Introducing: How FinTech Performs

Hey FinTech Fanatic,

Quick update before we dive into today’s news: I’ve just launched a brand-new weekly newsletter called How FinTech Performs.

Each week, it looks at the industry through data, market caps, top performers, and sector standouts, all in a few simple charts.

The first edition is already live: How FinTech Performs in 5 Charts.

If you’d like to follow along, you can check it out here.

Now, back to today’s headlines 👇

Cheers,

ARTICLE OF THE DAY

🇦🇪 The Power of a Good Gift (Card): Digital Gifting in the UAE. Gift cards plug directly into the payment and loyalty system: they’re as easy to send as a text message but as rewarding as in-person presents. Majid Al Futtaim’s answer is an all-in-one digital gift card linked to the SHARE loyalty program. Explore the full article

FINTECH NEWS

🏃➡️ Got 32 Seconds? We Want to Hear from You! If you like FinTech and love building community with us, your input matters more than ever. The FinTech Running Club has launched a 32-second survey about what you love most and where it can improve, too! It only takes 32 seconds to share your thoughts (yes, we timed it!). 👉 Take the quick survey here

🇰🇪 Kenyan FinTech Raise shuts down. After seven years in operation, the company has announced that it is closing its doors and will be migrating its users to Carta, a U.S.-based equity management platform. Co-founder Marvin Coleby explained that Raise struggled to find a scalable business model that worked within the African venture capital ecosystem.

PAYMENTS NEWS

🌎 Revolutionizing Code Generation with AI at Pomelo by Carlos Alvarez. At Pomelo, AI has become a core driver of innovation, enabling a complete transformation in how code is generated, clients are integrated, and products are developed. Led by Alvarez, the company has moved beyond experimentation, embedding AI deeply into its infrastructure to improve speed, accuracy, and operational consistency across Latin America.

🇺🇸 FIS builds on its awards momentum for treasury solutions by launching an AI-powered neural treasury suite. The solution suite combines AI, machine learning, and robotics to help corporate treasurers in businesses of various sizes with increasing efficiency, reducing operational risk, and unlocking cash flow to help fund strategic growth opportunities.

🇳🇿 Xero rolls out AI 'superagent' JAX. JAX will unify the Xero experience and learn a business’s rhythms, automatically adapting to how that business operates. It will automate routine tasks and workflows, such as bank reconciliations, data entry, and invoicing, which saves customers valuable time and helps them stay compliant.

🇨🇩 Visa launches “Visa Pay” in the Democratic Republic of the Congo to connect banked and unbanked users to digital payments. The service is designed to let consumers and businesses pay, receive funds, and transfer money across participating banks and mobile networks.

🇨🇳 PayPay integrates with the new overseas cashless payment service WeChat Pay. With this initiative, users of 26 cashless payment services from 14 countries and regions will be able to make payments at PayPay merchants when visiting Japan, including fees for dining, souvenirs, and accommodation.

REGTECH NEWS

🇬🇭 Bank of Ghana suspends Flutterwave, Cellulant, and 6 others over breaches. The Bank of Ghana stated that the crackdowns are part of an overall attempt to enforce compliance and enhance supervision of remittance and payment service companies operating in the country.

🇮🇩 Founder of Indonesian payments platform Gojek was arrested in connection with a graft probe. This is part of an investigation into an alleged $115 million corruption scandal linked to the government’s procurement of Google Chromebook laptops for schools.

