Kakao Pay to Acquire SSG Pay and Smile Pay in $365M Deal

Hey FinTech Fanatic!

Kakao Pay, one of Korea’s “big three” payments firms with a combined market share of 90%, is now strengthening its domestic position through M&A. The company is in advanced talks to acquire SSG Pay and Smile Pay from Shinsegae Group.

Together, SSG Pay and Smile Pay serve over 25 million users, a scale that makes them valuable assets in a market where size often determines reach. The estimated $365 million deal comes as Shinsegae looks to divest non-core assets and improve its balance sheet, following earlier talks with Viva Republica that ultimately collapsed.

While Kakao Pay trails Naver Pay and Toss Payments in revenue, it remains a major player, accounting for a significant share of Korea’s fast-growing transaction volume. Last year, daily usage of simple payment services averaged nearly 960 billion won, with electronic financial companies like Kakao Pay capturing just over half.

The acquisition would also expand Kakao Pay’s merchant network across retail and online marketplaces, opening new opportunities for financial product development within Shinsegae’s customer ecosystem.

This move follows Kakao Pay’s decision, two months ago, to discontinue its currency exchange service and shift focus to expanding QR payments for international use.

Read more global FinTech industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Transform Your Banking Experience! Subscribe to my Daily Banking Newsletter for the latest trends and updates delivered daily to your inbox. Embrace the Future of Banking—Never miss an update!

INSIGHTS

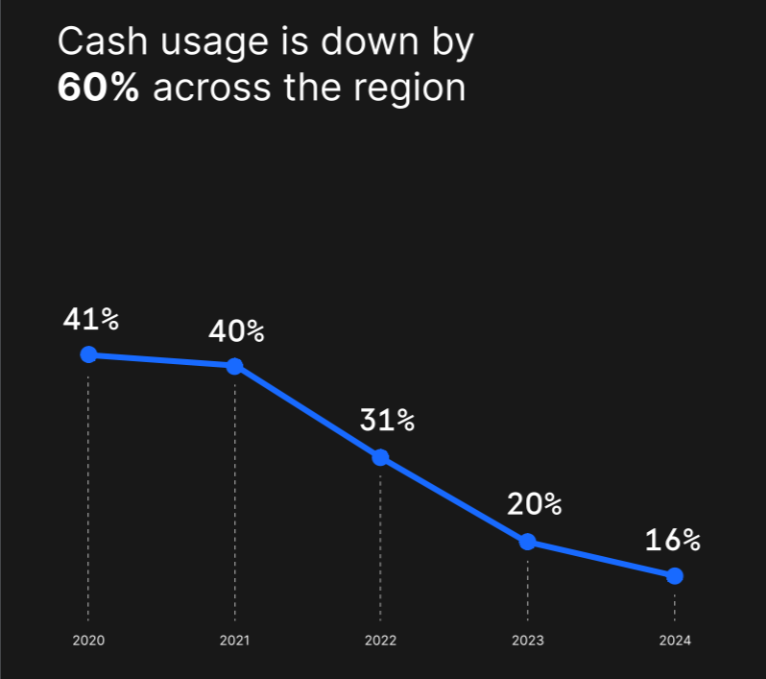

🌍 The state of digital commerce in MENA 2025 by Checkout.com. This exclusive report examines the evolving patterns and behaviors shaping the growth of digital commerce across the MENA region. Download the full report

FINTECH NEWS

🇸🇬 Airwallex Bucks The FinTech Winter: Inside the $6.2 billion bet on cross-border payments. Airwallex’s US$6.2 billion price tag now represents roughly 5.5 times its forecast US$1 billion run-rate revenue for 2025. That multiple looks steep beside public-market comps.

🇮🇳 Groww confidentially files draft papers for IPO. The filing of the pre-filed draft red herring prospectus shall not necessarily mean that the company will undertake the initial public offering, Groww said. Read more

🇩🇪 Bunq introduces stock trading in Germany. Users with bunq Stocks have access to over 400 stocks and ETFs, allowing them to buy and sell them around the clock. With Stocks, the neobank aims to simplify investing and offer people with an international lifestyle a product tailored to their personal needs.

