Google Pay Enhances Security and Flexibility with New Features

Hey FinTech Fanatic!

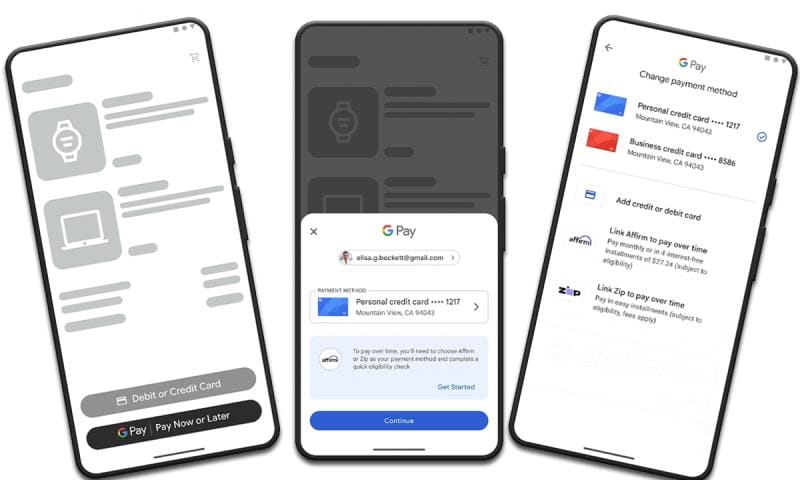

Google Pay has introduced three new features focused on security, convenience, and smart spending tools. Vice President Ben Volk highlighted that these enhancements are based on user feedback.

The updates include:

- Smart Checkout Benefits: Card benefits for American Express and Capital One users now appear during the Chrome desktop checkout process, helping users choose the best card for their purchases.

- Expanded BNPL Options: Google Pay has broadened its "buy now, pay later" (BNPL) offerings, allowing users to link existing BNPL accounts or sign up for new ones directly within the app, adding more payment flexibility.

- Biometric Authentication: Users can now autofill card details using biometric methods such as fingerprint, face scan, or PIN, enhancing security and convenience by eliminating the need to manually enter security codes.

Volk emphasized that merchants need no additional effort to activate these features, minimizing integration challenges. He also noted the significant role of AI in enhancing security and transaction efficiency within Google Pay.

Read more FinTech industry updates (lots of M&A activity) below, and I'll be back 😉

Cheers,

#FINTECHREPORT

📊 2024 Guide to Core Banking Modernization. The time is now to transform your banking core. Check out the complete report

INSIGHTS

📜 Consumer Financial Protection Bureau says buy now, pay later firms must comply with U.S. credit card laws and deem them as credit cards. View full document

FINTECH NEWS

🇺🇸 Mass FinTech Hub welcomes the Mass Bankers Association as its newest member. With this addition, the collaborative has welcomed nearly 55 member organizations to support its mission to advance FinTech across Massachusetts since its launch in 2021.

🇺🇸 Mastercard announced a partnership with LeapFinancial, the innovative digital solution that will revolutionize the remittance industry in LatAm. The "Integrated Remittance Service" supports both digital and cash payments, simplifying money transfers. This white-label solution enables top-ups with cash at over 85k US retailers, transfers to cards and bank accounts, and disburses remittances via cards, bank accounts, and wallets.

🇬🇧 Jaja Finance launches Gen AI chat assistant. Jaja is using this advanced technology to achieve its commitment of helping customers use credit better by enhancing customer interactions and significantly reducing customer response times through its in-app customer messaging centre.

🇺🇸 Teen FinTech Copper had to abruptly discontinue its banking, debit products. In a letter to customers, CEO and co-founder Eddie Behringer said the company had learned the previous week that the banking middleware provider they used, Synapse, was sunsetting its service “imminently.” Read more

🇬🇧 London FinTech Curve apologises over terms of service error: The firm said it would not permit transactions blocked by underlying payment sources. Read the full piece here

🇺🇸 The Consumer Financial Protection Bureau (CFPB) is suing SoLo Funds, a FinTech company that enables peer-to-peer lending, alleging that the company used “digital dark patterns” to deceive borrowers and illegally took fees while advertising to consumers that there were no fees.

