Is 2024 Going To Be The Breakthrough Year For "Pay by Bank"?

Hey FinTech Fanatic,

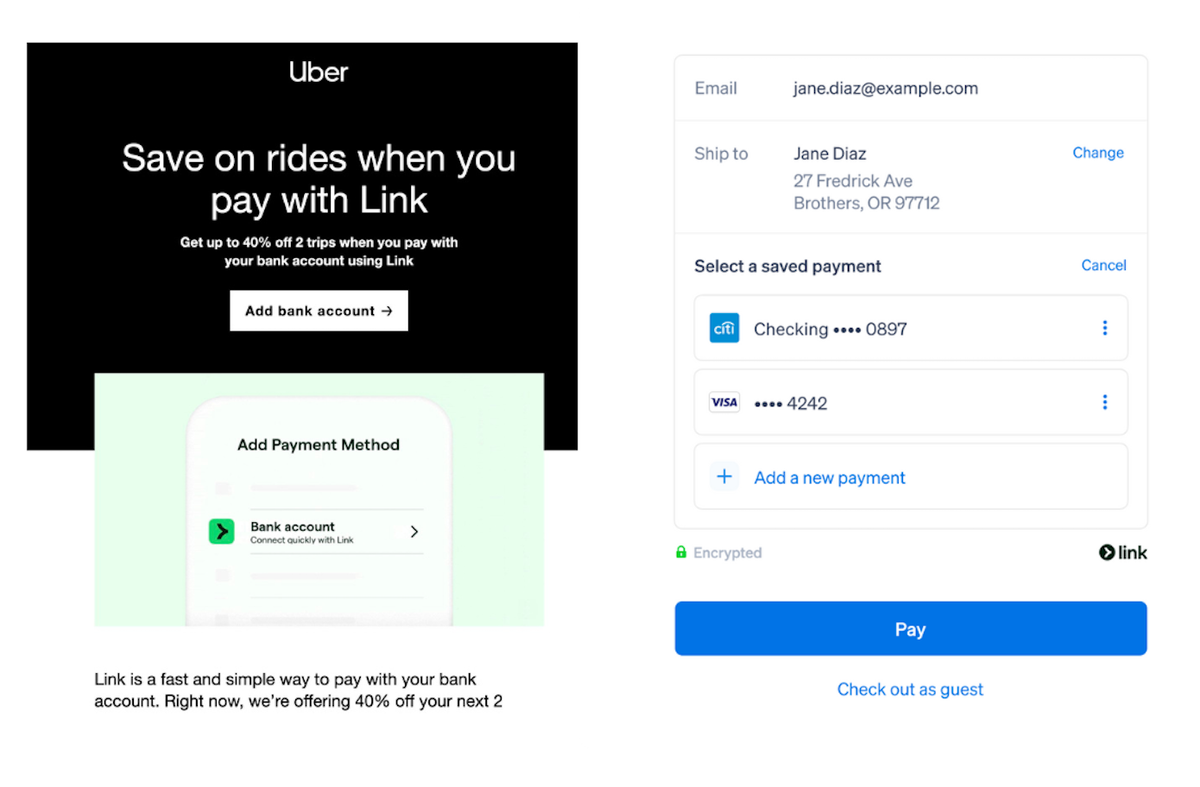

In an interesting move, Uber is introducing “Pay by Bank” (by Stripe) as a Payment Option, and they are pro-actively incentivizing users with cheaper rides if they choose that method over Cards and Wallet.

Is 2024 going to be the breakthrough year for "Pay by Bank"?

I've compiled a long list of updates from the global FinTech industry for your perusal below👇, and I'll be back in your inbox with more news!

Cheers,

POST OF THE DAY

💳 How does VISA/Mastercard make money?

This 6-step diagram shows the economics of the credit card payment flow:

FEATURED NEWS

🇫🇷 Swan is listed as one of the most influental startups in France. Who are the other France’s Most Influential Banking Startups Shaping 2023’s Landscape? You can find the list here.

