Google Pay Pilots New Buy Now Pay Later (BNPL) Options

Hey FinTech Fanatic!

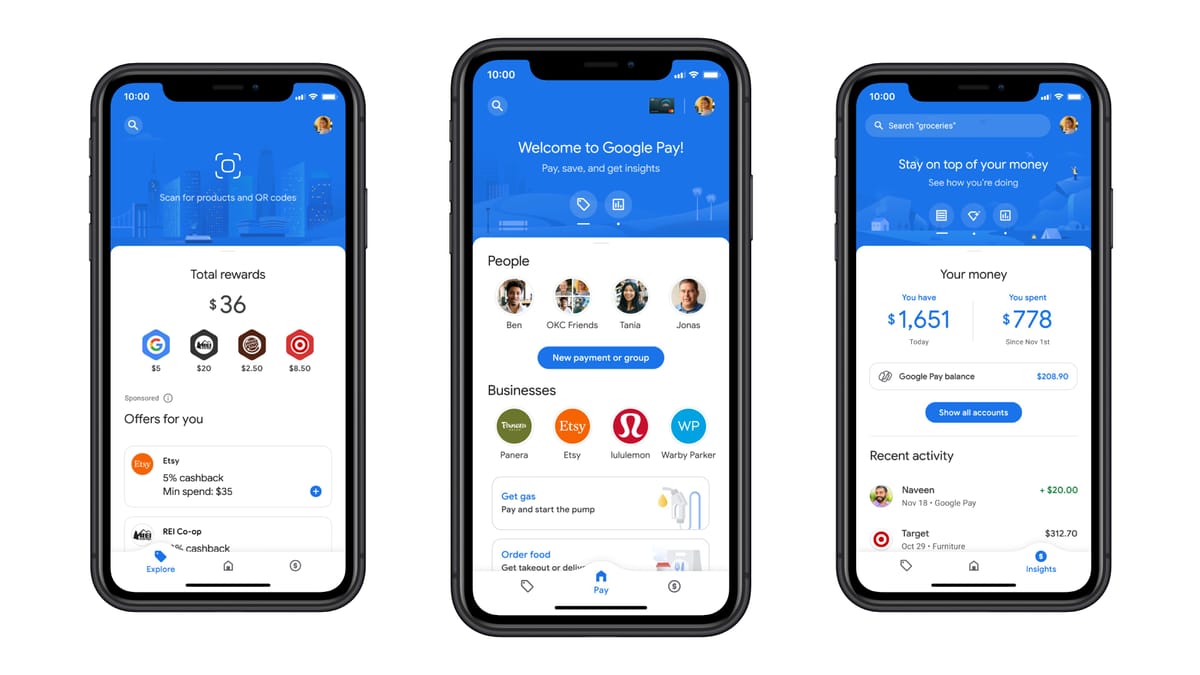

There seems to be no day without BNPL news. Drew Olson, Senior Director at Google Pay, discussed with PYMNTS CEO Karen Webster the growing consumer demand for diverse payment options, notably Buy Now, Pay Later (BNPL). This trend is particularly strong among the over one billion daily Google shoppers.

Olson emphasized the need for more payment choices across various merchants. In response, Google Pay has launched a pilot program with BNPL providers Affirm and Zip.

This initiative will introduce BNPL options at selected U.S. merchants in apparel, theater, and travel sectors that already support Google Pay for online transactions.

Google Pay's collaboration with these BNPL providers extends the payment options for merchants already integrated with Google Pay, enabling them to expand their payment methods without direct links to BNPL services.

Olson pointed out that this integration could boost merchant revenues. For instance, Affirm reports that merchants utilizing its services see a 60% increase in average order values compared to other payment methods.

BNPL providers also benefit from the expanded user base, as Google Pay users connect their wallets and explore BNPL options with other merchants.

Olson concluded by highlighting the seamless integration of these BNPL options into the existing Google Pay experience, offering a frictionless expansion of payment product distribution in a familiar user interface.

