HSBC’s new FX app Zing off to a “slow” start, and Revolut eyes Sponsorship Deal with Irish National Football Team

Hey FinTech Fanatic,

Another promising FinTech-Sports sponsorship deal is currently being negotiated: Revolut is considering a sponsorship agreement with the Republic of Ireland's football team.

I have often discussed the notable sponsorship deals emerging from FinTechs and neobanks, believing they significantly enhance a brand's value. These deals merge two of my greatest interests: FinTech and sports.

As we delve into the realm of digital banking, it appears that HSBC's new foreign exchange application, Zing, has experienced a "slow" start, with Wise and Revolut's apps being downloaded five and thirty times more, respectively, which is astonishing.

Touted as the most significant UK FinTech debut to date this year, banking giant HSBC aimed to challenge FinTech innovators.

Launched in the UK on January 3, Zing, HSBC's no-cost download app, provides affordable foreign exchange rates to retail customers, positioning itself against competitors like Revolut and Wise.

The executive behind Zing, James Allan, said it represented a “new kind of international payments solution”.

However, download statistics from Apptopia Inc., an app analytics company, indicate that Zing has had a sluggish start.

From January 3 to February 27, Zing garnered approximately 36,000 downloads in the UK, while Wise secured 203,000, and Revolut achieved an impressive 1.087 million downloads during the same timeframe.

On a global scale, within the same period, Wise achieved 3.7 million downloads, and Revolut reached 7.2 million.

Finally, I would like to extend my congratulations to my friends at Caliber, a leading marketing and communications agency specializing in FinTech and financial services, on their announcement of Grace Keith Rodriguez as the new Chief Executive Officer (CEO) of the firm.

My good friend Harvey Hudes, who has admirably led Caliber as CEO since its inception over 13 years ago, will transition to the strategic position of Chief Innovation Officer (CIO). My heartfelt congratulations go out to both, and I eagerly anticipate seeing you both at the FinTech Meetup in couple of days!

I've compiled more updates from the global FinTech industry for your perusal below👇, and I'll be back in your inbox with more news straight out of Vegas😉

See you there?

Cheers,

FEATURED NEWS

🇦🇺 Need a little extra fuel in the tank to power your startup’s growth? Global payments FinTech Airwallex is giving founders the chance to win a $10,000 acceleration grant. The unicorn is celebrating its recently announced partnership with Formula 1 racing team McLaren with a new competition to help businesses fast-track their growth.

FINTECH NEWS

🇯🇵 Nium becomes first global FinTech to secure Type 1 Funds Transfer licence from Japan’s FSA. The Type 1 license authorizes Nium to provide a wide range of financial services, including transferring up to 50 million JPY per transaction via Zengin-Net, Japan’s local payment clearing rail, to a Japanese beneficiary account.

🇦🇺 Former EML CEO Tom Cregan launches digital tipping FinTech for hospitality. The launch of OnTheMonee follows a Zeller study from October last year, revealing a 12% yearly increase in the average Australian tip to $17.93. Additionally, tips as a percentage of total transactions surged by 132% since January 2022. More here

Tymit announced a partnership with Harley-Davidson® to introduce the next generation of co-brand credit card programs. Together, they are launching two reward-based credit cards tailored to cater to the vibrant community of Harley-Davidson® enthusiasts across Europe: the H-D® Ultra Card and the H-D® Classic Card.

🇮🇳 Paytm crisis: User complaints spiked at Paytm Payments Bank even before RBI action. Paytm Payments Bank reported 66,751 complaints across various categories in the fiscal year ended March 31, 2023. This is a steep two-and-a-half times jump from 26,692 complaints that were reported in the previous year.

Socure and trustly combine for compliant pay by bank services. Socure, a FinTech in artificial intelligence for digital identity verification, sanction screening, and fraud prevention, and Trustly, an Open Banking payments provider, announced an industry-first partnership to offer merchants and FinTechs a streamlined onboarding and guaranteed Pay by Bank solution.

Investors shirk Kenyan FinTech as M-Pesa dominance makes it unattractive. Kenya, overlooked by FinTech investors in the past five years, lags behind Nigeria, Egypt, and South Africa, per a report from Nigerian firm Stears. The report notes Kenya secured merely 8% of the continent’s FinTech investments from 2019 to 2023. In contrast, Nigeria led with 39%, Egypt with 16%, and South Africa with 20%.

PAYMENTS NEWS

🇳🇱 Buckaroo wins merchant services deal with ABN Amro. This partnership is supported by Keensight Capital, one of the leading private equity managers dedicated to pan European Growth Buyout investments, and marks a significant step in transforming omnichannel payments and merchant services throughout the Netherlands.

Mastercard and MTN Group Fintech partner to drive acceleration of mobile money ecosystem in Africa across 13 markets. The partnership is set to launch a prepaid virtual card tailored for MTN's MoMo customers, granting them access to over 100 million acceptance points worldwide.

