HSBC Invested $150 Million To Launch FX Zing To Revolutionize FX Transactions

Hey FinTech Fanatic!

HSBC recently launched Zing, a new application poised to challenge established FinTech players such as Wise and Revolut in the competitive foreign exchange (FX) market.

Zing is designed to attract users with its promise of low transaction fees, a direct response to the cost-effective solutions offered by its fintech rivals. By doing so, HSBC aims to carve out a significant niche for itself in this sector by combining competitive pricing with the robust infrastructure of a traditional banking giant.

The financial specifics behind the development of Zing remain somewhat opaque, with HSBC keeping the project's budget under wraps. Nevertheless, documents from UK corporate filings shine a light on the potential scale of investment, revealing that nearly $74 million has been funneled into MP Payments Group Ltd, a move that analysts interpret as part of the bank's broader strategy for Zing.

Industry insiders speculate that the total expenditure on Zing could be as high as $150 million, indicating HSBC's substantial commitment to securing a foothold in the fintech arena.

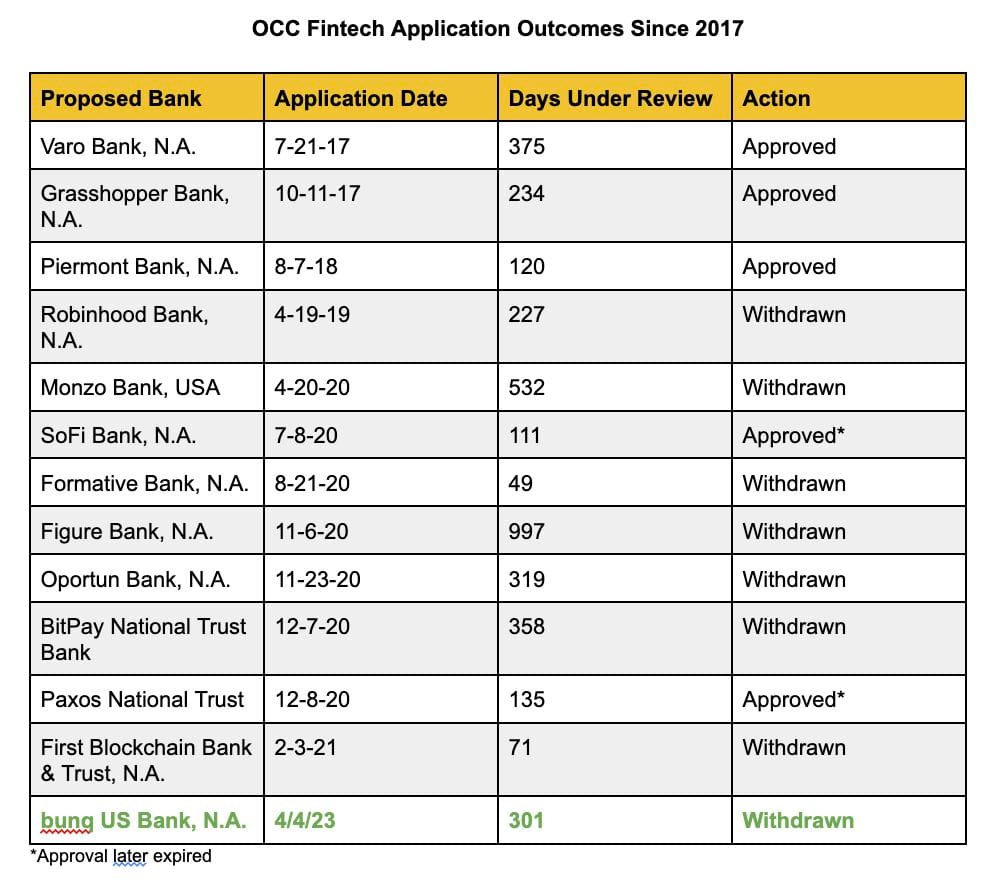

Meanwhile, neobank bunq is planning to 𝗿𝗲𝗮𝗽𝗽𝗹𝘆 shortly after it withdrew its application in the US on January 30th, after 301 days in the OCC’s queue.

Here is bunq’s exclusive explanation statement on the news of the withdrawal:

"bunq’s latest step in the application process is merely procedural. During the course of the application process, some difference of views has emerged between bunq’s home country regulator, the Dutch National Bank (DNB), and the FDIC and OCC in the US.

Regardless of the source of and reason for this unexpected divergence, bunq intends to speedily re-file the application, fully committed to resolving all the differences between DNB’s and the FDIC’s and OCC’s supervisory expectations."

As Michelle Alt mentioned on Linkedin: "It has now been 1,145 days since the OCC’s last fintech de novo approval." Is bunq gonna be the first to finally get approved?