🇺🇸 SoLo Funds vows to fight CFPB lawsuit. The company says it has followed the rules, consulted legal counsel and sought input from regulators since its inception. The president and co-founder of SoLo Funds, said the company has been unfairly targeted. Find out more

🇲🇽 Unlimit and DEUNA forge partnership for LATAM cross-border payments. The partnership utilizes DEUNA's payment orchestration and Unlimit’s infrastructure, and aims to improve cross-border payment processes for enterprises in Latin America (LATAM) and beyond.

🇺🇸 FinTech firm Payactiv—valued at over $500 million in 2020—is seeking a minority investor. The firm is exploring the sale of a minority stake in the company, four venture and banking executives told Fortune.

🇰🇪 LemFi, a cross-border payments provider, has gained additional approval from Kenya's Central Bank (CBK) to handle remittances. The latest license will enable the FinTech to provide remittance services in collaboration with Kenyan FinTech Flex Money Transfer.

🇺🇸 PubMatic has teamed up with Klarna to help the payments and shopping assistant company scale its native advertising inventory. The companies are rolling out the integration in the U.S. first, and then in Europe.

PAYMENTS NEWS

🇺🇸 Google Pay has broadened its BNPL options in the U.S. Shoppers can link their existing BNPL accounts (currently limited to Affirm and Zip) or sign up for new ones directly through Google Pay, increasing flexibility in payment options.

🇮🇳 Stripe is seeking to enter a joint venture with State Bank of India, aiming to acquire a significant stake in SBI Payments Ltd to break into the market in the country. Read more about this news and its latest updates

OPEN BANKING NEWS

🇬🇧 Capital on Tap partners with Plaid in the UK for streamlined SME underwriting. Capital on Tap will now be able to leverage Plaid's open banking infrastructure to provide UK small and medium-sized enterprises (SMEs) with more efficient access to funding.

🇺🇸 Atomic unveils Paylink Manage: The actionable subscription management tool for financial institutions. This feature provides a unified experience where consumers can connect, view, and track all of their recurring payments, including subscriptions and bills.

DIGITAL BANKING NEWS

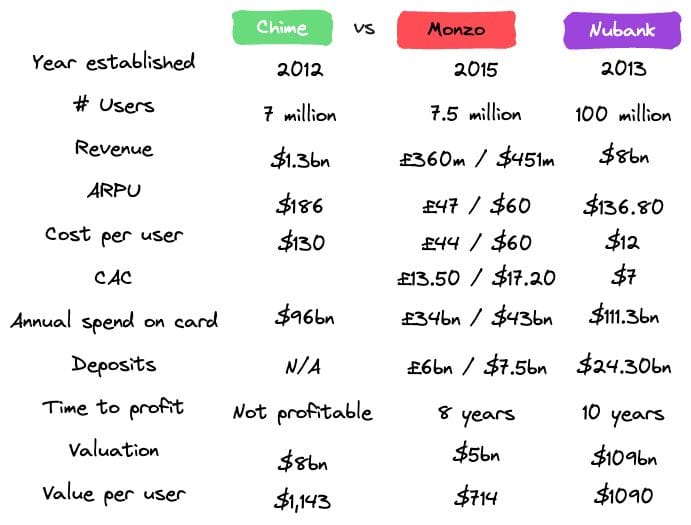

🔎 Neobank comparison by Michael Jenkins

🇦🇪 UAE's Wio becomes one of fastest 'neo-banks' globally to hit a profit. The UAE digital-only bank recorded a profit of Dh2 million in 2023, which is also its first full year of operations. Revenues came to Dh266.4 million.

🇬🇧 Fraud losses in the UK dropped by four percent in 2023, but still topped the £1 billion high watermarket. Criminals stole a total of £1.17 billion through unauthorised and authorised fraud in 2023, according to data from trade body UK Finance.