🇧🇷 PagHiper, a FinTech company specializing in Pix and bank slips for e-commerce, has been authorized by the Central Bank of Brazil (BC) to operate as a payment institution (IP). This authorization allows PagHiper to engage in the issuance of electronic money and manage prepaid payment accounts.

Softpay integrates BankAxept for tap-to-phone payments. Softpay is the first company to offer a tap-to-phone solution that accepts BankAxept, ensuring fast and secure transactions for both merchants and customers. With Softpay, merchants are able to use any Android device to accept BankAxept cards.

🇮🇳 RBI grants Payment Aggregator licence to Amazon Pay. Ecommerce giant Amazon’s FinTech arm, Amazon Pay, has received authorisation from the Reserve Bank of India (RBI) to operate as a payments aggregator (PA). With this, Amazon Pay joins a growing list of companies that have received the coveted licence this year so far.

Paying later: The inside story of Afterpay’s inevitable decline. “The integration with Block was a disaster,” according to an Afterpay employee involved in the merger process. Read the complete Capital Brief article where they interviewed more than a dozen current and former Afterpay and Block executives, managers and staff, and internal company correspondence.

OPEN BANKING NEWS

🇬🇧 Volt secures EMI licence to offer e-money accounts. It secured the EMI, or electronic money institution, licence from the Financial Conduct Authority. Volt said it plans to launch virtual accounts as a standalone product, specifically targeting enterprises.

Mastercard Open Banking enhances the debit and prepaid digital account opening experience. The program improves the digital account opening process by verifying account ownership, lowering account abandonment, reducing non-sufficient fund (NSF) returns, and minimizing manual entry of payment credentials.

🇬🇧 Open finance could boost UK GDP by £30.5 billion says CFIT CEO. The Centre for Finance, Innovation and Technology (CFIT) has published its report on the benefits of open finance in line with the Kalifa Review. CFIT led an open finance coalition with over 60 finance partners as part of this report. Keep reading

🇺🇸 Chime agrees to pay $2.5 million fine linked to customer complaints during COVID. Chime, the once-high-flying FinTech, has agreed to pay $2.5 million to the California Department of Financial Protection and Innovation to settle claims that it violated the state's consumer financial protection law for tardy handling of customer complaints in 2021.

