Groundbreaking UPI Technology Launches in Peru: A South American First

Hey FinTech Fanatic!

NPCI International Payments Limited (NIPL) has partnered with the Central Reserve Bank of Peru (BCRP) to introduce a real-time payments system in Peru, similar to the Unified Payments Interface (UPI).

This partnership is a significant milestone, positioning Peru as the first South American country to implement the globally acclaimed UPI technology, showcasing India's leadership in digital payment innovation.

The Central Reserve Bank of Peru has signed this deal to deploy the UPI-like system enabling instant payments between individuals and businesses, to reduce reliance on cash and expanding the use of a digital alternative to Peru’s large unbanked population.

Launched in 2016, the UPI has been central to India's efforts to use digital payments to boost financial inclusion and has now handled well over 100 billion transactions.

The NPCI international subsidiary was set up in 2020 to push the UPI, as well as the RuPay card network, outside of India. Earlier this year, the unit struck deals with Namibia and Nepal's largest payment network and it has also joined forces with Google Pay to accelerate global expansion.

Check out my Daily Payments Newsletter if you want to read more Payments news, and I'll be back in your inbox with more tomorrow!

Cheers,

#FINTECHREPORT

📊 𝐓𝐡𝐞 𝐒𝐭𝐚𝐭𝐞 𝐨𝐟 𝐁𝟐𝐁 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝟐𝟎𝟐𝟒 report, by Invoiced. Explore the current state of the B2B market alongside what shifts and advances we can all likely expect in upcoming years. Link here

FINTECH NEWS

🇩🇪 Top lawyer of ex-Wirecard boss walks away after money runs out. Markus Braun under mounting pressure as trial of Germany’s largest corporate fraud continues. Click here for more info

🇻🇳 Vietnamese FinTech unicorn MoMo sticks to super-app strategy despite the increasingly fierce competition in its home market, executive vice chairman and CEO Nguyen Manh Tuong said at Tech in Asia’s Saigon Summit held on May 30.

🇳🇱 Europe's FinTech funding slowdown dampens mood at Amsterdam event. Delegates had mixed feelings, but speakers and organizers were upbeat, especially about the promise of AI. Damien Dugauquier, co-founder of iPiD, said fundraising was "considerably harder" in Europe compared with the U.S. or Asia, which he attributed to Europe's weaker economic growth.

🇵🇱 Marqeta expands European footprint with opening of new office in Poland. Marqeta’s office in Warsaw will support the expansion of its card program management services, bringing its full range of platform offerings and expertise to the European market.

🇮🇳 Signal-based trading app Investmint has halted its services as the company found it difficult to figure out a reliable business model, and explores M&A deal. Sources say the firm had decent traction with substantial money left from the last fundraise but the team couldn’t translate them into monetization.

PAYMENTS NEWS

🇵🇪 NPCI International and the Central Reserve Bank of Peru Partner to Develop UPI-Like Real-Time Payments System in Peru. This collaboration marks a significant milestone, making Peru the first country in South America to adopt the globally renowned Unified Payment Interface (UPI) technology, a symbol of India's pioneering excellence in digital payments.

🪙 Visa looks to generative AI to enhance tokenisation. Mehret Habteab, senior VP of product and solutions at Visa Europe, told Finextra: “Not only is it powering up those merchants with the additional sales conversion, but it's driving really convenient, secure payment experiences for consumers.”

➡️ Tokenization for Dummies. VGS's CEO Chuck Yu explains in 30 seconds. Check out the complete video for a 3 minute explainer and more info.

🇦🇺 Block has backtracked on plans to launch Cash App in Australia, and Nick Molnar says it will instead expand features inside the Afterpay app, including allowing users to “pay in four” when they spend at any retailer, under a new subscription service.

🇺🇸 In an unusual move, Capital One is teaming up with Payment Giants (and rivals) Stripe and Amsterdam-based Adyen to offer a free product aimed at fraud reduction, the financial services giant told TechCrunch. By partnering with Stripe and Adyen with Direct Data Share, Capital One can act like a data clearinghouse, identifying fraud across all of their rails.