🇸🇬 Singapore-based fiat-crypto payments firm Alchemy Pay has unveiled a Web3 digital banking platform for enterprises. The Web3 Digital Bank initiative is designed to solve the problems that Web3 firms face in managing cross-border payments and transactions between fiat and crypto currencies.

🇺🇸 FIS upgrades mobile banking app. FIS® Digital One™ Flex Mobile 6.0 helps banks meet evolving customer expectations by offering an intuitive, user-friendly experience on mobile or online. It features a simplified design, new fraud prevention measures, and significant functionality upgrades.

BLOCKCHAIN/CRYPTO NEWS

🇬🇧 WisdomTree gets green light to list Bitcoin, Ether ETPs on London Stock Exchange. WisdomTree's Physical Bitcoin (BTCW) and Physical Ethereum (ETHW) exchange-traded products are expected to list on the LSE to professional investors on May 28.

DONEDEAL FUNDING NEWS

🇺🇸 SoFi strengthens lending capabilities with $350 Million personal loan securitization placement with PGIM. To date, SoFi has sold over $15 billion and securitized over $14.5 billion of personal loan collateral, underscoring the high quality of its personal loan portfolio.

🇬🇧 Ex-Revolut employees have launched Zeal, a DeFi wallet and crypto debit card for everyday purchases, backed by a $2 million investment from Gnosis to integrate Web3 financial rails. This was confirmed by Zeal founder Hannes Graah at DappCon in Berlin.

🇸🇦 Riyad Capital announced the launch of the “1957 Ventures” fund, a closed-end investment fund backed by Riyad Bank to drive transformative growth in Saudi Arabia’s FinTech sector, in line with the objectives of Saudi Vision 2030 and the Financial Sector Development Program.

🇺🇸 Footprint, a company that unifies KYC (Know Your Customer), security and authentication to automate consumer onboarding and reduce identity fraud, announced a $13 million Series A led by QED Investors

🇺🇸 Immigrant banking platform Majority secures $20M following 3x revenue growth. Majority aims to simplify the process of opening a bank account and accessing financial services for immigrants in the U.S.