PAYMENTS NEWS

🇬🇧 Ecommpay’s Moshe Winegarten comments on How New BNPL Regulations Will Influence Consumer Confidence and E-Commerce Checkout Performance.

He stated that the introduction of these regulations will establish a consistent standard across the industry, ultimately boosting consumer confidence. However, he also noted that e-commerce merchants should assess the potential impact of the new requirements, especially the obligation for financial services providers to conduct affordability checks on checkout performance.

Partnering with payment providers such as Ecommpay, which offer a variety of credit solutions, will be essential. For instance, solutions like Visa Instalments, where payments are taken directly from an existing Visa card without the need for credit checks, help eliminate extra steps in the checkout process, enabling faster transactions and higher approval rates.

🇮🇩 Indonesia’s QR payment system to launch in Japan and China starting Aug 17. The rollout in Japan depends on technical preparations, including sandbox trials with Japan’s payment authority. In China, technical and operational agreements have been finalized.

🌏 India and UAE redefine cross-border payments with UPI integration. This partnership offers super-fast, highly secure, and seamless payment methods, redefining financial interconnectivity between the two regions and providing millions of expats with a quicker, more convenient way to make remittances and global transactions.

🇦🇺 Zeller app launches mobile invoicing to tackle $115 bn debt to reduce late payments for Australian small and medium-sized businesses. The update introduces invoicing capabilities, allowing business owners to create, send, manage, and track invoices directly from their smartphones.

🇶🇦 POS and e-commerce transactions hit $3.18bln in April. Qatar Central Bank revealed that the value of e-commerce transactions amounted to QR3.54bn, with a total volume of 8.95 million transactions. Meanwhile, point of sale transactions recorded a total value of approximately QR8.05bn, with a transaction volume of 40.1m.

🇦🇪 JP Morgan-backed ISG and Bank of Baroda UAE launch Jaywan Cards in UAE. The introduction will significantly enhance merchant acceptance by offering lower costs and fees, improved transaction controls, and a fully digitised environment for payments and reporting.

🇦🇪 Careem Pay launches international money transfers to Jordan. The Careem app allows UAE residents to send money directly to bank accounts in Jordan quickly and at competitive rates. Careem Pay facilitates money transfers to some of the largest remittance corridors in the world.

🇨🇳 Visa launches Click to Pay in Hong Kong with ZA Bank, the first issuing bank in Asia Pacific. This enables cardholders to complete online transactions in seconds without the need for manual card entry. Keep reading

🇬🇧 Altery becomes Visa principal member. With its new principal partnership, Altery gains direct access to VISA’s global card network, giving it greater control over the processes and the flexibility to move faster when launching new features or responding to customer needs.

DIGITAL BANKING NEWS

🇪🇸 BBVA launches new FinTech app in Spain with savings incentives. The new app multiplies the benefits of being a customer: direct access to cards and Bizum to make fast, simple payments, personalized savings plans, and a financial coach to help manage finances, among other new developments.

🇦🇺 ANZ Bank plans to use AI agents to boost productivity. Initially, AI agents will assist business bankers by generating company and sector reports to improve client meeting prep and engagement. Future uses may include automating tasks like triaging loan applications.

🇨🇴 Nu Colombia introduces an initiative for achieving savings goals and financial targets. Cajitas para mi gente aims to empower Colombians. New Nu customers will get a boost that allows them to open a Money Box (Cajita) with a balance of 10,000 Colombian pesos in their account.

🇲🇽 Nubank receives authorization for the organization and operation of a commercial banking institution in Mexico. The National Banking and Securities Commission stated that the documentation submitted met the established requirements and that the Bank of Mexico (Banxico) issued a favorable opinion for the requested authorization.

🇸🇦 D360 Bank welcomes one million customers in four months. This underscores the growing demand for seamless and secure digital financial solutions in Saudi Arabia. The bank offers an intuitive digital banking experience, enabling customers to open an account in two minutes and access personalized financial services.