When shoppers opt for Google Pay at the checkout of merchants involved in the pilot program, they will receive a notification informing them of the availability of BNPL options through Affirm or Zip.

This strategy contrasts with Apple's method, where they have developed their own direct-to-consumer BNPL service, rather than relying on merchant distribution.

Apple Pay Later, which can be utilized at any retailer accepting Apple Pay, is available for eligible purchases, including those made in physical stores.

Enjoy more FinTech industry updates I listed for you below👇 and I'm back in your inbox tomorrow for more!

Cheers,

ARTICLE OF THE DAY

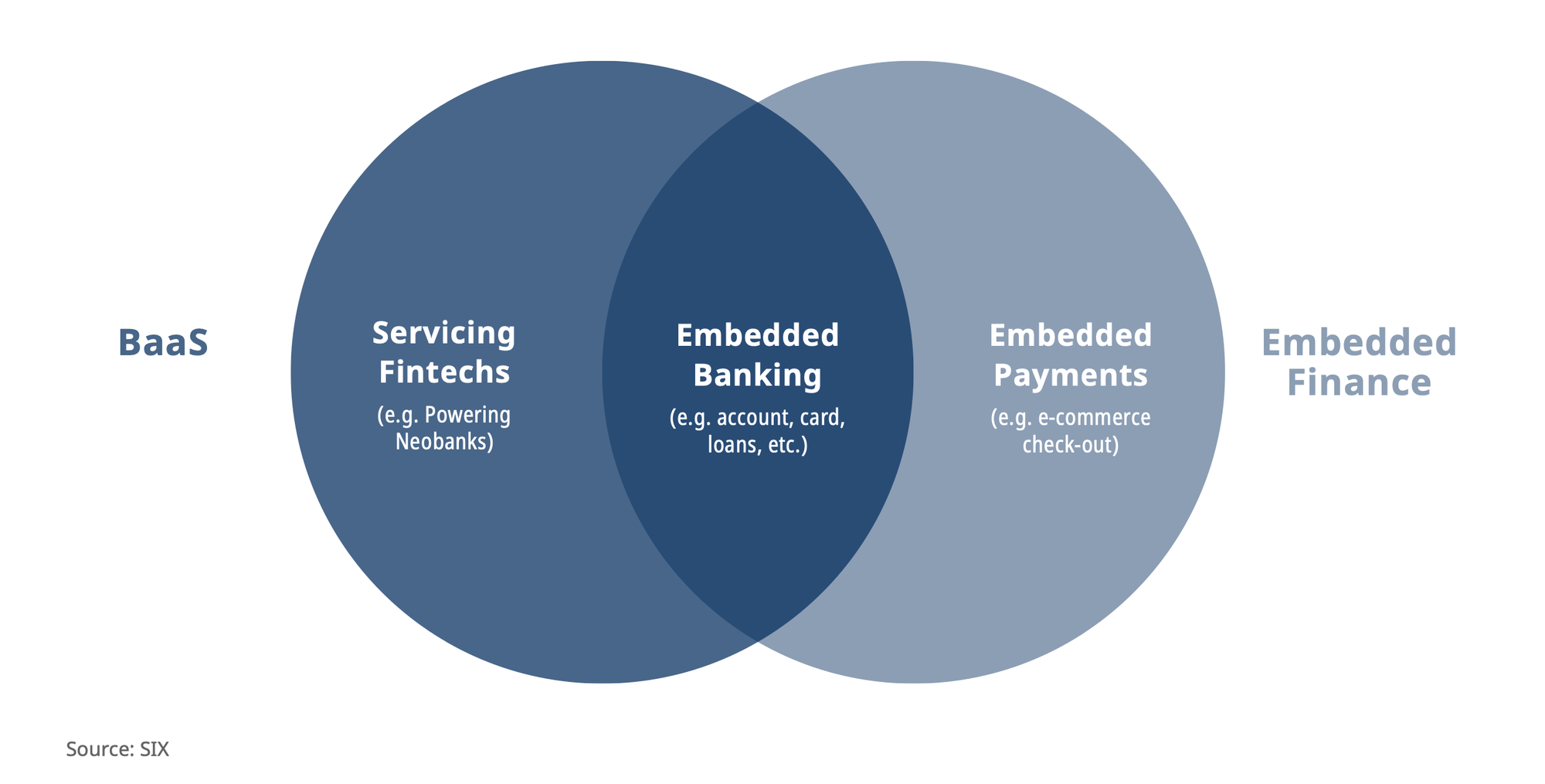

Banking-as-a-Service (BaaS) 🆚 Embedded Finance. Let’s connect the dots: BaaS enables companies, from startups to established platforms, to incorporate traditional banking services like accounts, cards, and loans into their products. Read my complete article for further insights.

#FINTECHREPORT

The economic state of Latinos in America: Advancing financial growth report by McKinsey shows that the Latino market offers a $155 billion opportunity for U.S. banks. Read the complete report for more interesting info and data on this topic.

FINTECH NEWS

🇺🇸 Check out the “Top 50 FinTech companies transforming business finance & lending in 2023.” by Taktile and Portage. They have identified the top 50 US fintechs they believe are leading the way in business finance and lending innovation this year. Link here

🇰🇪 Kenyan e-commerce start-up Copia announces 5-year partnership with Visa. The partnership will include a digital wallet that brings together shopping and financial services into one, allowing consumers to not only shop and pay but also to save and borrow from the start-up’s app.

🇨🇦 US-based paytech ConnexPay adds payments in Canadian Dollars (CAD) to its virtual card issuing offering. This expansion also opens up ConnexPay’s services to a new market, serving 38.25 million people and 1.21 million businesses. Read more

E-commerce lender SellersFi secures Citi-led credit facility. With the new funding secured, SellersFi plans to launch additional financial tools in 2024, including an FDIC-insured business checking account, business debit and credit cards, and insurance.

