🚨HERE WE GO! Airwallex Acquires OpenPay

Hi FinTech Fanatic!

Let’s kick off the way Fabrizio Romano breaks a transfer deal 🚨 HERE WE GO!

Airwallex has acquired OpenPay, a San Francisco-based billing platform specializing in subscription management, payment orchestration, and revenue analytics.

The move brings OpenPay’s billing and analytics capabilities into Airwallex’s global platform, strengthening its position against players like Stripe Billing and Recurly, while helping customers automate and accelerate revenue growth.

Scroll down for more M&A updates and other FinTech news I’ve listed for you today, and I’ll be back in your inbox tomorrow!

Cheers,

#FINTECHREPORT

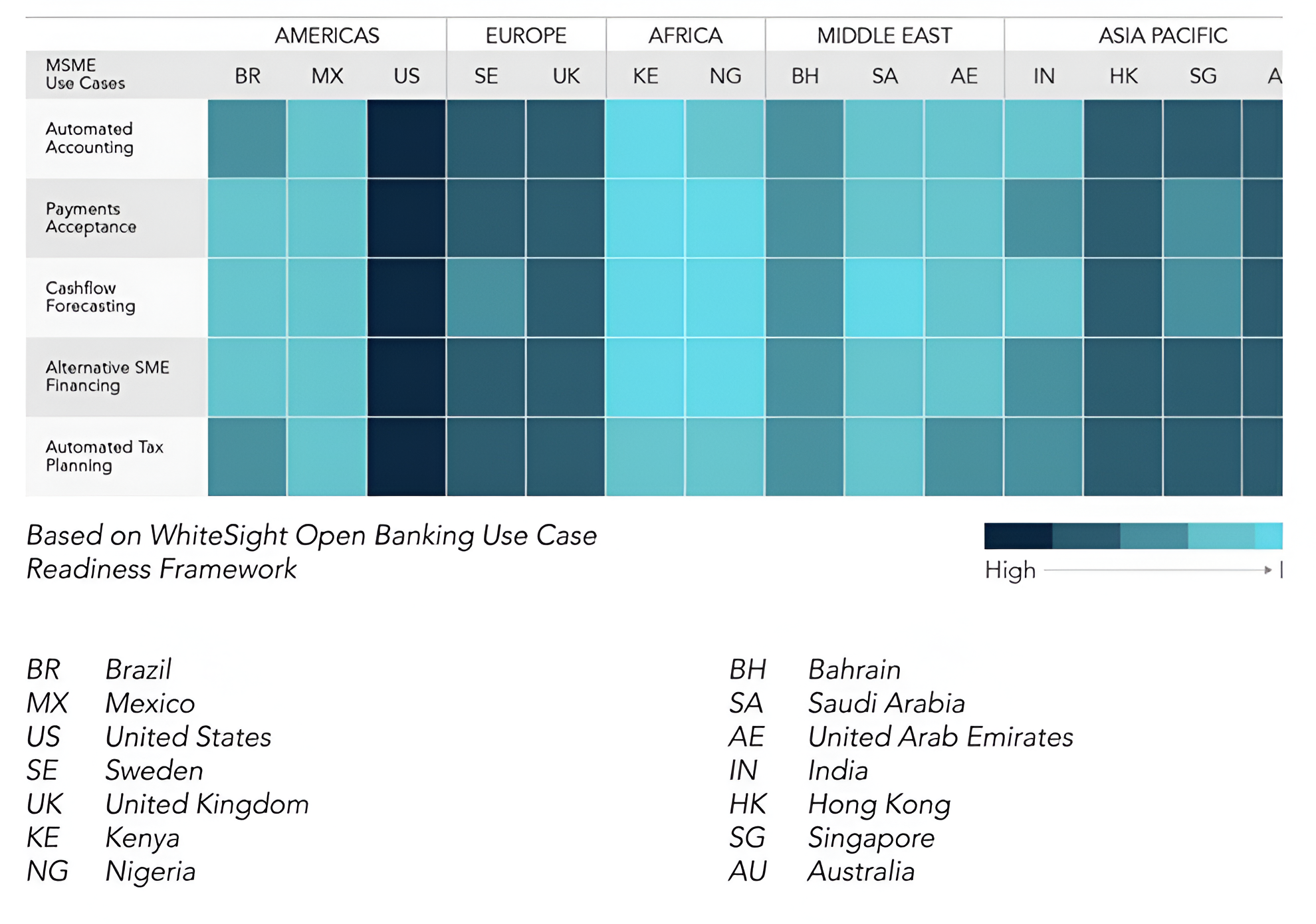

🌍 Navigating the Middle Eastern Open Banking Landscape: A Strategic Playbook.

