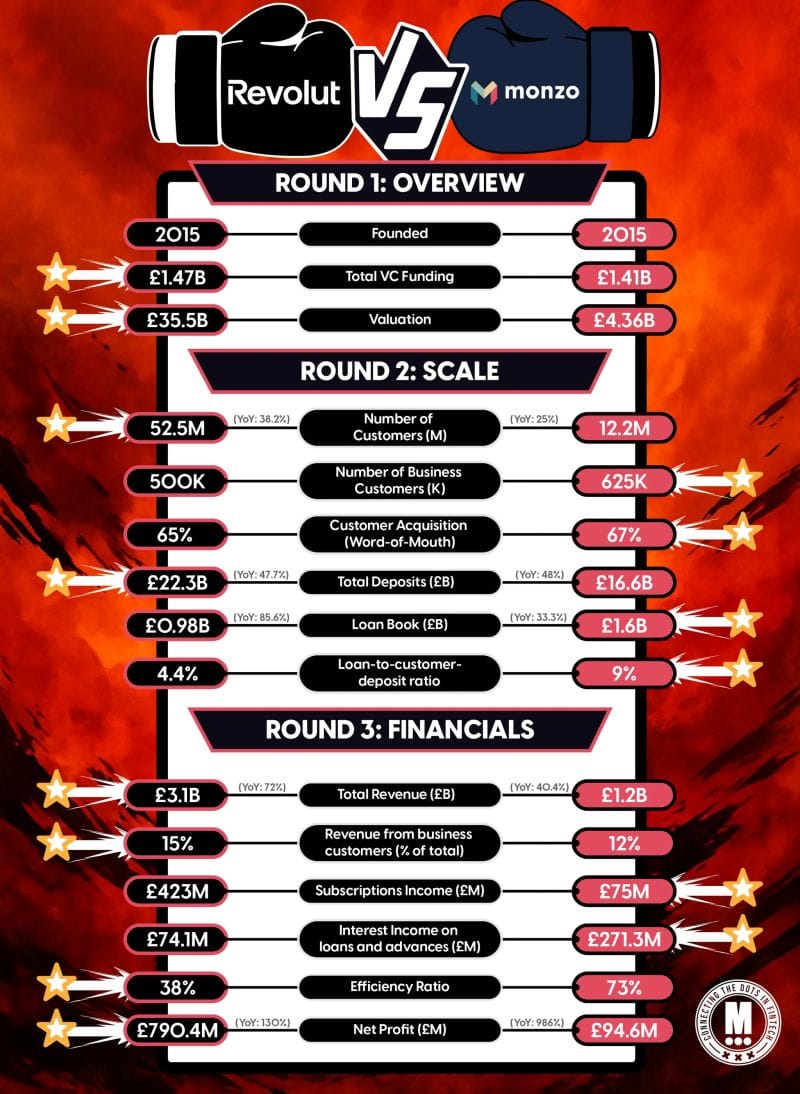

Revolut 🆚 Monzo Bank

👉 Read my full article for the complete comparison

Looking at these numbers, what catches your eye the most?

FINTECH NEWS

🇸🇪 Klarna CEO Sebastian Siemiatkowski sounds alarm on AI job cuts causing recession. He predicted that the accelerating pace of AI adoption could trigger a short-term slowdown and urged business leaders to rethink jobs, reskilling, and their workforce strategy. Meanwhile, Klarna has launched an AI-powered phone hotline featuring a digital clone of its CEO; this innovative tool personalizes customer interactions, answering questions and gathering feedback.

🇺🇸 Chime prices IPO at $27 per share to raise $864 million. The company had marketed the offering between $24 and $26 per share. The IPO values Chime at roughly $11.6 billion on a fully diluted basis. It generates the bulk of its revenue from interchange fees.

🇳🇱 Adyen opts for build over buy. Dutch payments processor Adyen plans to keep fueling expansion, including in the U.S., by building its software and systems over buying up other businesses, Adyen’s president for North America, Davi Strazza, said in an interview.

🇺🇸 Stripe will help millions of Shopify merchants accept stablecoin payments. Shoppers will be able to pay with USDC on Base using their preferred crypto wallet. By default, Stripe allows merchants to receive stablecoin payments in their preferred local currency, which is then deposited into their bank account, just like any other payment they receive.

PAYMENTS NEWS

🇮🇳 Sebi set to launch new UPI mechanism for MFs and brokers. This initiative aims to ensure investors make payments only to verified entities, accompanied by a visual verification cue. A 'Sebi check' functionality is also under development, allowing investors to verify the authenticity of their UPI ID.

🇮🇳 Travel FinTech Scapia launches Rupay credit card to target UPI payments, merges credit line and statement with Visa card. Users can see a unified credit card statement, and a single bill is generated at the end of the billing cycle. The company targets young millennials and Gen Z customers who are looking for travel offers and rewards.

REGTECH NEWS

🇺🇸 Plaid is launching Plaid Protect. A real-time fraud intelligence system that helps detect and prevent fraud from the moment a user first interacts with your app or service. By drawing on fraud signals across a billion devices in the Plaid network, Protect goes beyond what any single company can see.

DIGITAL BANKING NEWS

🇩🇪 Vivid reaches 50,000 business customers and is ambitiously expanding. New features will be rolled out in the current quarter to further round out its product portfolio. These include a card acquiring service that enables merchants and service providers to easily accept card payments.

