Klarna Doubles UK Merchants As Hits 11 Million Customers

Hey FinTech Fanatic!

Ten years ago, Klarna quietly stepped into the UK market, offering a new way to shop. By October 2024, it was still building momentum, with just under 10 million active customers and a little over 41,000 retailers. Seven months later, the picture has shifted: 11 million customers and nearly 60,000 merchant partners, up almost 50%, now anchor Klarna firmly in the fabric of British retail.

In just one year, Klarna doubled its UK merchant partners, adding names like Argos, eBay, Eurostar, and John Lewis. The UK now stands as Klarna’s third-largest market, with revenues rising 30% in 2024. What began as an alternative to traditional credit cards has become a staple in how millions manage their everyday purchases.

Since its launch, Klarna estimates it has helped UK shoppers avoid nearly half a billion pounds in interest. Capital Economics found that one in two BNPL users reduced their credit card use after discovering services like Klarna’s. The average outstanding BNPL balance sits at £150, far below the £1,295 seen on credit cards.

“Eleven million UK customers is a huge moment for us,” said Raji Behal, Head of Southern and Western Europe, UK & Ireland. Klarna now offers flexible payments, delivery tracking, and spending insights to 93 million consumers globally.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

FEATURED NEWS

🌍 EPI is in talks with Spain’s Bizum and Portugal’s Sibs about a potential partnership, as Europe pushes to reduce its reliance on U.S. tech giants in the payments sector. In an effort to reduce Europe’s dependency on American companies in the payments space, European payment providers are exploring opportunities for collaboration.

INSIGHTS

🇬🇧 Revolut and Octopus are about to Disrupt UK Telecom. The firms are launching a Mobile Virtual Network Operator (MVNO). This allows them to offer customized services without the high costs of building and maintaining a network, similar to developing a distinctive hotel on land owned by someone else.

FINTECH NEWS

🇺🇸 How is ACI Worldwide combating the APP fraud problem? ACI Worldwide is working hard to empower global fraud intelligence exchange by using a new generation of multi-layered responsible tools embedded with AI to deliver precise and real-time decision-making, enabling users and financial institutions to identify fraud efficiently.

🇺🇸 PowerPay secures $400 million committed multi-lender warehouse facility led by KeyBank. The collaborative effort among multiple financial institutions will ensure the Company’s long-term sustainability and continued innovation in lending solutions.

🇬🇷 FinTech Group Qualco and its owners target raising €98 million in Athens IPO. The company plans to offer shares at a price range of €5.04 to €5.46 apiece as early as next week. It aims to sell as much as €57 million of new stock in the offering, while existing backers will likely offer another €41 million of shares.

🇺🇸 Claude Integrates with Plaid: Introducing MCP for smarter, personalized financial workflows, and is designed to simplify the management of Plaid integrations. Initially available through Anthropic's Claude, this new offering provides access to customized data and insights.

🇺🇸 Robinhood rival eToro weighs US IPO launch as soon as next week. The company had filed for an IPO with the US Securities and Exchange Commission in late March, but paused its listing plans amid tariff-related stock volatility. Read more

PAYMENTS NEWS

🇺🇸 The future of real-time payments with Bridget Hall, Leader of Real-Time Payments for the Americas at ACI Worldwide. Real-time payments are expanding globally, with both emerging and established markets advancing their adoption. Real-time payments are increasingly embedded in daily transactions.