🇺🇸 EBay to stop taking American Express after fee dispute. EBay will drop AmEx cards as a payment option on the online marketplace because of “unacceptably high fees,” according to an email reviewed by Bloomberg News. EBay plans to notify customers this week about the change, which is set to take effect Aug. 17.

🇸🇬 HitPay, a Singapore-based commerce platform for SMEs, has earned a major payment institution (MPI) license from the Monetary Authority of Singapore (MAS). The license allows HitPay to offer merchant acquisition and money transfers, both domestic and cross-border, enhancing its core payment gateway services for SMEs.

🇬🇧 Plend launches embedded credit API as an ethical alternative to Buy Now Pay Later. The ‘powered by Plend®’ API marks a significant technological leap forward, enabling organisations, customer-facing platforms, and institutions to embed affordable and longer-term credit options within their existing user journeys.

🇬🇧 Payabl. expands Latin American payment options. UK-based paytech company Payabl. has announced the integration of four local payment methods in Latin America into its range of local payment solutions: PIX, Boleto, OXXO, and SPEI.

OPEN BANKING NEWS

🇬🇧 emerchantpay partners with TrueLayer to launch Open Banking payments for merchants in the UK and Europe. With this solution, merchants can leverage this new payment option to allow customers to instantly connect to their online banking environment at checkout for a secure and frictionless payment experience.