#FINTECHREPORT

📊 US Faster Payments Council publishes QR code report. Check out the full report through this link.

FINTECH NEWS

🇺🇸 Goldman Sachs Group Inc. is closing down its Automated-Investing Business for the masses after clinching a deal with Betterment. The bank has struck an agreement to transfer clients and their assets from the unit known as Marcus Invest to Betterment, a $45 billion digital investment-advisory firm.

🇬🇧 Manchester-based innovative FinTech Ryft, announces a new partnership with Clearhaus, allowing the Danish acquirer to leverage its technology solutions and cater to digital platforms and marketplaces.

🇸🇬 SG FinTech firm Bambu shut down after missing profit targets. The B2B FinTech startup had been on a path to profitability in 2023. But it fell short, and shut down on December 31, founder Ned Phillips confirmed. Read more

🇧🇷 NuInvest, Nubank's investment brokerage, has just received authorization from the Central Bank (BC) to operate in the foreign exchange market. The regulator's green light was published recently, on Apr. 19. The digital bank acquired the then Easynvest in September 2020. Later, the brokerage was renamed NuInvest.

PAYMENTS NEWS

🇺🇸 ACI Worldwide, Inc. reports financial results for the Quarter and full year ended December 31, 2023. "2023 was another year of progress for ACI, with steady revenue growth and improving margins,” said Thomas Warsop, president and CEO of ACI Worldwide. Explore the full article for further insights.

🇳🇱 Airwallex partners with Bird. Airwallex, a leading global payments and financial platform for modern businesses, announced its partnership with Bird (formerly MessageBird), a global communication platform, to power Bird’s international payments infrastructure.

🇺🇸 This is interesting: Uber is introducing “Pay by Bank” (by Stripe) as a Payment Option, and they are pro-actively incentivising users with cheaper rides if they choose that method over Cards and Wallet. Read on

🇯🇵 Japan’s Docomo to sell contactless smart rings; users can make payments at the wave of a hand. The firm plans to form a business alliance with Evering Co., the manufacturer of the smart rings, and aims to strengthen the services it offers outside the telecommunications industry.

🇨🇳 The Bank of China is conducting a pilot in the city of Shenzhen of a new service that makes it possible for merchants to accept contactless digital currency payments on standard NFC mobile phones. More on that here

🇺🇸 Klarna expands global partnership with Expedia Group, offering flexible payments to US consumers, enabling them to book flights and stay using its interest-free Pay Now or Pay in 4 options. This comes after Klarna's successful launches in the UK, Germany, Sweden, and Finland.

Viva.com and SUNMI unify advanced payments technology with widest range of smart POS devices. Through this collaboration, Viva.com’s Tap on Any Device technology, featuring the hardware agnostic Terminal app, is available on SUNMI’s Android hardware portfolio.

REGTECH NEWS

🇫🇮 Basware debuts AI-based fraud protection product, AP Protect, an AI-powered solution that empowers finance teams to protect their organisations from the threat of profit loss, invoice errors and fraud. Read on

DIGITAL BANKING NEWS

🇺🇸 Grasshopper debuts digital application for SBA loans. The digital bank doubles down on commitment to small businesses, meeting demand for easier access to capital and digital solutions to efficiently manage their finances. Read more

🇬🇧 Zopa is in no rush to IPO, but the digital banks are coming for the incumbents. The CEO concedes that the incumbents’ wealth of customer data is a great asset. But he points out that Zopa has some deep customer data itself, having been in business since 2005.

🇦🇺 Goldman Sachs is considering applying for a local banking licence to extend a broader suite of lending products to its ultra-high net worth clients in Australia, the bank’s co-head of global private wealth management, John Mallory, says.

🇬🇧 Allica Bank reports first profitable year just three years since opening its doors to lending. The bank, which offers a portfolio of lending, savings and investment products to SMEs typically neglected by larger banks, reported full year revenues up 141% on 2022 at £191 million.