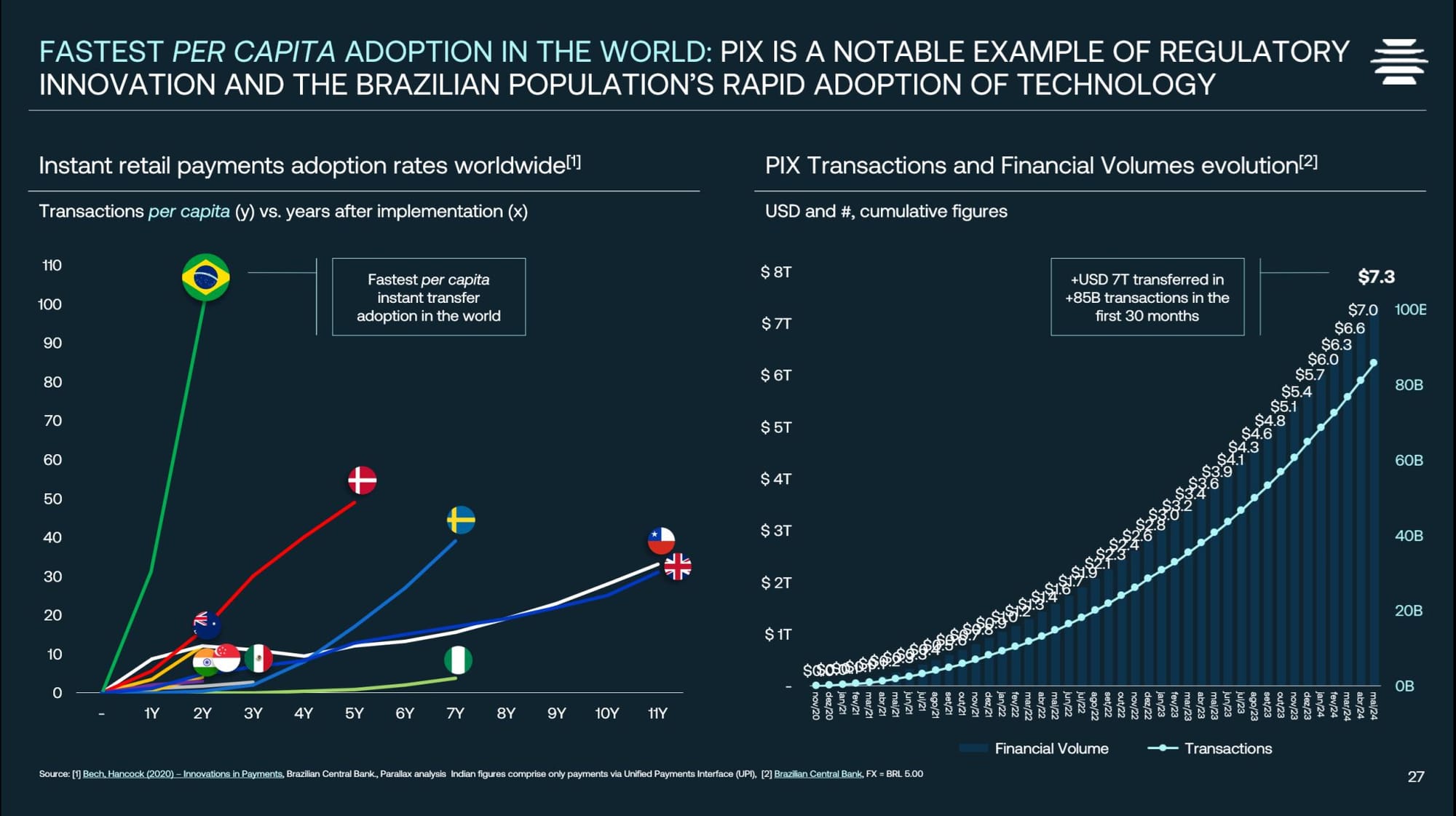

🇧🇷 Pix is the most successful digital payments system in the world. 75% of Brazilians use it and transact the equivalent of 25% of the country's GDP every month.

🇺🇸 Venmo is gaining ground in payments as Cash App struggles. Revenue in PayPal’s Venmo business rose 20%, outpacing 10% growth in total payment volume, as PayPal added new card users and pushed deeper into checkout. For PayPal's CEO, monetizing Venmo is a key piece to his turnaround plan.

🇺🇸 JP Morgan’s DLT payments gain traction with 8 major MENA banks. “With eight of the largest banks on board, Kinexys has a significant opportunity to transform the multi-currency clearing and settlement infrastructure in the region and expand these capabilities globally,” said Naveen Mallela, Global Co-Head of Kinexys by J.P. Morgan.

🇬🇧 Klarna hits 11 million UK customers as UK revenue soars 30% in breakout 2024. Since launching in the UK ten years ago, Klarna has helped shoppers avoid nearly half a billion pounds in interest by offering a simpler, fairer alternative to credit cards.

🇳🇱 Dutch court rules Klarna must justify late fee charges in its business model. It states that Klarna failed to prove that it does not profit from debt collection fees, suggesting that these charges are part of its revenue model. The decision raises concerns about transparency in "buy now, pay later" services and could lead to refunds for consumers who have paid such fees.

🇧🇬 Final preparations underway for Bulgaria’s transition to the Euro in card payments. The Bulgarian National Bank (BNB), in collaboration with BORICA AD, the Government Securities Depository, the Central Depository AD, and the banking community, has led the preparations for transitioning payments and settlements to the euro.

