I Just Had a Priceless Experience

Hey FinTech Fanatic!

The NYC Marathon was already a few days ago, but I needed some time to let the whole experience sink in. Running through the streets of New York has been a dream for almost my whole life, and thanks to Mastercard, that dream came true.

Truly Priceless.

I couldn’t believe it when the invite came in. Getting to line up before the pros and lead the race, even if they caught me somewhere in Brooklyn 🤣, was an unreal experience I’ll never forget.

It wasn’t my best day on the course, and my fellow Dutch runner Sifan Hassan also struggled a bit out there, but the atmosphere made up for everything. I think we are both already thinking about coming back for a little revenge on the result 😉

I’ll admit, I’m more used to the flat European courses like Amsterdam or Berlin. They make your finish time look a bit better, and the training is a lot easier too. Speaking of which, both our FinTech Running Club crews in Amsterdam and Berlin are hosting runs tomorrow, Wednesday, November 5th.

If you’re around, join us!

Once again, a big thanks to Mastercard for making this dream come true and making the whole NYC experience truly Priceless.

Scroll down for today’s FinTech news 👇 and I’ll be back in your inbox tomorrow with more industry updates.

Cheers,

INSIGHTS

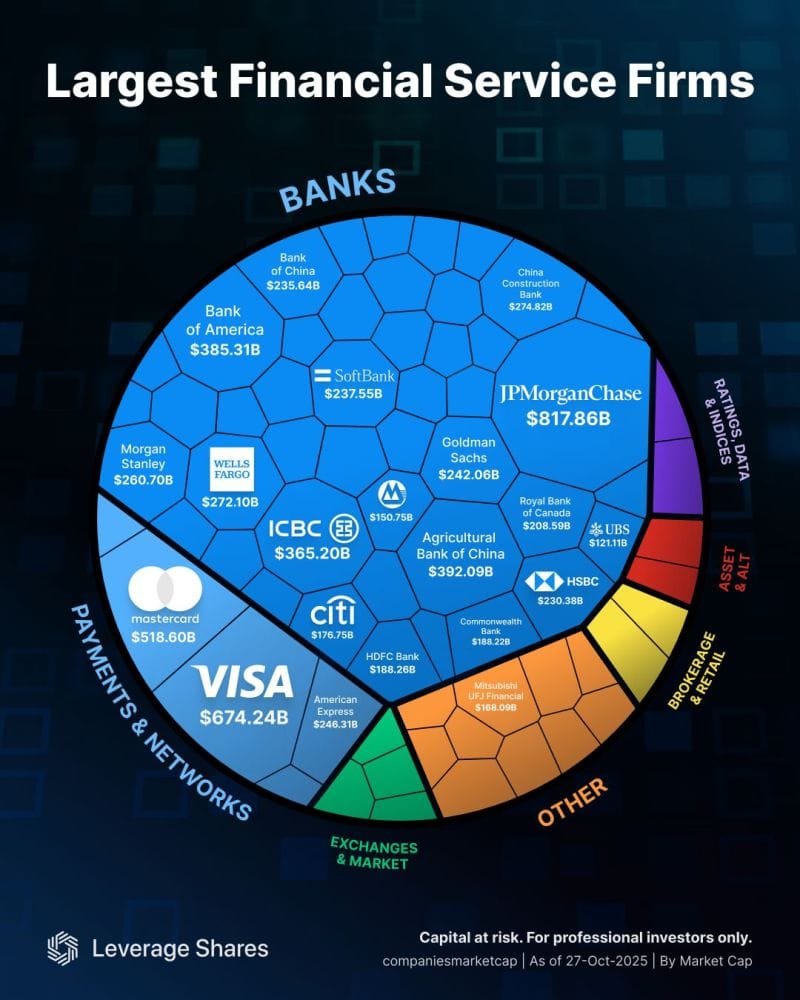

💰 Here's an overview of the largest Financial Services firms.

FINTECH NEWS

🇹🇷 Turkish state grabs another FinTech as company seizures continue at a pace. Istanbul's penal court has appointed Turkey’s Deposit Insurance Fund (TMSF) as trustee of local FinTech Ozan, following money laundering allegations against the company, according to the Istanbul Chief Prosecutor’s Office. The move further expands TMSF’s growing control over the country’s FinTech sector.