🇺🇸 Banking groups ask SEC to drop cybersecurity incident disclosure rule. Five US banking groups asked the regulator to remove its rule, arguing that disclosing cybersecurity incidents directly conflicts with confidential reporting requirements intended to protect critical infrastructure and warn potential victims.

🇦🇹 N26 launches loans and installment payments in Austria. The N26 loan is aimed at customers planning larger purchases or implementing financial projects. With a credit limit of up to €15,000 and flexible terms of up to five years, it offers maximum planning security.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Coinbase faces another data breach lawsuit claiming stock drop damages. Coinbase investor Brady Nessler said in a lawsuit filed in a Pennsylvania federal court that the data breach and the alleged broken agreement with the UK’s FCA resulted in a precipitous decline in the market value of the company’s common shares, causing stockholders to suffer significant losses and damages.

🇺🇸 Y Combinator-backed blockchain firm Axiom hits $100m in 4 months. Axiom plans to expand beyond Solana and Hyperliquid, though details are not yet disclosed. The platform incentivizes users by returning up to 43% of its fees as rewards.

🇩🇪 Deutsche Bank partners with finaXai on token fund servicing. The partnership will assess the integration of machine learning and large language models into asset servicing workflows. The initiative aims to build on Project DAMA 2, a multi-chain asset servicing pilot designed to improve fund servicing efficiency.

🇫🇷 BNP Paribas launches tokenized money market fund shares. The tokenized fund is the result of a collaboration involving BNPP AM and Allfunds Blockchain as the technology provider, which serves as the transfer agent and fund-dealing service provider.

PARTNERSHIPS

🇲🇾 CIMB Bank taps ACI Worldwide for payments platform modernisation. The partnership involves deploying ACI’s ISO 20022-native platform to unify all account-to-account transactions, including real-time, ACH, RTGS, and cross-border payments, onto a single system. The platform will first be launched in Malaysia.

🇬🇧 BoomFi and Paytiko to provide crypto payment rails to merchants worldwide. Together, the companies aim to make it easier for merchants to offer customers flexible, fast, and secure crypto payment options alongside traditional payment methods.

🌍 dLocal powers Panda Remit's expansion into Africa with faster, reliable cross-border payment solutions. This collaboration reduces transaction costs, increases operational efficiency, and accelerates market expansion, ensuring reliable access to funds for those who rely on remittances.

🌏 Areeba and Codebase Technologies' partnership to address the rising demand for banking-as-a-service across the Middle East. This collaboration aims to deliver turnkey BaaS solutions that empower banks and FinTechs to rapidly deploy modern, user-centric financial products and services across the region.

🇪🇬 Fawry joins forces with CTM360 to strengthen digital risk protection and safeguard customers from evolving cyber threats. Through this partnership, Fawry will gain real-time visibility into potential cyber risks, enabling the company to swiftly detect and respond to threats.

🇵🇭 EastWest adopts Temenos SaaS for core modernisation. The Philippine-based universal bank plans to deploy the cloud-native system across its retail, SME, and corporate banking divisions as part of its digital transformation strategy.

🇦🇺 Alchemy Pay expands in Australia's crypto payment market with PayID support. By integrating PayID, Alchemy Pay empowers Australian users to seamlessly convert local currency (AUD) into crypto assets. Keep reading

🌍 Cecabank and Bit2Me to roll out digital asset solution in Europe. Through this new offering, both aim to allow banks to provide crypto services more securely and efficiently, while falling in line with the legal clarity and oversight offered by Europe’s Markets in Crypto Assets (MiCA) regulation.