FINTECH NEWS

🇲🇽 Women reducing the gender economic gap in Mexico by Sonia Gomez, Director of ACI Worldwide Solutions in Latin America. The report emphasizes that only 36.1% of women have access to credit, and many remain underserved. It underscores the opportunity to expand services to over 12 million women. ACI Worldwide's Real-Time Payments report shows how real-time digital payment systems are helping to close this gap by increasing financial access for women.

🇺🇸 Crypto.com CEO, Kris Marszalek, says he’s tempted to IPO. He says the company “has the numbers” to do a public listing, but enjoys being private. Marszalek also discusses the company’s latest partnership to create a crypto reserve with Trump Media.

🇺🇸 Blockchain lender Figure seeks a valuation of up to $4.1 billion in its US IPO. Figure and some of its existing investors plan to sell 26.3 million shares in the IPO at prices expected to be between $18 and $20, aiming to raise $526.3 million. Continue reading

🇺🇸 Stripe among first FinTechs to file opposition to JPMorgan fees. Stripe is among the first financial-technology firms to directly and publicly appeal to the US Consumer Financial Protection Bureau (CFPB) to take immediate action against banks charging for access to their customers’ financial data.

🇸🇪 Klarna paid more than $16 million to nonprofits founded by the wife of its CEO, Nina Siemiatkowski. Klarna has paid Nina Siemiatkowski's nonprofit Milkywire $2.75 million for its services since 2022, and a further $1 million to purchase carbon credits, which are permits to offset a portion of its greenhouse gas emissions through supporting projects that remove the equivalent amount of emissions.

🇺🇸 Walmart-backed FinTech OnePay is adding wireless plans to its everything app. OnePay Wireless will be available in the OnePay app, according to Gigs, the mobile services startup that partnered with the company. The plan costs $35 a month for unlimited 5G data, talk, and text on the AT&T network.

🇬🇧 Revolut founder to become one of Britain’s top 10 richest businessmen as share sale gives huge valuation. Nikolay Storonsky has around a 25 per cent holding of the firm, meaning his personal wealth will grow to more than $18bn, putting him in the top 10 richest businesspeople in the UK.

PAYMENTS NEWS

🌎 The 5 most common myths about card use that you should know. According to Diego Quesada, Country Manager Central America, and the Caribbean at Pomelo, a company specializing in the issuance, processing, and management of card businesses, it's a mistake to think that cards are an obsolete system compared to new payment methods.

🇮🇳 PhonePe rolls out loan facility against mutual funds. The new service was launched in partnership with NBFC DSP Finance. The loan facility allows users to borrow against their mutual fund holdings, providing them with access to funds without having to redeem their portfolios, marking its latest step into secured lending.

🇯🇵 Stripe expands services in Japan, launching Terminal to unlock unified commerce for businesses. The announcement was made at Stripe Tour Tokyo, where Stripe showcased a series of products and features, including upgrades that leverage AI and stablecoins, to help businesses leapfrog into the next era of commerce.

REGTECH NEWS

🇬🇧 Synapse brokerage executives charged over $100M customer fund freeze. Regulators say inadequate supervision led to two million customers losing access to deposits. They also highlight risks in the FinTech "banking-as-a-service" business model.

🇱🇺 Chinese payments giant Alipay fined in Luxembourg for ‘important’ AML breaches. Alipay has been fined €214,000 by Luxembourg’s financial regulator for ‘important’ breaches of AML (anti-money laundering) rules. The regulator said Alipay “committed important breaches to Luxembourg’s AML professional obligations”.

DIGITAL BANKING NEWS

🇫🇷 SocGen assess strategy for BoursoBank facing Revolut push. SocGen’s CEO, Slawomir Krupa, is considering slowing a previous plan to focus on cutting client acquisition costs once the 8 million target is reached. Revolut’s recent push is prompting SocGen to reassess its options to defend its leading market position in France.

