Getnet and UnionPay International Accelerate Acceptance of UnionPay Cards in Spain and Portugal

Hey FinTech Fanatic!

Getnet and UnionPay International (UPI) have signed a strategic agreement to expand UnionPay card acceptance across Spain and Portugal, covering retail, e-commerce, and public transport.

The partnership builds on years of cooperation between the companies and aims to speed up acceptance across in-store and online channels. It will also explore UnionPay QR code payments, a method used among Chinese consumers.

The agreement includes expanding acceptance across metro systems, buses, trains, bikes, and parking. With Chinese tourism to Iberia growing more than 15% per year, the goal is to reduce friction for travelers and support conversion.

Getnet brings large-scale deployment capabilities and a global platform, having recorded a 15% year-on-year increase in transaction volume in 2025. The Nilson Report also ranked the company as the number one acquirer in LATAM by volume in 2024.

UPI operates one of the world’s largest acceptance networks. UnionPay cards can be used in 183 countries and regions, with over 200 million cards issued outside mainland China.

Scroll down for more FinTech stories shaping the week, and I’ll be back in your inbox tomorrow!

Cheers,

FEATURED NEWS

🇪🇺 European FinTech Market Map 👇

INSIGHTS

🇺🇸 JPMorgan doesn’t want to pay Frank founder Charlie Javice’s legal bills. JPMorgan says it has been billed $142 million for the legal defense of Frank founder Charlie Javice and executive Olivier Amar, who were convicted of defrauding the bank after its $175 million acquisition of the startup. Now seeking to overturn a judge’s order requiring it to cover their fees, JPMorgan claims the bills included excessive charges.

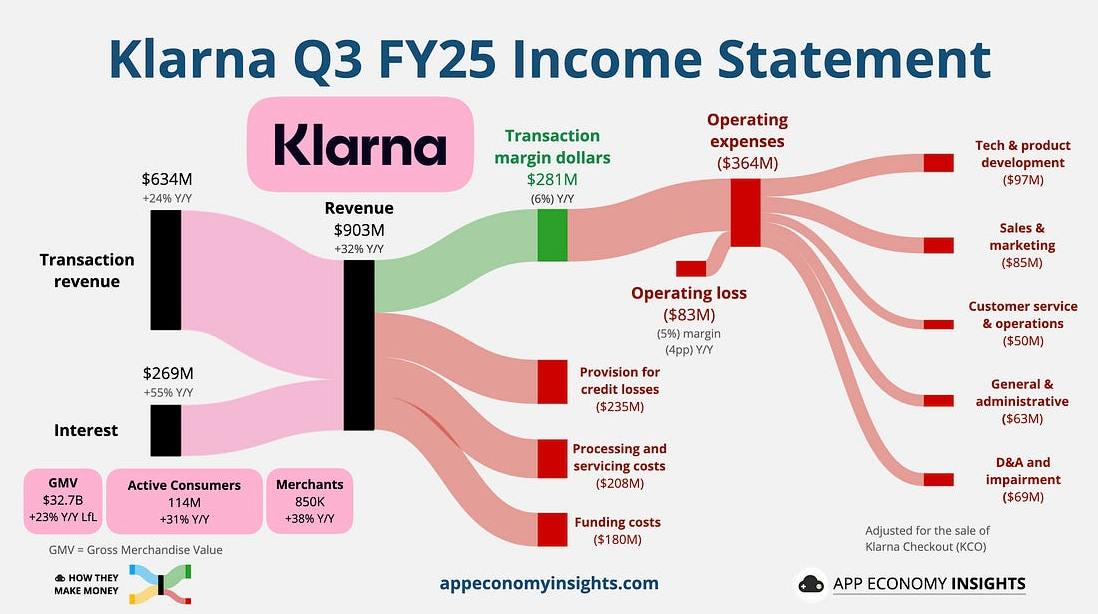

📈 Klarna dropped its first earnings since the NYSE IPO.

FINTECH NEWS

🌍 Your Chance to Host in 2026! The FinTech Running Club is growing fast, and this could be your moment to lead! We’re looking for new community hosts across Central America: Panama, Costa Rica, Guatemala, Honduras, and Nicaragua. If you’re someone who loves running, fintech, and community building. 👉 Sign up to become a host!

🇺🇸 Revolut records show payment to corporate ‘spy’ in the Rippling vs Deel case. Keith O’Brien, an Irish employee at Rippling, claims that Deel CEO Alex Bouaziz induced him to leak confidential information for $6,000 per month, with the first payment sent via Revolut and subsequent payments made in cryptocurrency.

PAYMENTS NEWS

🇬🇧 Ecommpay integrated the new Apple Pay QR. “Integrating Apple Pay QR into the Ecommpay checkout path is opening payment capabilities to the entire digital landscape to deliver more convenience for Apple Pay users,” commented Artur Zaremba, Head of Internal Payment Solutions Product Stream, Ecommpay.

🇩🇪 PAYONE now offers the Wero digital wallet payment system nationwide for merchants and service providers in Germany as an acquirer and a licensed payment service provider. With official EPI membership, PAYONE can offer its customers Wero acceptance in e-commerce nationwide after successful pilot payment transactions with selected merchants.

🇦🇪 Mastercard brings agentic payments to life with Majid Al Futtaim in the UAE. When launched, cardholders will be able to use their AI agent to search, discover, and transact through Mastercard Agent Pay, including booking theatre tickets at VOX Cinemas with ease.

DIGITAL BANKING NEWS

🇬🇧 Monzo races past 14 million customers amid record growth and standout engagement. High satisfaction scores and strong engagement are driving growth, with 70% of customers active on a monthly basis and over 1 million on paid plans. Monzo continues expanding its services, including an upcoming tax-filing tool for sole traders and landlords.

