Klarna Hits 1M U.S. 🇺🇸 Klarna Card Sign-Ups in Just 11 Weeks

Hey FinTech Fanatic,

Klarna just dropped a stat that’ll make your jaw hit the floor: 1 million U.S. sign-ups for its debit-first Klarna Card… in only 11 weeks. 🤯

That’s roughly 13,000 new users a day, with a spike of 50,000 on Sept 23 alone. Not quite Revolut’s record-breaking 17-day dash to a million (remember that?), but still a monster debut for a Swedish brand trying to conquer America’s payments game.

The magic sauce? Pairing the familiarity of debit with the flexibility of “pay later”—a combo Klarna says gives shoppers “the best of both worlds.”

Judging by the uptake, U.S. consumers seem to agree.

Have a great weekend, and I'll be back in your inbox on Monday!

Cheers,

POST OF THE DAY

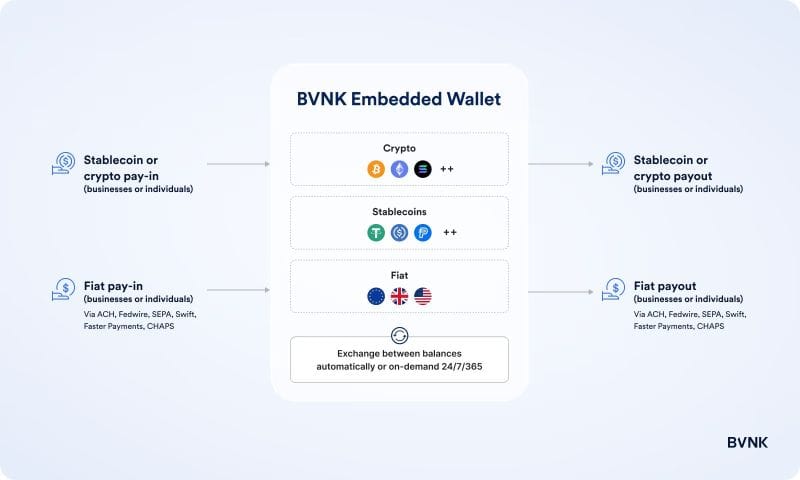

🪙 Are you looking for a beginner-friendly guide to embedded stablecoin wallets?

FINTECH NEWS

🌍 Airwallex accelerates market entry in the Middle East as part of a broader global growth strategy across APAC, EMEA, and the Americas. In the UAE, it has secured In-Principle Approval for key payment licenses, enabling services like multi-currency accounts, global transfers, and corporate cards. Meanwhile, Airwallex has also established a new entity in Saudi Arabia, aligning with Vision 2030 and supporting the region’s digital economy.

🇺🇸 Klarna chairman to CEO: We're 10 years behind Revolut. The warning came just after Klarna's IPO debut on the New York Stock Exchange, where shares jumped 30%. While the event featured celebrations, Michael Moritz’s sharp message underscored the challenge of catching up with Revolut.

🇰🇷 Naver shares surge on tie-up talks with top crypto exchange, Dunamu. Naver said in a regulatory filing that discussions cover a range of areas, including a possible share swap, while Dunamu said in a text message that it is exploring cooperation with Naver but that nothing has been finalized.

🇬🇧 Payments firm Ebury to revive £2bn London float next year. Ebury, which handles cross-border payments for small businesses, is expected to seek a valuation of around £2bn, with Santander thought to be unlikely to proceed with an IPO if that figure is not attainable.

FINTECH RUNNING CLUB

🏃➡️ Don’t miss out, join our first run in Sofia tomorrow at 9 AM in South Park!

PAYMENTS NEWS

🇦🇺 PayPal provides $1.5 billion in flexible loans to Aussie SMBs. The initiative enables eligible business customers to access funding swiftly, with loan amounts based primarily on their PayPal sales figures. Approved applicants generally receive funding within minutes, with a single fixed fee agreed at the time of application.

🇩🇰 Pleo launches Embedded Finance Solution, giving partners instant access to industry-leading spend and cash management for SMBs. With Pleo Embedded, partners can now offer their customers smart company cards, automated expenses, accounts payable, and a real-time cash management suite as a fully white-labeled or co-branded solution.

🇧🇷 EBANX enables Pix recurring payments for Hotmart, leading to a 32-point retention increase. Hotmart is now converting more than four times the number of recurring payments that previously failed with Pix into continued subscriptions. Continue reading

🇨🇭 Bivial AG rolls out Physical Visa Debit Cards. The physical Visa cards complement Bivial's robust suite of finance solutions, including Business Accounts, global bank transfers, direct debit collections, virtual IBANs, virtual corporate cards, alternative payment methods/wallets, and API-first banking infrastructure.

🇰🇷 Kakao Pay links Japan’s PayPay to offline payments in Korea. This enables Japanese PayPay users to make offline payments at more than 2 million merchants across the country. The online payments company said that PayPay’s network is now connected to Korean offline stores, allowing Japanese travelers to pay as they would at home.