DIGITAL BANKING NEWS

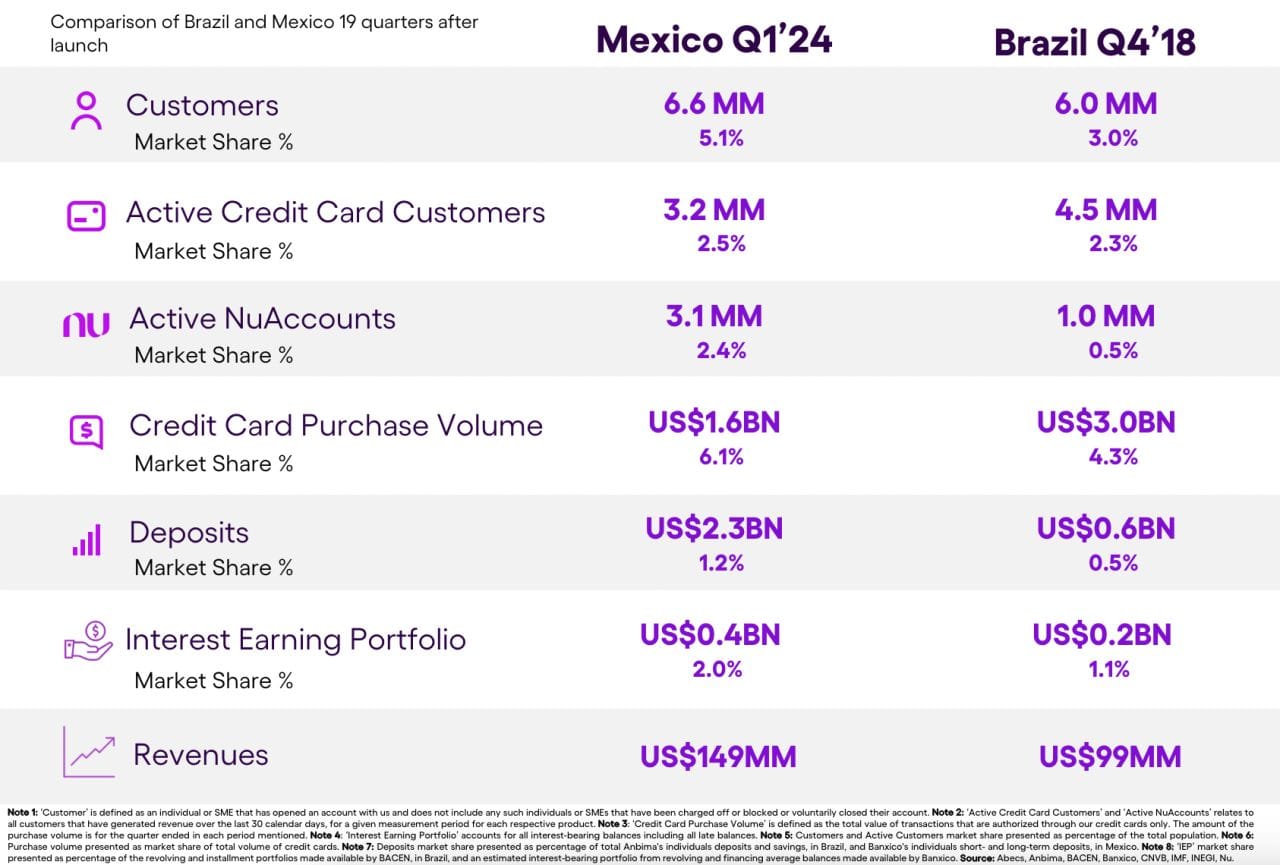

Nubank's results in Brazil 🇧🇷 🆚 Mexico 🇲🇽, 19 quarters after launching:

Mexico truly is the promised land for Neobanks 🤯

🇧🇪 Viva.com partners with Belgian Beobank, expanding its European synergies as an Acquirer Partner of Choice. The strategic partnership introduces a new partnership model for Belgium, to hasten the adoption of digital payments among Belgian SMEs, delivering a comprehensive business proposition that supports growth.

🇭🇰 The Hong Kong Monetary Authority (HKMA) is set to replace the term “virtual bank” with “licensed digital bank” for the eight branchless lenders operating in the city to boost public confidence and eliminate negative connotations associated with the term.

🇨🇦 Zūm Rails, the company merging open banking and instant payments so businesses can use any payment rails they want, announced its work on a large-scale Banking as a Service (BaaS) project. Read the full piece here

🇬🇧 Digital bank Zopa to expand into current accounts, investments and SME lending. Zopa’s big goal is to incentivise its 1.2m customers to use it as their primary bank account, CEO tells Sifted. The plan is to make its current account easy to use and good value, likely by offering a competitive interest rate, he says.

DONEDEAL FUNDING NEWS

🇺🇸 Nium retains Unicorn status, raising US$50 Million in series E round at a $1.4 billion valuation. That is 30% below the valuation from its last funding round in 2022. Read the full article for further insights

🇺🇸 Minority-Led PE firm, Estancia Capital, targets $350M FinTech fund. In particular, the firm sees opportunities in data providers, market infrastructure and private FinTech, according to presentations made to several LPs. Estancia plans to invest between $20 million and $70 million in eight to 12 companies.

🇹🇷 Sipay, a Turkish FinTech offering offline and online payment services, wallet services and host of a modular platform, has raised a $15M Series A round, which will be used to advance product development and local and international expansion.

🇮🇳 FinTech Fibe raises $90 mn. The company plans to deploy the new fund for business expansion, market outreach and curating tailor-made products across its loans portfolio. Read more

🇸🇬 iPiD secures $5.3m in Pre-Series A round to strengthen global payments. These new funds will be utilized to accelerate the commercial rollout of iPiD’s Verification of Payee solutions in Europe. This includes assisting payment service providers (PSPs) in complying with the upcoming Verification of Payee regulation.

M&A

🇮🇹 Worldline rumored to acquire Credem’s Merchant Payment Services. A report of June 4 by Reuters, notes that this is the latest in a series of sales of banks’ “merchant books,” which banks have been unloading as technological advancements require new investments.

🇺🇸 CSG acquires Florida-based paytech iCG Pay in $17m deal. CSG says that the purchase will provide the company with new independent software vendor (ISV) channel partnerships and a “proven team of payments leaders” to help it expand its footprint in the North American payments market.

MOVERS & SHAKERS

🇺🇸 Julie Thurlow and Sears Merritt Named Co-Chairs of Mass Fintech Hub. They will be responsible for leading Mass Fintech Hub’s Advisory Board, guiding the collaborative’s strategic vision and helping strengthen the state’s FinTech ecosystem with programming that builds community, attracts investment, develops talent and seeds collaboration.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()