IKEA's Evolution: From Furniture Giant to Financial Powerhouse with Ikano Bank Acquisition

Hey FinTech Fanatic!

Welcome back! I hope you had a wonderful long weekend, taking advantage of the Easter break to enjoy some much-needed time off with your family and rest up—just like I did.

As we all return, recharged and ready to dive back into our routines, I've gathered some exciting FinTech industry news updates for you.

Enjoy the list below, and I'll be back with more in your inbox tomorrow!

Cheers,

BREAKING NEWS

🇨🇦 Nuvei announced the $6.3 billion deal with private equity firm Advent International on Monday (April 1), three weeks after reports of a possible acquisition emerged. Click here to learn more

FEATURED NEWS

🇺🇸 What will happen to Ripple Labs? On Monday, the US Securities and Exchange Commission (SEC) proposed that Ripple Labs—the SF-based blockchain firm—pay $1.9B in fines for the continued sale of its cryptocurrency, XRP. To Ripple, the move shows how the SEC “remains bent on wanting to punish and intimidate Ripple—and the industry at large.” Ripple is positioning itself as a bulwark against regulatory encroachment, with its legal future indistinguishable from the sector’s. But is that really the case? READ MORE

INSIGHTS

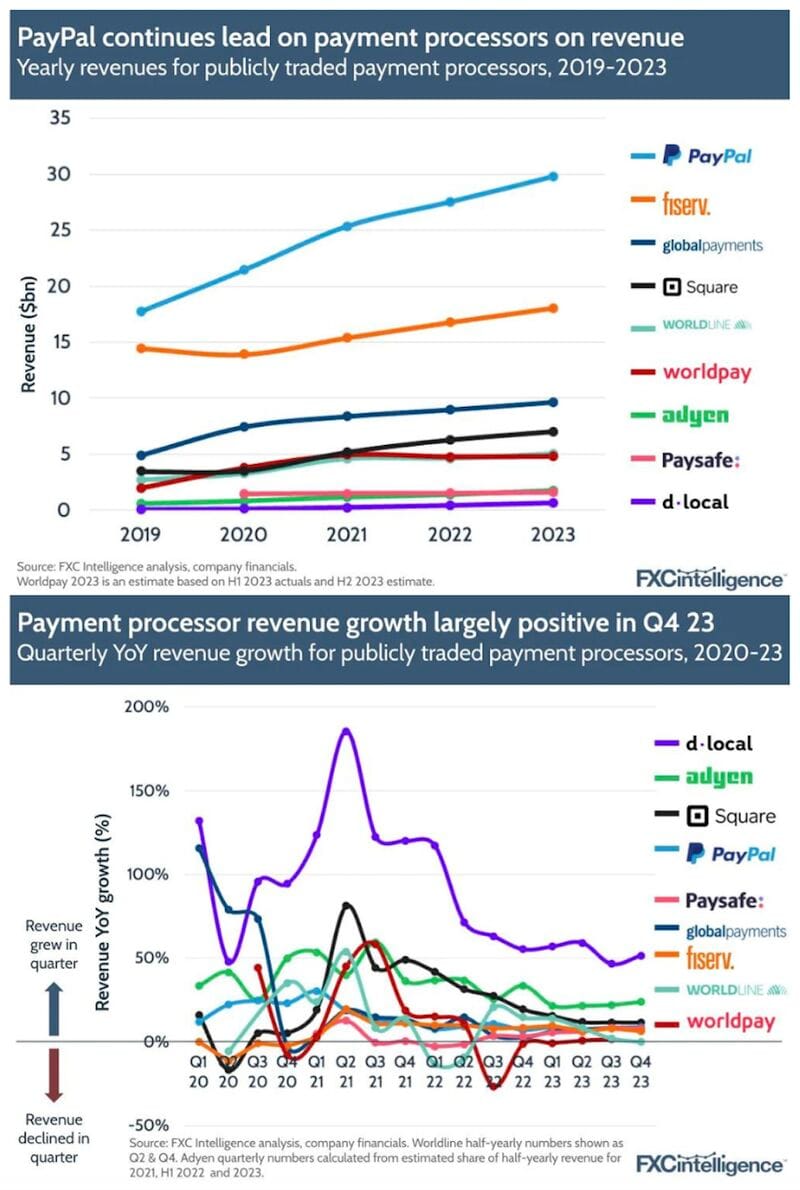

🇺🇸 Visa+ is now live with PayPal, Venmo and DailyPay in the U.S. Astra, Brightwell, Cross River Bank, Current, Fiserv, i2c and Tabapay will expand Visa+ to new use cases. In 2023, US person-to-person (P2P) payment volume was estimated at $993 billion. The convenience and speed of digital payments have transformed the way money is moved. Read full piece here