🇺🇸 Klarna Card passes 1 million US sign-ups in 11 weeks. Launched in the US on July 4th, the Klarna Card has quickly resonated with consumers looking for more freedom in how they pay, whether paying instantly with debit or spreading the cost over time.

OPEN BANKING NEWS

🇬🇧 TrueLayer revenues up 63% in 2024 as it charts path to profitability. The highlights from TrueLayer’s FY2024 financial data showcase a year of exceptional growth and momentum towards achieving profitability. Its growth has been driven by increased adoption of its Pay by Bank solution across key sectors, particularly in e-commerce.

REGTECH NEWS

🇲🇾 BNM fines Alipay Malaysia RM340,000 in wider compliance crackdown, for failing to update its sanctions database as required under the Financial Services Act 2013 and the AML/CTF and Targeted Financial Sanctions policy. This lapse disrupted the screening of customer accounts and delayed the freezing of funds linked to a listed entity.

DIGITAL BANKING NEWS

🇪🇸 Santander accelerates the signing of alliances in the payments business. The bank is seeking to expand its services and introduce new solutions to its portfolio. In this context, its subsidiary Getnet has just announced an agreement with FinTech company Payrails to leverage its cutting-edge technology.

🇳🇱 ABN AMRO has launched BUUT, built in collaboration with Mambu, a neobank designed to empower young people with smarter money management tools. Additionally, Visa and Pismo have teamed up with ABN AMRO to power BUUT's challenger card targeted at Gen Z consumers. While BUUT led the proposition with deep customer insight and regulatory expertise, Pismo's cloud native platform enabled the rapid build of a seamless debit card experience built for a digital-first generation.

🇲🇦 Revouts planned a meeting with Bank Al-Maghrib at the beginning of October, as the group´s interest in Morocco is confirmed following the recruitment of a head of operations and the first exchanges last June. Keep reading

BLOCKCHAIN/CRYPTO NEWS

🇳🇱 Bunq becomes first European neobank to launch flexible crypto staking. The Dutch challenger partners with Kraken to offer rewards up to 10% annually across EU markets. The new service allows users to stake digital assets without lock-up periods or timing restrictions.

🇺🇸 European banking alliance plans Euro stablecoin to challenge US market dominance. The project represents a coordinated effort by traditional European banks to enter the stablecoin market, potentially establishing a significant competitor to existing dollar-denominated digital currencies in cross-border payments and digital asset transactions.

PARTNERSHIPS

🇺🇸 Circle taps Crossmint to expand stablecoin rails for humans and AI. Crossmint stated that by integrating its Wallets and APIs for stablecoin onramps, orchestration, and agentic payments with USDC, it is laying the foundation for a new era of finance.

🇬🇧 TransferGo expands partnership with tell.money. The collaboration now includes both open banking API compliance and the implementation of the EU Verification of Payee (VoP), a process that helps confirm whether the name entered by a payer matches the account details provided, reducing fraud and misdirected payments.

🇬🇧 Thredd powers OFX corporate card expansion across key global markets. Thredd provides the processing backbone, compliance expertise, and in-market support that enable OFX to deliver secure, scalable physical and virtual corporate card programmes with real-time spend controls, automated expense management, and multi-currency capabilities.

🇺🇸 Backbase and Prove partner to enable faster and safer onboarding for financial institutions. The integration brings together seamless identity verification and secure customer experience to address fraud prevention and onboarding friction. Additionally, Backbase and Akkuro partner to deliver an integrated end-to-end banking transformation. This collaboration is set to deliver an end-to-end modern banking technology stack across all lines of business.

🇲🇾 Malaysia's MBSB launches international remittance service powered by Wise Platform. The partnership enables customers to transfer money internationally in real-time across more than 12 currencies, including USD, GBP, EUR, SGD, IDR, and AUD.

DONEDEAL FUNDING NEWS

🇮🇱 FinTech unicorn Tipalti raises $200 million in debt and surpasses $200 million ARR. The funds will help to accelerate its investment in artificial intelligence and international expansion. The deal comes shortly after Tipalti acquired Statement, a treasury automation startup built around native AI technology.

🇮🇳 FinTech startup Oolka raises $7 million to scale agentic AI credit platform. The funding will help the company scale its engineering, data science, and product teams, while accelerating the rollout of advanced AI features. Read more

🇨🇳 RedotPay achieves Unicorn status with $47M strategic investment. The round saw new participation from Coinbase Ventures and a global technology entrepreneur, with increased commitments from Galaxy Ventures and Vertex Ventures.

🇺🇸 YC-backed Alguna emerges from stealth with $4M seed round. The funds from the seed round, which was supported by several undisclosed industry angels, will be used to expand the team in the US and UK, mostly focusing on the go-to-market teams and marketing.

MOVERS AND SHAKERS

🇬🇧 Zilch appoints Amex veteran Boriana Tchobanova as COO. Bringing her two decades' worth of Fortune 100 experience, she will work with the team to deliver major initiatives that will support the organization’s growth, unlock new revenue opportunities, and improve efficiencies.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()