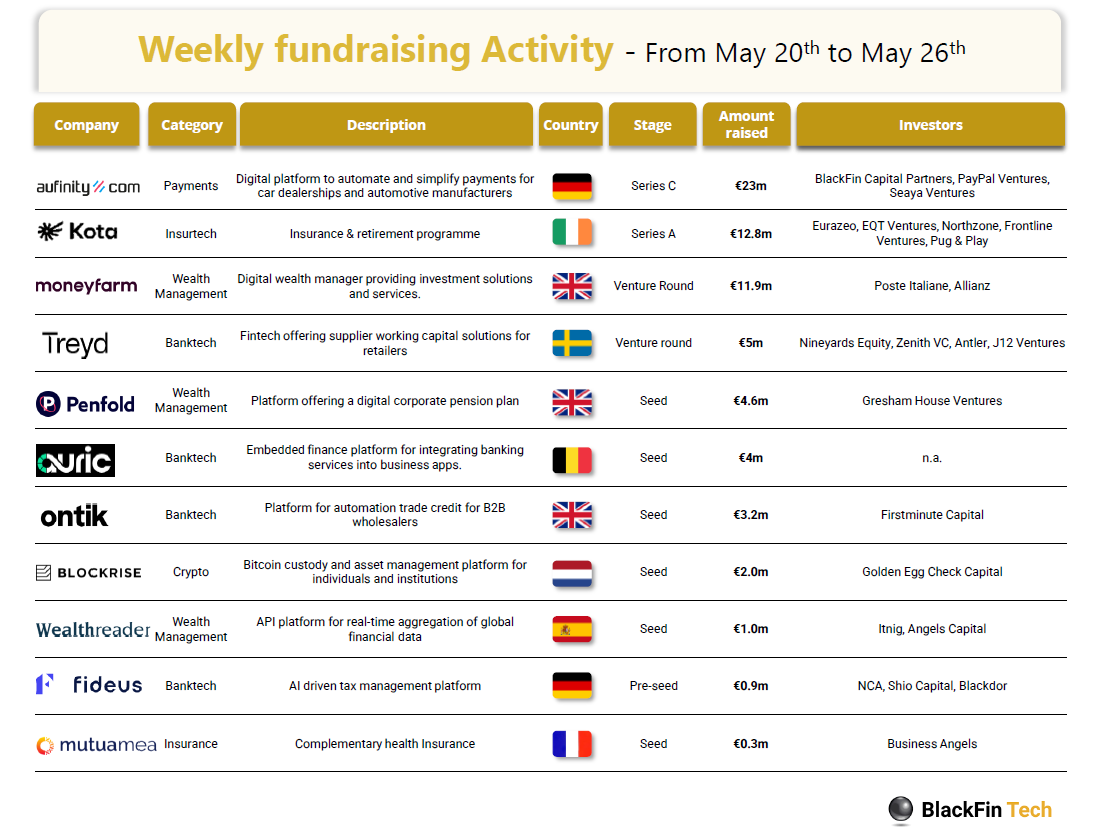

DONEDEAL FUNDING NEWS

💰 Over the last week, there were 11 FinTech deals in Europe, raising a total of €68.7 million in equity, three deals in the UK, two deals in Germany, and one deal each in Ireland, Sweden, Belgium, the Netherlands, Spain, and France.

🇮🇳 Lightspeed joins $20m series B for Indian wealthtech firm. The funding will be used for capital expenditure, marketing, and general corporate purposes. The platform lets users compare, invest in, and manage fixed-income products, including bank fixed deposits.

🇦🇪 UAE’s Gainz raises funds to tackle $200b SME financing gap in MENA. The investment signals strong confidence in Gainz’s mission to democratize SME financing in a region where access to working capital remains limited and fragmented.

🇮🇳 Indian FinTech firm Mufin Green bags $18m for EV loans to MSMEs. This funding aims to expand its electric vehicle (EV) financing and leasing operations. It will also be allocated to enhance financing for electric two-, three-, and four-wheelers, as well as related infrastructure.

🇬🇧 UK FinTech Capital on Tap raises £650m to expand £1.2bn Master Trust facility. Capital on Tap CEO Damian Brychcy stated that the recent funding milestone reflects both the trust partners have in Capital on Tap and the company's commitment to simplifying the financial lives of small business owners.

M&A

🇰🇷 Kakao Pay plans to acquire SSG Pay and Smile Pay for digital optimisation in Korea. If successful, it will strengthen Kakao Pay’s position in the Korean mobile payments market. Additionally, Kakao Pay would expand its merchant relationships in retail and online marketplaces, paving the way for new financial products.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()