🇰🇷 Kbank surpasses 14 million customers amid rapid growth. The firm explained that its growth has been driven by four core offerings: competitive refinancing loans, the "Plus Box" parking account, app-based earning services, and debit cards featuring popular character designs.

🇬🇧 UK’s digital bank OakNorth lends $20m to JV between Sabal Investment Holdings and 12 North Capital. The $20m loan will fund the acquisition of a non-performing loan secured against three Class A purpose-built memory care facilities in Leesburg and Warrenton, Virginia, and San Antonio, Texas.

🇵🇹 Revolut launches eSIMs and global data plans in Portugal. The eSIM allows customers to use the Revolut app without consuming their mobile data, facilitating access to all the app's products and features, even in places where there is no data coverage, highlights the FinTech.

BLOCKCHAIN/CRYPTO NEWS

🇸🇾 Crypto exchange Binance expands to Syria as the US lifts sanctions. “After years of exclusion, Syrians now have the chance to build, invest, and connect,” Binance Chief Executive Officer Richard Teng said in a statement. Keep reading

🇺🇸 Bank of America’s Stablecoin play hinges on U.S. lawmakers’ next move. Lawmakers are working on a bill to regulate stablecoins. The GENIUS Act bill would set strong rules on how stablecoins should be backed and handled. It mandates that each stablecoin must be supported by real U.S. dollars or other assets that can be quickly sold.

🇧🇷 Brazil moves closer to holding bitcoin as national reserve. The bill supports the idea of using Bitcoin as a strategic asset, aligning Brazil with the growing global trend of digital reserve diversification. While it still needs further approvals, the move signals a shift in how nations view Bitcoin, as more than just a currency, but a potential store of value at the national level.

🇸🇨 MEXC launches $100 million fund to protect users from hacks. The fund is to respond quickly if the platform is compromised by a hack, a critical system vulnerability, or a large-scale exploit. MEXC said affected users could receive compensation without the delays typically seen in insurance claims.

PARTNERSHIPS

🇲🇳 Capitron Bank joins Thunes’ Direct Global Network to streamline payments in the Mongolian market. Customers will be able to send funds instantly across borders to bank accounts, mobile wallets, cards, and cash pick-up locations worldwide. With Mongolia’s export volumes experiencing double-digit growth, transactions continue to increase.

🇺🇸 Carlyle teams up with Citi to invest in FinTech lenders. As part of the partnership, they will share market intelligence and explore co-investment and financing opportunities, the companies added. Continue reading

🇺🇸 Marqeta to power new Klarna debit card in the U.S. With its modern, flexible card issuing platform, Marqeta makes it possible for global leaders like Klarna to expand to new markets and offer innovative payment options tailored to evolving customer needs.

🇺🇸 Klarna partners with Nift to enhance the customer experience and drive revenue growth. The partnership addresses a growing need among retail, payments, streaming, and fitness platforms for more meaningful, nonintrusive ways to engage customers.

🌍 Bonprix and Trustly to launch new partnership streamlining payments in the Nordics. Through this collaboration, Trustly's innovative A2A payment solution will be implemented in Finland, Sweden, and Norway. This enables a faster, smoother, and more secure payment experience for Bonprix's Nordic customers.

🇵🇰 Allied Bank, UnionPay, and Paysys partner to launch tokenized tap-and-pay in Pakistan. This collaboration empowers ABL customers. ABL will now offer tokenized mobile payment solutions that replace sensitive cardholder data with unique tokens, enhancing security while enabling faster transactions.

DONEDEAL FUNDING NEWS

🇺🇸 Financial planning platform Abacum bags $60M Series B round. The fresh capital has been earmarked to drive Abacum's expansion throughout the US, a market which currently accounts for 50% of the company's revenue. Read more

🇮🇳 Snapmint set to raise $40M led by General Atlantic. This will be the third funding round for the Mumbai-based startup since March 2022. The company attributes much of its growth to D2C brands using Snapmint’s installment payment options.

🇦🇪 Dubai-based regtech Qanooni closes $2M funding round to drive regional expansion. The startup will utilize the capital to accelerate its expansion across the UAE and UK markets, in addition to enhancing its proprietary AI engine tailored to legal workflows.

🇩🇪 Berlin-based FinTech startup Payrails raises over €27 million for its global payment software. The funds will be used to accelerate product innovation, product roadmap expansion, and support commercial growth across EMEA to meet enterprise demand.

M&A

🇸🇬 Vistra acquires payroll platform iiPay. The acquisition is expected to serve Vistra's clients with "improved automation in payroll processing, enhanced multi-country payroll consolidation and reporting, and stronger support for complex international operations", according to a statement.

MOVERS AND SHAKERS

🇮🇳 PayG appoints Harmeet Sethi as Chief Executive Officer. Sethi's leadership is expected to drive the company's growth and expansion in the FinTech sector. Under his guidance, PayG aims to enhance its mobile app offerings, focusing on convenience, accessibility, and security for users and merchants alike.

🇬🇧 UBS UK high net worth boss Chris Oliver resigns. He has now left the lender and wealth manager after nearly 15 years at the firm to “pursue an opportunity outside the organisation”, according to an internal memo. Keep reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()