JPMorgan Rolls Out Instant Dollar-Euro Settlement on Kinexys

Hey FinTech Fanatic!

JP Morgan is set to enable instant settlement for dollar-to-euro foreign-exchange conversions on its Kinexys blockchain platform, with plans to introduce the British pound soon after.

As JPMorgan exec Naveen Mallela, co-head of Kinexys (formerly Onyx), put it, “If you look at JPM Coin, we generate revenues from fees, we also generate revenue from liquidity from holding those balances. We’re coming up with a third revenue stream from FX spreads.” Powered by the JPM Coin tokenized deposit, Kinexys processes over $2 billion daily and is scaling rapidly.

JPMorgan’s strategy here is notable for its ambition: Kinexys represents one of the few large-scale digital ledgers managed by a major bank. While it currently handles a fraction of JPMorgan’s daily $10 trillion in transactions, Kinexys’s growth is accelerating.

This latest feature aims to attract more clients—including FinTech firms—while potentially bringing Kinexys closer to profitability within three to five years. The goal with it? A seamless, high-speed FX system that transforms settlement from days to seconds.

Read more global FinTech industry updates below👇 and I'll be back tomorrow!

Cheers,

#FINTECHREPORT

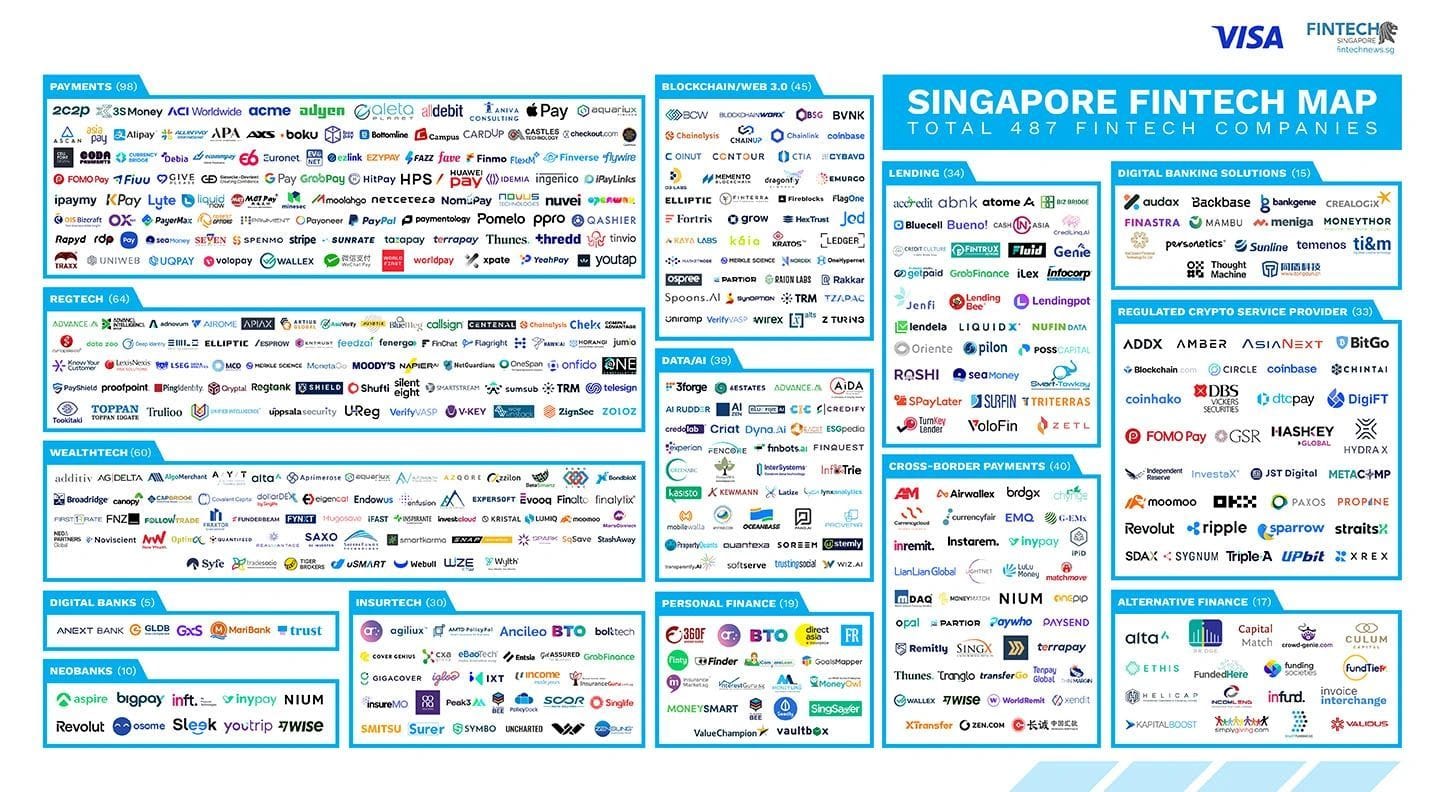

📊 The 2024 edition of the Singapore FinTech Market Map is out👇

Anyone missing in this overview?

FINTECH NEWS

🇺🇸 Jack Henry & Associates profit jumps on robust demand for banking technology. The company posted a 17% jump in first-quarter profit on Tuesday, driven by higher demand for its technology solutions, as banks and financial institutions accelerated their digital modernization initiatives.

🇬🇧 Accept Cards introduces cash processing tech for SMEs. The UK payments broker has launched Accept Cash, an innovative cash payments solution to meet SME demand for instant, affordable cash deposits that support cash flow stability. Link here

🇺🇸 FTC sues FinTech app Dave over misleading $500 cash advance ads. The FTC's lawsuit claims the app, which targets users facing financial hardship, rarely offers the full advertised amount, charges up to $25 for instant cash, and has a monthly $1 fee. Dave said many of the claims are incorrect and it will defend itself.

PAYMENTS NEWS

🇺🇸 Sure and Checkout. com partner to improve payments for digital insurance. By partnering with Checkout.com, Sure optimizes authorization rates, strengthens fraud prevention, and increases customer retention with hands-on, performance-focused support.