🇲🇾 Aeon Bank to start its Islamic digital operations in Q2 2024. Malaysia’s first Islamic digital bank aims to attract mainly tech-savvy and Generation Z consumers, as well as micro, small and medium enterprises (MSMEs) currently underserved due to their size, the bank's CEO said.

🇺🇸 Capital One Financial and Discover Financial Services spent months talking — and even walked away from negotiations at one point — before the two companies reached a deal that, if it gets approved, will create the largest credit card lender in the United States.

🇺🇸 Americans are losing millions of dollars every year to criminals who steal money from their bank accounts through fraudulent wire transfers. Some U.S. senators are now pressing major banks for answers about what they are doing to stop the scammers.

🇩🇰 Challenger bank Lunar trials voice-enabled AI-powered chatbot- voiced by CEO. The idea is currently being road-tested by the Danish neobank Lunar, which along with UK advertiser-subsidised BNPL firm Zilch recently spoke about AI and generative AI and how they were deploying it within their organisations.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Bankman-Fried agrees to help in lawsuit targeting FTX celebrity endorsers. The agreement, which pending court approval would resolve plaintiff’s civil claims now and in the future against Bankman-Fried, was first reported by Bloomberg.

DONEDEAL FUNDING NEWS

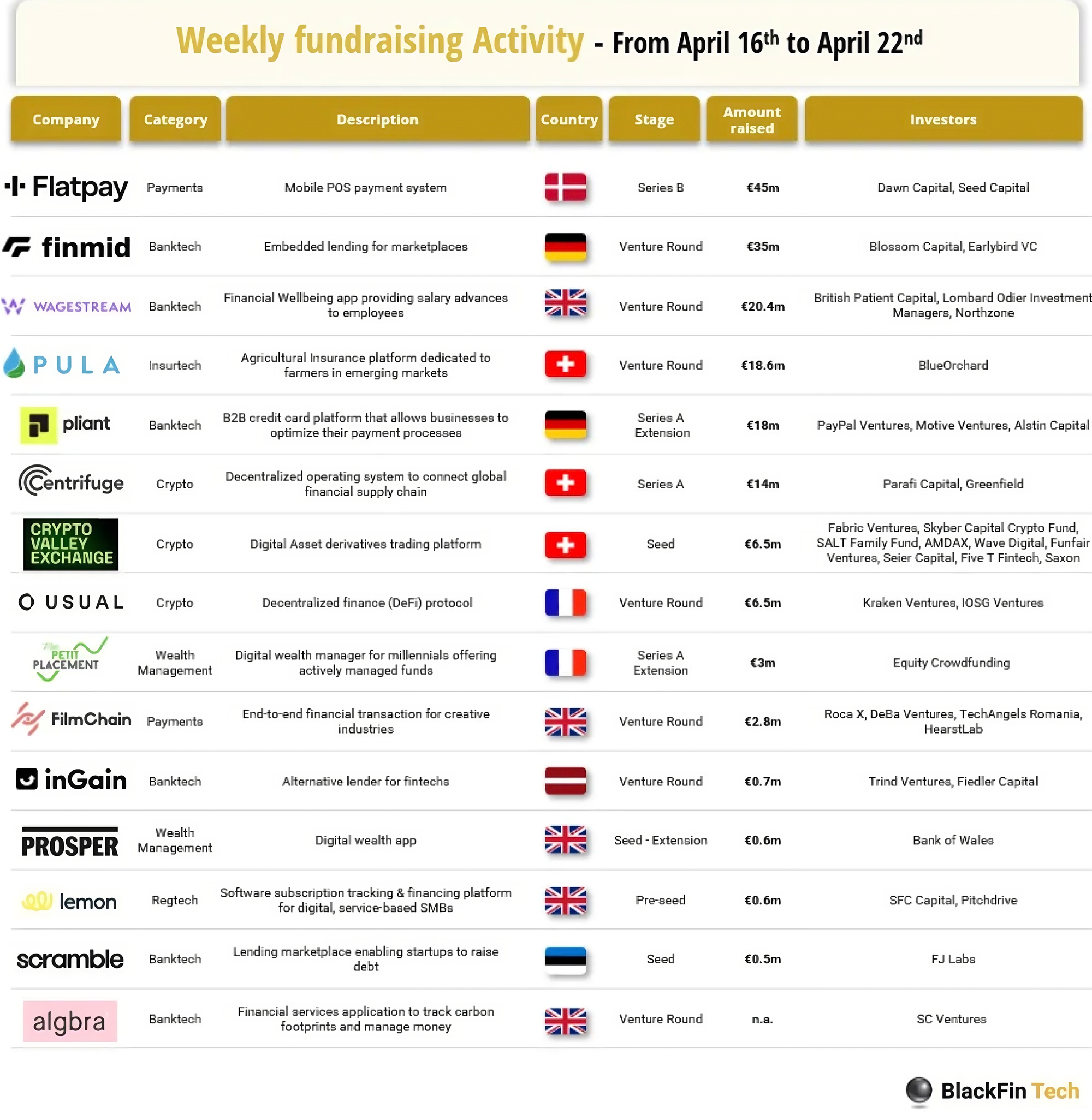

Last week we saw 15 official FinTech deals in Europe for a total amount of €159.6m raised, with 5 deals in the UK, 3 in Switzerland, 2 in France, 2 in Germany, 1 in Denmark, 1 in Latvia, and 1 in Estonia. Check out the full BlackFin Tech article here

🇹🇷 Equities platform Midas raises $45M Series A as FinTech retains its sparkle in Turkey. Midas intends to use the new funding to roll out three new products: cryptocurrency trading, mutual funds and savings accounts, and has plans to expand beyond Turkey, aiming to target countries in the MENA region.

