Has Monzo lost its ‘mojo’?

Wonderful Wednesday fellow FinTech Fanatic,

The title of this newsletter poses an intriguing question, sparked by the financial website This is Money. While the answer might not be crystal clear, some fresh stats about the number of people switching to and from digital bank Monzo certainly shed light on the intense competition among neobanks for customers.

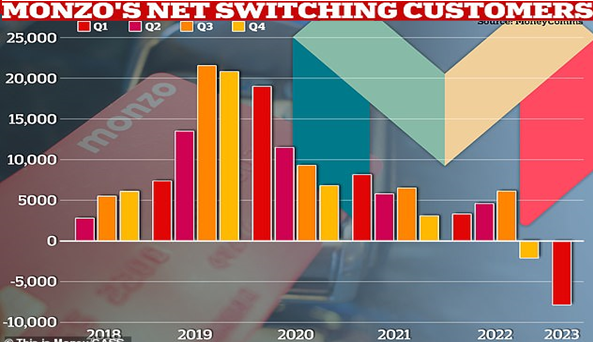

London-based Monzo lost a net 7,635 switchers during the first three months of 2023, according to information gathered by This is Money.

That’s quite a contrast to 2019, when Monzo received more than 63,000 switching customers from other banks. In the last three months of 2019 it hoovered up 20,843 joining Monzo using the official switching service - more than any of the big banks in that period.

However, the declining numbers in 'switchers' for Monzo already emerged towards the end of last year, when it lost a net of 2,079 switching customers - the first time the neobank experienced negative figures.

Now Monzo sustained an even steeper drop-off of a net 7,635 switchers in the first three months of 2023, according to the most recent data.

Some experts think the drop-off in switching customers is a natural progression while others think the bank will need to offer cash bonuses like its rivals if it wants to see switchers return.

A Monzo spokesman said the latest switching numbers painted a very small part of the overall picture, adding: 'We are currently adding more than half a million customers per quarter and are the UK's 7th largest UK bank, with almost 8million customers.'

Block shuts European P2P payments brand Verse

While payments-firm Block released a gross profit of $1.87 billion in its second quarter 2023 results last week, it announced this week that it is shutting down the Cash App's Verse brand in the EU and its BNPL platform Clearpay in Spain, France and Italy, citing disappointing growth and profitability.

Spanish P2P payments app Verse was acquired in 2020 with the hope of replicating the huge success of the Cash App in Europe.

Clearpay is the European brand of Afterpay, which Block bought in a multi-billion dollar deal in 2021.

Block, formerly known as Square, is a payments company founded by Twitter co-founder Jack Dorsey. Its popular mobile app, Cash App, is a popular tool for buying and selling Bitcoin.

Thanks for reading this far and please follow me to the other FinTech news:

POST OF THE DAY

How does VISA work when we swipe a credit card at a merchant’s shop?

Check out the full process

NEWS HIGHLIGHT

EDBI-Backed Singapore Fintech Startup Thunes Wants To Take On SWIFT. For now, Thunes only handles a fraction of the money transfers that SWIFT does. As of June, Thunes has processed a total of $50 billion in transactions since its inception in 2016. Read more

#FINTECHREPORT

Banking-as-a-Platform Market Forecasts, Trends and Strategies 2023-2028report by Juniper Research, provides in-depth analysis and evaluation of how financial institutions are reimagining their business operating model by creating a BaaP ecosystem alongside third-party providers. Click here to download.

The Future of Payments in South Africa: Challenges and Opportunities. Explore the evolution of payments and how enterprises can leverage it’s digital future. Download the complete report here

INTERVIEW

Charles Delingpole’s evolution: From fintech CEO to influential angel investor. As the former CEO of ComplyAdvantage transitions to his role as executive chair, Delingpole's influence in the fintech sector expands through strategic angel investments and a spot on the AltFi Awards 2023 judging panel. Click here to read the full interview by Oliver Smith.

FINTECH NEWS

Tap to Pay on iPhone comes to Zettle by PayPal. The new functionality, which is available to any Zettle by PayPal user in the UK with a compatible* iPhone, enables customers to use their iPhone to accept contactless payments in-person, without needing to purchase additional hardware.