FINTECH NEWS

🇸🇦 MoneyGram teams up with Saudi FinTech barraq. Through this partnership, consumers in Saudi Arabia will be able to use the barraq mobile app to send funds to family and friends globally. This is possible through MoneyGram’s advanced cross-border technology platform.

🇬🇧 Core banking provider Vilja enters UK through Mast deal. This strategic partnership will help Building Societies streamline operations, improve efficiency, and foster innovation across their channels. Mast and Vilja’s solutions are built for automation, and self-service with an API-first architecture.

🇯🇵 Rakuten to consolidate FinTech units, enhancing customer acquisition. The Japanese Financial conglomerate Rakuten announced on Monday its strategic plan to consolidate its FinTech operations into a single, cohesive unit. The move enhances synergy and streamlines customer acquisition efforts across various financial services.

PAYMENTS NEWS

🇫🇷 BNP Paribas brings iPhone Tap to Pay to French customers. Tap to Pay on iPhone allows merchants to accept physical debit and credit cards, Apple Pay and other digital wallets using only their iPhone and the AXEPTA BNP Paribas app, removing the need for card readers or extra hardware.

🇺🇸 JPMorgan seeks embedded payments niches. With its embedded payments software products and services, JPMorgan is allowing its corporate clients to embed payments capabilities in their own systems so they, in turn, can offer payments services to their customers.

DIGITAL BANKING NEWS

🇳🇱 Ingka CEO Jesper Brodin wants more of Ikea shoppers’ wallets as group buys up Swedish bank. Ingka, which owns and operates the vast majority of IKEA stores across the globe, announced it agreed to buy up its remaining stake in Ikano Bank, which was the brainchild of Ikea founder Ingvar Kamprad, for an undisclosed fee.

🇺🇸 NWSB selects Apiture Digital Banking Platform to fuel continued growth. The Apiture Digital Banking Platform will provide NWSB's customers with seamlessly integrated consumer and business banking solutions that deliver a consistent, fully featured experience as they shift among online, mobile, and in-person channels.

🇬🇧 Monzo, a UK-based digital bank, says it now can accept accounts from Limited Companies owned by other firms. These firms may now apply for a business account. In a blog post, Monzo explains that many Limited Companies are owned by individuals, but as the company grows, it may accept outside investors.

🇮🇹 Italian asset manager Azimut Holding set out plans to spin off part of its network of financial advisers and merge it into a new digital bank, adding it was looking at outside investors taking a stake of up to 50% in the new unit. Azimut said the plan was to list the business within the next 6-9 months in a move that would boost the value of their investment for existing shareholders.

DONEDEAL FUNDING NEWS

🇸🇪 Buy Now, Pay Later on a Porsche? Zaver raised a total of $30M to make it a reality. The company has now closed a $10 million extension to its Series A funding round, bringing its total Series A to $20 million. Total investment to date stands at $30 million. In Europe, Zaver competes on BNPL with Klarna, PayPal, and incumbents such as Santander and BNP Paribas.

M&A

🇨🇭SIX buys majority stake in fixed income data outfit FactEntry. This strategic acquisition significantly enhances SIX's data offering and aligns with its customers' desire for the company to expand its global fixed income footprint. The acquisition closed March 27, 2024. Financial terms and deal structure details are not being disclosed.

MOVERS & SHAKERS

🇪🇪 Montonio names Johan Nord Chief Revenue Officer. This appointment marks a significant milestone for Montonio, reflecting the company’s current growth phase and its commitment to attracting top talent in the payments and FinTech industry. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()