🇫🇷 Paris-based Payflows announced on Monday that it has secured €25M in a Series A funding round led by Balderton Capital. Payflows offers a single source of truth for accounts payable, accounts receivable, customers, suppliers, payments, and cashflows, leading to improved visibility and teamwork.

🇺🇸 Rumor has it that HR/FinTech startup Rippling is raising $200 million, with another $670 million worth of shares being sold by existing stockholders. This will be Rippling’s Series F and could raise its valuation to as high as $13.4 billion on a post-money basis, up from the $11.25 billion valuation it reached just a year ago.

🇲🇾 Seedflex launches “Pay-As-You-Sell Advance™” In Malaysia; raises seed from 500 Global to bridge the credit gap for MSMEs in SE Asia. The company aims to expand the service to a wider group of Malaysian cashless merchants across digital economy partner platforms later this year.

🇳🇬 The Peer will return $350,000 to investors after shutting down. Investors were told they would receive 20% of their funds back (around $460,000), but one person said The Peer’s seed round was less than the $2.1 million announced, implying a lower refund.

🇪🇬 Egyptian FinTech Bokra raises $4.6 million pre-Seed round. The funds will be used to launch the Bokra app, expand the range of investment products, and geographically scale operations across MENA. Read the full piece here

🇳🇬 Nigeria’s Moove makes Top 10 global FinTech funding in Q1 2024 with $100 million raise. Moove’s $100 million raise turned out to be the largest raise by an African tech startup in the first quarter of 2024.

🇱🇹 Lithuanian FinTech Softloans snaps €1M to help SMEs access finance. The company intends to use the funds to expand operations and development efforts. It also plans to expand in Lithuania and beyond. Read full article

🇦🇪 UAE FinTech firm Fortis raises $20mln in Series A funding to fuel expansion. The raised funds will be utilised for the development of Customer-Centric Services, prioritizing UX / UI design, along with forging new partnerships with banks, payment systems, and B2B services to complement their existing products.