Let me know what you think in the comments and I'll be back with more news in your inbox tomorrow!

Cheers,

SPONSORED CONTENT

#FINTECHREPORT

Fyle integrates with AmEx to offer U.S. Business and Corporate Card Members the ability to issue on-demand virtual Cards via the Fyle platform, with built-in controls, and enhanced security. Read the full piece here

FINTECH NEWS

Has Apple Card been a success? Check out this comprehensive article by Alex Johnson for an overview of the latest updates on Apple Card's performance and insights into key industry trends. Link here

🇮🇳 PayU's LazyPay migrates to Thought Machine. This partnership has enabled LazyPay to build innovative lending and credit products, deliver a superior, secure, and efficient user experience, and set a new standard for credit financing in India.

🇸🇦 Why is FinTech flourishing in Saudi Arabia? The rapid growth and flourishing of the FinTech sector in Saudi Arabia is a testament to the country's committed efforts toward embracing digital transformation and innovation as part of its Vision 2030 objectives. Read the full article for further insights.

🇿🇦 MTN’s Mobile Money Platform, MoMo, and banking technology innovator JUMO introduce Qwikloan to redefine lending in South Africa. This revolutionary initiative seeks to offer accessible and affordable short-term loans, transforming the financial landscape in South Africa.

🇺🇸 ChargeAfter, the embedded lending platform for point-of-sale financing announced that Citi Retail Services, one of North America’s largest and most experienced retail payments and credit solution providers, selected ChargeAfter as a technology provider for its Citi Pay® products.

PAYMENTS NEWS

🇳🇵 Nepal Clearing House selects ACI Worldwide for card payment central infrastructure, to help drive the establishment and operation of National Payment Switch (NPS) and rollout of a domestic card scheme for Nepal (NEPALPAY). Access the full artice here

🇸🇪 Mastercard and Pagero partner to expand businesses access to seamless digital payments. By integrating with Mastercard´s Cross-Border Services, Pagero will now support account-based cross-border and domestic payments, significantly scaling the connectivity of its payments offering.

🇪🇪 Inbank turns to Montonio for a BNPL offering in Estonia initially, with potential plans to expand to other markets in the future. Montonio is known for offering a range of payment and ecommerce services to its merchants, including bank payments, card payments, pay later, and financing.

🇵🇭 Real-time digital payment system means business for Philippines. According to the 2023 Prime Time for Real-Time report published by ACI Worldwide, 195 billion real-time payment transactions were recorded globally in 2022 and are forecasted to reach 511.7 billion by 2027. In the Philippines, real-time payment transactions are expected to grow to 1.5 billion by 2027 from 625 million in 2022.

Hands In and Yuno unite to revolutionise split payments in LatAm. This alliance aims to drive innovation and efficiency in the Latin American travel and hospitality sectors, addressing the challenges of card decline rates by opting for split payment options amongst multiple cards and individuals.

PSCU/Co-op Solutions unveils New BNPL option for Credit Unions. This solution allows cardholders to enjoy greater flexibility and convenience when making purchases. As part of the integration process, the company has developed this BNPL solution that caters to clients of the legacy Co-op ecosystem.

🇧🇷 Nubank announces the launch of Tap to Pay on iPhone for its three million SME customers in Brazil. The feature allows merchants to accept all forms of contactless payments. On another note, the bank ’s security feature “Modo Rua'' has surpassed 1.5 million users and is more popular among adults aged 25 to 44.

Sabre and Revolut bring more benefits to travel agencies through virtual payments. The two tech companies announced the successful results of their partnership, which is propelling the B2B payments process for travel agencies. Both companies onboarded over 40 customers in under a year, reshaping the financial landscape for travel agencies.

REGTECH NEWS

🇸🇬 Confide, the revolutionary governance, risk, and integrity platform founded by Wirecard whistleblower, Pav Gill, announces a strategic collaboration with the Association of Corporate Investigators (ACi). This alliance positions Confide at the forefront of industry innovation, harnessing ACi's vast member expertise to significantly enhance its product offerings.

🇬🇧 Napier Continuum for AML compliance now available as plug-and-play hosted service or headless API. Napier Continuum is now available through two new service offerings: Napier Continuum Live and Napier Continuum Flow. These new solutions deliver Napier’s experience in helping financial institutions transform their AML solutions with a compliance-first focus.

🇪🇪 Salv awarded licence to operate as a ‘Closed Service KYC Utility’ service provider. Salv has broken new ground by becoming the first technology firm in Europe to secure the regulator-awarded licence that will enable financial institutions to leverage Salv’s Bridge platform to help combat financial crime.

DIGITAL BANKING NEWS

🇳🇱 bunq is planning to reapply shortly after it withdrew its US application on January 30th, after 301 days in the OCC’s queue. Click here to read bunq’s exclusive explanation statement and discover the full story.