🇺🇸 Chime introduces the new Chime Security Center. With the new Security Center, members get real-time insight, security tips, and intuitive tools. It is designed to make protection intuitive, visible, and built around its members, giving everyone more control and confidence in their daily money management.

🇦🇷 Mercado Pago and Revolut pursue Central Bank approval to operate as fully regulated banks in Argentina. At a Central Bank panel, Mercado Libre executive Alejandro Melhem outlined a user-focused strategy built on simple, free accounts, frequent app updates, and interest-bearing accounts.

BLOCKCHAIN/CRYPTO NEWS

🇺🇸 Kraken announced Kraken Ramp. Kraken Ramp enables businesses to spin-up seamless global money-movement rails, relying on Kraken’s peerless track record and expertise to come to market fast. It allows any platform to integrate buy/sell flows directly into their product.

🇧🇷 KuCoin Pay enters Brazil via Pix, allowing millions of users to instantly convert and spend over 50 cryptocurrencies at any merchant that accepts Pix QR codes. The feature enables seamless crypto-to-BRL transfers and payments directly from KuCoin accounts, combining crypto and fiat wallet functions while meeting Brazil’s KYC and regulatory standards.

🇧🇷 Tether announces investment in Brazilian fintech Parfin. According to Paolo Ardoino, CEO of Tether, the partnership aims to strengthen the bridge between traditional finance and blockchain, expanding access for institutions and users to more efficient financial solutions. He believes that Latin America is currently one of the most promising regions for innovation in digital assets.

PARTNERSHIPS

🌍 Getnet and UnionPay International accelerate acceptance of UnionPay cards in Spain and Portugal. This move reinforces both companies’ commitment to delivering a broader, more inclusive, and seamless payment experience across in-store retail, ecommerce, and transportation.

🇬🇧 eToro partners with Moneyfarm to launch Cash ISA solution for UK clients. By introducing a Cash ISA, eToro is responding to growing demand from UK customers for transparent, high-yield cash solutions that sit alongside their investments, helping them make confident financial decisions even when they choose to hold cash.

🇬🇧 Zilch became the official way to pay for Arsenal Football Club. The global partnership, which marks Zilch’s first foray into sports, spans both men’s and women’s teams and will make available Zilch’s range of flexible payment options to Arsenal supporters.

🇺🇸 Afterpay and Cash App bring pay over time to where Visa® is accepted. The card combines standard Cash App Card features, no hidden fees, fraud protection, and weekly offers, with an optional Afterpay installment feature activated in-app. The pilot will launch in the coming months, followed by a broader rollout in early 2026.

🇺🇸 Klarna deepens partnership with Blackhawk Network to give consumers even more choice and flexibility for purchasing gift cards, just in time for the holidays. Continue reading

🇦🇪 Robo.ai partners with Zand Bank to pioneer a new paradigm in machine economy FinTech, enabling instant H2M and M2M payments using an AED stablecoin, secure custody and on-chain identity for devices, tokenization of real-world assets like smart vehicles and eVTOLs, and on-chain ESG reporting to support Dubai’s 2050 Net Zero targets.

🌍 Roam partners with Bridge to power global payments for Africans. Through the app, users can open a U.S. bank account, receive USD or stablecoin payments, convert to local currency, and send money back to the U.S., all from one platform.

🇬🇧 Zodia Custody collaborates with beaconcha.in. This collaboration improves Zodia Custody’s ability to provide clients with insights into validator performance, staking activity, and network health, ensuring transparency. Keep reading

🇺🇸 Gr4vy and Worldline strengthen partnership to simplify global payment expansion. The partnership combines Gr4vy’s flexible payment technology with Worldline’s global acquiring network and regional infrastructure, giving merchants a single, scalable way to enter new markets and optimize payments locally.

🇮🇱 MoonPay Ventures announced a significant expansion of its partnership with Zengo Wallet. The collaboration enhances wallet usability, expands payment access, and accelerates product innovation across Zengo’s ecosystem. As part of the expanded partnership, MoonPay is now the exclusive payment provider powering Zengo’s Buy and Sell Crypto features.

🇧🇷 Uber guarantees 6 months of free service in partnership with Nubank. The offer is valid for customers of all segments of the financial institution and new Uber One subscribers. The same applies to Nubank users, ensuring that the functionality can be achieved without needing to change plans.

DONEDEAL FUNDING NEWS

🇺🇸 Kalshi’s valuation jumps to $11B after raising a massive $1B round. Backed again by Sequoia and CapitalG, the startup has surged in popularity around political and pop-culture event betting, recently hitting $50 billion in annualized trading volume.

🇺🇸 Former BlackRock employees raised $4.6 million for HelloTrade. HelloTrade aims to give investors around the world access to U.S. assets. The platform also offers perpetual futures, which give customers more exposure to an asset than they would have in cash on the platform.

🇲🇽 Mexico FinTech Inks $50 million credit line to boost microloans. The company aims for the new facility to help it triple in size and serve half a million new customers, an ambitious goal in Mexico’s challenging credit market, where fast growth and high levels of non-performing loans have delayed lenders’ profitability.

M&A

🇺🇸 Coinbase to acquire Vector. Vector’s technology will be integrated into Coinbase's consumer trading experience to give users broader access to on-chain markets. As part of this integration, Vector’s current mobile and desktop apps will be sunsetted.

MOVERS AND SHAKERS

🇬🇧 Paragon Bank hires Simon Glass as head of mortgage operations. In his new role, Glass will head up Paragon’s operations team with a focus on delivering good customer outcomes. He will lead the lender’s buy-to-let underwriting, completions, and customer relationship teams.

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

Comments ()