🇬🇧 Thunes and GCash launch innovative, cross-border digital wallet top-up solution. This ground-breaking initiative enables GCash users to top up their wallet balances directly within the app using funds from their U.K. and European bank accounts.

🇨🇭 Bluecode introduces contactless NFC payments alongside existing barcode and QR code technology. This will enable users of Bluecode partners, such as issuing banks, to make secure, contactless payments simply by tapping their smartphones at payment terminals.

🇸🇬 Nium and Partior to offer real-time multi-currency payments. This partnership makes Nium the first FinTech payment service provider to join the Partior network, and supports Nium’s recent strategy of connecting more networks to its real-time payments infrastructure.

🇳🇬 MTN Nigeria to obtain two additional payment licences for MoMo PSB. MTN Nigeria has applied for Payment Service Solutions Provider (PSSP) and Payment Terminal Service Provider (PTSP) licences for its FinTech subsidiary MoMo PSB, reflecting its growing focus on digital payments in the country.

🇸🇬 Visa collaborates with QR payment providers to enable cross border payments across Asia Pacific. The pilot program will begin in Singapore, with more to be rolled out across the region in 2025. Through its network expertise, Visa will enable consumers to use their everyday payment apps to scan and pay at QR merchants locally and abroad.

🇸🇬 Tencent partners with Visa to bring Palm Payment to Singapore. The service will first be rolled out in Singapore, where Visa cardholders from participating banks, including DBS, OCBC, and UOB, will be part of the pilot program. Read more

🇸🇬 Mastercard goes OTP-free in APAC for faster, safer online transactions. Combining tokenization, Click to Pay, and biometric passkeys, it enables secure, on-device facial or fingerprint scans for seamless online checkout, the same way consumers unlock their phones every day.

🇦🇪 Mastercard joins Buna, the Arab Regional Payment System. The collaboration combines Mastercard Move’s money transfer capabilities and extensive network with Buna’s cross-border payment system to enable seamless payments into and out of the MENA region.

🇬🇧 British FinTech firm Wise posts 55% jump in profit on expanding market share. Revenues at the money transfer platform climbed 19% year-over-year for the period, to £591.9 million, the company reported Wednesday. Continue reading

🇬🇧 Finseta enhances payment security with launch of Confirmation of Payee service powered by tell. money. This service will ensure that payments are directed to the intended recipients promptly and with enhanced security measures to ensure the accuracy of transactions.