🇲🇽 Mercado Pago, the fintech division of the e-commerce giant Mercado Libre, is currently exploring the possibility of becoming a bank in Mexico. The goal of obtaining a banking license, according to sources, is to streamline all the work that has been done with regulators.

🇦🇺 Westpac is to replace its currrent invoice finance loan system with technology from Dancerace. The Australian bank will be replacing its current systems with Dancerace's c3 Backoffice Control, f3 Client Onboarding and e3 Client Access systems. The upgrade aims to simplify and streamline Westpac's lending process.

🇺🇸 Chase makes Multi-Billion dollar investment in its branch network. Hundreds of branches at rival banks are being closed each year, and customers are shunning the teller and choosing the mobile app. But at the nation’s biggest bank, old-fashioned bricks-and-mortar locations are part of the secret sauce: JPMorgan plans to build 500 new branches in the next three years.

BLOCKCHAIN/CRYPTO NEWS

🇱🇺 B2C2, the leading crypto liquidity provider servicing institutional clients globally, has obtained regulatory approval to operate in Luxembourg and expand its EU presence. B2C2 has become the 12th virtual asset service provider (VASP) to be officially registered on the CSSF public register in the country.

🇺🇸 MetaMask and Robinhood Connect integrate to make it easier to access Web3. New integration allows customers to purchase crypto through Robinhood’s low cost order engine, facilitating web3 adoption through a secure, user-friendly, and self-custodial approach.

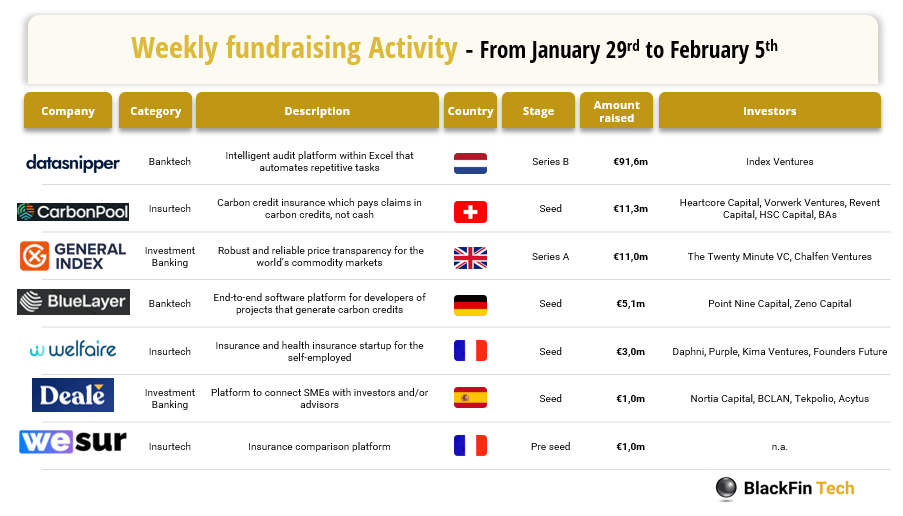

DONEDEAL FUNDING NEWS

Last week we saw 7 official FinTech deals in Europe for a total amount of 124m€ raised. With two deals in France, one in the Netherlands, one in Switzerland, one in the UK, one in Germany, and one deal in Spain. Link here

A church pastor has raised $20 million for his startup, called Overflow, that aims to make charitable giving frictionless. With the new funding in place, Overflow is looking to move beyond giving and provide a suit of financial products to churches and non-profits, says CEO Vance Roush, a pastor and former Googler.

M&A

🇮🇳 Indian fintech giant Cred is to move into the wealth management market with the acquisition of mutual fund and stock investment platform Kuvera, which currently manages assets of over $1.4 billion for its 300,000 strong user base. Financial terms of the transaction have not been disclosed.

🇦🇺 Zip in the takeover spotlight. Market speculation suggests that Zip Co, a BNPL firm, may be attracting acquisition interest following a remarkable financial turnaround. Previously struggling, Zip has executed a $60 million reversal, transforming a $30 million loss into a $30 million profit.

🇬🇧 British technology group Onfido is in advanced talks to sell itself to U.S.-based Entrust Corp, two people familiar with the matter told Thomson Reuters. Onfido, which uses artificial intelligence to verify customer identities, could be valued around $650 million in a deal, one of the people said.

MOVERS & SHAKERS

🇮🇱 Team8, a unique global venture group that builds and invests in early-stage companies with deep expertise in cyber, data, fintech, and digital health, announced that Judd Caplain, the former Global Head of Financial Services at KPMG has joined Team8’s Fintech Advisory Board.

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()