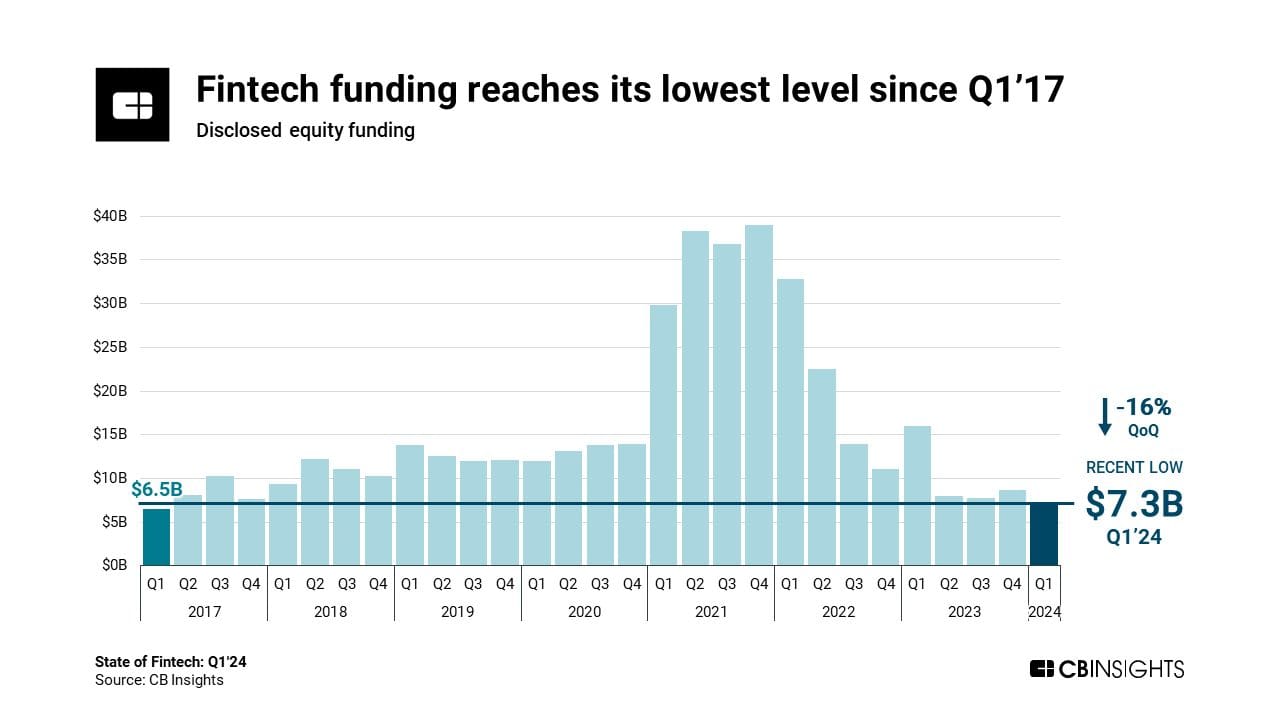

➡️ Investors remain cautious in FinTech, with funding declining to its lowest quarterly level since 2017 even as deals tick up. Link here

M&A

🇸🇪 Klarna is selling Hero, the virtual shopping platform it acquired in 2021, to video commerce outfit Bambuser in a deal worth around EUR1.3 million. Hero's virtual shopping platform connects millions of shoppers with product experts via text, chat and video, all directly from a brands ecommerce store.

🇬🇧 £2.9bn takeover of Virgin Money moves closer as shareholders are sent offer details. Shareholders at the business have been sent documents outlining the terms of the deal, which would create a combined group with total assets of around £366.3bn and total lending and advances of around £283.5bn.

MOVERS & SHAKERS

🇺🇸 Nium appoints Alexandra Johnson as chief payments officer. With this newly-created position, Nium sets itself up to closer align itself with partners across the payments ecosystem. Johnson will work across Nium’s markets, leading the Global Banking and Payment Operations teams.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()