DIGITAL BANKING NEWS

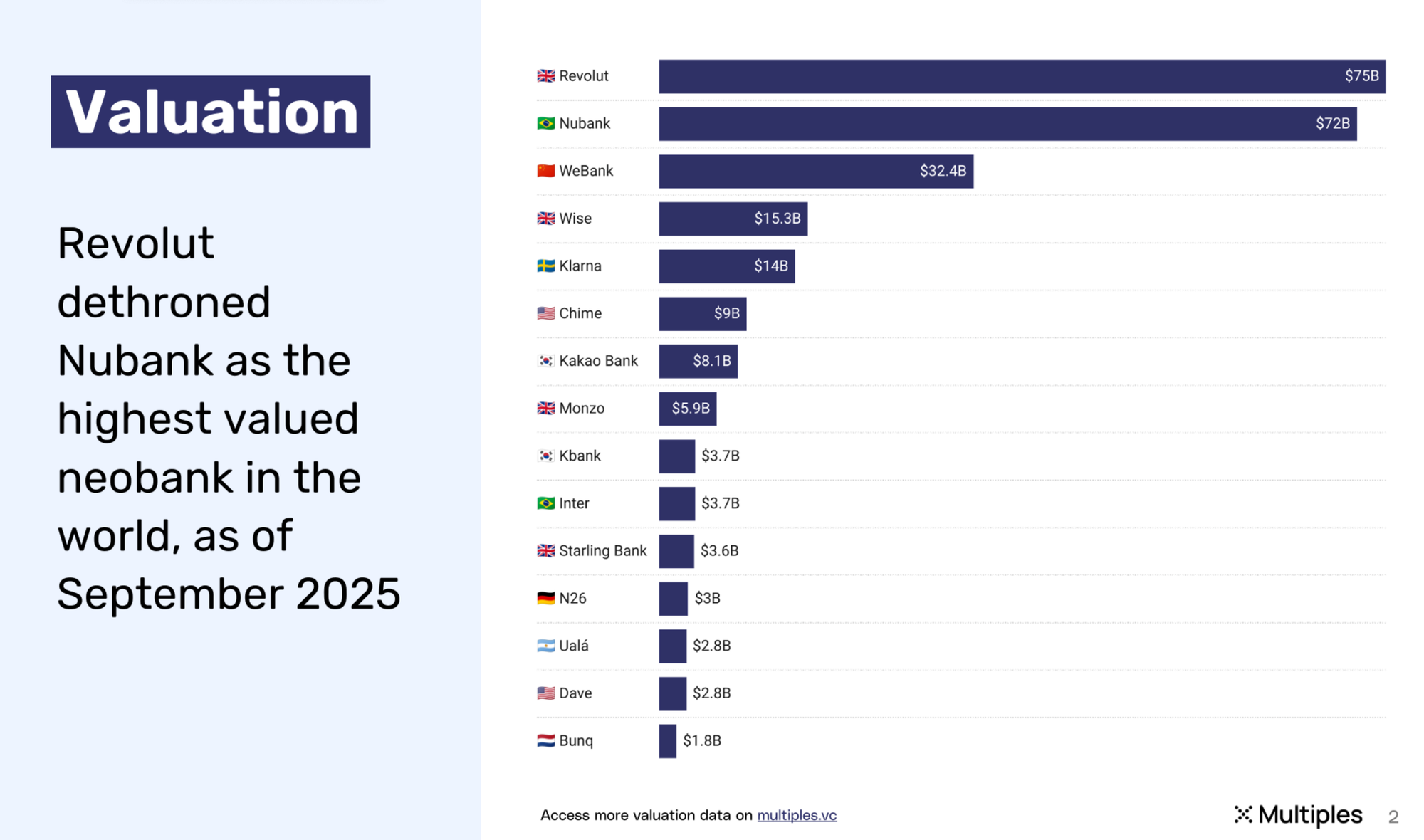

➡️ Revolut dethrones Nubank as the largest neobank in the world by valuation🤯

Here's the latest Global Neobank Valuation overview & comparison👇

🇺🇸 SoFi signs Josh Allen to a commercial deal. Allen has proven himself as an MVP, performing at the highest level. SoFi Plus matches that same superiority as America’s most rewarding financial membership, giving members the tools to help them bank, borrow, invest, and earn to get their money right, all in one app.

🇺🇦 TASCOMBANK to launch digital bank on Trigger Neobank engine. The initiative is a step in the bank’s digital transformation strategy to deliver a mobile-first banking experience that will redefine service standards in the Ukrainian financial sector.

🇨🇭 Valiant is a Swiss bank that offers multibanking for private customers. With the Valiant app and e-banking, customers now not only have an overview of their Valiant accounts, but can also view those of third-party banks. Regardless of which bank the account is held with, both balances and account movements are clearly available.

🇪🇸 BBVA and SAP forge a strategic alliance to improve corporate and business banking services. The solution will enable BBVA to transform and optimize how financial transactions are carried out for corporate and business banking clients, making the whole process more efficient and agile.

BLOCKCHAIN/CRYPTO NEWS

🌎 Public firm Bitcoin Holdings tops 1 million BTC. Publicly traded companies now collectively hold more than 1 million BTC (1,000,632 BTC) worth around $110 billion, according to BTC Treasuries, underscoring the growing role of corporate adoption in the bitcoin market.

🇪🇺 Crypto Exchange Gemini expands EU offering with staking and perpetuals. The new staking service allows users to earn rewards on Ether and Solana with no minimum amount required. The rollout follows the company’s recent approval under the EU’s Markets in Crypto-Assets Regulation (MiCA).