🇳🇱 Amsterdam’s Sprinque shuts down; co-founders pivot to AI startups and FinTech advisory. The Dutch company cited shifting market conditions and a tighter investment climate as core reasons behind the closure. Keep reading

REGTECH NEWS

🇬🇧 FCA seeks feedback on regulation of cryptoasset trading platforms in next phase of road to regulation. Clear crypto regulation will boost confidence in the sector, supporting growth. In this latest discussion paper (DP), the FCA is seeking views on intermediaries, staking, lending and borrowing, and decentralised finance.

DIGITAL BANKING NEWS

🇦🇺 Revolut reports record profits in Australia & globally for 2024. The company announced a net profit before tax of AUD 4.4 million for its Australian operations in 2024, an all-time high for the business in this market. Australian revenue increased by 163% year-on-year. Meanwhile, the company is negotiating with the National Bank of Ukraine to obtain a banking license. The NBU is interested in the entry of the neobank Revolut into the Ukrainian market.

🇵🇭 Digital bank Maya throws hat into premium credit card market. The digital bank seeks to disrupt the credit card market with the rollout of a mobile-first credit card product that targets the country’s demographic sweet spot, the young, tech-savvy, and “unhappily banked” consumers.

🇺🇸 OakNorth has surpassed $1bn in lending to US businesses since July 2023. With a focus on supporting lower mid-market businesses with revenues between $1m and $100m, OakNorth’s backing continues to be a catalyst for growth, innovation, and market leadership for its customers.

🌍 Tietoevry Banking’s new insight-report reveals an increase in digital payment fraud in Europe. The new Payment Fraud Report reveals a sharp increase in digital payment fraud across Europe, mainly driven by increasingly sophisticated social engineering tactics and the use of AI. Read on

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Tether holds $120b in US treasuries in Q1 2025. This amount includes both direct and indirect investments. Direct holdings in US treasuries were US$99 billion. The remainder came from indirect exposure through money market funds and reverse repurchase agreements.

📈 Kraken Q1 2025 financial update: Kraken generated approximately $472 million in gross revenue for Q1 2025 and adjusted EBITDA of $187 million. This marks a 19% YoY revenue increase, despite a slowdown in overall market trading activity following a strong Q4 2024.

🇰🇷 KuCoin to re-enter South Korea after securing key markets. KuCoin CEO BC Wong said that some regulators might be using regulation to drive away global players and pave the way for domestic trading platforms. Continue reading

PARTNERSHIPS

🇿🇦 Nasdaq expands partnerships with JSE and BMV. This follows the launch of a new modernisation blueprint, developed in partnership with Amazon Web Services (AWS). This is designed to empower market operators to cost-effectively modernise their markets while mitigating transformation risk and reducing barriers.

🇦🇪 Emirates chairman Sheikh Ahmed bin Saeed Al Maktoum discusses collaboration with PayPal leadership team. During a recent meeting, they discussed opportunities to build on their 15-year relationship. The meeting comes as Dubai accelerates its D33 Agenda, an initiative aimed at positioning the emirate as a global hub for innovation and the digital economy.

🌎 FinTech Affirm partners with UATP to expand BNPL travel payments internationally. This collaboration aims to integrate Affirm’s installment payment options into UATP’s network, which includes airlines, rail carriers, and travel agencies across the U.S., U.K., and Canada.

DONEDEAL FUNDING NEWS

🇸🇦 Saudi FinTech firm Erad nets $16m pre-series A. The company provides funding access within 48 hours. Erad plans to use the investment to expand its operations in Saudi Arabia and other markets. The funds will also help enhance its product offerings and increase local hiring.

🇮🇳 Kaleidofin raises $5.3 million from IDH Farmfit to grow agri-lending. The investment will support Kaleidofin’s mission and help scale its lending portfolio and expand credit scoring, middleware, and risk services through selected partnerships. Keep reading

M&A

🇺🇸 Kraken completes acquisition of NinjaTrader. Crypto traders will soon be able to seamlessly access traditional derivatives in Kraken's trading experience, and derivatives traders will be able to access crypto markets on the NinjaTrader platform.

🌎 Qenta expands payment network with Pipit Global purchase. This move is expected to extend Qenta’s reach in the international payments market, leveraging Pipit’s network of over one million pay-in points and mobile money system integrations.

MOVERS AND SHAKERS

🇨🇭 Temenos veteran Martin Bailey departs after 25 years. Martin Bailey has concluded a 25-year career at Temenos, announcing on LinkedIn this week that he has departed the core banking tech vendor. He first joined the Swiss vendor in 2000, initially taking charge of enterprise technology as product director.

🇺🇸 Flutterwave CTO Gurbhej Dhillon resigns, marking the third senior exit. During his time at Flutterwave, Dhillon led several technical overhauls. The company boosted its system performance to manage increased demand. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()