🇳🇱 Neobank BUUT is now available. BUUT, the new bank from the creators of Tikkie is available for download. Designed specially for teenagers and their parents, BUUT helps young people take control of their money using handy pots that make payments and saving money easy.

🇺🇸 SoFi announces the Agentic AI ETF, providing access to the next wave of AI. AGIQ will invest in U.S. companies included in the BITA US Agentic AI Select Index, which is designed to track businesses involved in developing, providing, or utilizing agentic AI technologies.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Crypto.com and Underdog partner to offer sports prediction markets. The partnership aims to offer sports prediction markets in 16 states, mostly focused on where legal sports betting has not been adopted. Keep reading

🇩🇪 Sygnum extends asset management offerings to Germany and Liechtenstein. Investors can now access selected parts of Sygnum’s suite of investment solutions, including a non‑directional, low‑volatility strategy. Since its inception, this strategy has focused on seeking yield‑generating opportunities in the crypto market while aiming to manage technology and platform risks.

🇳🇱 Crypto Exchange OKX fined $2.6M in the Netherlands for failing to register with the Dutch National Ban. The fine on the company, whose official name is Aux Cayes FinTech Co., relates to the period July 2023 to August 2024, before the introduction of the European Union’s Markets in Crypto Assets regime (MiCA), according to a press release.

🇺🇸 Coinbase’s Mag7 + Crypto Equity Index Futures. This innovative futures contract aims to meet growing investor demand for tools that bridge traditional financial markets with digital assets. The product offers thematic exposure to innovation and growth by capturing the performance of both transformative technology companies and blockchain-native assets.

PARTNERSHIPS

🇵🇭 Philippine FinTech GCash teams up with Alipay+ and Mastercard for ‘Tap to Pay’ global launch. GCash Tap to Pay can now be used by its users to pay at more than 150 million Mastercard acceptance locations across the world, powered by Near Field Communications (NFC) technology.

🇯🇴 Mastercard collaborates with Zain Cash to drive digital payments in Jordan. The collaboration features Zain Cash’s Mastercard prepaid, credit card portfolio and SMEs solutions. In addition, Mastercard will support the FinTech company in setting up its Innovation Hub, where it will co-create innovative payment solutions and services.

🇨🇭 Alchemy Pay partners with Swiss-regulated Fiat24 to launch Web3 digital bank. The company explained that global clients will now be able to open Swiss IBAN accounts directly through its service. Alchemy Pay described the move as part of its broader effort to simplify financial management for Web3 businesses and individual users.

DONEDEAL FUNDING NEWS

🇺🇸 Pave Finance raises $14M in an oversubscribed seed Financing. The capital injection, which exceeded the initial $10 million financing target due to high demand, has accelerated product development and supported the commercial rollout of Pave’s professional software platform, an AI-powered portfolio management tool.

🇯🇵 LayerX raises $101M to provide back-office automation in Japan. LayerX’s offerings provide solutions for companies in Japan that need to automate finance, tax, procurement, and human resources (HR) but have run into barriers when trying to do so, according to the report.

M&A

🇺🇸 Airwallex to introduce billing capabilities via OpenPay acquisition. The acquisition will bring OpenPay’s billing and analytics capabilities into Airwallex's global platform, strengthening Airwallex’s position against other players like Stripe Billing and Recurly, and empowering Airwallex customers to unlock and automate revenue growth.

🇺🇸 Chargebee acquires Inai to supercharge AI-powered payments intelligence. The acquisition of Inai represents a significant advancement in Chargebee’s mission to provide merchants with greater visibility and control over their payment experience, regardless of the payment gateways they use or their geographic location.

🇦🇺 Aryza acquires Bravure. Based in Sydney, Australia, this strategic acquisition reinforces Aryza's commitment to the Australian market while enhancing its capabilities in the complex post-arrears environment. Continue reading

🇿🇦 South Africa's Nedbank sells Ecobank stake for $100M. Jason Quinn, group CEO of Nedbank, says the decision to sell its ETI stake "follows a detailed evaluation of the strategic alignment, financial performance, and long-term value proposition of the investment".

MOVERS AND SHAKERS

🇦🇺 UBank appoints Kanishka Raja as new CEO. UBank said the new CEO is an experienced banking executive, with leadership experience in banking strategy and business performance, along with a deep understanding of the needs of digitally savvy banking customers.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()