PARTNERSHIPS

🇺🇸 Stripe and Paradigm announce new payments-focused blockchain Tempo, a so-called Layer-1 blockchain built around stablecoins, or cryptocurrencies typically pegged to the U.S. dollar. Layer-1 blockchains like Bitcoin or Ethereum are more demanding to build and operate than “Layer 2s,” which sit atop other blockchains.

🇸🇪 Qliro taps Vilja to power next-gen payments expansion. The move is a milestone in Qliro’s expansion journey, strengthening its ability to deliver next-generation checkout and unified payment services across the Nordic region and into new European markets.

🌍 Ripple partners with Chipper Cash, VALR, and Yellow Card to launch RLUSD in Africa. The move brings RLUSD into the African market for the first time. Ripple said the expansion is intended to address institutional demand for regulated and reliable digital assets.

🇰🇪 Tanzanian FinTech NALA enters Kenya in partnership with Equity Bank and Pesalink. This partnership will give FinTechs and remittance firms direct access to trusted local rails and provide merchants and SMEs with quicker, more predictable international transactions.

DONEDEAL FUNDING NEWS

🇺🇸 Andreessen-Backed FinTech Lead Bank hits $1.47 billion valuation. The funds will help the bank bolster its balance sheet as it’s looking to grow its business in the booming FinTech sector. Continue reading

🇺🇸 Etherealize raises $40 million to expand Wall Street’s use of Ethereum. The Etherealize CEO said they were focused on tokenizing, or putting in blockchain wrappers, financial assets like mortgages, credit, and other fixed-income products, among other projects.

M&A

🇲🇽 Mexico’s Klar catches up on race to bank license with Bineo Buy. If approved, the acquisition will allow Klar to operate with a banking license and catch up with other FinTechs betting on banking licenses to grow their market. Keep reading

🇮🇪 Fiserv continues European growth by closing the acquisition of AIB merchant services. The acquisition supports Fiserv’s growth in the broader European market, including expanding growth opportunities for Clover, the world’s smartest point-of-sale system, across the region. AIBMS is one of Ireland’s largest payment solution providers and one of Europe’s largest e-commerce acquirers.

MOVERS AND SHAKERS

🇨🇭 Temenos CEO Jean-Pierre Brulard steps down with immediate effect. Speaking on his departure, Brulard said: "I am proud of everything achieved since I joined; much was accomplished during the 16 months of my tenure." "I would like to thank everyone at Temenos, its customers, and partners for their confidence. I wish all the best to the company," he added.

🇧🇪 Thomas Delaet appointed as new Swift CPO. Delaet joins Swift from McKinsey and Company's division McKinsey Digital, where he focused on core technology modernisations and headed the Cloud Services business. Keep reading

🇺🇸 Joe Wilson returns to bunq as Chief Evangelist. His return is driven by bunq’s relentless forward momentum and the intelligent ambition of its team. He promises to share data, stories, and insights as the company continues to redefine digital banking in Europe.

🇺🇸 Cat Ferdon Joins Coinbase as Chief Marketing Officer. She joins the company with a clear mission: to accelerate user growth and help onboard a billion people to crypto, advancing Coinbase’s vision of expanding global economic freedom. Her leadership is set to play a pivotal role in scaling the company’s impact and reach in the evolving digital finance landscape.

🇺🇸 Varo Bank to accelerate responsible and customer-focused AI efforts with New Chief Artificial Intelligence Officer Asmau Ahmed. She will lead company-wide AI and machine-learning efforts. Asmau has led teams and delivered products over the past 20-plus years, most recently sitting on the leadership team at Google X, where she led the development of new technologies.

🌍 Revolut taps Former Societe Generale CEO Frederic Oudea as Western Europe Chairman. “I had no intention of returning to work for a traditional bank,” Oudea said. The role is a “good opportunity to take part in a new venture” in a firm that has the technological and financial means to succeed, he added.

🇺🇸 Elon Musk’s X Money loses executives amid regulatory problems. Several executives have left the payments service, known as X Money, over the past 12 months, including its CEO and two chief compliance officers. Keep reading

🇦🇪 CFDs broker Traze sees the departure of CEO Erkin Kamran. He led the firm to secure a Category One license from the UAE’s Securities and Commodities Authority. Kamran expressed pride in launching and scaling a top-tier regulated broker and announced he is now working on a new stealth project at the intersection of TradFi and Web3.

🇧🇷 Nubank Appoints Patricia Whitaker as Chief Executive Officer of NuInvest. Previously, she served as chief investment officer at PicPay and led the equity division at XP Inc., and also worked at Nubank and Redpoint Ventures. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()