🇮🇳 PayPal-backed Pine Labs seeks up to $439 million in Mumbai IPO. The company will offer shares at 210 rupees to 221 rupees apiece. Anchor investors will be able to place bids on Nov. 6, and other investors from Nov. 7 to Nov. 11. The offering includes a fresh issue of shares worth 20.8 billion rupees and the sale of about 82.35 million shares by founder and existing investors.

🇲🇦 Cash Plus launches a 750 million dirham IPO to expand its network and boost growth, with 400 million dirhams raised through a capital increase, at a subscription price of 200 dirhams per share. This operation values the group's equity at approximately 4.5 billion dirhams. The primary aim of this stock market listing is to finance the expansion of Cash Plus's network.

🇺🇸 US FinTech Navan’s founders net $25m each in IPO share sale. Navan, an American company with a large Israeli R&D center and about 3,400 employees worldwide, sold 30 million new shares, raising US$750 million, while existing shareholders sold 6.9 million shares for US$173 million.

PAYMENTS NEWS

🇨🇳 Thunes powers WeChat Pay HK’s expansion in cross-border money transfers. Thanks to the collaboration, WeChat Pay HK users based in Hong Kong can now send money across the globe in real time and access faster, more affordable cross-border remittance options, enhancing the convenience of sending money abroad.

🇹🇱 SIBS reinforces its commitment to modernizing payments in Timor-Leste. SIBS's participation in this project included transaction processing, card production and personalization, the supply of ATM and POS terminals, and the implementation of a card management solution at this bank.

🇺🇸 Afriex and Visa bring real-time cross-border payments to 160+ markets. By integrating Visa Direct through Afriex’s financial institution partner, Afriex is making it faster and easier for individuals and businesses to send and receive funds across borders.

REGTECH NEWS

🇦🇹 Swiss Crypto Bank AMINA secures MiCA license in Austria. Austria’s approval paves the way for AMINA EU’s launch, which will offer crypto trading, custody, portfolio management services, and staking to professional investors, including family offices, corporations, and financial institutions, AMINA said.

🇧🇷 Nium secures payment institution license to expand direct operations in Brazil. The license allows Nium to offer locally regulated services, including PIX, TEDs, boletos, and prepaid card issuance once operational. Nium can now onboard and operate directly in the country, improving efficiency and enabling faster domestic and cross-border transactions.

🇧🇩 bKash, telcos, banks, and conglomerates line up for a digital bank. Twelve entities have applied for licences to operate digital banks in Bangladesh. The applicants for proposed digital banks include mobile financial service provider bKash, mobile phone operator Robi, and Banglalink's parent company Veon, microfinance institutions, and Akij.

DIGITAL BANKING NEWS

🇨🇦 Questrade Financial Group just received full regulatory approval to launch Questbank, officially becoming Canada’s newest bank. CEO Edward Kholodenko says the decision to get a banking licence, instead of partnering, is all about trust and stability, aiming to convince customers to finally move away from the Big Six.

🇺🇸 Chime leads in new checking accounts opened in Q3. Neobank Chime has become the most popular destination for consumers opening new checking accounts, according to the most recent J.D. Power report. Of the new checking accounts that were opened in the third quarter, 13% were opened at Chime.

🇰🇷 Toss adds Chinese, Vietnamese, Thai, and Russian to its app. According to Toss, the four newly added languages are among the most commonly used by foreign nationals residing in Korea, enabling more customers to access financial services in their preferred language through this expansion.

🇴🇲 ahlibank launches Google Pay to enhance digital banking experience. This strategic move enables customers to make secure, contactless payments while reinforcing ahlibank’s drive to modernize everyday banking through user-centric innovation.

BLOCKCHAIN/CRYPTO NEWS

🇸🇬 Crypto.com debuts first AI LLM-Integrated MCP. Crypto Market Data by Crypto.com seamlessly integrates with a user’s LLM to provide live cryptocurrency market data and insights, including price quotes, order books, conversions, candlestick charts, and more.

🇨🇳 Ant Chairman Eric Jing Xiandong touts ‘tokenised money’ for settlement but remains mum on stablecoin plans. Ant has used tokenised bank deposits to achieve cross-bank real-time settlement this year through the Hong Kong government’s Project Ensemble, Jing said at the city’s largest FinTech conference.