🇵🇰 Dlocal and inDrive enhance driver payments in Pakistan. The partnership facilitates seamless and immediate wallet top-ups for drivers. This comes as a large portion of Pakistan’s population remains unbanked.

🇬🇧 ConnexPay integrates with Shift4 to streamline payment solutions. This partnership will empower online travel agencies (OTAs) and hospitality businesses in the UK and Europe by integrating ConnexPay’s payment issuance solutions with Shift4’s payment processing infrastructure.

DIGITAL BANKING NEWS

🇮🇩 BCA Syariah goes live with Thought Machine’s Vault Core. Since adopting Vault Core, BCA Syariah has launched new products like a top-up e-wallet, Wadiah savings, and an online Hajj Fee Deposit, with plans for gold financing and term deposits soon.

🇦🇺 CBA launches owned media network: CommBank Connect. This will offer relevant content to retail and business customers, enhancing their experience while giving partners and advertisers access to engaged audiences. Read on

🇬🇧 NatWest and Capco partner to navigate the future of payments. The collaboration facilitates customer, operational and infrastructure opportunities through the development of Bankline Direct Digital, which ensures long-term regulatory compliance among other benefits.

🇪🇺 UniCredit and Commerzbank square off with target hikes amid takeover battle. Both banks raised their outlook on Wednesday with third-quarter results, while markets await whether UniCredit will pursue its takeover bid for Commerzbank after building a stake in September.

🇸🇦 Jeel and audax to roll out BaaS, open banking solutions in Saudi Arabia. The partnership will enable Saudi banks and financial institutions to rapidly transition from outdated legacy systems and embrace flexible business models such as Banking-as-a-Service (BaaS), digital banks, and open banking solutions.

🇪🇺 Credit Agricole, Credit Suisse lose challenges against EU cartel fines. The companies lost their appeals against EU antitrust regulators, which stated that the cartel operated in the European secondary trading market for U.S.-denominated supra-sovereign, sovereign, and agency (SSA) bonds.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Bitcoin hits record above $75,000 as crypto industry celebrates Trump win. Bitcoin surged to a record high of $75,389 on Wednesday, rallying over 7% as crypto investors celebrated Donald Trump’s election victory, following his pledge to make the US "the bitcoin superpower of the world."

🇲🇾 Ant International partners Standard Chartered, OCBC for blockchain settlement. Ant announced two Singapore updates for its Whale platform: StanChart integrated for 24/7 SGD liquidity, and OCBC will enable real-time payments between Singapore and Malaysia.

🇸🇬 Crypto.com set to launch banking access, credit card and stocks services. This will be supported by its most significant benefit, Level Up, which offers customers the most comprehensive crypto and finance rewards through a single brand, Crypto.com.

🇺🇸 JPMorgan to offer instant Dollar-Euro settlement via blockchain. JPMorgan Chase & Co. will soon offer instant settlement for foreign-exchange conversions between the dollar and the euro via its Kinexys blockchain platform and plans to add sterling to the service over time.

🇺🇸 Goldman, JPMorgan eye crypto clients as IPO prospects surge. The bankers hope to score some lucrative IPOs that cryptocurrency companies could launch following the U.S. presidential election. Find out more

🇩🇪 Boerse Stuttgart Digital partners with Fenergo to scale regulatory compliant crypto solutions across Europe. Through this partnership, Boerse Stuttgart Digital accelerates growth in Europe's crypto market by enhancing infrastructure scalability and streamlining compliance with Fenergo.

PARTNERSHIPS

🇧🇷 B89 and PagBrasil join forces to expand Pix in Latin America. This collaboration enables B89 to offer Pix International to merchants in Panama, Colombia, Peru, Bolivia, Paraguay, Venezuela, and Ecuador, allowing Brazilian citizens to pay in reais at a fixed exchange rate.