DIGITAL BANKING NEWS

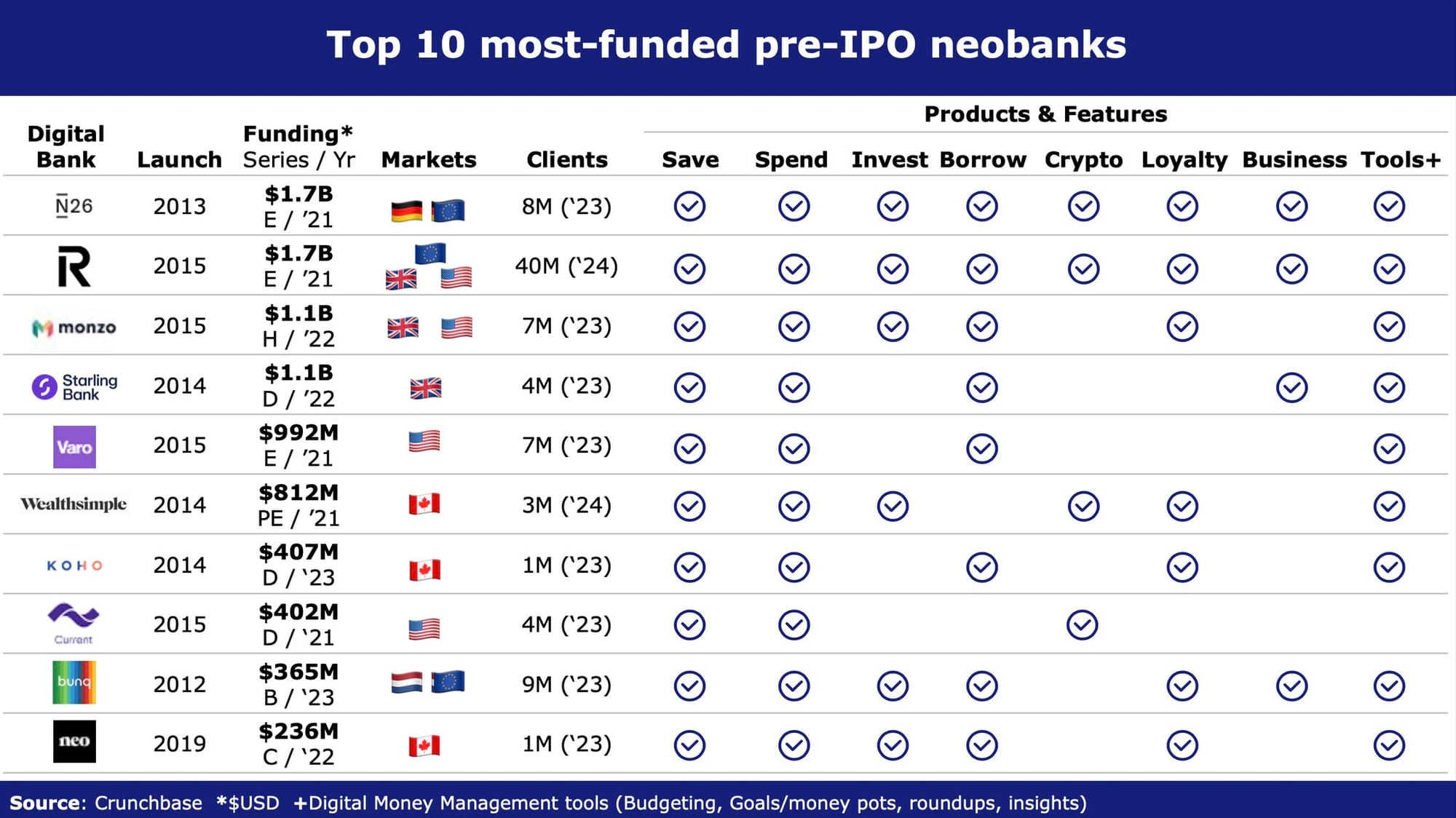

The Top 10 most-funded pre-IPO neobanks in the world.

🇺🇸 Green Dot sets aside $20 million after draft AML order from Fed. The bank and FinTech Green Dot says it has received a proposed consent order from the Federal Reserve tied to its compliance with anti-money-laundering regulations and other risk management matters that could cost it tens of millions of dollars.

🇬🇧 HSBC’s new FX app Zing off to a “slow” start, as Wise and Revolut estimated to be downloaded five and 30 times more, according to app analytics firm Apptopia, which uses an algorithm that combines publicly available metadata from the App Store and Google Play along with its proprietary device panel data to generate daily estimates of mobile app performance.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Gemini agrees to return $1.1bn to Earn customers. The agreement relates to a failed partnership between Gemini and DCG unit Genesis on the former's Earn interest-bearing product. Last year, customer assets were frozen after Genesis halted withdrawals following the FTX collapse.

KuCoin partners with Revolut to support EUR transactions On-Ramp and offer seamless one-click digital asset purchases using euros. In an official announcement, KuCoin stated that users can now buy various digital assets listed on the platform directly through Revolut Pay.

DONEDEAL FUNDING NEWS

🇬🇧 Anne Boden-led taskforce urges investment firms to set gender targets. The recommendation came from the independent women-led high-growth enterprise taskforce, established in 2022 to identify the barriers for women in accessing high-growth capital and suggest solutions.

🇨🇦 Canadian paytech Helcim completes $20m Series B funding round. The recent cash injection will be used to fuel Helcim’s product development, with the FinTech prioritising the enhancement of its distribution channels and the expansion of its financing, payment, and software services for small business merchants.

M&A

UniCredit eyes acquisition of Vodeno: UniCredit's interest in acquiring Vodeno signals a strategic shift towards embracing innovation and technology in the banking sector. This move could set a precedent for future collaborations between traditional banks and FinTech firms, driving the industry towards a new era of customer-centric services and technological advancements.

MOVERS & SHAKERS

🇺🇸 MoneyLion subleases New York City office space from X. The FinTech company has subleased 35,000 square feet at 245-249 W. 17th St. in Chelsea, where Twitter had put up nearly 200,000 square feet of office space for sublease as the app was rebranded into "X."

🇬🇧 Former chancellor Philip Hammond takes over the chair at Railsr. Hammond's appointment is the latest in a series of FinTech jobs taken on by the former UK chancellor, following chairmanship and advisory roles at cryptocurrency firm Copper and challenger bank OakNorth respectively.

🇬🇧 Emma Hagan appointed ClearBank UK CEO. In the newly established role, Hagan will be responsible for overseeing all aspects of ClearBank’s operations in the UK and further strengthening the bank’s position in the UK market. Read on

🇬🇧 Payhawk to grow UK headcount by 44%. Payhawk reported 89.4% global annual growth in SaaS revenues in 2023 combined with net revenue retention from new customers in 2023 at 151%. Carrying its strong product momentum into 2024, the company announces several key appointments, key partnerships, product expansions, and hiring across multiple markets.

🇲🇾 MoneyLion’s Co-Founder Foong Chee Mun appointed CPO at YTL-Sea Digital Bank Project, which is among the five entities awarded a digital banking license in Malaysia. In addition to his new role, Foong also heads YTL AI Labs, where he will be shifting away from traditional product management roles to focus on integrating artificial intelligence in banking solutions.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()