Juni Expands Its Payment Horizons: Enables Cross-Border Transactions to US and China for European Ecommerce Businesses

In a move that reaffirms its commitment to revolutionizing digital commerce banking, Juni has taken a pivotal step in expanding its cross-border payment capabilities. European businesses using Juni's platform can now seamlessly conduct transactions with entities in both the US and mainland China.

In a move that reaffirms its commitment to revolutionizing digital commerce banking, Juni has taken a pivotal step in expanding its cross-border payment capabilities. European businesses using Juni's platform can now seamlessly conduct transactions with entities in both the US and mainland China.

The increasingly intertwined global business landscape demands seamless international transaction capabilities. According to recent data, the global B2B cross-border payments market is on track to skyrocket to a whopping $56.1tn by the end of the decade. This underscores the urgent need for digital commerce firms to have the means to efficiently manage inventory sourcing, vendor payments, and intercompany transfers on a worldwide scale.

Juni's enhanced 'Send Money' product will grant businesses within the European Economic Area (EEA) the ability to make direct, secure Cross-Border Payments to both mainland China and the US using their Juni USD accounts. This move aligns perfectly with Juni's long-term vision: to position itself as a formidable alternative to traditional banking for digital commerce enterprises and to fortify its foundational banking services.

“Legacy banks often struggle to offer competitive international transfers with a smooth customer experience and it’s something we know is incredibly important to our customers,” says Samir El-Sabini, CEO & Co-founder of Juni.

“Our new cross-border payments feature ensures ecommerce businesses can pay vendors, suppliers and do intercompany transfers easily. This is one of many steps we’re taking to become a banking alternative for our customers.”

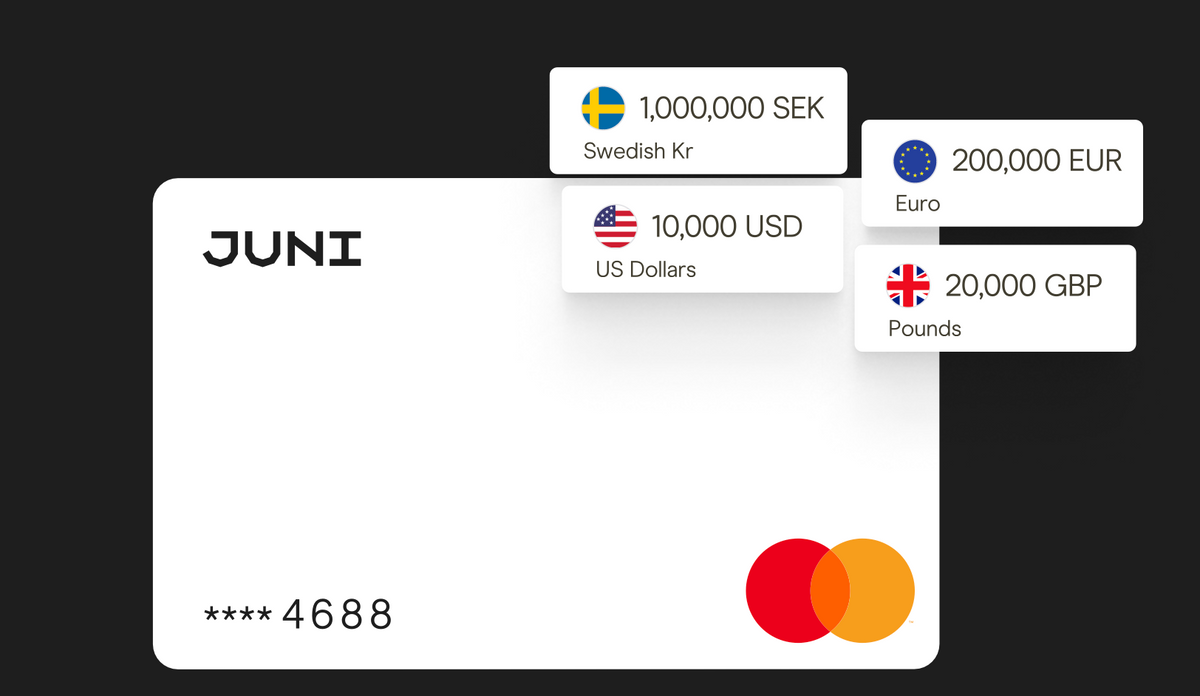

Businesses working with global entities can use Juni to move money between multi currency IBAN accounts in USD, GBP, EUR, NOK and SEK, with account payments FX capped at 0.5%.

“We’re really excited to bring this feature to market”, says Shelley Havemann, Senior Director of Product at Juni.

“By facilitating USD to USD international transfers simply and efficiently, we strengthen our banking proposition while laying the foundation for expanding our invoice management offering to include inventory payments. We will look to add additional jurisdictions in the coming months.”

Cross-border Payments to the US and mainland China will be available for ecommerce businesses across the EEA.

The aim is to make the feature available to businesses in the UK in the second half of 2024.

Comments ()