DONEDEAL FUNDING NEWS

🇸🇬 FinTech Capital C raises funds for SEA ‘super app’ launch. The FinTech company plans to use the new funds to expand its reach across Southeast Asian markets. They aim to develop a comprehensive financial services “super app.” More here

M&A

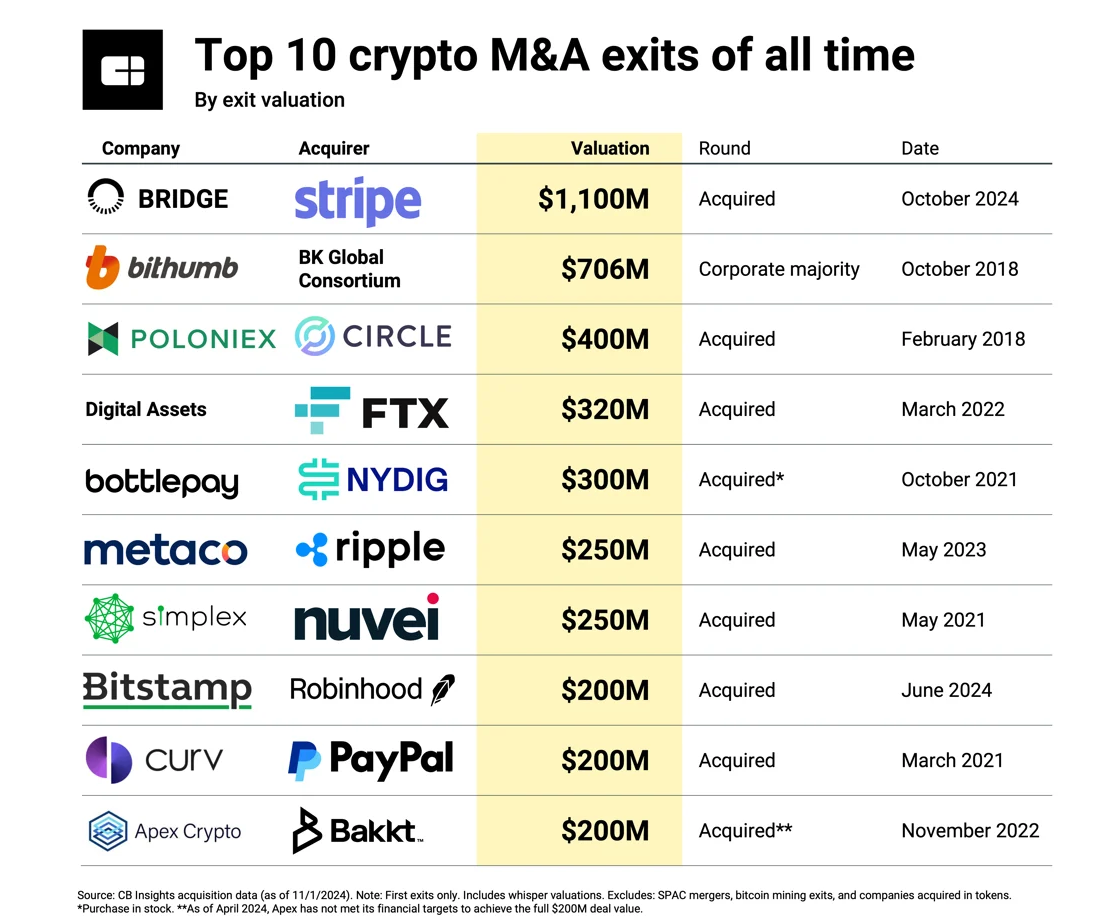

🇺🇸 Stripe acquired Bridge for $𝟭.𝟭𝗕 which represents a lofty 𝟵𝟬𝘅 𝗺𝘂𝗹𝘁𝗶𝗽𝗹𝗲 🤯

Here is the 𝗧𝗢𝗣 𝟭𝟬 Crypto M&A exits of all time:

🇳🇿 BNZ acquires BlinkPay to grow Open Banking in New Zealand. According to BNZ, the investment will enable BlinkPay to accelerate and scale its innovation and product development through access to the bank’s resources and expertise. Financial details of the investment have not been disclosed.

MOVERS & SHAKERS

🇬🇧 Monument Technology grows leadership team with key appointments. Diptesh Mishra has been appointed as CTO and Nick Lawler as CCO. Both executives are two critical hires who each bring market leading capability and experience to Monument Technology’s leadership team.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()