PAYMENTS NEWS

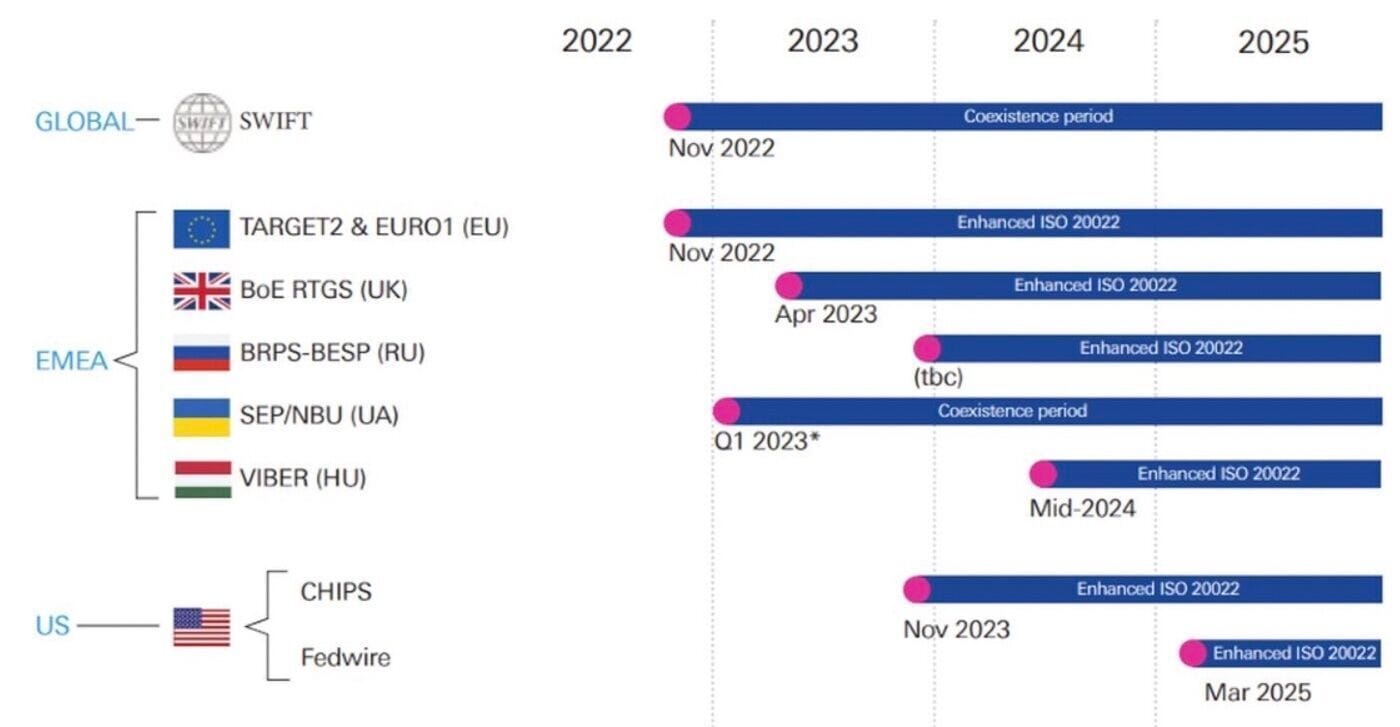

ISO 20022 roadmap until 2025. Check out the complete article and learn more about ISO 20022. Link here

🇦🇺 Motive Partners has completed its plan to acquire Australian BNPL provider Splitit delisting the fintech from the stock market. In a statement, Splitit said the funds will be used to accelerate its growth, execute its strategic plan, and redomicile the company to the Cayman Islands, to reduce its administrative costs.

🇸🇬 Worldline Group’s subsidiary obtains Major Payment Institution licence for Singapore. The MAS license allows Worldline the opportunity to bring its innovative and market-leading payment technology solutions to one of the most advanced and rapidly expanding global markets with huge growth potential.

🇵🇭 PH’s BillEase teams up with Alipay+ to roll out auto-debit feature. Alipay+ Auto Debit is expected to streamline the payment process by enabling BillEase users to grant merchants pre-authorization to automatically deduct funds. This is achieved through a simple agreement within the BillEase application.

🇬🇧 UK payments watchdog proposes cap on interchange fees. The watchdog believes that the card schemes have "likely raised these fees to an unduly high level", at the expense of UK businesses. Read more

🇺🇸 Affirm teams with Blackhawk Network on gift card purchases. By partnering with BHN and Affirm, merchants will give eligible holiday shoppers additional flexibility to finance last-minute gift purchases after most holiday shipping deadlines have passed.

Klarna partners with CarTrawler for ‘Travel Now, Pay Later.’ Klarna will provide CarTrawler with its full range of flexible payment options to the latter’s customer base that they can use to book car rentals, as well as on over 70 airlines and 250 travel websites.

OPEN BANKING NEWS

🇬🇧 DirectID and KubeMoney partner for innovative open banking solutions, enhancing credit decisions and simplifying lending for SMBs and individuals. This partnership ensures faster loan processes and empowers lenders, digital platforms, and non-financial brands to make precise credit risk decisions for their customers.

🇬🇧 GoCardless partners with Acre to help mortgage and protection brokers save time and get paid faster. These partnerships see businesses seamlessly integrating GoCardless into the software they already use, managing payment and other business activities in one place. Read on

DIGITAL BANKING NEWS

Top 10 neobanks in the world. Neobanks are delivering innovative, digital-only services and giving millions more customers access to banking. FinTech Magazine takes a look at the top 10. Link here

🇦🇹 Raiffeisen Bank International, operating across 12 countries, has all the apparent challenges and requirements for data sharing across applications, platforms, and governments. It built a decentralized data mesh enterprise architecture, with real-time data sharing as the key to its digital transformation.