PARTNERSHIPS

🇺🇸 Robinhood and Sage Home Loans team up to democratize access to homeownership. All eligible Robinhood Gold subscribers can access mortgage rates at least 0.75% below the national average, along with a $500 credit toward closing costs on new home purchases or refinances, powered by Sage Home Loans.

🇫🇷 Worldline partners with Fipto to enable the next generation of payment rails with stablecoin. Through this partnership, Worldline and Fipto aim to demonstrate how digital assets and traditional payment rails can coexist, enabling merchants, banks, and financial institutions to choose the solution that best serves their needs.

🇺🇸 Marqeta powers the expansion of Klarna debit card across Europe, enabling customers to choose between paying now or later, all through a single debit card experience. Through one integration with Marqeta’s platform, Klarna can accelerate time-to-market and scale efficiently across multiple countries.

🇺🇸 T-Mobile taps Capital One to issue its first credit card, which will feature no annual fees and 2% in T-Mobile rewards on every purchase. The T-Mobile card will run on Visa Inc.’s payment network, according to a statement. T-Mobile customers will also get $5 off their bills each month when they use the credit card via autopay.

🇧🇷 Banco Inter and Chainlink power real-time CBDC trade settlement between Brazil and Hong Kong. Chainlink has completed a blockchain-based pilot that enabled the central banks of Brazil and Hong Kong to settle a cross-border trade transaction in real time using digital currencies and smart contracts.

DONEDEAL FUNDING NEWS

🇸🇦 Stream secures $4 million seed funding to transform B2B payments in MENA. With this round, Stream will fuel its product development in engineering, compliance, payment capabilities, and the overall user experience while strengthening its internal systems to support a rapidly growing subscriber base.

🇮🇳 BNPL startup Snapmint raises $125 Mn led by General Atlantic. The proceeds will be used to expand its EMI-on-UPI offering and grow its merchant network. According to the company, the round will provide an exit to some of its early angel investors.

🇺🇸 US FinTech Lettuce Financial raises $28m in Zeev Ventures-led round. The company's latest cash injection will fund its platform expansion initiatives, focusing on retirement planning with Solo 401(k) and SEP IRA guidance. New features include multiple plan choices, real-time insights on tax implications and transaction classifications, and benefit comparisons.

M&A

🇺🇸 ACI Worldwide acquires European FinTech Payment Components. ACI will integrate Payment Components technology into ACI Connetic, accelerating the roadmap of the industry's only cloud-native unified payments platform that seamlessly integrates account-to-account (A2A) payments, card processing, and AI-powered fraud prevention within a single, modular cloud-native architecture.

🇮🇳 AtoB to acquire India’s LogiPe in global fleet FinTech expansion. The move aims to strengthen AtoB’s worldwide capabilities in delivering next-generation financial services for fleet owners and operators. Keep reading

MOVERS AND SHAKERS

🇦🇹 Bitpanda CEO, Eric Demuth, takes the role as Executive Chairman & President of the Board, and Lukas Enzersdorfer-Konrad will become the sole CEO. In this position, Eric will focus on shaping Bitpanda’s long-term vision and strategy, while driving the company’s global expansion and growth agenda.

🇨🇭 Swissquote appoints Jan De Schepper as new CEO of finance app Yuh. He will also remain on Swissquote’s Executive Board, continuing to lead the company’s product and marketing strategy. Keep reading

🇿🇦 TymeBank will have a new CEO from January, Cheslyn Jacobs. “Jacobs, a TymeBank founding team member, brings a wealth of institutional knowledge and leadership experience, having played an integral role in building the business,” TymeBank said in a statement.

🇬🇧 Santander appoints Felipe Peñacoba as CEO for its Payments Hub. Peñacoba has been Revolut's Chief Information Officer (CIO) for the past four and a half years. He was based in London and was the only Spaniard on the board of directors or the supervisory board of the neobank most popular among young travelers.

🇺🇸 Payroll startup Deel names former Intuit Exec Joe Kauffman as CFO for IPO goal. Kauffman previously served as the head of corporate development at New Oriental Education & Technology Group and as CFO of TAL Education Group, which he helped take public.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()