Mastercard enables CVC-less payments for tokenised cards in India. Starting from the second transaction made with the card, the cardholder will solely have to select their tokenised card from the checkout page, confirm the the one-time password (OTP), and complete the transaction without introducing the CVC.

TerraPay approved for Major Payment Institution licence in Singapore. The firm, with regulatory approvals in 28 countries, facilitates fully compliant international money transfers, frictionless business pay-outs, and alternative payment methods.

EML keeps silent as investors sweat over size of 2023 losses. EML Paymentshas gone to ground in the last four months as it scrambles to fix non-compliant anti-money laundering systems and a swathe of operational problems in Europe.

Israeli fintech Vesttoo talks to investors after fake collateral scandal. Vesttoo, which uses artificial intelligence technology to connect the insurance industry and capital markets, is in contact with regulatory bodies worldwide, a spokesperson said in an emailed statement after discovery of fake letters of credit used on its platform.

Bud Financial launches generative Al core platform Bud.ai. The platform will empower any financial services organization to transform their transaction data into powerful new customer insight and achieve the holy grail of personalization at scale in customer experience.

Amazon set to launch credit card in Brazil with Bradesco. Amazon's Brazil Country Manager, Daniel Mazini, said in a note that the company is always "looking for opportunities" to improve the shopping experience of customers in Brazil.

Visa brings Apple Pay to Vietnamese cardholders. The launch of Apple Pay marks a significant milestone in the advancement of cashless payments in Vietnam. Customers can now use Apple Pay with their Visa card and experience a seamless and secure payment method, further enhancing the convenience of digital transactions.

DIGITAL BANKING NEWS

Tinkoff Bank application disappeared from Google Play. “Due to Google restrictions, the Tinkoff apps have disappeared from Google Play,” A statement said. The company emphasized that already downloaded applications will continue to work on Android devices as usual.

N26 gives customers in France local IBAN numbers. The German bank hopes money transfers will become easier - but it will change how customers declare their account on tax returns. Read more

Revolut launches in Armenia. The global financial superapp has recently launched Revolut Lite in Armenia to enable customers in the country to make fast, free and secure money transfers in 25+ currencies – domestically and internationally – usually within one working day.

Kakao Bank posts strong Q2 results. In the second quarter, the South Korean digibank’s net profit jumped 44% annually to 81.9 billion won (US$63.6 million), compared to 57 billion won (US$43.8 million) a year earlier.

South Africans lose millions to new NFC fraud. The Ombudsman for Banking Services is warning members of the public about the rise in contactless payments fraud in South Africa. According to the banking ombud, it has seen the emergence of a new scam involving the use of near-field communication (NFC) technology.

PARTNERSHIPS

Bancolombia Group and Avista have embarked on a strategic alliance aimed at bolstering their ability to seize emerging opportunities in a critical market segment, the Silver Economy. This initiative aligns with both entities' focus on financial inclusion.

POS player Lopay signs with TrueLayer for instant settlement. Working with TrueLayer, Lopay has been able to integrate low-cost and instant payouts into its offering. The entire integration — backed by clear documentation and expert integration support — took just one week from start to finish.

Payhawk integrates with Yapily for instant payment top-ups. The integration with Yapily allows Payhawk to offer its customers the ability to link one or more bank accounts from over 2,000 banks and institutions from dozens of countries.

PaymentComponents and Brillio forge partnership. Together, PaymentComponents and Brillio are set to redefine the future of global payments solutions and drive unparalleled growth in the financial services industry.

M&As

Vijay Shekhar Sharma buys 10% stake in Paytm worth $628m from Antfin. The deal is thought to signal the further unravelling of Paytm’s once-close relationship with Antfin. Read more

#DONEDEAL

Brazilian crowdfunding platform EqSeed recently set a new record by raising BRL 7.5 million in a funding round. The funding will facilitate the acceleration of product and technology development, EqSeed plans to double its team of approximately 20 members within the next year.

Educbank has just raised R$ 70 million through a securitized debenture, coordinated by Itaú BBA. The company's key product ensures full tuition fee receipt, even when families delay payments. This, alongside their funding lines, payment methods, and management tools, allows partner schools to maintain a positive cash flow.

Want your message in front of 100.000+ intech fanatics, founders, investors, and operators?

Comments ()