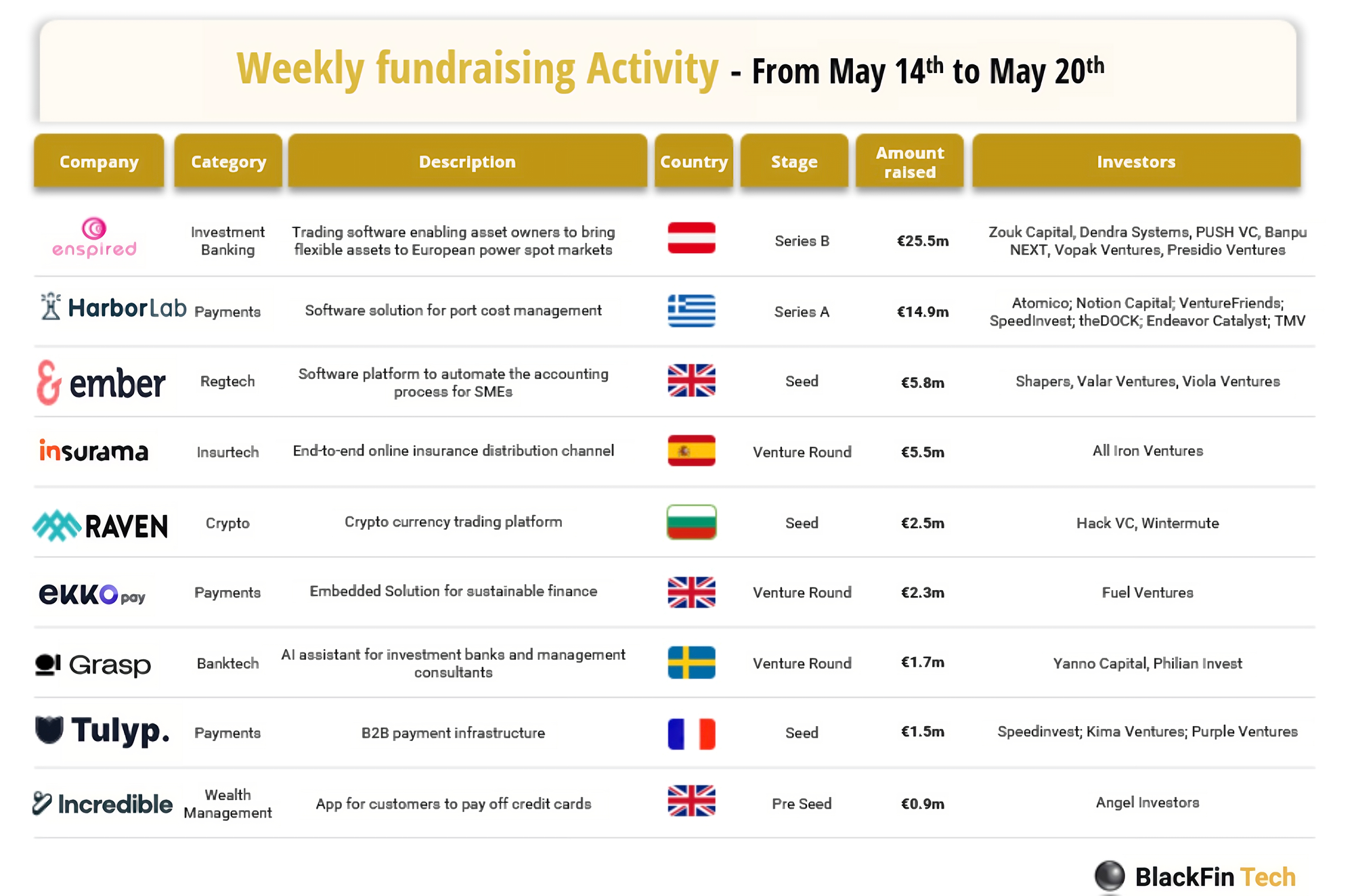

Last week we saw 8 official FinTech deals in Europe for a total amount of €58.1m raised with 3 deals in the UK, and 1 in Austria, Greece, Spain, Sweden, and France. A true European mix! Check out the complete BlackFin Tech article

M&A

🇬🇧 Experian acquires strategic stake in Reward. This further collaboration will focus on leveraging Experian’s rich data and audience activation capabilities to fuel Reward’s offerings across banks and retail, expanding reach to create a more rewarding experience for consumers.

🇩🇪 FE fundinfo acquires German FinTech Dericon. The investment connects FE fundinfo clients to the Sparkassen Group, a network of public banks with over 50 million customers across Germany.

🇮🇳 CashFlo acquires Logitax to scale up its B2B payments, financing platform. The Logitax acquisition is said to be critical for CashFlo to scale up and serve more mid-market and large enterprises. The Logitax team, including its leadership, will join CashFlo to continue developing finance automation.

🇩🇪 Fabrick, an Open Finance operating company, continues to execute its international growth and consolidation strategy in a growing market, and announces agreement to acquire finAPI GmbH, one of the leading German operators of Open Finance solutions.

🇪🇬 Egypt's EFG Hermes acquires minority stake in Danish FinTech Kenzi Wealth. The new investment and partnership are a significant milestone in EFG Hermes' digitalisation vision, which promises to usher in a new era of investment opportunities for clients.

MOVERS & SHAKERS

🇮🇱 Team8 onboards NEXT Insurance Co-Founder Alon Huri as New Managing Partner to drive FinTech innovation. The appointment of Huri, who brings vast experience and expertise as a successful FinTech entrepreneur, is a valuable asset for Team8 and its portfolio companies.

🇨🇴 Bernabe Murata has taken on the role of Head of Sales at Yuno. Having been with Yuno since its inception, Bernabe brings a wealth of experience and expertise to his new position. Continue reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()