🇪🇸 The lack of alternatives from banks in Spain has led Revolut’s Flexible Account to reach €350 million invested. The entity explains that this “novel” product is focused on those clients who “are looking for attractive returns or who wish to protect their money against inflation with a lower expected risk compared to alternative investments.”

Lemfi and ClearBank partnership provided migrants with 37,000 virtual accounts carrying out 550k transactions/month. ClearBank is providing LemFi with agency banking services to enhance international payment services for emerging market immigrants in North America and Europe.

🇩🇪 Deutsche Bank forms stablecoin joint venture company. The new venture, AllUnity, regulated by BaFin, Germany’s financial supervisory authority, plans to launch within the next 18 months. Its long-term focus is accelerating mass market adoption of digital assets and tokenization.

🇪🇸 Nebeus unveils nomad accounts. This innovative financial solution is designed to empower users across the globe, providing them with the tools they need to get paid and monetize their skills and expertise not dependent on their location.

🇺🇸 Revolut U.S. doesn't rule out return to Crypto services. Discover the key takeaways from an interesting interview Axios conducted with CEO Siddhartha Jajodia. Please click here to learn more

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 KuCoin to pay $22M, exit New York to settle state suit: The exchange will pay $16.77 million to NY customers and $5.3 million to the Attorney General’s office to settle charges of violating securities laws by offering unregistered tokens.

🇯🇵 Japanese card issuer JCB is moving to Phase 2 of a pilot to trial offline P2P payments for a central bank digital currency (CBDC). For this phase, customers will be able to transfer CBDC funds from one person to another person using their cards and mobile phones even without Internet connectivity.

PARTNERSHIPS

🇸🇬 Singapore-based FOMO Pay has joined forces with Zand Bank, the UAE’s first digital bank, in a strategic partnership to facilitate seamless cross-border payments between the dynamic markets of Asia and the Middle East and North Africa (MENA).

DONEDEAL FUNDING NEWS

🇫🇷 Pivot raises $21.6 million just a few months after its creation. After raising a $5.3 million pre-seed round in April, the company worked on the first iteration of its procurement tool over the summer. For now, the company plans to end the year with 10 clients.

🇨🇦 Terminal raises $3.1M, wants to be the ‘Plaid of trucking’, The startup aims to continue building on its Unified API, giving companies that build insurance products, fleet software and other financial services the vehicle and locations data they need.

🇸🇦 Saudi Arabia's Lendo raises $28 million. With this funding round, Lendo is going to expand into new markets, support new and current customers and launch new Shariah-compliant products, all the while continuing to innovate the marketplace for digital lending.

🇺🇸 Preczn rakes in $6.8m to revolutionise SaaS platforms with operational FinTech features. With the new funds, Preczn plans to strengthen its product and go-to-market teams, accelerating its fast-paced growth. Read more

🇧🇷 Conta Simples, a neobank focusing on B2B credit, has secured a $30.1 million investment and received a crucial license from the Banco Central do Brasil. This license empowers the firm to develop and offer its own credit products, a capability previously reliant on collaborations with other financial institutions.

M&A

🇮🇳 M2P Fintech acquires Goals101 in a cash-and-equity deal worth Rs 250 crore. The acquisition will help M2P Fintech double down on its existing credit card management suite and increase its value-added service offerings.

Vertex bids to acquire e-invoicing vendor Pagero. Vertex's acquisition of Pagero speeds up their October 2023 partnership, offering multinational companies an end-to-end solution for automated business transactions, global management of indirect tax, and e-invoicing compliance.

MOVERS & SHAKERS

🇬🇧 Klarna’s AJ Coyne joins Monzo as vice-president of marketing. AJ brings three years of valuable experience in Klarna. Read full article here

Want your message in front of 100.000+ fintech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()